Sanofi Spin-off Notes

June 3, 2022 Update

- As many supply chain problems persist in pharmaceuticals and biotech EUROAPI has an opportunity to capitalize as a new supplier

- EUROAPI is a strong player in the active pharmaceutical ingredient (API) space with the second highest revenue

- However, EUROAPI was spunoff from Sanofi because it was not seen as a strong enough growth opportunity by management

Sanofi Spin-off Quick Summary – March 27, 2020

Resources from Sanofi

Spin-off Press Release – February 24, 2020

Spin-off Webcast Replay – February 24, 2020

Investor Relations Contact Information:

- Felix Lauscher – Head of Investor Relations, North America and Asia

- Email: ir@sanofi.com

- Phone: +33 (0)1 53 77 45 45

Other Resources

Sanofi to Spin Off Drug Ingredient Business by 2022 – February 24, 2020, Financial Times

Sanofi Plans to Spin Off Drug Ingredient Business – February 24, 2020, Motley Fool

Sanofi Plans Spinoff of Manufacturing Facilities – February 24, 2020, Barron’s

Overview

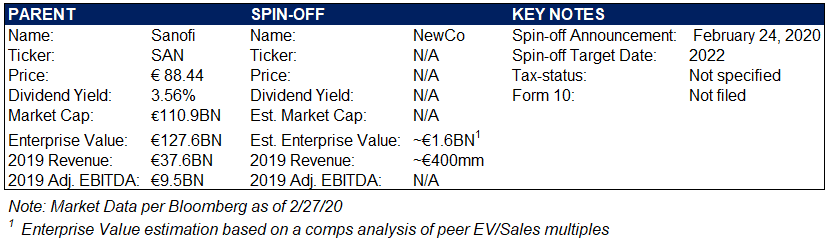

On February 24th, Sanofi announced that they would be spinning off their active pharmaceutical ingredient manufacturing business into its own, publicly traded company via an IPO on the Euronext Paris. The transaction is expected to be executed at some point in 2022, and the taxable nature of the deal is yet to be announced.

Why the Spin-off?

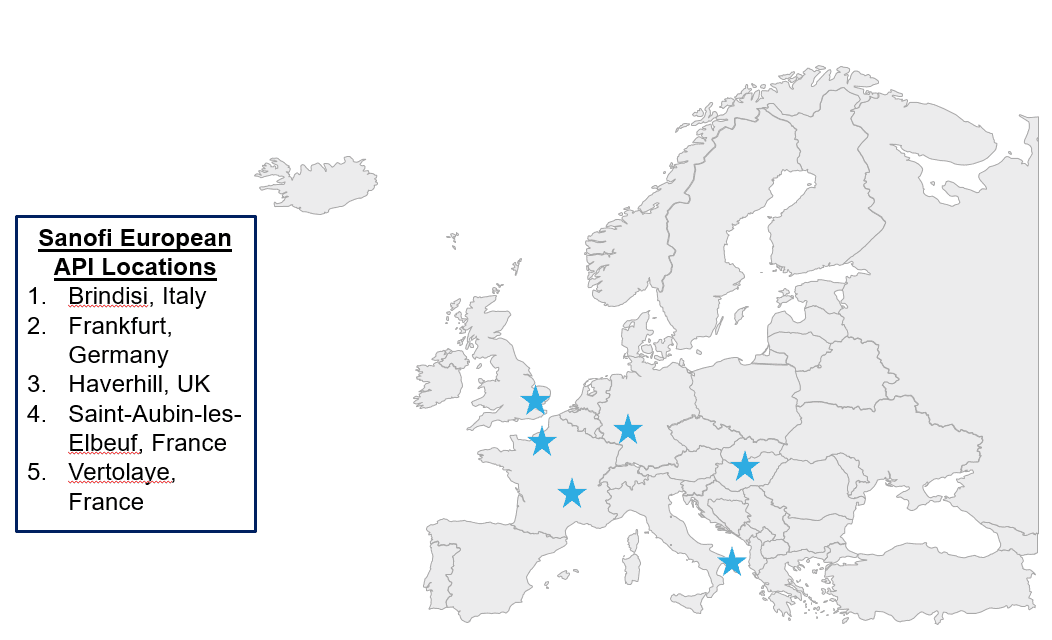

Per management in the press release, Sanofi is executing this spin-off in order to secure better, more independent API manufacturing and supply capacities in Europe. This spin-off would combine Sanofi’s current commercial and development activities with six of its European API production sites. The plan for this is that a new API company based solely across Europe would balance the industry’s heavy reliance on API that is currently sourced from Asia. Per the 2019 CPA Industry Report, 60% of worldwide API production volume is located in China and India, so this spin-off would create a more direct access point throughout Europe.

Spin-off Overview

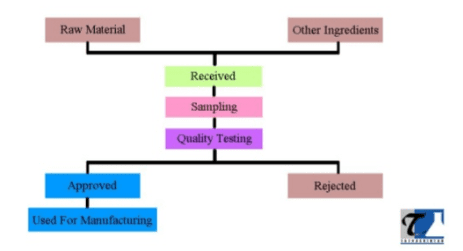

Company

The SpinCo consists of the business units within Sanofi that are considered active pharmaceutical ingredient manufacturers (APIs). APIs are essentially the businesses that manufacture the active ingredients in various pharmaceuticals from raw materials. This is done through both chemical and physical means in which the scientists synthesize raw materials into a form in which they can work properly in pharmaceutical products.

In terms of past growth, investors and analysts as a whole know and have been told almost nothing about the direct financials of this business. The only number that management has provided regarding the business’s financials is that they had approximately 400mm in sales this year, and they expect the business to reach about 1 billion in sales by 2022, when the spin-off is expected to happen. However, this figure would make the business the second largest API manufacturer in the world, and this would be a pure play for investors trying to gain targeted exposure to the space.

The business is likely rather non-cyclical, the only concern being political risk surrounding drug pricing which would squeeze many of their customers, leading to less pricing power for the SpinCo.

Industry

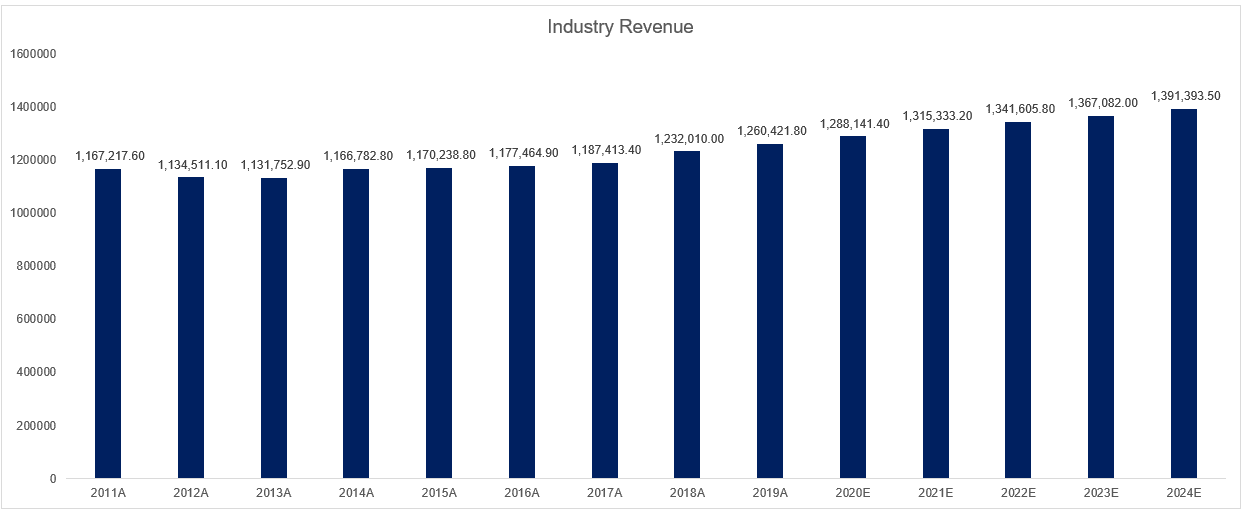

Globally, the pharmaceuticals industry is expected to grow well over the next few years, driven by the increasing global age and a rising health standard globally, meaning more countries will be able to afford and actually demand more pharmaceutical medicine. Through this, more businesses will need to manufacture pharmaceutical drugs, leading to a higher demand for API firms like the SpinCo.

Additionally, events like epidemics will drive an increased degree of production for new treatments. Companies will need rapid ingredient manufacturing, leading to increased API demand in times of crisis in which API firms will have even more pricing power.

Finally, the roll-off of many patents in coming years combined with a more lenient regulatory environment will likely spur more growth in biosimilars. Lower clinical costs combined with a less concentrated environment will enable more upstart biosimilar products that will need even more ingredients from APIs.

Competition

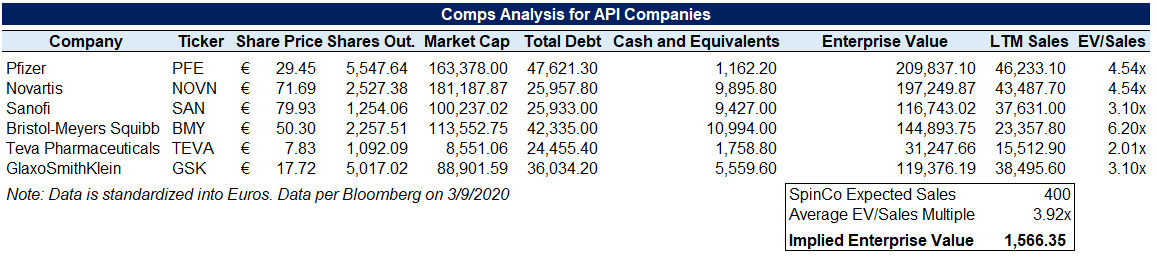

Competition in this space in largely centered around business units of larger pharmaceutical companies, not standalone businesses like Sanofi would be creating with this spin-off. Granted, per the spin-off press release, it appears that the SpinCo would have immediate scale after the spin-off, as management indicated that the new company would be the second largest API firm in terms of revenue globally. Major publicly traded players in the space currently include Pfizer, Novartis, Bristol-Meyers Squibb, Teva Pharmaceuticals, and GlaxoSmith Klein.

Customers

Per the spin-off press release, the SpinCo will focus its efforts in serving third parties and partnering with other pharmaceutical companies. This means that, essentially, they would be looking for customers that would outsource their API work, in addition to continuing to sell to Sanofi. Considering most of the major large pharmaceutical companies do their own API manufacturing, it could be reasonably expected that most of the SpinCo’s customers will be smaller, more niche manufacturers of various pharmaceutical products. However, management has not indicated any specific customers that they already have partnerships with or will roll over as existing customers apart from themselves.

Quality of Business

Since management has provided virtually no specific numbers in terms of financial data, analysts and investors cannot reasonably triangulate the quality of the business from a quantitative perspective. From a qualitative perspective, however, this appears to be a rather solid business. They will be the dominant player in Europe in this market, and Europe as a continent is rife with pharmaceutical companies, meaning that there should be a relatively large addressable market for the SpinCo to attack.

Capital Structure

Although there was not a specific capital structure spelled out in any filings yet, the spin-off press release did state that they do not intend for the SpinCo to carry any debt immediately after the transaction. However, since the API business will be able to operate as its own entity, they will have the freedom to raise capital in whatever manner they need to operate most efficiently for shareholders.

Management

The only piece of the management team that has been announced for the SpinCo presently is the incoming Chief Executive Officer, Jack Boom. After significant research, we were unable to find any information on Boom on the Sanofi investor relations site, Google, or LinkedIn.

Potential for Indiscriminate Selling

Although the spin-off will have a solid mid-cap profile, there is definitely a potential for indiscriminate selling. The market caps will be very different, and the business models will be different as well. However, there may be an investor group that wants specific, pure play exposure to the API industry, so you may see some support from fundamental-agnostic buyers as well.

Valuation

Although there is essentially no financial data available, we attempted to find a very rough estimate of fair value by taking a selection of comparable companies and utilizing their mean EV/Sales multiple, then basing the valuation off of management’s approximate indication of last year’s sales data. This methodology would indicate that the SpinCo would be worth approximately €1.6 billion.

Leave A Comment