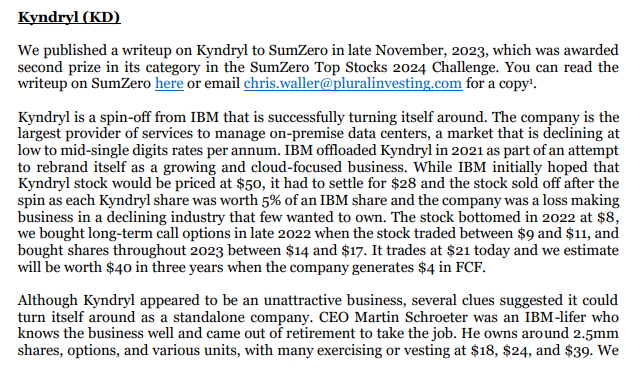

IBM Spin-off (Kyndryl) Notes

February 15, 2024 Update

From Plural Partners Fund Q4 2023 Letter:

From Greenlight Q4 2023 Letter:

6/12/2022 Update

Kyndryl Shares Swoon on Fear It Faces Huge Liability in Lawsuit Against IBM

– A $1.6BN lawsuit went against IBM and investors fear that Kyndryl may be on the hook as it was the division that did the work in question.

11/25/2020 Update

- Bloomberg reports that IBM will cut 10,000 jobs in the UK and Germany.

11/19/2020 Update

- Good Seeking Alpha article on IBM and how tech spin-offs have performed in the past.

10/22/2020 Update

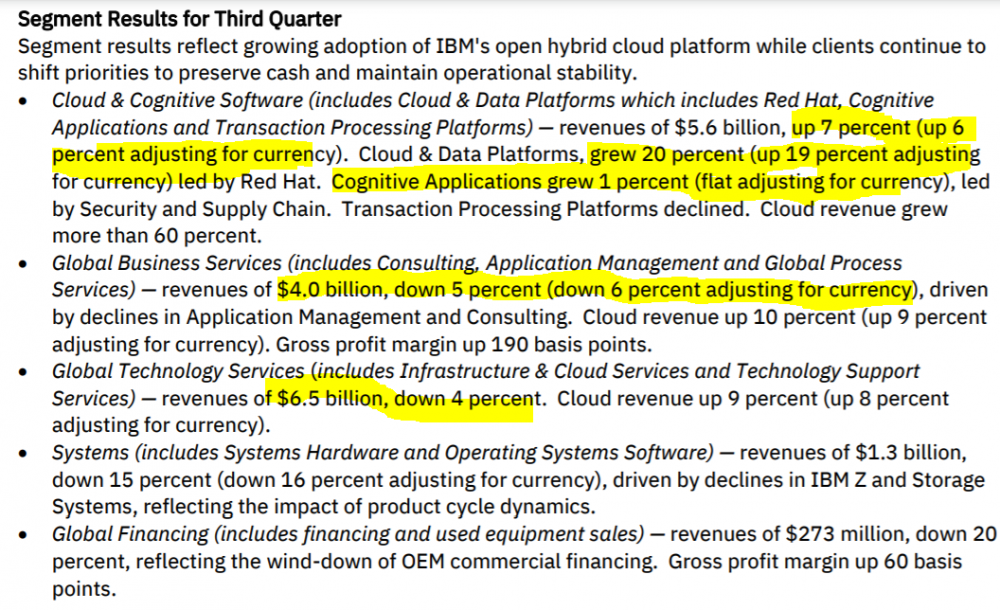

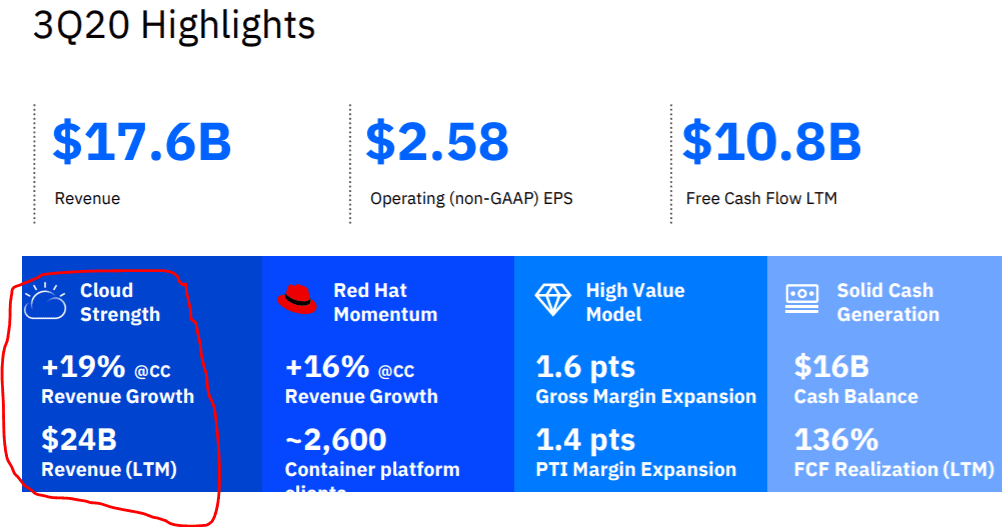

- IBM recently reported Q3 results.

- Revenue decreased 2.6% (Down 3.1% adjusted for divested businesses and currency).

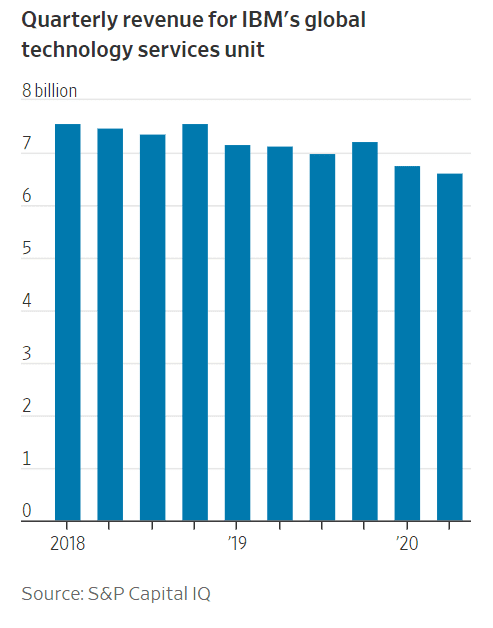

- Revenue for Global Technologies Services was down 4%. The infrastructure spin-off makes up the majority of revenue for Global Technologies Services, but management didn’t break out the growth rate for the business that will be spun off.

- The company didn’t offer guidance due to Covid uncertainty.

- While the spin-off will allow IBM to break up into a “good company” and “bad company (the spin-off)”, it’s unclear to me how good the “good company” will be.

- IBM notes trailing twelve month cloud revenue is $24BN and is growing at a constant currency rate of 19%.

-

- This is pretty amazing. MSFT trades at an EV/revenue multiple of 10x. CRM trades at a multiple of 10.8x. At a 10x multiple, this business is worth $240BN on an enterprise value basis. IBM’s entire enterprise value right now is $152BN.

- The problem is that the Remainco will have several other businesses that are detracting from growth.

- For instance, IBM’s Cloud & Cognitive Software division (the group that is encompasses cloud is only growing at 6%. While cloud is growing at 19%, Cognitive Applications is flat while Transaction Processing Platforms is down 9% y/y.

- Global Business Services (another part of Remainco) saw a revenue decline of 6% to $4.0BN.

- Systems (the final part of Remainco) saw revenue decline by 16% to $1.3BN.

- As a result, the total remainco is currently seeing shrinking revenue on an aggregate basis.

- Valuation Thoughts:

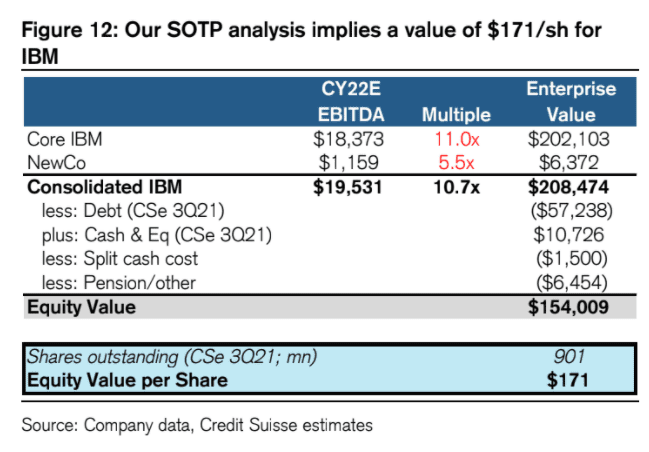

- Credit Suisse argues that new IBM should trade at ~11x EBITDA. It will eventually grow at a low to mid single digit rate and comps (ORCL, ACN, and CTSH) trade in that range. This seems reasonable. One thing that I want to watch is whether the business starts to grow again in the 4th quarter. While the cloud demonstrated strong growth, all other segments were shrinking. If the business isn’t growing, 11x EBITDA may be too rich.

-

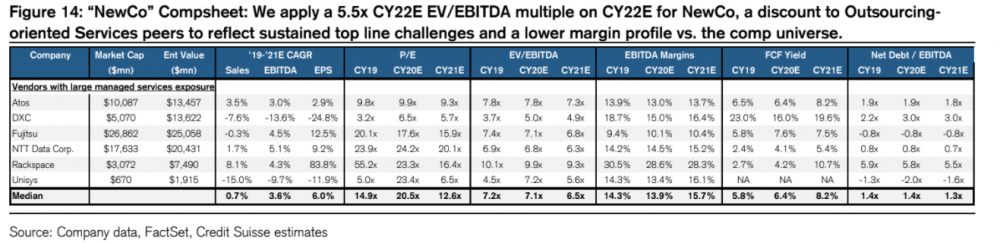

- CS argues that the spin-off (NewCo) will trade at 5.5x EBITDA at a discount to other Outsourced Oriented Service companies such as DXC.

-

- Adding cash and subtracting debt, pension liabilities and one time costs, CS gets to a $171 price target which is reasonable. I still don’t believe there is any urgency to own the stock in the near term as the spin-off won’t happen to until the end of 2021. In the meantime, I will be looking for signs of growth for New IBM and stability for the spin-off.

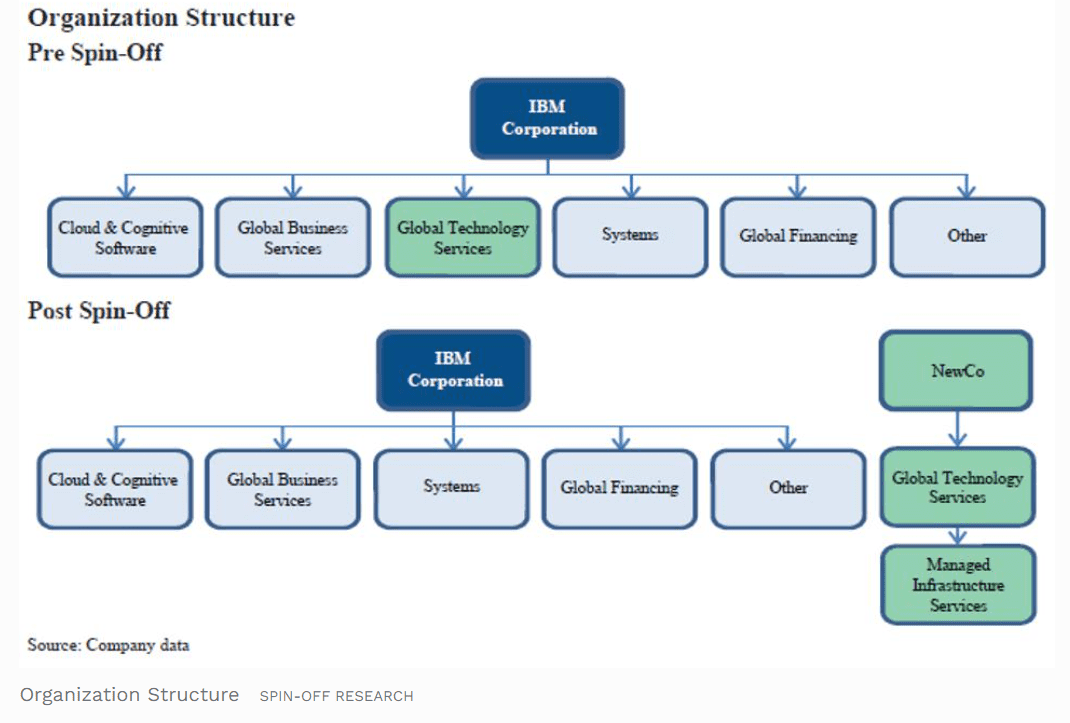

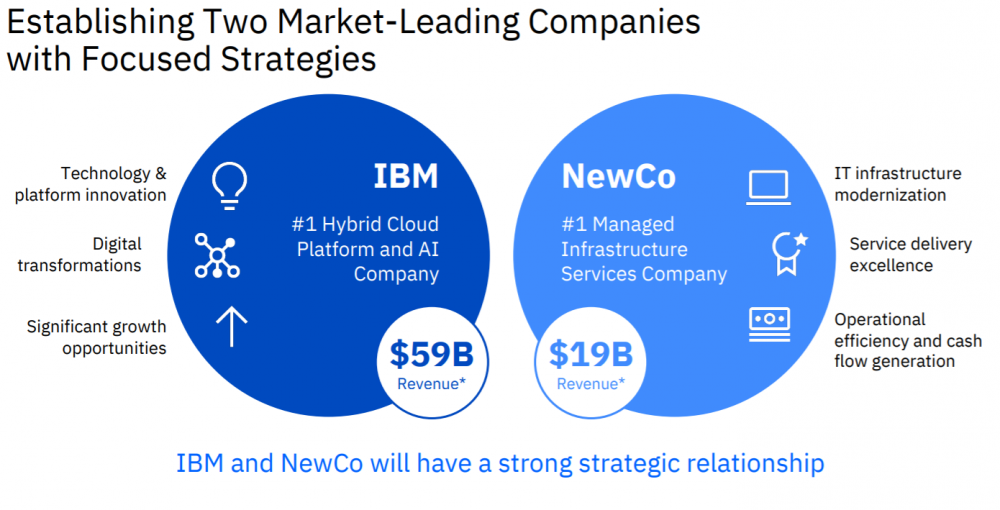

- IBM Company Structure pre vs. post spin-off:

- Questions:

- Are any parts of Global Technology Services going to kept at IBM or will it all be spun out?

- GTS represented $26.4BN in TTM sales at time of spin-off announcement. IBM said spin-off had ~$19BN in sales so a part of the Global Technology Services business will be kept at IBM.

- GTS is comprised of infrastructure and cloud services and technology support so perhaps cloud services and technology support will stay at IBM.

- What are the products the the infrastructure business sells? Servers? Storage? Disclosure in 10-k is unclear.

- Are any parts of Global Technology Services going to kept at IBM or will it all be spun out?

10/15/2020 Update

- Good article on how IBM lost its monopoly.

10/9/2020 Update

- On Thursday October 8, 2020, IBM announced that it would spin-off a business unit that focuses on managing clients’ IT infrastructure (~25% of IBM sales and staff) to focus on faster-growing businesses like cloud computing and artificial intelligence.

- Here is a link to the transaction conference call replay.

- Here is the slide deck.

- Good WSJ article on the announcement.

- Credit Suisse Report.

- Bloomberg 8 Minute Interview with IBM CEO

- Spin-off:

- Technology services division. Has struggled for years:

-

- Spin-off will be lower growth and lower margin but will target an investment grade credit rating. IBM has been focused on harvesting cash flow to pay down debt.

- Generates revenue by providing on premise IT outsourcing, project based assignments, and Managed Cloud Services (MCS) where IBM is responsible for managing a clients’ private, hybrid, or multi-cloud environments.

- Will compete against DXC Technologies (DXC), Microsoft (MSFT), and BMC Software (private).

- Company has relationships with 4,600 clients in 115 countries and 90,000 employees.

- Operates in $500BN market.

- New company will be able to partner with all cloud vendors instead of just IBM (although it will remains IBM’s preferred partner), should provide an opportunity for growth.

- Timing: expected to be complete by Q4 2021.

- Opted for a spin-off to provide customers with certainty over next steps. IBM would be open to an acquisition offer as long as it didn’t jeopardize customer relationships.

- Leadership structure will be decided within a few months.

- Will be twice the size of its nearest competitor.

- Will focus on operational efficiency and cash generation.

- In the most recent quarter, global technology services (the division that encompasses managed infrastructure services) saw revenue decline by 7.6% y/y.

- This is from

- Over the past fifteen years, IBM has taken several initiatives to change strategic focus for the company.

- It sold its PC manufacturing business to Lenovo Group in 2005 (IBM was losing share to Dell)

- In 2014, it exited its semiconductor business (IBM had to pay Global Foundries $1.5BN to take its division off its hands!)

- Nonetheless, IBM has struggled to reposition the company.

- Over past 8 years sales have declined by 25%.

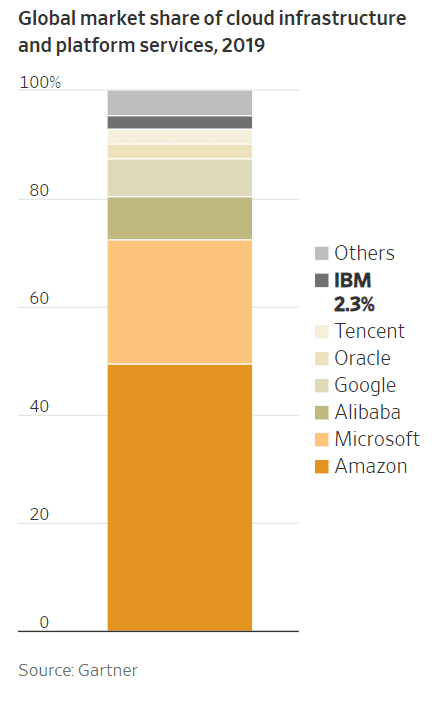

- IBM was late to the cloud and trails Microsoft and Amazon considerably.

-

-

- IBM has tried to focus on the hybrid cloud where clients use to manage software and other systems across different cloud services and their own data centers.

- In 2019, IBM bought Red Hat for $34BN largely to catch up in cloud computing.

- Once spin-off is complete, more than 50% of revenue will be recurring.

- Remainco is expected to grow mid single digit growth in the medium term.

- Since Red Hat acquisition cloud revenue growth has accelerated. In Q2 2019, cloud grew 5%. In Q2 2020, cloud revenue grew 30%. IBM has succeeded by focusing on the hybrid cloud market which it calls a $1 trillion opportunity.

-

- Why is the cloud?

- Companies rent rather than buy computing horsepower.

- Decision was made by new CEO (became CEO in April 2020), Arvind Krishna.

- Before becoming CEO, Krishna ran the company’s cloud and cognitive-software division.

- Layoffs

- In the backdrop of the pandemic, IBM announced that it would be laying off an unspecified number of workers as customers dial back IT spending and software spending on new deals.

- Dividend:

- Committed to sustainable and growing dividend.

- IBM is a Dividend Aristocrat as it has 25 years of dividend increases.

- Debt:

- The company has $58.4BN of debt. Net debt to EBITDA is 4.4x. Pretty significant. Both companies will have an investment grade rating after the transaction.

- My initial thoughts:

- Usually it doesn’t pay to invest in businesses that are in secular decline which it appears the spin-off is. However, I bet it will pay a pretty sizeable dividend and this might provide a measure of downside support.

- IBM stock popped 6% on the announcement. This is typical of companies that announce spin-offs, but over time, I would expect the stock to fade as “spin-off euphoria” dissipates.

- The announcement is a positive for IBM shareholders, but not necessarily a reason to buy the stock today.

- We have a lot of time to wait. Transaction won’t take place until the end of 2021.

Nice summary

Thanks Richard!

Hi Richard,

Any thoughts on this as it is back around prices when the spinoff was announced?

Cheers, Sam