Spin-offs with Insider Buying (February 2021)

This month, we saw some insider buying, but to be honest, there’s been more selling than buying.

On the buying side, we will highlight Arlo Technologies (ARLO) and Dorchester Minerals (DMLP).

On the selling side, we will highlight ANGI Homeservices (ANGI) and Bluebird Bio (BLUE).

Let’s start with the buying (that’s more fun).

Arlo Technologies (ARLO)

Last month, we highlighted Arlo as a stock with strong insider buying.

Arlo makes wireless cameras and has a loyal following. Right after its initial spin-off from Netgear (NTGR), demand for its products declined which resulted in an inventory build. Then the pandemic hit.

Arlo has finally recovered and appears to be back on track as Q3 2020 sales returned to growth.

Alro shares spiked in December when one of its cameras appeared in the Apple store although the camera is no longer listed.

The bull case for Arlo has always been that it is an acquisition candidate for a home security company (like ADT) or a large tech company like Google, Amazon, or Apple.

Google bought Nest for $3.2BN and Amazon bought Ring for $1BN.

Arlo is relatively cheap with an enterprise value of $386MM.

And the two year anniversary of Arlo’s spin-off has passed so the company could get acquired without any adverse tax consequences for Netgear (it’s parent).

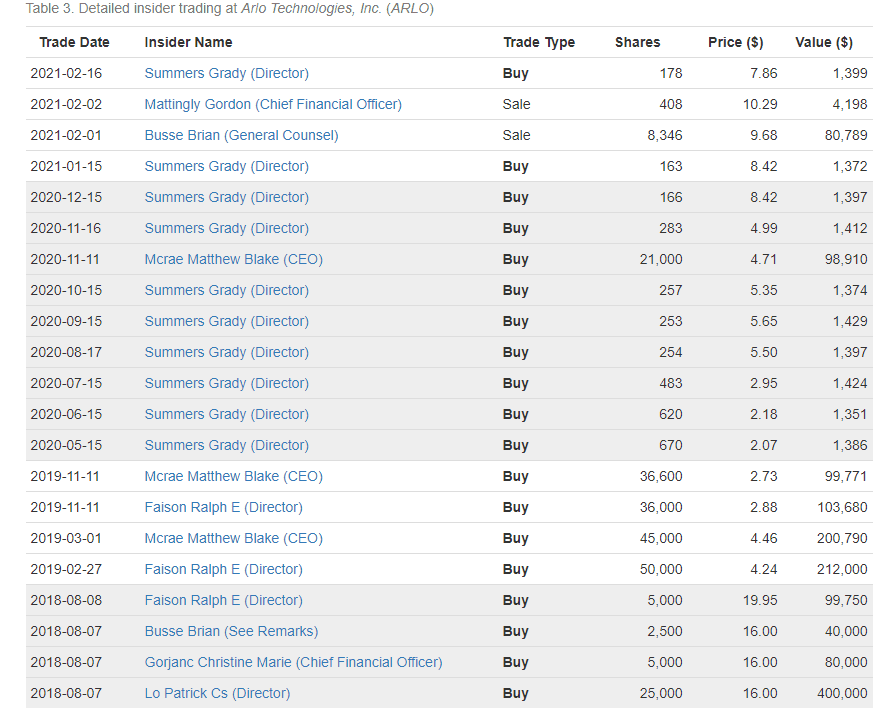

This month, we saw more insider buying from director Grady Summers as shown below.

Dorchester Minerals (DMLP)

Dorchester Minerals is not a spin-off but is a very interesting company.

It is in the oil and gas business but don’t stop reading yet. It’s one of the highest quality companies that I’ve ever seen.

Dorchester owns a bunch of mineral rights and royalties. As such, it doesn’t spend anything on capex and spews cash flow.

Better yet, it pays out all of the cash that it receives as dividends and has no debt.

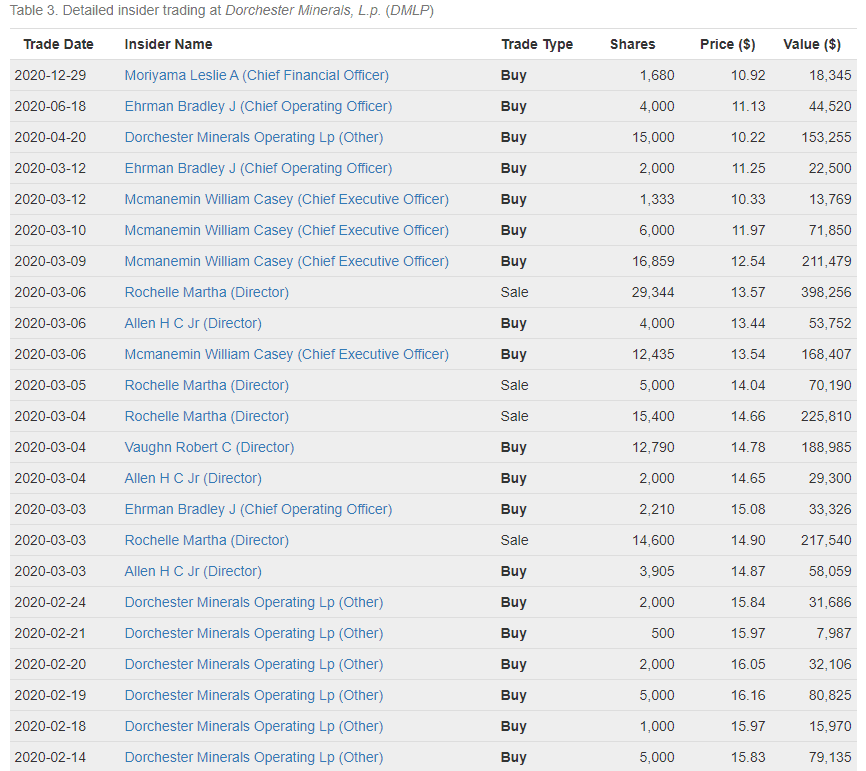

The latest insider purchases (shown below) happened in December 2020, but insiders have been buying aggressively for quite some time.

The stock is well below its pre-pandemic levels despite oil prices back above $60/bbl.

One other positive is this stock can be owned in retirement (non-taxable accounts). Most partnerships should not be owned in non-taxable accounts as they can generate unrelated business taxable income (UBTI) that you will have to pay (eliminating the tax advantage of your retirement account).

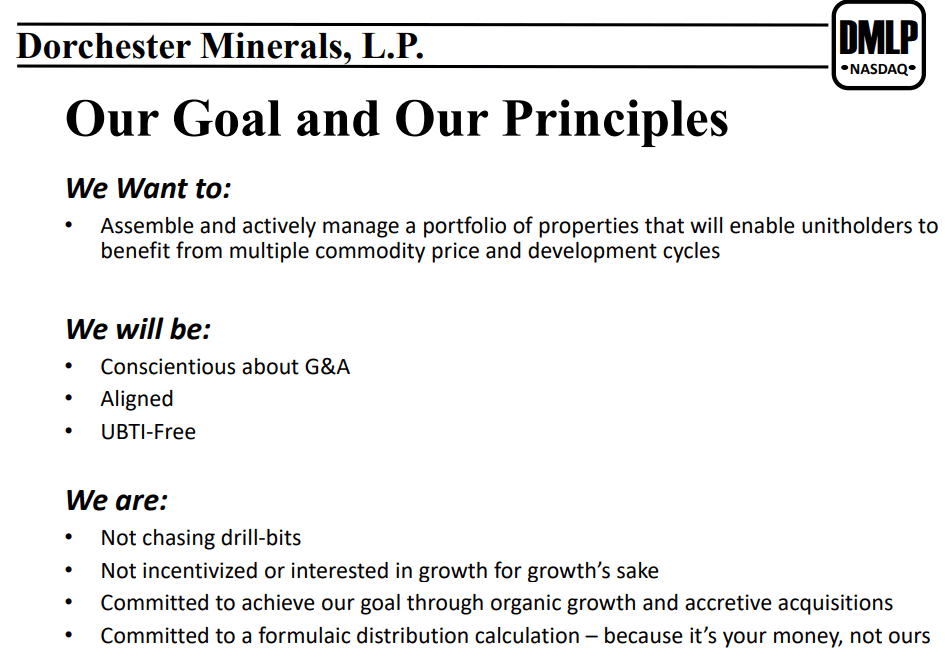

However, one of Dorchester’s corporate goals is to be “UBTI-free” as shown below.

Thus, it appears (although I’m not a tax advisor!) to be a safe name to own in a retirement account.

ANGI Homeservices (ANGI)

One name that I closely follow is ANGI Homeservices. It operates a bunch of marketplaces (HomeAdvisor, Angie’s List, Handy, etc.) that allow homeowners to connect with service providers.

Andrew Walker knows the name very well and makes the case that the stock could be a multi bagger from here.

I just can’t get there mainly based on my experience using their services. For example, I booked a cleaner through Handy but now just text directly with the cleaner and pay her cash, cutting out Handy.

I’ve also tried HomeAdvisor and haven’t been able to successfully book anyone (a plummer wasn’t available when I needed a plummer, etc.). Here are my notes on the name.

Nonetheless, I wouldn’t bet against the team at IAC (who controls ANGI) or Andrew Walker for that matter!

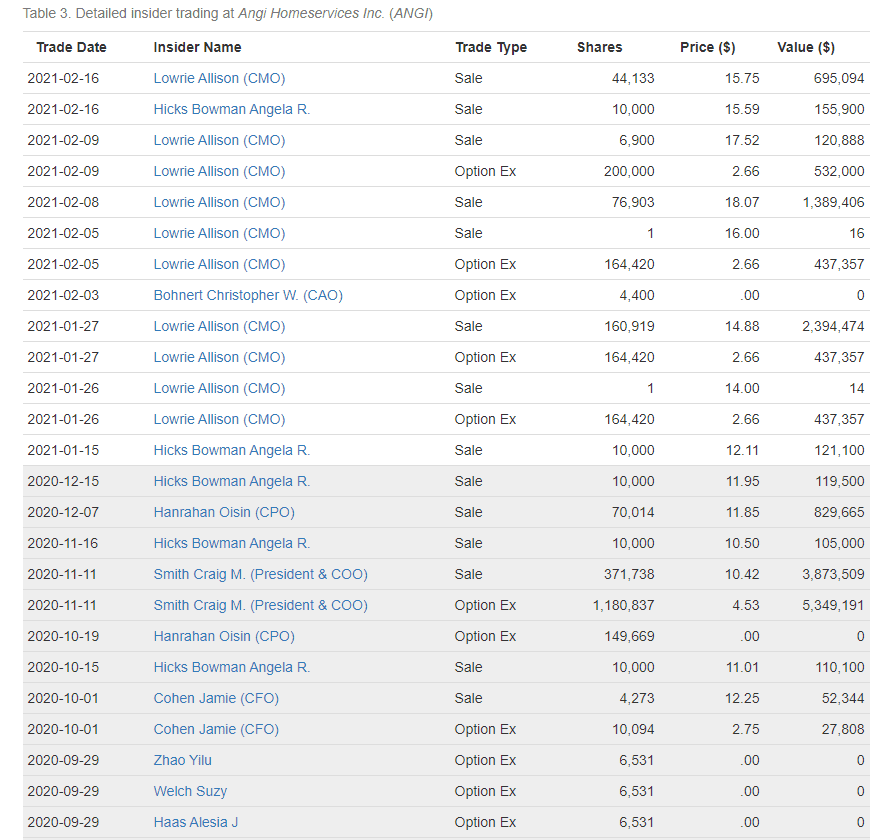

Anyway, there has been some selling with ANGI of late. Insider buying is more predictive than insider selling, but the heavy selling doesn’t exactly inspire confidence.

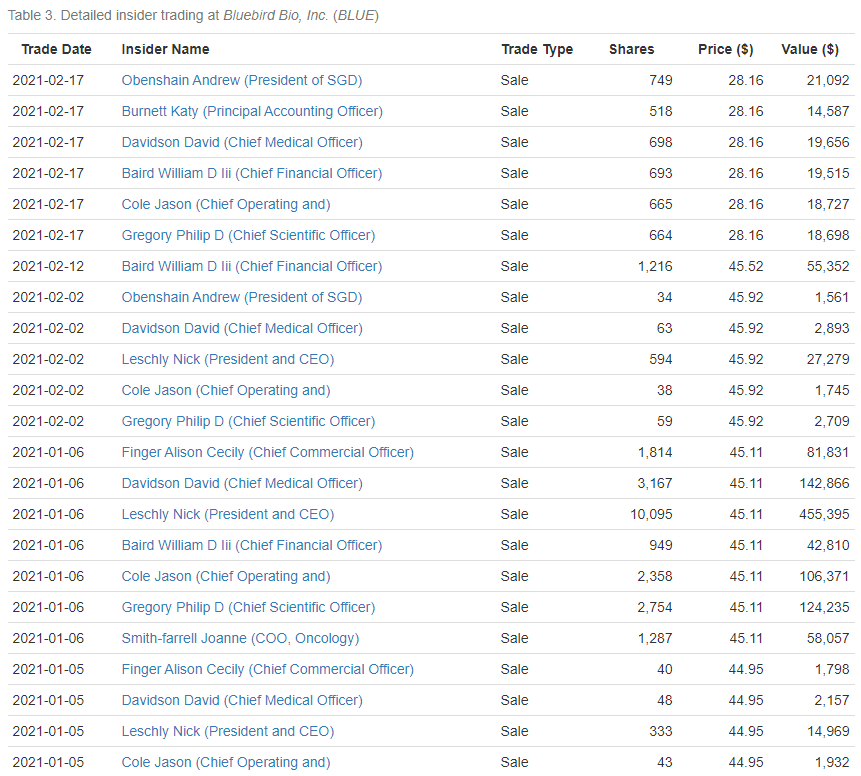

bluebird bio Inc (BLUE)

I hadn’t heard of bluebird bio until they announced in January they would be breaking up into two public companies.

By the end of 2021, the company will spin off its oncology division and the remaining company will focus on rare diseases.

Focus usually helps companies, but I don’t really understand the rationale for the spin-off. I’m not a biotech expert and I would have to be one to have a strong view on the company.

But it appears that insiders have been RUSHING to the exit so far in 2021.

Thank you for the information. When you put it the way you do it herps with what I have found.

Glad its helpful, Elayne!

BLUE is very telling. Thank you, this is great. Nice to spot outliers on the selling side of things!

Thanks Nick!