Background

Dover (DOV) announced in September 2017 that it was reviewing strategic options (sell, merge, or spin-off) for its energy business. A month later, activist investor, Dan Loeb, disclosed his DOV position and urged management to sell its energy business. Loeb noted, “Removing the cyclicality from Dover will greatly reduce earnings volatility, allowing investors to focus on a high quality industrial portfolio with strong growth drivers.”

Ultimately, DOV management decided to proceed with a spin-off, and that spin-off (Apergy) will being trading tomorrow. Apergy (APY) sells artificial lifts, automation tools and drill-bit inserts and caters to the upstream oil & gas industry. In the when-issued market, APY has been trading in $34 to $40 range. It is trading at $36.59 as of 3:30 on May 8, 2018 and will begin regular-way trading tomorrow, May 9, 2018.

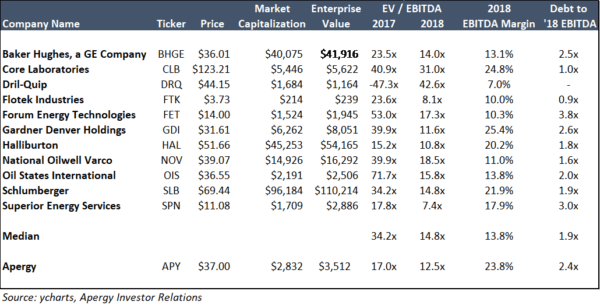

Valuation

APY is trading at an EV / 2018 EBITDA multiple of 12.5x while comps (per management’s analyst day presentation) trade at 14.8x. Assuming APY should trade more in-line with its comps, the stock would trade at ~$45, implying 22% upside from where it closed today. We believe APY should trade at least in-line with peers given APY’s leverage profile is in-line with peers, but its margin profile is superior. We are looking forward to the spin-off and will monitor the situation for indiscriminate selling. Per our research, it generally pays to wait at least 6 days until selling pressure is absorbed before establishing a position.

Management Incentives

Per the Form 10, 6.5MM shares (9% of shares outstanding) are reserved for equity compensation for management and employees so management will be aligned with shareholders. Typically, options in spin-offs are granted based on initial trading ranges. Thus, management is incentivized for the stock to trade cheaply initially until those options prices are set.

Will there be any indiscriminate selling?

DOV is a member of the S&P 500 index, and APY will be dropped from this index but will be added to the S&P 400 index. As such, there could be some forced selling from index funds and ETFs. Further, DOV’s market cap of $14.4BN dwarfs APY’s expected market cap of $2.9BN. This could result in portfolio managers indiscriminately selling APY given portfolio constraints. However, Dover/Apergy did host a detailed 3 hour analyst day presentation (links below) so this spin-off is not completely under the radar.

Other Information

Additional Articles

April 2018 – Bloomberg – “Does a Halfway Breakup Go Far Enough?

December 2017 – Bloomberg – “Dover’s Breakup Plan Has Goodies for Dan Loeb”

October 2017 – Bloomberg – “Activist Loeb Discloses Dover Stake, Holds Management Talks”

September 2017 – Bloomberg – Do-It-Yourself Breakup Talk, Dover Style

Leave A Comment