Carrier Global Spin-off Deep Dive – March 30, 2020

Resources from Parent Company:

Carrier Form 10 – March 11, 2020

Carrier Investor Day Presentation – February 10, 2020

Contact information:

- Phone: (860) 728-7608

- Email: InvRelations@corphq.utc.com

Other Resources:

HVAC Stocks Will Stay Hot Even if the Economy Cools – April 5, 2019

5 Emerging Trends That Are Reshaping the Commercial HVAC Industry -January 18, 2020

Overview

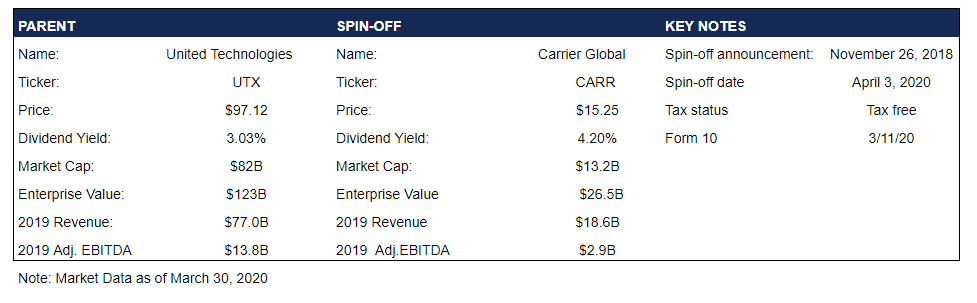

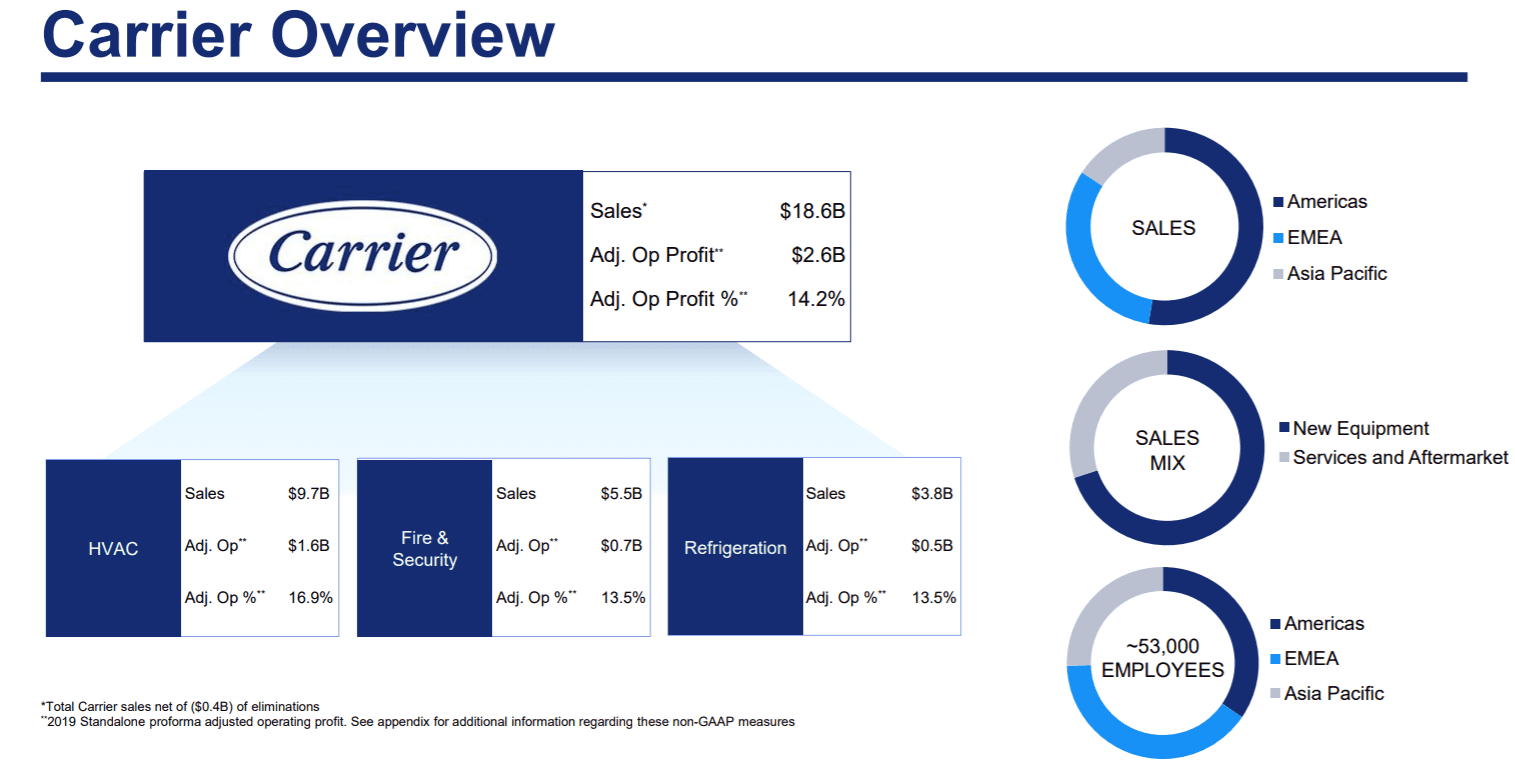

On November 26, 2018 United Technologies ( UTX $82) announced the company’s intention to spin-off its commercial businesses, Otis and Carrier, into independent entities. Subsequently, in 2019, UTX agreed to a merger of equals with Raytheon (RTN $124). UTX will assume the name Raytheon Technologies and will be one of the largest and most important aerospace and defense pure play companies in the world. UTX stock price had been very strong until the recent coronavirus scare, advancing almost 44% last year while estimates had been rising. Carrier, a well established company, is a global provider of HVAC, refrigeration, building automation, and fire safety and security products.The company’s 2019 revenue was about $18.6 billion with operating profit of $2.6 billion. Shareholders of United Technologies will receive 1 share of Carrier for each share held.(The Form 10 says that there will be about 865.3 million shares outstanding). Otis, a company with a long history, is the world’s leading manufacturer of elevators, escalators and moving walkways. Otis’s 2019 revenue was about $13.1 billion and EBIT was about $1.8 billion. UTX shareholders will get 0.5 shares of Otis for each share held. Both spin-offs will be tax free. The record date was March 19, and the distribution date will be April 3. We recently published a deep dive on Otis. Carrier is trading in the when issued market for $15.25 per share. The implied market cap is $11.03 billion. Our estimate of fair value is well above the when issued price as you will see in our discussion of valuation below. We expect ‘‘regular-way’’ trading of Carrier common stock to begin on April 4.

Why the Spin-off?

The reasoning presented in the press release stated, “Each business will be better positioned to pursue a capital allocation strategy more suitable to its respective industry and risk and return profile, and enjoy greater flexibility with an independent equity currency and more appropriately aligned management and employee incentives.” In looking over the performance of each of the segments of UTX, you’ll see that revenue and operating profit growth at Otis and Carrier have been a drag on overall performance. Both divisions have shown profit declines since 2016 and revenue growth has been below 4% per year. In contrast, Pratt & Whitney and Rockwell Collins have shown strong revenue growth. Both had good growth in operating profits too. Even after a strong year in 2019, the company’s valuation could realize improvement. With the EV to EBITDA ratio now at 8, (down from 12.5 recently), management hopes for the better valuation of a pure play.

Spin-off Overview

Company

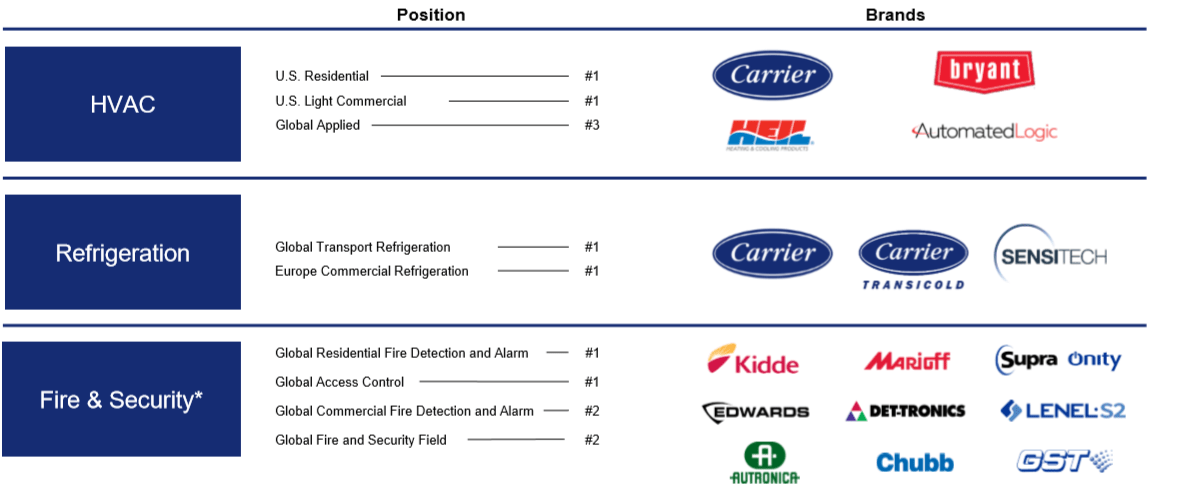

Carrier is organized into three business segments—HVAC; Refrigeration; and Fire & Security. The company prides itself on its history of innovation, beginning with its founders—Willis Carrier, who designed the world’s first modern air conditioning system; Robert Edwards, who patented the first electric alarm bell; and Walter Kidde, who produced the first integrated smoke detection and carbon dioxide extinguishing system for use onboard ships. In the last two years, they have introduced over 200 new products.

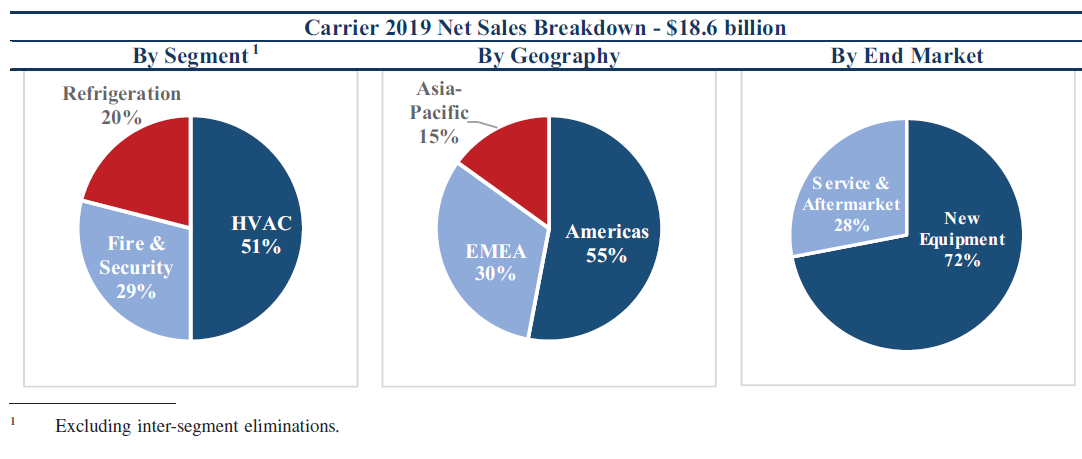

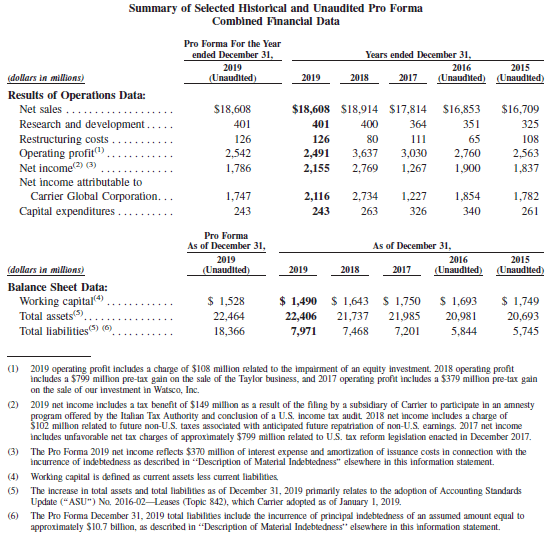

Today, Carrier is well known and has a portfolio of brands that include Carrier, Automated Logic, Carrier Transicold, Edwards, GST, Kidde, LenelS2, and Marioff. The company believes their businesses enable modern life by promoting smarter, safer, more efficient and more sustainable buildings and infrastructure. Carrier also provides a broad array of related building services, including audit, design, installation, system integration, repair, maintenance, and monitoring services. The company also provides refrigeration and monitoring products and solutions to the transportation industry. Carrier sells its products and solutions either directly, including to building contractors and owners, transportation companies, retail stores and food service companies, or indirectly through joint ventures, independent sales representatives, distributors, wholesalers, dealers, and retail outlets. They have an extensive global footprint with approximately 53,000 employees globally, including approximately 3,600 engineers, and their solutions are sold in over 160 countries around the world. According to the table below from the Form 10, Carrier has enjoyed modest sales growth and operating profit has been flat over the last four years. The operating margin has declined from 15.3% in 2015 to 13.7% last year.

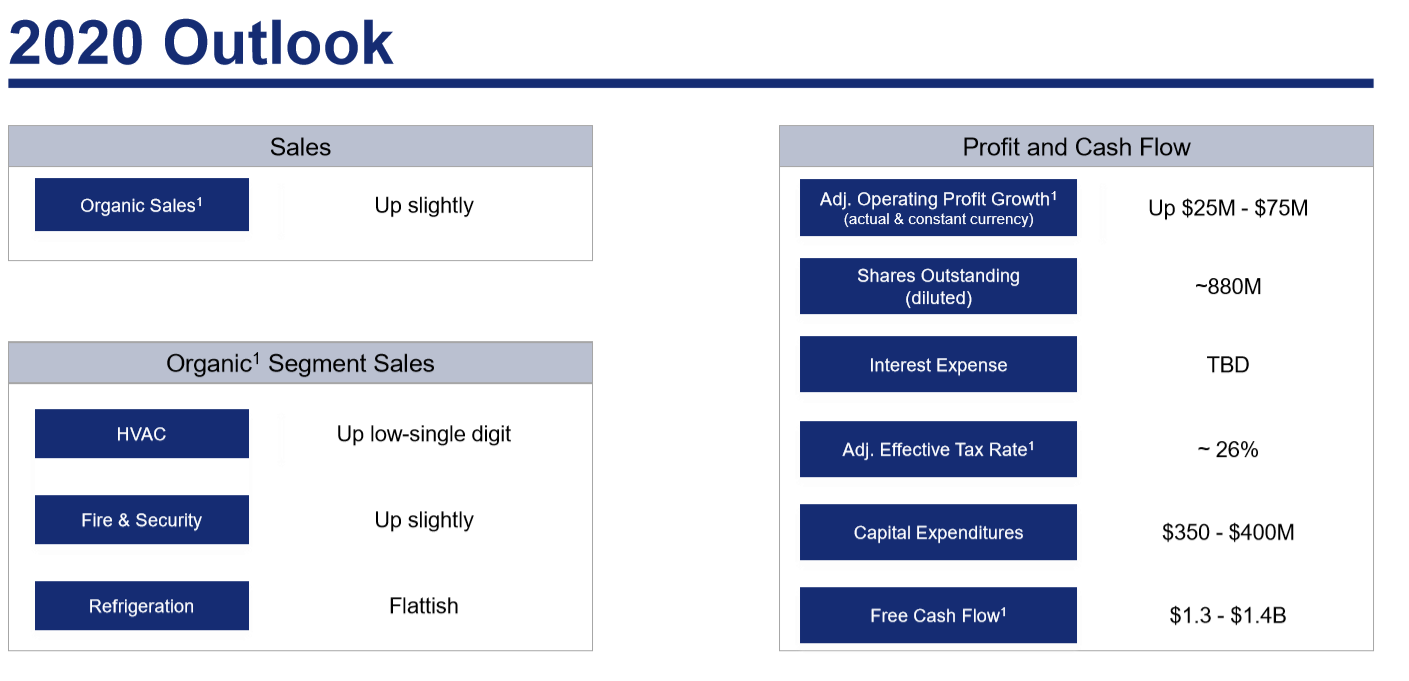

In Q4 last year, Carrier sales declined 2.8%, and adjusted operating profit declined 4.8%. Expectations for 2020 were presented at the investor day and are shown below:

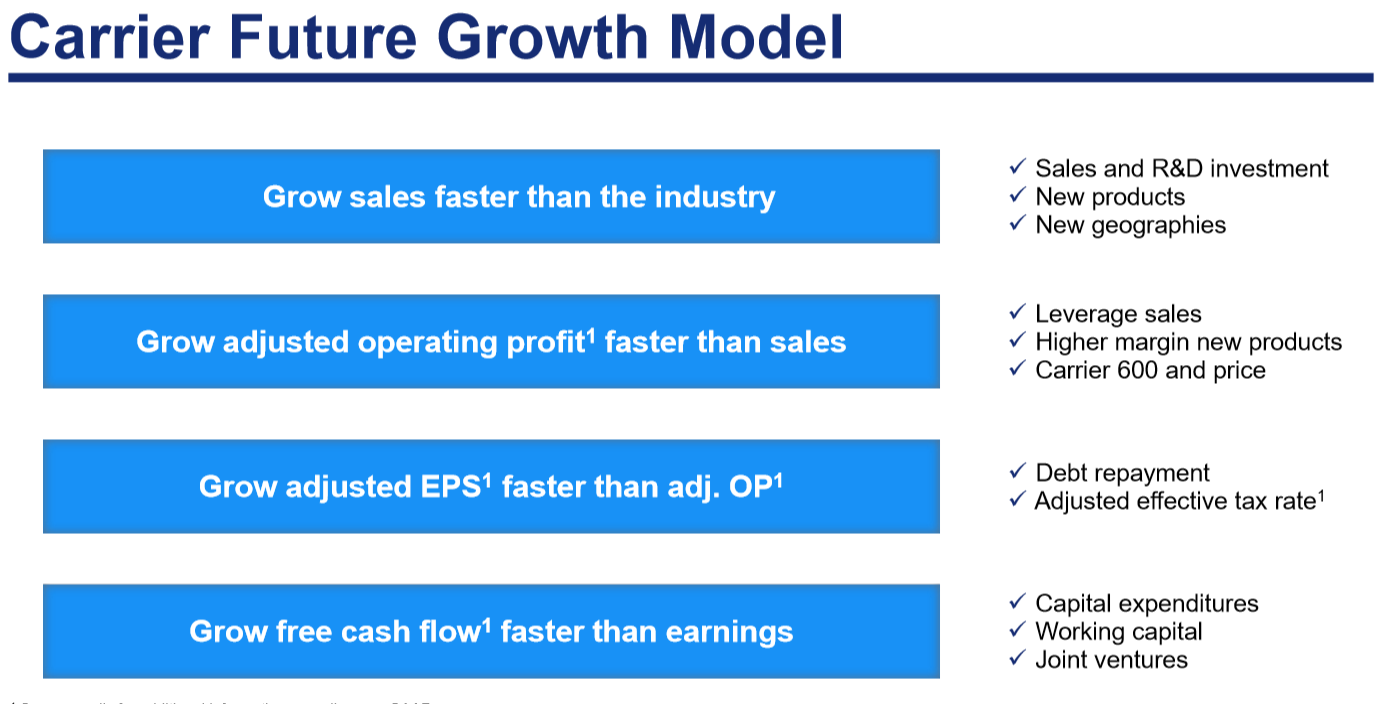

Beyond 2020, they expect mid single digit sales growth and high single digit adjusted EPS growth. We should look for the free cash flow conversion rate to be 90 to 100%.

The expected business model is shown below:

Company Strategy

The company has an ambitious strategy to reestablish growth by taking advantage of what they see as enduring worldwide mega trends. Urbanization, climate change, increasing requirements for food safety, rising standards of living, and needs for increasing energy conservation are all trends that support demand for Carrier products and services. David Gitlin, coming over from aerospace about six months ago and now the CEO of Carrier outlined the strategy for the company. Gitlin said a basic theme will be top line growth. The first leg of the strategy will be to grow the base. They plan to invest in R&D and grow the sales force to enable this growth. Secondly, he plans to concentrate on product and geographic extension. The third leg of their strategy is to expand their service business and to embrace digital innovation. They have brought people to Carrier from other segments of UTX and from outside the company who have been successful in growing service businesses. They plan to pay for their strategy with cost reductions. Gitlin points to the success they enjoyed at Rockwell Collins (a UTX division) in cost reduction. He claims these initiatives will not be achieved at the expense of margin reduction, an ambitious claim to be sure. Lastly, Carrier will continue to try to optimize their portfolio of products and services by making divestitures, and looking for smart acquisitions.

Industry

CEO Gitlin was excited to describe four enduring macro trends that support his prediction of mid single digit top line growth at Carrier. Grand View Research backs this prediction in a recent report that says that the $130 billion HVAC industry will grow 6.1% per year from 2020 to 2027. Climate change will support demand for air conditioning products and cause regulatory change. Gitlin pointed out that the 18 hottest years in history occurred in the last 19 years. Urbanization of the worlds’ population has been a steady and continuing trend. 50% of the world’s population now live in urban areas and he asserted that the number will be 70% by 2050. Demand for refrigeration, smoke detectors and other safety and security equipment will accompany this movement to cities. The continuing growth of the middle class also speaks to support for Carrier products. Finally, digitation and connection of HVAC equipment will help with preventive maintenance and reduce costs for the industry. It’s clear that smart and environmentally friendly technological advancements play a huge part in shaping the HVAC industry. DeVap, short for desiccant enhanced evaporate, cools the air using an evaporative cooling system where water is run into a honeycomb media and a fan is blown through the honeycomb causing water to evaporate. Environmentally hazardous CFCs (chlorofluorocarbons) are being replaced by R22, a more environmentally friendly coolant. Smart thermostats and geothermal technology will become standard. More sophisticated digital “software-as-a-service’’ models enabled by data and analytics will also be developed.

Competition

Carrier is subject to significant competition from a large number of companies in the United States and other countries, and each competes on the basis of price, delivery schedule, product performance and service.The geographies in which they sell their products and services tend to have a large number of local competitors, but clearly Carrier is one of the leading equipment manufacturers and service providers in most regions. The company stresses technical innovation, offers promotional pricing and training incentives to thwart competition. The anticipation of regulatory change is important to Carrier so that products and services can be quickly adapted. Competition in HVAC equipment includes many international, regional and local companies. The largest of which include Daikin Industries, Ltd., Gree Electric, Ingersoll-Rand PLC, Johnson Controls International PLC, Lennox International, Midea Group and Mitsubishi Electric Corporation. Competition in refrigeration also includes multinational companies, such as Ingersoll-Rand PLC, Daikin Industries, Ltd. and Panasonic Corporation. Sales depend heavily on product performance, efficiency and reliability, as well as service and support. From time to time, customers and others may seek to become competitive suppliers of their products and services or pursue other strategies to disrupt the business model. For example, an affiliate of a customer in the transport refrigeration business has started to produce refrigeration units for shipping containers, and another one of their transport refrigeration customers has started to produce refrigeration units for truck trailers. Competition in fire and security products, solutions and services includes several large multinational companies, including Assa Abloy AB, Bosch Group, Zhejiang Dahua, Hangzhou Hikvision Digital, Honeywell International Inc., Johnson Controls International PLC and Siemens AG.

Customers

Carrier sells its products and services directly to end customers and indirectly through thousands of distributors, independent sales representatives, wholesalers, dealers, other channel partners and retail outlets. The Carrier business model is not dependent on any single customer. The products solve different problems for a very diverse set of customers in a range of applications and locations. They expect that sales to emerging markets will continue to account for a significant portion of sales as developing nations and regions around the world increase the need for their products.

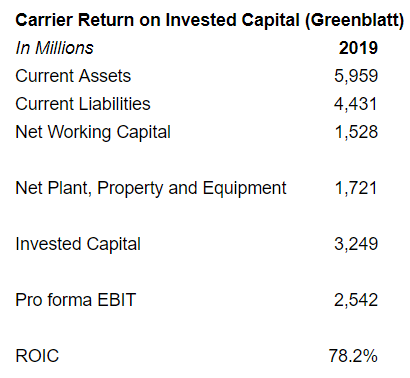

Quality of Business

Carrier benefits from competitive margins and a track record of good cash flow generation. Over the past two years, the operating margins have been over 13%, down from prior years, but still a respectable level sustained through strong brands and operational efficiency. The business also benefits from the low capital intensity which has contributed to a track record of generating strong operating cash flow. Over the past two years, capital expenditures averaged approximately 1.3% of net sales and the company generated a cumulative $4.1 billion of operating cash flow. Following the distribution, it expects to pay a cash dividend on a quarterly basis at an aggregate annual rate of approximately $550 million. In connection with their focus on cost-effective performance, they launched a strategic cost reduction initiative in 2019 with the goal of reducing cumulative supply chain, factory and general administrative costs by up to $600 million in the aggregate by the end of 2022. EBITDA in 2019 was almost 8 times the projected annual interest cost, a very strong coverage ratio.

Carrier, while not as attractive as Otis, does generate very high returns on invested capital as shown below.

Carrier’s businesses are economically sensitive to residential and commercial building cycles.

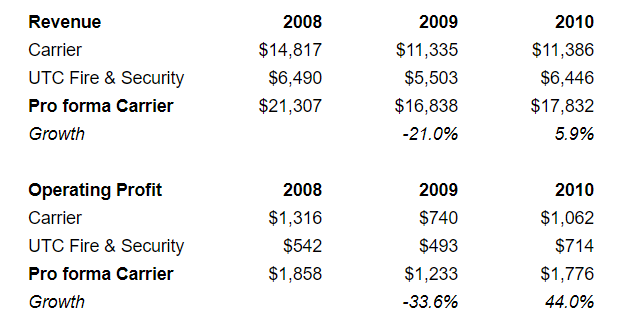

We looked back at UTX’s 2010 10-k to analyze the company’s cyclicality during the last downturn.

As shown above, pro forma Carrier revenue declined 21% and operating profit declined 33.6% in 2019. While this is a substantial decline, it was not catastrophic. As such, Carrier might be an attractive buy at some point if it sells off to a draconian level.

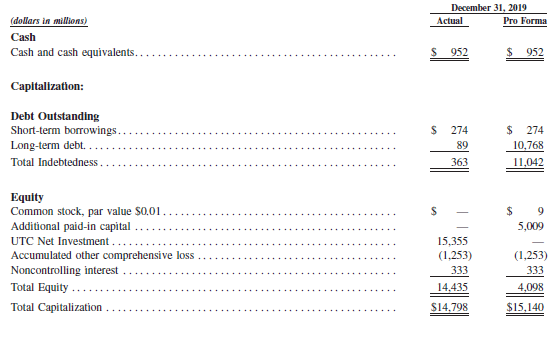

Capital Structure

Carrier recently completed financing transactions of approximately $10.7 billion with the proceeds to be used to distribute cash to UTX. As a result of these transactions, Carrier anticipates having approximately $11 billion of outstanding indebtedness upon completion of the spin-off. The maturities are spaced with a 14 year average maturity. Pro-forma interest is expected to be $379 million or 3.39%. On the distribution date, the debt will consist of a combination of long-term notes and bank term loans. The company expects an investment grade credit rating by each of Moody’s Investors Services, Inc. and Standard & Poor’s. The following table shows Carrier’s capitalization as of December 31, 2019, on a historical basis and on a pro forma basis.

The company will also have other off balance sheet contractual obligations totaling a little over $3 billion consisting of operating leases, purchase obligations, and other long-term liabilities. About half are to be met in 2020.

Management and Incentive Compensation

Of the 15 people considered to be on the leadership team, 8 have joined Carrier as recently as June last year. The company hopes that this recruitment of talent may foster a new sense of urgency for growth. The other members of the team have many years of experience at Carrier. The company will be led by David Gitlin, who will be Carrier’s President and Chief Executive Officer, and John V. Faraci, who will be Carrier’s Executive Chairman. Background information of these and the other most senior positions of leadership are shown below:

Biographies

John Faraci served as Chairman and Chief Executive Officer of International Paper from 2003 to 2014. Earlier in 2003, he was elected as President and director of that

company, and served as its Executive Vice President and Chief Financial Officer from 2000 to 2003.

David Gitlin was appointed President and Chief Executive Officer of Carrier in June 2019. Gitlin has many years of varied experience at United Technologies. He previously served as President, HVAC. Prior to that he was President and Chief Operating Officer of Collins Aerospace and President of UTC Aerospace Systems from 2015 to 2018 after leading the integration of Goodrich Corporation with UTX. Gitlin earned a bachelor’s degree from Cornell University, a Juris Doctor from the University of Connecticut School of Law and an MBA from MIT’s Sloan School of Management

Timothy McLevish was appointed Vice President & CFO of Carrier in October 2019. He has extensive experience at a variety of prominent companies including most recently WalgreenBoots Alliance where he last served as Senior Advisor to the Chief Executive Officer. Other appointments include Kraft Foods, Ingersoll Rand, The Mead Corporation, Kennemetal, RR Donnelley, and Conagra. Mr. McLevish holds a bachelor’s degree from the University of Minnesota and an MBA from Harvard Business School.

Christopher Nelson will be President of HVAC Commercial, appointed in April 2018. Previously, he held many roles at Carrier including, President, North American HVAC from 2012 to 2018 and Vice President, Sales & Marketing for Residential & Commercial Systems from 2008 to 2012 Nelson holds a bachelor’s degree in science from the University of Notre Dame and an MBA from Cornell University.

Mathew Pine will be President of HVAC Residential. Matthew Pine, appointed in April 2018. Prior to that, he held several other roles within Carrier’s business, including Vice President and General Manager, HVAC – Residential from 2017 to 2018 and Vice President, Marketing & Product Management from 2014 to 2017. Pine holds a bachelor’s degree in business from The University of Alabama and an MBA in finance from Northeastern University.

Jurgen Timperman will be President of Fire & Safety, appointed in February 2019.

Prior to that, he held several other roles within UTX’s fire and security business, including President, Global Fire & Security Products from 2017 to 2019, President, Global Security Products from 2015 to 2017, President, Security & Access Solutions from 2012 to 2015, President, Fire & Security Operations from 2011 to 2012 and Regional General Manager, Global Security Products, Middle East and Africa from 2009 to 2011. Mr. Timperman holds a master’s degree inelectro-mechanical engineering from Ghent University in Belgium.

Compensation

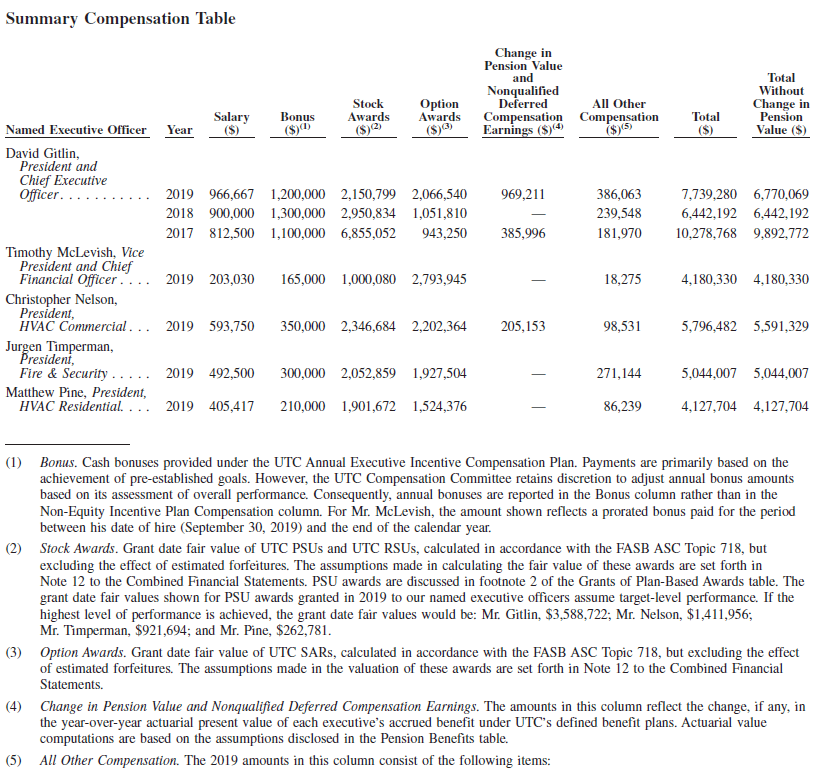

Immediately after the distribution, Carrier’s executive compensation program will be similar to UTX’s executive compensation program, and will generally be comprised of base salary, an annual performance-based bonus, annual Long Term Incentive Awards (Performance Share Units, Stock Appreciation Rights, & Special Equity Grants) and executive perquisites. Later, the Carrier Compensation Committee will reconsider and develop Carrier’s compensation programs that are consistent with Carrier’s business needs and goals. Carrier will have rigorous share ownership requirements for senior executives and directors. Each Carrier executive officer will be required to own Carrier common stock ranging from six times their base salary for the CEO to three times for less senior executives. These requirements are intended to reduce risk by aligning the economic interests of executives and directors with those of shareowners.

Carrier will adopt the 2020 Long-Term Incentive Plan immediately following the distribution. 90 million shares are reserved under the plan for distribution to employees (865.3 million shares outstanding). These shares can be awarded over a period of years. Individual awards in each year are limited.

Carrier’s Executive Chairman, John V. Faraci, will receive a base salary of $1,000,000 per year and an annual long-term incentive award opportunity of $1,500,000.

The following table shows the 2019 compensation for the key executives.

The bonus pool for the company is a function of achieving predetermined targets of EBIT and Free Cash Flow. The LTI awards are designed to align the interests of

executives and shareowners while attracting and retaining talented senior leaders. The awards are subject to three-year, service-based (and in the case of PSUs, performance-based) vesting requirements.

Potential for Indiscriminate Selling

Of the two spin-offs (Otis and Carrier), we think Carrier could be the most subject to indiscriminate selling as it is the most cyclically sensitive company. Nonetheless, Carrier will still be a large cap stock and many mutual fund managers will be able to own it. This may limit indiscriminate selling pressure.

Valuation

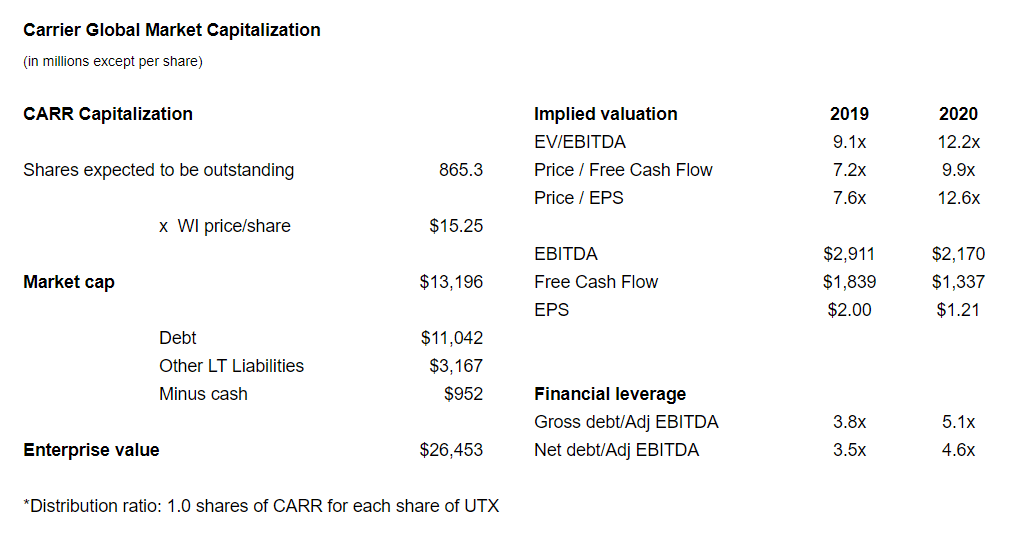

At it’s when issued price of $15.25, CARR is trading at a market cap of $13.2BN and an enterprise value of $26.5BN.

It appears very cheap on a 2019 basis, but I expect share declines in EBITDA, FCF and EPS in 2020, consistent with 2009.

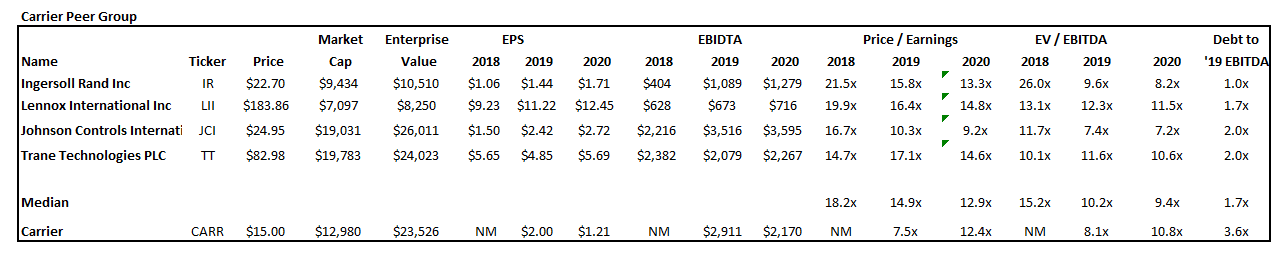

Versus its public peers, CARR appears cheap on 2019 numbers, less so on 2020 numbers. However, 2020 numbers for CARR’s peer set have not been adjusted down. As such, 2019 is probably the best comparison year.

Discounted cash flow analysis suggests that CARR is worth $25 to $32.

Conclusion

While CARR appears to be selling in the when issued market at a 48% discount to its fair value, we are approaching the stock cautiously. I think the next couple quarters are going to be difficult for most public companies, especially those such as CARR which are cyclical. My sense is that investors may be able to buy CARR significantly cheaper in the future. At the right price, CARR would be a compelling buy as its business should rebound sharply following a recession.

CARR also expects to pay a $550MM dividend annually which corresponds to a 4.2% yield. While I’m forecasting operating earnings to decrease by 25% in 2020, I still expect the company to generate $1.3BN of free cash flow. As such, the dividend will have plenty of coverage.

Risks

In the Form 10, many risks are listed that are common to all spin-offs. We mention those that we think are most important.

- Almost half of Carrier revenue comes from overseas and the company depends on many suppliers so the coronavirus, particularly in China, will have a major impact on supply and revenues in the coming year.

- More than half of the company’s annual revenues come from the sale of new equipment for new construction. Building industries are very cyclical and the current downturn in the global economy will hurt sales.

- CARR has high leverage with a net debt (we included pension obligations and other as “debt”) to ‘19 EBITDA multiple of 3.6x. That the company was able to issue debt at 3.4% suggests a strong, resilient business. Nonetheless, Carrier could be subject to credit rating downgrades if business turns south.

- UTX, Carrier and Otis will indemnify each other for certain liabilities. If Carrier is required to pay under these indemnities, financial results could be hurt.

- Though the amounts involved in asbestos-related claims are not material individually or in the aggregate in any year, publicity surrounding claims could hurt the stock.The estimated range of total liabilities to resolve all pending and unasserted potential future asbestos claims through 2059 is approximately $255 million to $290 million. CARR has recorded the minimum amount of $255 million, which is recorded in Other long-term liabilities on the Balance Sheet. Aqueous Film Forming Foam (‘‘AFFF’’) is a firefighting foam used to extinguish certain types of fires primarily at airports and military bases. AFFF was manufactured by several companies, including National Foam and Angus Fire, which had a very small share of the AFFF market both in the United States and worldwide. UTX acquired the National Foam and Angus Fire businesses in 2005 which had been operated by Carrier. In 2013, UTX divested the business. Carrier and many other parties have been named as defendants in numerous lawsuits alleging that the historic use of AFFF caused personal injuries and property damage. Carrier believes that it has strong defenses to the claims. If the plaintiffs were to prevail, the liability is not known.

Too bad they loaded it with debt. not great timing.

Hoping EV declines to less than $22B.

Both Otis and Carrier are to be part of SP500 so indiscriminate selling may not be very much.

xailvu