Spin-off Overview

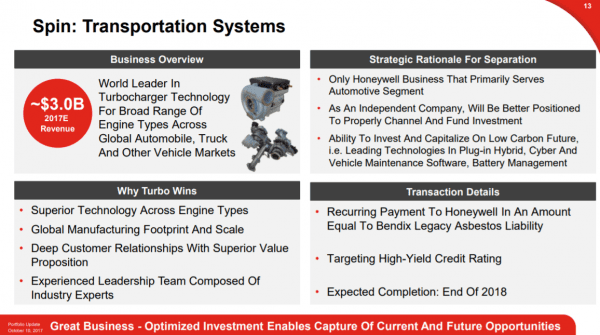

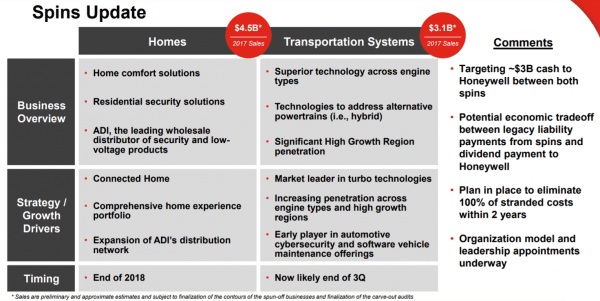

On October 10, 2017, Honeywell (NYSE: HON) announced that it had concluded its strategic review and that it plans to proceed with two tax free spin-offs. The first spin-off would consist of HON’s Transportation Systems business and will occur by the end of Q3 2018. The second spin-off will consist of HON’s Home and ADI Global Distribution Business and will occur be the end of 2018.

Honeywell recently announced that the transportation spin-off would be named Garrett Motion. HON investors will receive 1 share of GRX for every 10 shares of HON. When issued trading will begin on Monday, September 17, 2018 and regular way trading will begin on October 1, 2018 under the ticker GTX.

Source: Honeywell Slide Deck

Background:

From Bloomberg:

Pressured by activist investor Third Point, Honeywell International Inc.’s new boss is ditching 132 years of corporate history in an effort to sharpen the company’s focus on its core businesses.

On the way out: automotive turbochargers and the household-systems operations, which include a thermostats business with roots that go back to the late 19th century. Chief Executive Officer Darius Adamczyk expects $3 billion from spinning off those units, and Honeywell will use the money to repay debt, buy back shares and prowl for acquisitions.

The auto-parts unit will generate about $3 billion in annual revenue and have a workforce of 6,500 employees, Honeywell said.

The automotive business had shown promise of outpacing the car industry as vehicle manufacturers used turbochargers to cut weight and emissions while retaining power. Growth prospects diminished as the percentage of engines with turbochargers increased, denting future demand, and the threat of electric-vehicle sales sharpened.

The automotive unit shrank in 2014 after Honeywell sold off a brakes business to Federal Mogul Corp. for $155 million. The operation was tucked under Honeywell’s aerospace division, where it didn’t quite fit. In 2013, the last full year Honeywell broke out financial results for the business, segment profit margin of 13.3 percent trailed the company average of 16.3 percent.

Analysis

At first blush, this looks like a spin-off that will be sold indiscriminately. And I believe rightfully so. Of course, we have to wait until the spin-off happens to see its valuation. After all, any stock is a buy if it reaches a certain price.

Let’s walk through some key details.

Garrett’s primary business is selling turbochargers to automobile manufacturers. What is a turbocharger? It is a device that increases an internal combustion engine’s efficiency and power output by forcing extra compressed air into the combustion chamber. This is an important technology in a world that is mandating higher fuel efficiency and reduction in exhaust emissions. Turbochargers allow vehicles to cut weight and emissions while retaining power. As such, turbocharger sales growth is expected to exceed vehicle sales growth.

However, the counter argument is that there will be an increasing proliferation of electric vehicles on the road without combustion engines. Garrett (GRX) makes technologies that can boost the efficiency and performance of electric vehicles but does not break out what percentage of revenue comes from this segment (my guess is it’s small). Increasing market share of electric vehicles is an intermediate to long term threat to Garrett’s turbocharger business, in my view.

The other obvious but important point is the turbocharger business is heavily reliant on the auto market and thus, extremely cyclical.

Alright, let’s move on to financials. Over the past three years, sales have increased at a CAGR of 3%, but sales have been down 5% in total from 2013 to 2017. GRX generated $424MM of EBITDA in 2017 and $590MM of adjusted EBITDA. GRX adds back all the usual items (non cash compensation, etc.) but also an $130MM charge related to an asbesto liability.

Now let’s move onto the balance sheet. GRX will have $1,660MM of debt and $1,714MM of obligations due to Honeywell. The obligations due to Honeywell consist of $1,364MM to cover an asbestos liability and $350MM to cover a tax liability that resulted from it repatriating its cash (however, HON gets to keep the cash that was repatriated!).

So all in debt (in my view) is $3,374MM or 5.7x adjusted EBITDA.

What is the company worth? GRX’s closest competitor is Borgwarner which trades at 6.9x TTM EBITDA. So GRX is going to be an extremely highly levered, cyclical company with a slim equity cushion. Meanwhile we are in the later innings of an economic expansion.

Finally, investors will receive 1 share of GRX for every 10 shares of HON. All these factors lead me to believe that GRX will be sold indiscriminately. However, it looks like a business that I wouldn’t want to own at (almost) any price.

Company Resources:

Press Release – October 10, 2017

Slide Deck – September 6, 2018

Analyst Day Webcast – September 6, 2018

Form 10 – August 23, 2018

Articles

Bloomberg – Honeywell Will Spin Off Car Parts and Home Systems Businesses– October 10, 2017

I bought GTX today. EBIT, after the honeywell obligation, is higher than I thought having a good EY (Greenblatt EBIT/EV) and ROIC was surprisingly high. Honeywell obligation is capped and is scheduled to disappear in 2023. Growth of 6% the first 6 months. And most important of all, mgt is loaded up with stock.

Thanks Jim. Looks like you may have bottom ticked it.

If I did it was pure luck. I have always observed that no one hits the exact top or bottom.

Yes very hard to time it perfectly.