Chewy is 15% Overvalued

Background

A subscriber recently asked me what I thought of Chewy (CHWY) so I spent some time digging into it.

It was a fun exercise in part because it’s the opposite of what I typically look for.

First, it was a recent initial public offering (IPO). IPOs are propped up by artificial forces because only a portion of the company is IPO’d so demand for shares usually exceeds supply which pushes shares higher. Spin-offs, of course, have a different dynamic. They are usually pushed down by artificial forces. Shares of spin-offs are distributed (not sold) to the shareholders of the parent company whether or not those shareholders want the spin-off. Usually the supply of shares exceeds the demand for shares which pushes the spin-off’s price lower.

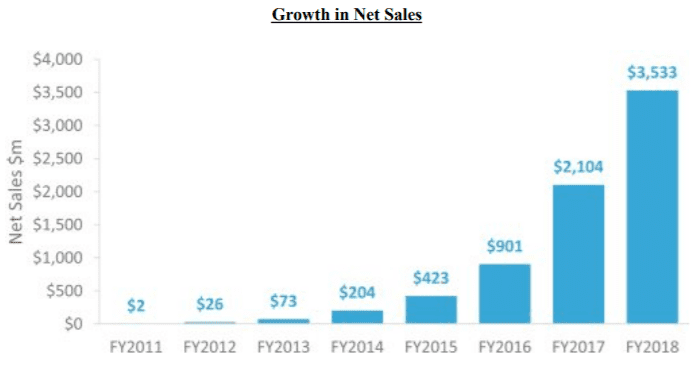

Second, Chewy is a growth story – an incredibly growth story. I tend to focus on value stocks. Check out Chewy’s growth since inception below. You will never see the below growth in a value stock.

As you would expect, it is trading at a healthy EV/sales multiple of 2.7x despite negative EBITDA and no expected profit until 2023.

Company Description

Chewy runs a website that allows “pet parents” to order any and all products that their pets will need.

I’ve taken the following directly from Chewy’s IPO prospectus:

Our mission is to be the most trusted and convenient online destination for pet parents everywhere. Since our launch, we have created the largest pure-play pet e-tailer in the United States, offering virtually everything a pet needs. We believe that we are the preeminent online destination for pet parents as a result of our broad selection of high-quality products, which we offer at great prices and deliver with an exceptional level of care and a personal touch.

Secular Tailwinds

First let’s start with all the secular tailwinds that are benefitting Chewy.

Defensive Industry

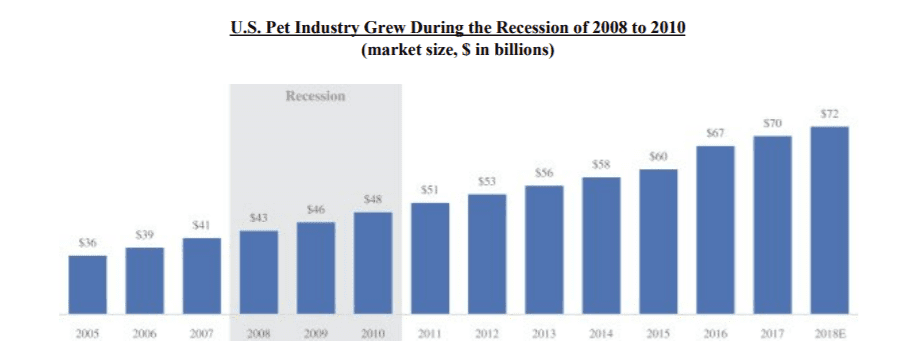

The petcare industry is an excellent industry. People in the United States view their pets as family members and are willing to spend a lot on food (organic, gluten free dog food anyone?) and petcare products for their beloved animals.

As a result, petcare spending should hold up well in a weaker economic environment.

In fact, pet care spending grew throughout the Great Financial Crisis.

This defensive attribute is great in all economic environments, but it’s especially attractive in the current late economic cycle environment.

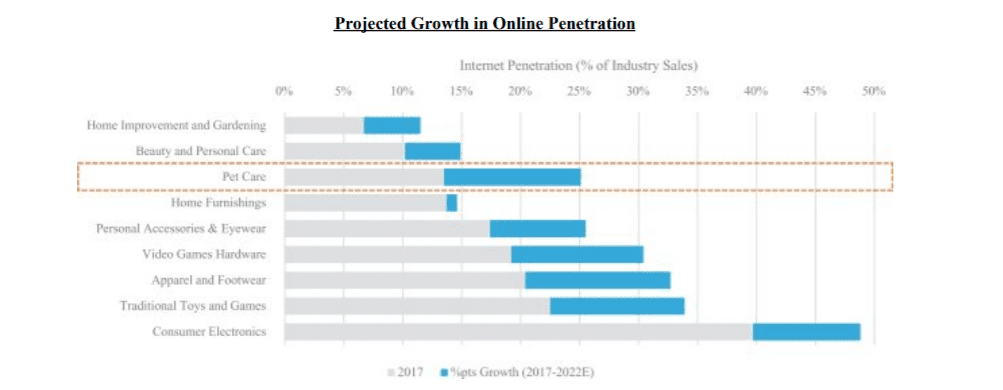

Transition from Offline to Online Buying

Further, similar to most retail categories, petcare product buying is transitioning from offline to online as shown below.

As such, Chewy is positioned incredibly well.

Loyal Customer Base

Customers LOVE Chewy. My sister is a vet and she told me, “My Vet clinic loses sales to Chewy, but I love them. They are an incredible company.”

Chewy’s app has a 5 star rating in the Apple and Google app store. See below:

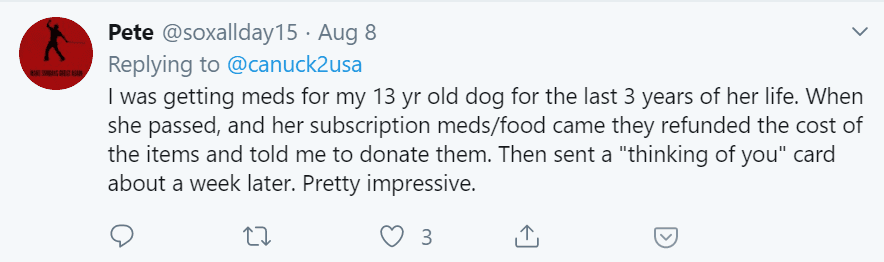

As evidenced by the screen shot below, Chewy goes above and beyond to treat its customers well.

I could go on and on, but I don’t think anyone would argue with me that CHWY’s fundamentals and future prospects are excellent. The runway for growth is long.

Valuation

As we all know, investing success doesn’t just require you to pick the fastest growing business. Or the best business. You also have to factor in valuation.

So let’s take a crack at it.

The best way to look at Chewy in my opinion is from a top down perspective.

Currently, the pet care market is a $73BN market in the US. The pet care market is growing at about 4% a year, and I expect that growth rate to continue for the foreseeable future given favorable industry tailwinds.

Approximately, 14% of pet care sales (or $10.2BN) are online and Chewy has 35% market share (or $3.5BN) of those online sales.

I assume that over the next 20 years, the percentage of pet care products that are sold online increases from 14% to 66% (stable at 66% thereafter).

While the online penetration increasing from 14% to 66% may seem aggressive, I think it’s reasonable as online penetration continues to accelerate due to advances in technology, logistics and consumer behavior.

I also model that Chewy’s market share increases from 35% to ~45% over that period (stable at 45% thereafter). This market share is similar to Amazon’s in the US ecommerce market.

Other Assumptions…

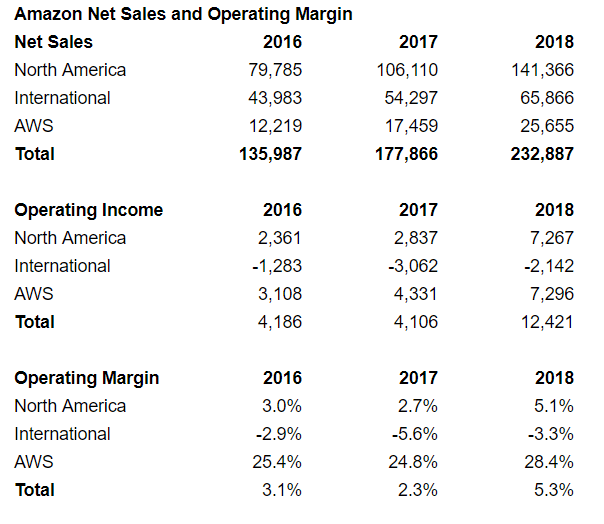

I assume that Chewy is eventually able to achieve a 5.0% operating margin (EBIT margin) in the US, similar to Amazon’s North America operating margin as shown below.

Source: Amazon 2018 Annual Report

I assume CHWY’s weighted average cost of capital is 8.0% (1.98% RFR, 1.2 beta, 5% equity risk premium).

I would include a screenshot of my DCF, but it’s so big that it would be hard to read. Instead, here is a read only link to it:

Summary

With the assumptions outlined above, I get to a $11.3BN fair value ($28 per share) which is 15% below CHWY’s current share price ($33.62).

I was a little surprised that my fair value turned out to be so high (I figured the stock was even more overvalued).

I haven’t given the company any credit for the international opportunity. It will no doubt try to expand, but Amazon isn’t even making a profit internationally (see chart above) and so I don’t think it is prudent to assign any value there.

Other things to consider….

Melvin Capital and Long Pine Capital recently disclosed sizable positions in the stock. They are very smart investors. Clearly they see significant upside despite the elevated valuation.

What do you think?

Is Chewy a buy? Comment below.

can you run a reverse DCF to see what is the implied growth rate in the business?

Thanks for the questions, John. It’s a little tricky because Chewy will continue to grow incredible quickly for the foreseeable future and then moderate.

But here’s what is priced in at its current price($30 per share) from a revenue perspective (assuming the same margin expectations): 20% average revenue growth through 2030 and then 4% growth thereafter.