How to Front Run the Index

I had just finished my third cup of coffee as the market opened.

I settled into my chair and watched the early price action of Kontoor Brands (KTB) on its first day of trading with eager anticipation.

You see, one of my favorite things to do (I know it’s a bit weird) is to watch indiscriminate selling. Especially if it’s indiscriminate selling of a stock that I’ve researched and would want to own at the right price.

KTB fit the bill. It was a spin-off from VF Corp, a S&P 500 company with a $30BN+ market cap. KTB with an initial market cap of $2.3BN, was highly likely to be sold indiscriminately by large cap fund managers and index funds who are not able to own small cap stocks by mandate.

In early trading, KTB did not disappoint. It opened at $35.55 and began to drop like a rock. During the morning, it fell 5% on heavy volume to $33.71…but then a funny thing happened.

The stock started to appreciate due to extremely heavy buying pressure.

The stock ended the day at $38.60, up 9% on the day and up 15% from its intraday low!

After a little digging, I realized that KTB had been added to the S&P Small Cap 600 Index effective the next day. So instead of indiscriminate selling, there was indiscriminate buying by index funds!

In total, 15.8MM shares traded, which represents 28% of KTB shares outstanding. The day’s trading volume was 13x higher than its current daily average.

It got me thinking….

Is there a pattern that I can take advantage of?

So I went back and looked at all the index additions/subtractions for the S&P 500, the S&P Midcap 400 and the S&P Small Cap 600.

I thought that perhaps there was an opportunity to buy a stock on the morning before the day that it was added to the index and to sell it just before the close to take advantage of index fund indiscriminate buying. I would be taking advantage of what I had seen with Kontoor Brands.

After crunching the data, this strategy appears to have some merit, at least as it relates to the S&P Small Cap 600 (this strategy wasn’t compelling for the S&P 500 or the S&P Mid Cap 400).

On average, you would have made 0.46% per transaction on 36 transactions over the past year if you had 1) bought these stocks at the open on the day before they were added to the S&P 500 Small Cap 600 index and 2) sold these stocks at the close on the same day.

This return may not sound like much, but I compounded each transaction, and it works out to a 17% return. Quite compelling on an absolute basis and better than the 2% that the S&P 500 has returned over the past year.

While this seems interesting, there was an even better opportunity related to stocks that were removed from an index (and not added to another index).

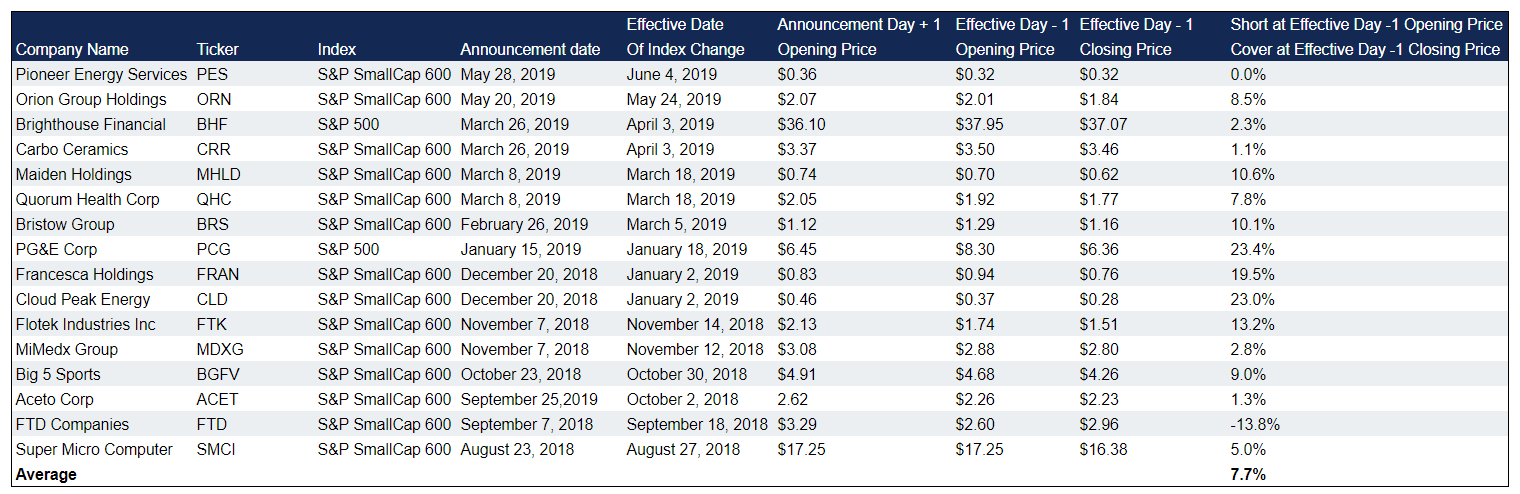

In total, I found 16 names that were removed from the S&P 500 or S&P Small Cap 600 over the past year due to pending bankruptcy, market cap or other issues. Note these names weren’t subsequently added to another index.

You could have 1) shorted these stocks at the open on the day before they were removed from the index and 2) covered these stocks at the close on the same day.

You would have made on average (and excluding transaction costs), 7.7% on average. Not bad for a day trade! See the data below.

There was an even more compelling return (10.8%) if you had shorted each stock at the open the day after the announcement and covered your short at the close on the day before it was removed from the index.

What’s the catch?

Brokerage firms have limitations on shorting stocks that are trading below $2.50 and many of the above stocks were below that level when they were removed from the index. I use Schwab and it charges higher interest for lower priced stocks. Further, these stocks are probably heavily shorted anyway so they could be hard to borrow.

Nonetheless, the returns look very compelling even assuming you pay a high rate of interest to your broker.

More to come on this strategy as I plan to dig deeper.

What ended up happening with Kontoor Brands?

Luckily for me, the indiscriminate selling resumed in the weeks that followed, and I was able to buy the stock at an average price of $28.05 at an implied dividend yield of 8.0%. Opportunities like KTB don’t happen every month, but when they do, it’s like shooting fish in a barrell!

Hi, sounds interesting and smart, but it’s a well known strategy among prop desks. They have their live calculations of which stocks are added/removed to the indices, according to the index rulebooks. So, they are trading the likelyhood of in/exclusion. Normally, you’re too late if you wait for the announcement.

(I work at a European proptrading firm)

Thanks for the insight, Peter! That make complete sense. From my analysis, it looks like the return is all arbitraged away for the large cap stocks, but an opportunity still exists in small cap stocks. Particularly, on the short side. However, it may exist due to the difficulty in shorting low priced stocks. I’m planning on digging deeper into this…

Rich, you still looking at this strategy?

I think it’s interesting, but I haven’t spent as much time on it recently!