Equitrans Spin-off

EQT’s spin-off, Equitrans Midstream (ETRN), began regular way trading this morning under the ticker ETRN. Ever since EQT acquired Rice Energy in 2017, activists Jana and D.E. Shaw have urged a break up to separate the midstream and upstream businesses to increase shareholder returns.

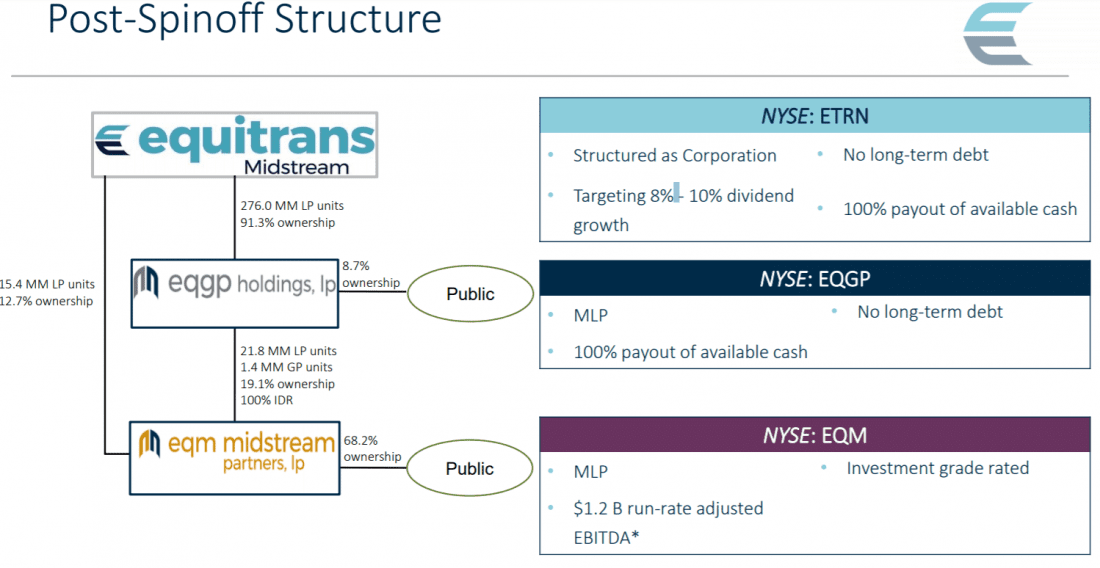

Equitrans midstream is a corporation and owns units in EQGP Holdings and EQM Midstream. EQGP and EQM are both Master Limited Partnerships. EQM is the entity that holds, operates and finances the assets. ETRN’s cash flows will be generated by its ownership stake in the underlying MLPs. See below for the structure of ETRN.

Source: Equitrans Slide Deck

Equitrans will pay out as a dividend everything that is available to distribute (after annual G&A and cash taxes). Management expects taxes to be near zero for a few years.

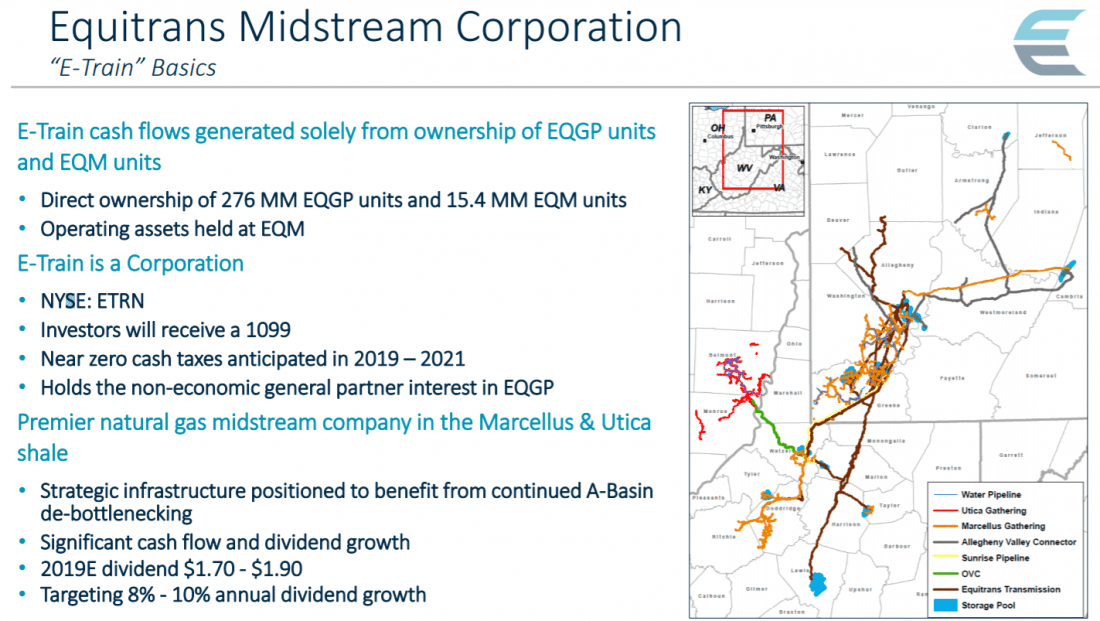

ETRN is a premier natural gas midstream company located in the Marcellus and Utica shale. It’s primary customer is EQT (the parent), a leading natural gas player nationwide. See below for a map of ETRN’s key assets and other important stats.

Source: Equitrans Slide Deck

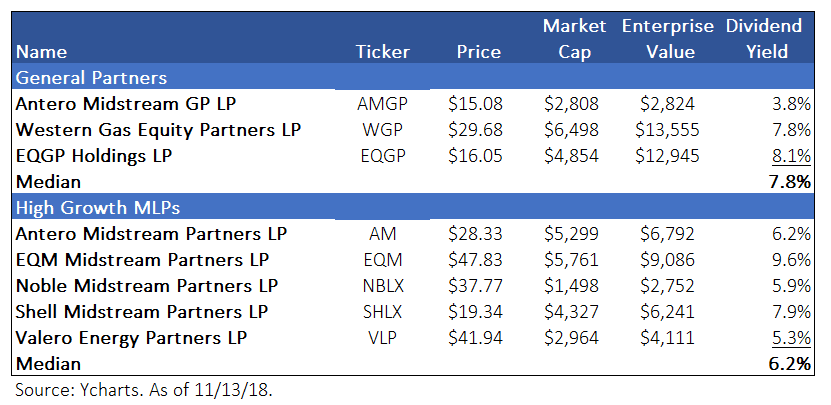

The company is targeting a $1.70 to $1.90 2019 dividend which implies an 8.5% yield at ETRN’s latest price. This appears attractive relative to some of ETRN’s peers as shown below (I’ve included EGGP and EQM as reference points). Assuming ETRN’s yield compresses to 8.0%, it implies ETRN would trade at $22.50, suggesting modest upside.

Leave A Comment