Fortive Spin-Off Deep Dive – October 9, 2020

Resources from Fortive

Vontier Investor Conference Slide Deck – October 5, 2020

Vontier Summary of Financial Data – October 5, 2020

Latest Spin-off Press Release – September 15, 2020

Fortive Announces Leadership Appointments for NewCo – December 11, 2019

Other Resources

Vontier Set to Join S&P 500 – October 5, 2020

What Wall Street Is Saying About Industrial Firm Fortive’s Upcoming Split – September, 28, 2020

Overview

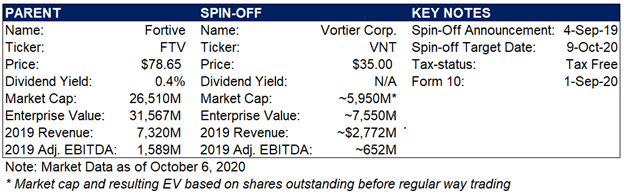

On September 4, 2019, Fortive Corp. (“FTV”) announced its intentions to separate into two publicly traded companies, with the legacy business retaining the Fortive name and containing Fortive’s Field Solutions, Product Realization, Health, and Sensing Technologies businesses. At the original spin-off announcement, the intended was yet-to-be-named. Fast-forward to today, Vontier Corp. Wi (“VNT”) is a global industrial technology company focused on transportation and mobility solutions and will be financially broken up into the following divisions: Mobility Technologies and Diagnostic and Repair Technologies. Vontier was issued on September 24, 2020 and began trading under the ticker “VNT.WI” with the stock closing at $34.00. Regular way trading begins on October 9, 2020, under the ticker VNT.

Why the Spin-off?

The parent company, Fortive, was initially spun out from Danaher Corporation in 2016, allowing FTV to revamp and increase the value of its underlying portfolio businesses. Since its spin-off, FTV has been able to drive growth in its top-line, gross margin, adjusted operating margins, and its recurring revenue base. FTV is looking to accomplish the same mission with its spin-off of VNT. Originally, FTV planned on carving out ~20% of VTN via IPO. Due to the global pandemic that brought the world to a complete standstill, FTV reversed its planned carve-out structure and decided on an 80.1% spin-off. The fundamental thesis for the spin-off is to allow FTV and VNT to execute strategic plans to enhance revenue and cost synergies while also being able to pursue inorganic growth strategies via M&A freely. Management expectations call for VTN to acquire a leading market position in an array of end industries, including auto repair, environmental solutions, smart cities, retail fueling HW, retail solutions, infrastructure solutions, etc.

Spin-off Overview

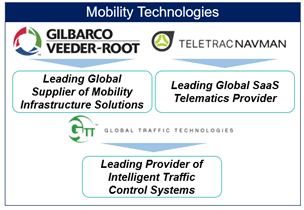

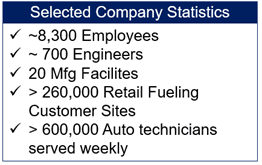

Company

Vontier Corp. will be a global industrial company focused on the transportation and mobility sector financially operating in the following to segments: Mobility Technologies and Diagnostics and Repair Technologies The Mobility segment is made up of portfolio businesses focused on integrating fueling solutions, data-driven fleet, and mobile asset management, and smart city infrastructure. Products and services offered include fuel dispensing, remote fuel management, point-of-sale and payment systems, environmental compliance, vehicle tracking, fleet management, and traffic management. The Diagnostics and Repair Technologies segment comprises portfolio businesses prepared to meet evolving vehicle technology needs through auto repair services and automatic vehicle diagnostics. The products and services offered include vehicle repair tools, tool boxes, automotive diagnostic equipment, software, and a full line of wheel-service equipment. Mobility technologies recorded 2019 sales of ~$2.1bn (~78% of total revenue) while the Diagnostics and Repair Technologies segment recorded 2019 sales of ~$0.6bn (~23% of total sales).

Company Strategy

VNT’s company strategy is centered around maximizing stockholder wealth and value with the following key initiatives:

1. Build Competitive Advantage Through Innovation That its Customers Value

Over time, VNT’s focus on the customer’s needs has allowed them to continuously innovate and create new products/services where competitive leadership can be attained and retained. To become a dominant player in the industry, VNT is continually innovating while simultaneously improving product vitality. A long history of reliability and strong brands has positioned VNT’s products and services at customer workflows’ key points.

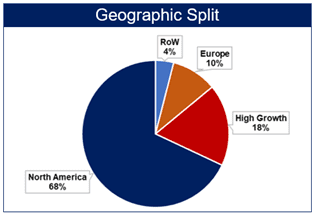

2. Leverage and Expand its Global Business Presence

~35% of 2019 sales were generated outside of the United States with significant operations in key geographic markets. VNT plans to prioritize developing localized solutions for high-growth needs worldwide with strong local manufacturing and product development capabilities. Further, intentions are set to continue to chase acquisitions and investments in businesses that complement the existing strategy in that specific market or region.

3. Attract and Retain Talented Employees

VNT believes that its team of talented employees, guided by a culture in pursuit of continuous improvement, will provide a competitive edge. The goal is to continue to attract, develop, and retain world-class leaders and employees to drive engagement with its customer-centric approach.

4. Drive Continuous Improvement Through Application of its Business System

All operations and employees use the business system founded on FBS to drive continuous improvement, measured by metrics such as quality, delivery, cost, growth, and innovation. By continually applying this business system, VNT has driven more vital customer satisfaction and profitability in product and services lines. The business system will extend beyond lean concepts to include methods for driving growth and innovation demanded in its key markets.

5. Redeploying its Free Cash Flow to Grow and Improve its Business Portfolio

By constantly re-investing free cash flow that is generated by the existing business portfolio to drive inorganic growth and to acquire business that fits with the strategy of the business portfolio, VNT will be awarded entry into new and attractive markets while also furthering cementing their competitive advantage in the existing markets in operates in. A track record of disciplined sourcing and integration of acquisitions is essential for VNT’s growth strategy.

Industry

By being spun out from FTV, VNT now can focus its inorganic and organic strategies to improve its position in the following three broadly defined industries in which its end customers operate in:

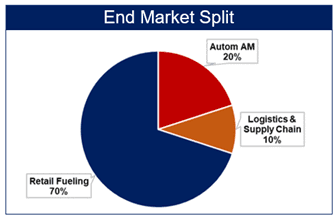

1. Retail Fueling

The retailing fueling industry comprises companies that operate by selling automotive fuel or lubricating oils at its retail stores such as service stations, fuel stations, and other similar establishments. The industry has technologically become more advanced, and it has incorporated technological assistance and applications in as many areas as necessary, such as mobile payment. While the lion’s share of the fuel retailer’s revenue comes from fuel sale, margins are razor-thin. As a result, many retail fueling operators are making the strategic change in mindset from “gas station” to “retailer.” There is now a stronger focus on winning in the more profitable non-fuel categories such as food & beverage. More emphasis is being placed on the reliance on software and analytics to improve productivity and customer experience. Given Covid-19’s impact on fuel demand for vehicle travel, retail fueling operators have been at the forefront of that negative demand shock. As fuel prices and demand are expected to remain stagnant, expect more operators to adopt the software and analytical tools to give them an edge and a surviving chance.

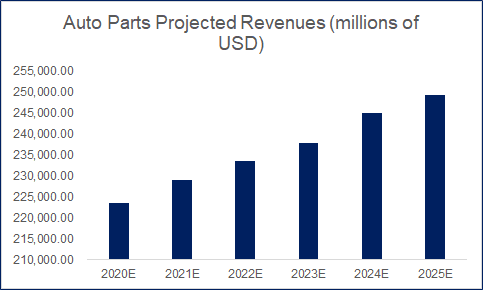

2. Automotive Aftermarket & Repair Solutions

While VNT appears to be towards the forefront of the technological innovation in the sector, automotive parts and other ancillary products are a slower growth industry, with margins expected to compress going forward. Drivers of this slowdown are more efficient cars that require fewer parts and fewer repairs, demand trends towards more compact cars that need to be both fueled and repaired less often, and an increase in cheaper, lower-quality foreign competition. Revenues for the industry, per IBISWorld, are expected to grow around 2% per annum over the next five years, which could undoubtedly be exceeded on an individual level due to VNT’s positioning within the higher growth tech area of the industry.

3. Fleet Management / Logistics & Supply Chain

Fleet management allows companies to remove or minimize the risks associated with vehicle investment, improving efficiency, productivity, and reducing their overall transportation and staff costs. Roughly 75% of fleet managers rely on fleet management software or vehicle telematics to help support their day-to-day operations. Global Market Insights estimated the global market valuation for fleet management would cross US$ 55 billion by 2026. The increasing demand to enhance operational efficiency across the transportation and logistics industries is expected to contribute significantly to market growth. Due to the COVID-19 crisis, fleet operators across the region emphasize deploying advanced fleet management solutions to minimize the impact of disruptions and ensure business efficiencies.

Competition

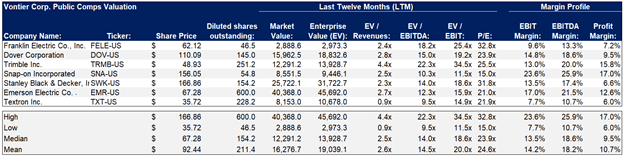

VNT generally operates in a highly competitive market in both its business segment, with large and smaller players having a particular market percentage in a specific industry vertical. However, a pure play competitor does not exist since none of the competitors offer all the same products and service lines or serve all the same markets as VNT. Competitors in the Mobility Technologies sector include Dover, Franklin Electric, and Trimble Navigation. Competitors on the Diagnostics and Repair Technologies segment include Snap-On and Stanley Black & Decker. Additionally, general peers include Emerson Electric and Textron.

Customers

Customers for both segments include a wide variety of purchasers. Customers include energy companies, fueling stations, convenience store retailers, fleet operators, and municipalities on the Mobility Technologies segment. On the Diagnostics and Repair Technologies segment, customers include automotive technicians, national automotive aftermarket retailers, technical education students, tire installation, and repair shops.

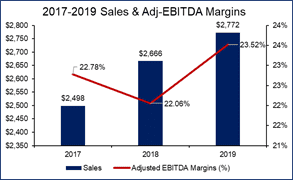

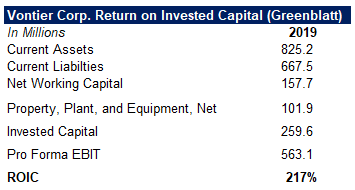

Quality of Business

Below is the calculation for Return on Invested Capital calculated using the Greenblatt method. As you can see, taking EBIT and dividing it by the business’s invested capital yields us an ROIC of 217%. Additionally, from an income statement perspective, VNT is doing exceptionally well and has been growing over the past couple of years. From 2017-2019, gross profit grew at a 5.4% CAGR while maintaining a 43% gross margin profile. Using the same time, normalized operating profit grew at a 7.5% CAGR with a ~20% Adj. normalized operating margins.

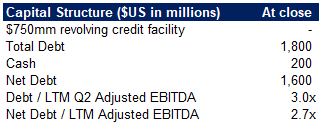

Capital Structure

Below is the balance sheet overview highlighting the latest capital structure provided by the company. As you can see, VNT is very well positioned and is more than able to repay total debt with roughly 3 Adjusted EBITDA turns. Furthermore, management highlighted the following three capital structure highlights: (1) ~$1.5bn of M&A capacity over the next 2-3 years, (2) $950mm of total liquidity, and (3) its investment-grade style balance sheet. Individual tranche’s debt did not provide a specific interest rate, but the average interest rate of loans between FTV and VNT during the 2019 period was 1.0%

Management Bio and Incentive Compensation

Chief Executive Officer, President: Mark Morelli

Mark Morelli joins NewCo from the Columbus McKinnon Corporation, where he served as President & CEO. Before his time at Columbus McKinnon, Morelli spent four years as President & COO of Brooks Automation. He also served as President & CEO of Energy Conversion Devices, Inc. and held leadership positions at United Technologies Corporation. Morelli is a former U.S. Army commander. He has a Master of Business Administration from the Massachusetts Institute of Technology and a Bachelor of Science in Mechanical Engineering from the Georgia Institute of Technology.

Chief Financial Officer: David Naemura

David Naemura brings nearly 25 years of financial leadership experience across a range of global industrial companies. He joins VNT from Gates Industrial Corporation, where he has served as CFO for five years. Before his time at Gates, Naemura held numerous financial leadership positions at Danaher Corporation, including VP of Finance and Group CFO, overseeing many VNT portfolio businesses. He has a bachelor’s degree in Business Administration from Oregon State University.

Potential for Indiscriminate Selling

On the surface level, it does not appear that there is any potential for indiscriminate selling when the spin-off of FTV and VNT occurs. In fact, post-spin-off, VNT, will be added to the S&P 500 effective before the opening trading on Friday, October 9, replacing Noble Energy Inc. Additionally, post-spin-off, FTV will remain in the S&P 500.

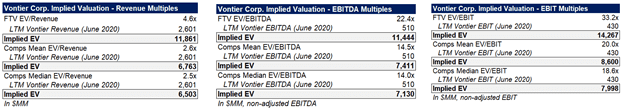

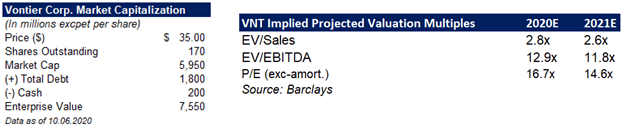

Valuation

Risks

The effects of Covid-19 put VNT’s global operations of its suppliers, customers, and vendors and is having a material impact on the business and the results of its operations. Efforts to mitigate the spread of the virus have caused VNT, its customers, and its suppliers to reduce commercial activities and utilization of facilities and manufacturing sites, resulting in a reduction in demand for VNT’s products and services. The degree to which Covid-19 will impact the business in the future will depend on unpredictable future developments.

Potential changes or uncertainties in U.S. social, political, regulatory, and economic conditions, including trade policies and tariffs, can adversely affect the business. For example, when the U.S. raised tariffs on certain imported goods into the United States, additional tariffs increased and called for substantial changes to trade agreements. Since VNT operates globally, tariff situations pose a severe threat to where and how they can work.

A key variable in VNT’s success formula is to acquire businesses and make investments into joint ventures. M&A and strategic relationships involve many risks in and of itself, including financial, accounting, managerial, operational, legal, compliance, and an array of other broadly defined potential setbacks. Failure to mitigate these risks as best as possible can adversely affect VNT’s ability to gain market share and retain its competitive edge in a massively competitive industry.

Added to my spin-off portfolio too. I think it has a great potencial for growth. Thank you Rich.

Thanks Jose