Spin-offs with Insider Buying (January 2021)

This week, we have some insider buying as well as some selling.

Let’s go in alphabetical order…

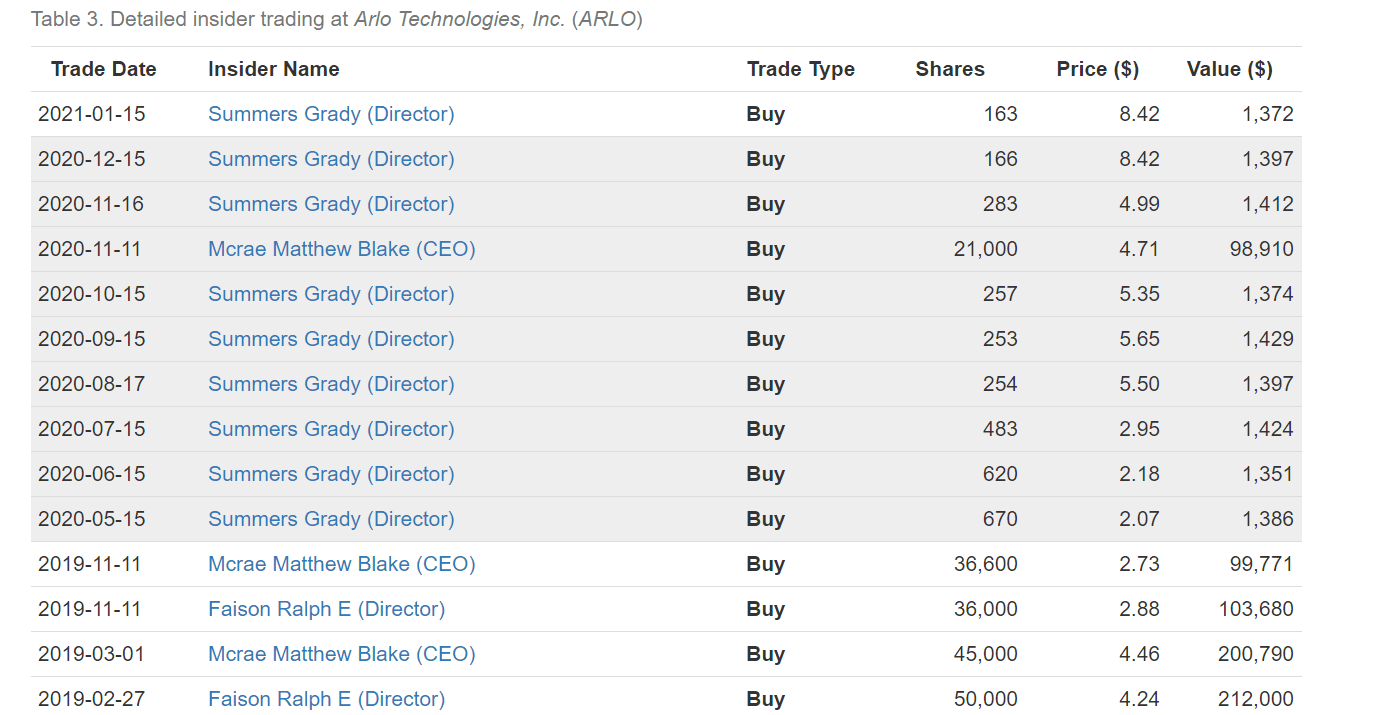

Arlo Technologies

Arlo (ARLO) is a 2018 spin-off from Netgear (NTGR). Until recently, it has been an absolute disaster.

It makes wireless cameras and has a loyal following. Competition is fierce with Nest (Owned by Google), Ring (owned by Amazon) and many others.

Nonetheless, Arlo is well capitalized and relatively cheap trading at 1.1x revenue. It could be an acquisition candidate for Apple or another security company. Further, there has been pretty aggressive recent insider buying as seen below. I’m not interested in the stock given its low margin profile and fierce competition.

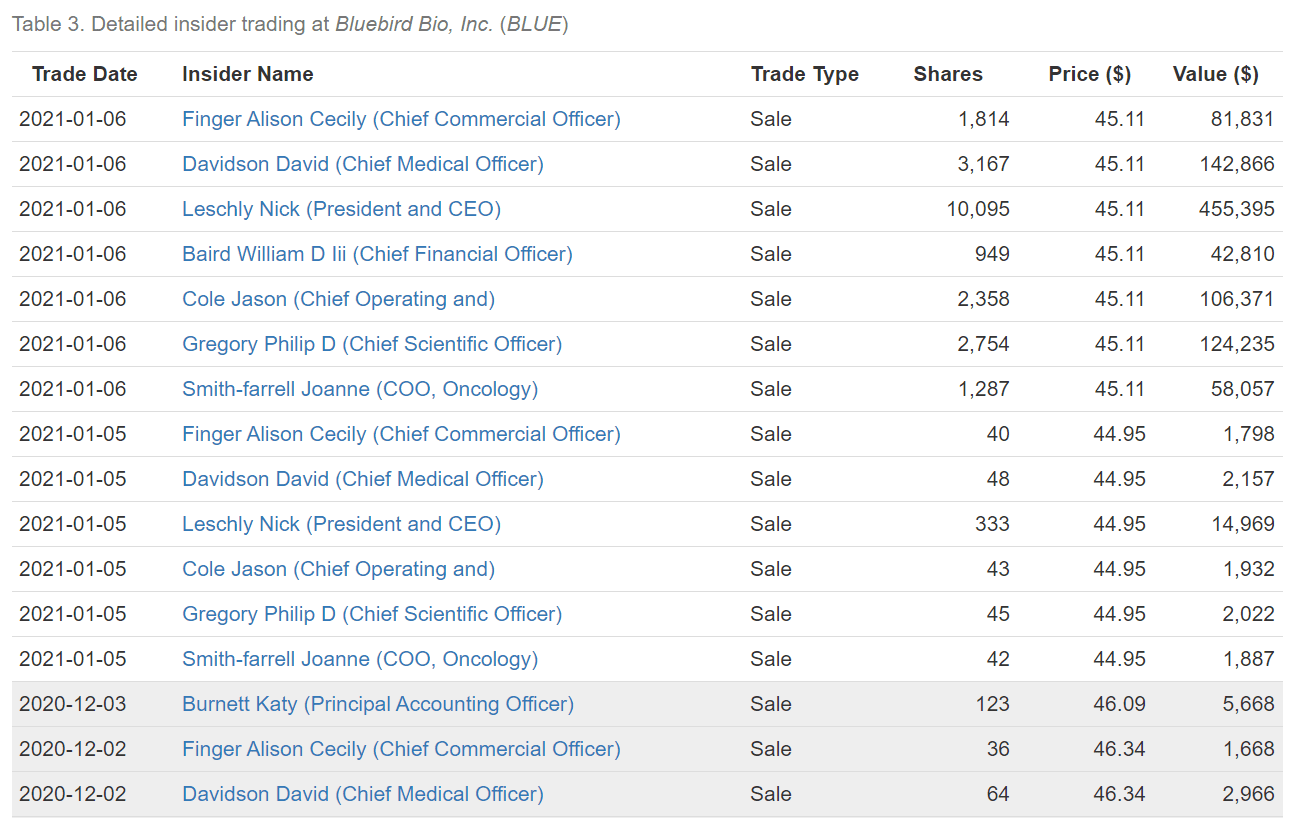

bluebird bio (BLUE)

Bluebird bio is on my radar as it recently announced that it intends to spin-off its oncology business. It is expected to occur this year. The remaining company will be a rare disease treatment portfolio.

Bluebird is a $2bn EV company with $250mm of sales. I have no insight into their pipeline so this transaction is not actionable for me.

Recent insider selling is not exactly inspiring…

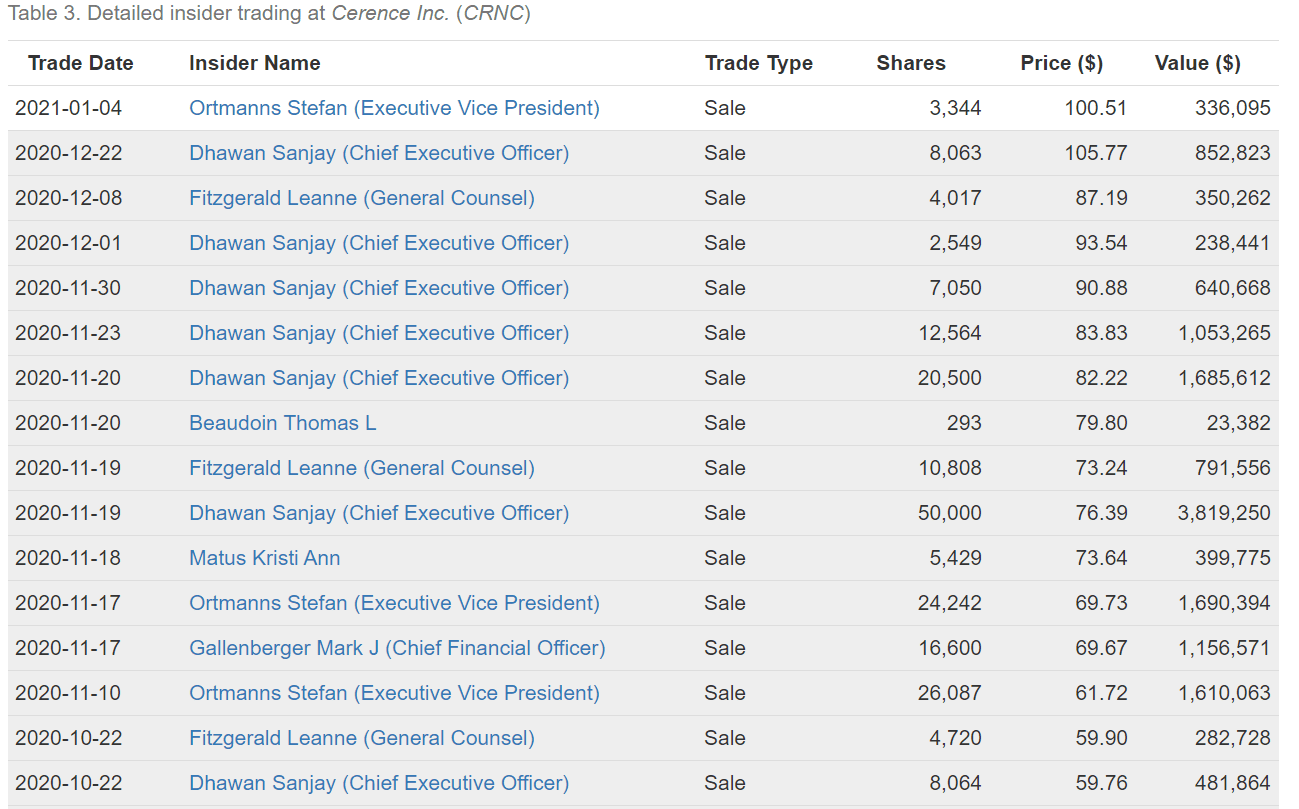

Cerence (CRNC)

Looking at Cerence (CRNC) is a little painful. I did all the work on the company at the time of the spin-off and actively decided to pass. My concern was the lack of recurring revenue. Yes, Cerence sells software to auto manufacturers, but sales 100% depend on new auto sales. There is no recurring nature to revenue. Plus, we were late in the cycle at the time of the spin-off and global auto sales had peaked.

Why happened?

The stock has 8x’d since its spin-off low.

Like I said, painful.

Nonetheless, I’m not about to buy it now, especially given heavy insider selling…

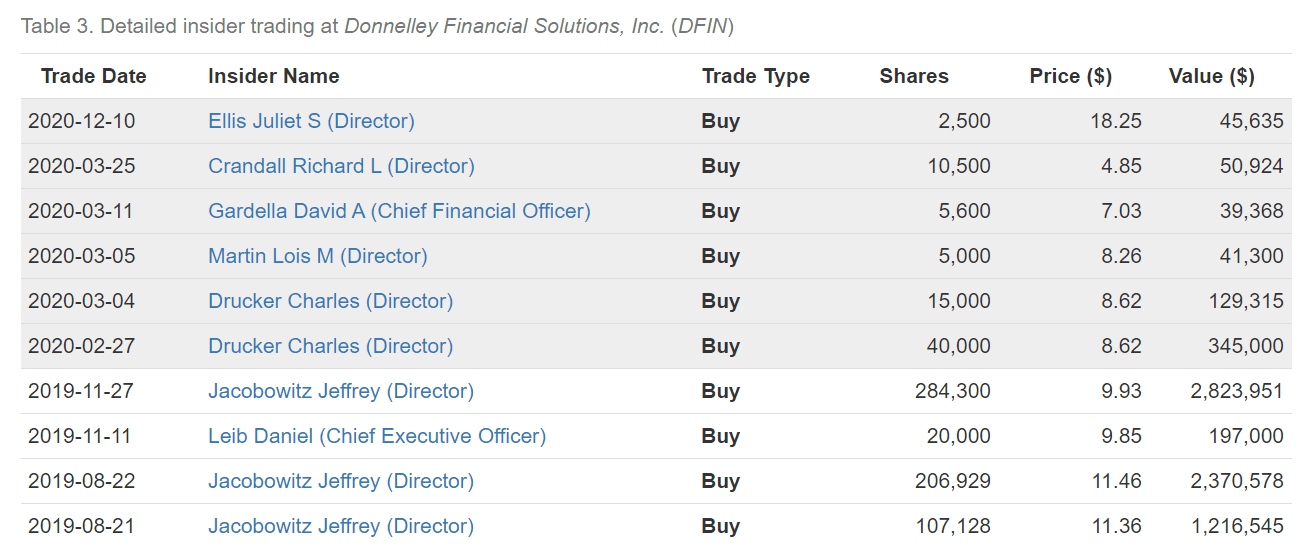

Donnelley Financial Solutions (DFIN)

Donnelley Financial Solutions is a legacy 2016 spin-off that I’ve watched for years. The company is in the final stages of a turnaround as it shifts from a printing business to tech enabled and software services. Here is a great write up that summarizes the thesis courtesy of @rsosa8. In nutshell, the stock is cheap and an activist investor is in charge. If the turnaround stumbles the company will probably be sold. I like the risk/reward set up.

Recent insider buying is encouraging….

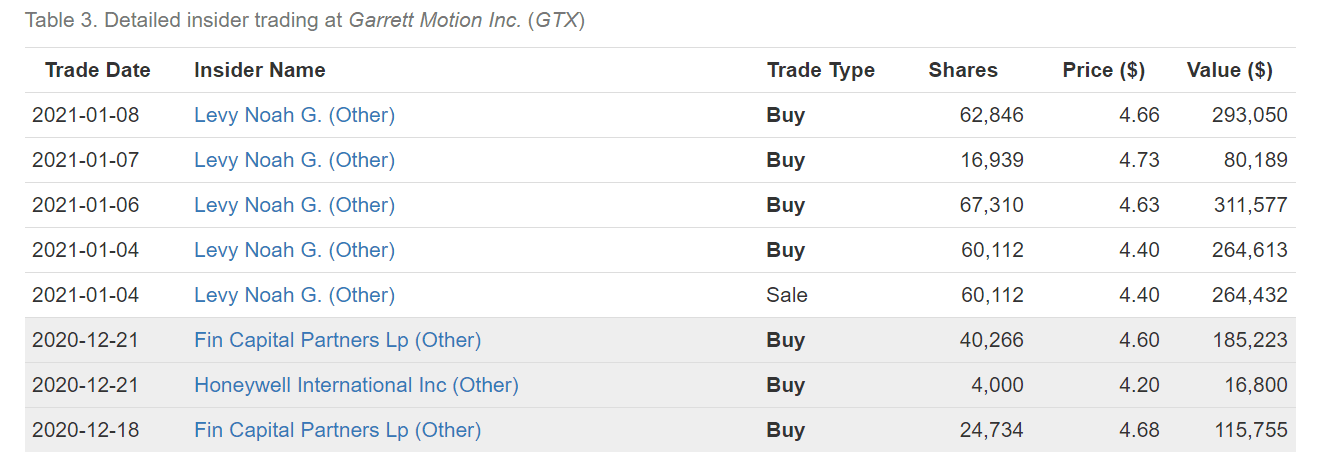

Garrett Motion (GTXMQ)

Last month, we highlighted insider buying at Garrett Motion. This month, there was more.

The company is a 2018 spin-off from Honeywell (HON) that has declared bankruptcy largely to get out of its legacy asbestos liability obligation to Honeywell.

Here is a good overview of the situation and there is also a good summary on VIC.

Recently, Garrett announced that the company has selected an enhanced proposal from Centerbridge and Oaktree. Shareholders will have the right to receive $6.25 in cash (or keep their shares which will remain publicly traded) while also having the right to subscribe to up to $200MM of preferred stock at the same terms as the sponsors (Centerbridge and Oaktree). Recent insider buying has been below the current share price, but the stock still looks interesting at ~$6.18.

Vistra Energy (VST)

Vistra is a 2016 spin-off/post bankruptcy reorg.

It is a utility company based in Texas that looks quite attractive trading at 4.6x free cash flow and 6.0x on an EV/EBITDA basis.

There has been some nice insider buying recently…

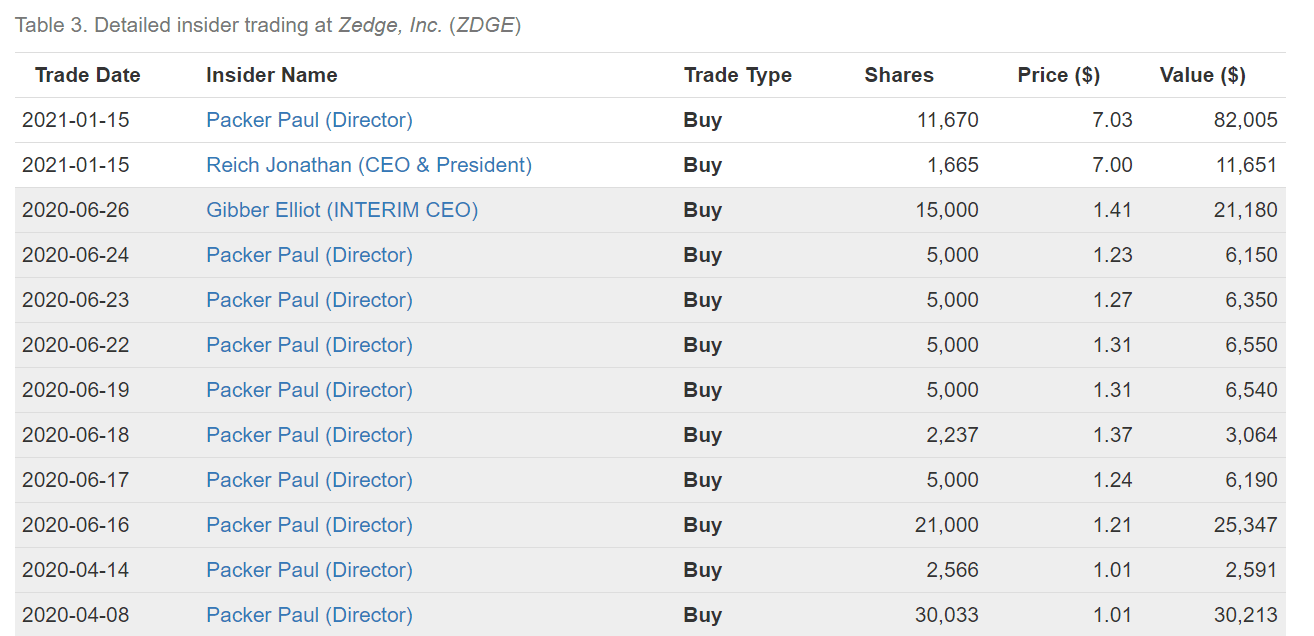

Zedge Inc (ZDGE)

Zedge Inc is a 2016 spin-off from IDT Corp (IDT). Zedge focuses on creating mobile apps. Historically, it generated all of its revenue from advertising associated with its free mobile phone wallpaper and ringtones.

Recently, the company has offered a subscription offering which has been a hit. As a result, of strong subscription revenue and an improving advertising market, revenue increased 94% (!!!) in the most recent quarter.

Despite the jump in shares, insiders have been buying in the open market.

Leave A Comment