Maxeon Solar Technologies, Ltd. Overview – August 28, 2020

Summary:

Maxeon Solar (MAXN) spun off from SunPower (SPRW), on August 27, 2020 and is trading at $20, down 46% from where it traded in the when issued market. I believe the stock is probably undervalued based on where peer solar manufacturers trade (roughly 1.0x revenue) and based on the implied valuation ($1BN+) of the company from an equity investment in Maxeon by TZS, a Chinese company. Nonetheless, I’m approaching the situation cautiously given that 1) Maxeon is losing money and will for the foreseeable future and 2) Maxeon’s business model is capital intensive and highly competitive. I think fair value is ~$37 and would likely be a buyer of the stock if it dropped below $15.

What could change my mind?

If we saw strong insider buying and/or a sharp revenue acceleration, it would increase my confidence in the stock and potential valuation upside.

Resources from Maxeon Solar Technologies Ltd.

Maxeon Company Slide Deck – August 2020

Registration Statement Form 20-F– July 31, 2020

Form 20-F Registration Statement Declared Effective by SEC– August 4, 2020

Maxeon Launches Fifth-Generation Shingled Bifacial Solar Panels – July 23, 2020

Maxeon Solar Technologies 2020 Capital Markets Day – July 16, 2020

Other Resources

SunPower Reports Second Quarter 2020 Results – August 5, 2020

The Motley Fool on Solar Consolidation – July 27, 2020

SunPower Separation Call – November 11, 2019

The 13 Biggest Solar Stocks on the Market – October 27, 2019

Introduction

The solar industry is a hot industry. Many of the stocks are up over 100% in the last year. We seem to be in a consolidation phase. Most recently Sunrun is in the process of acquiring Vivent Solar, a profitless company, for a very lofty 9.9x revenue in a stock deal.

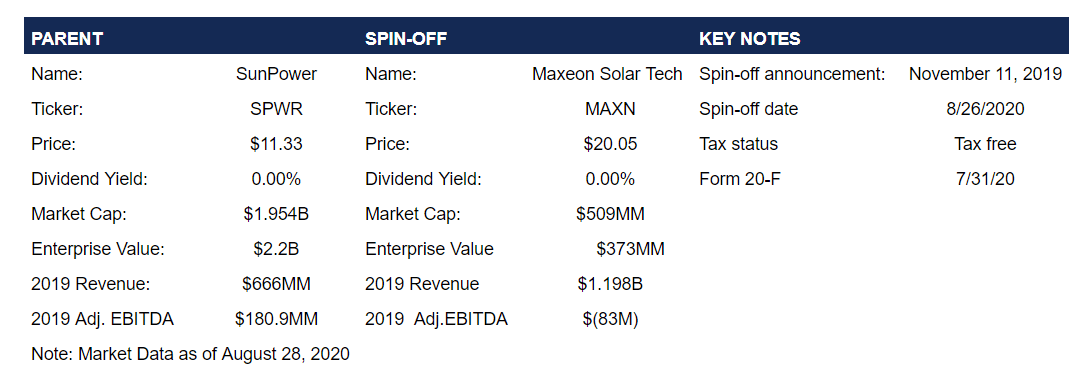

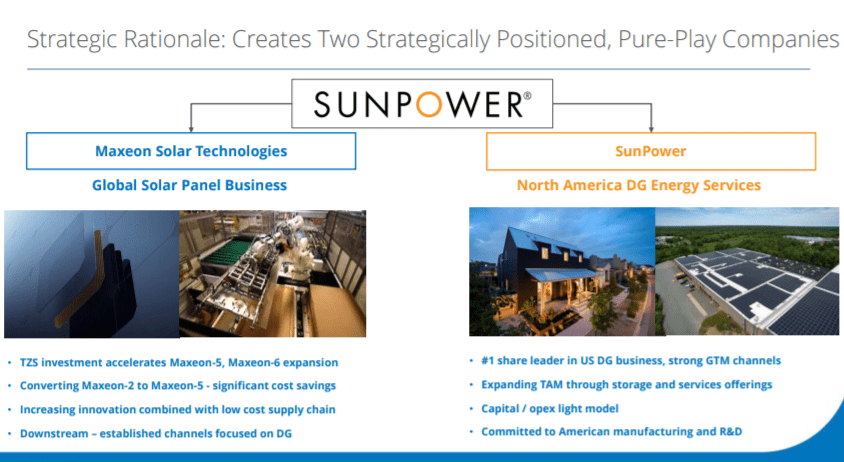

On August 27, 2020, SunPower (SPWR), spun off Maxon Solar Technologies (MAXN), its international solar manufacturing operations. SunPower (the remainco) will continue as a leading North American solar power services company.

As part of the spin off, SunPower transferred its non-US solar cell and panel manufacturing facilities, technology, and international sales & distribution capability to Maxeon. In addition, SunPower transferred certain ownership positions in several primarily non-US companies that are involved in the solar business.

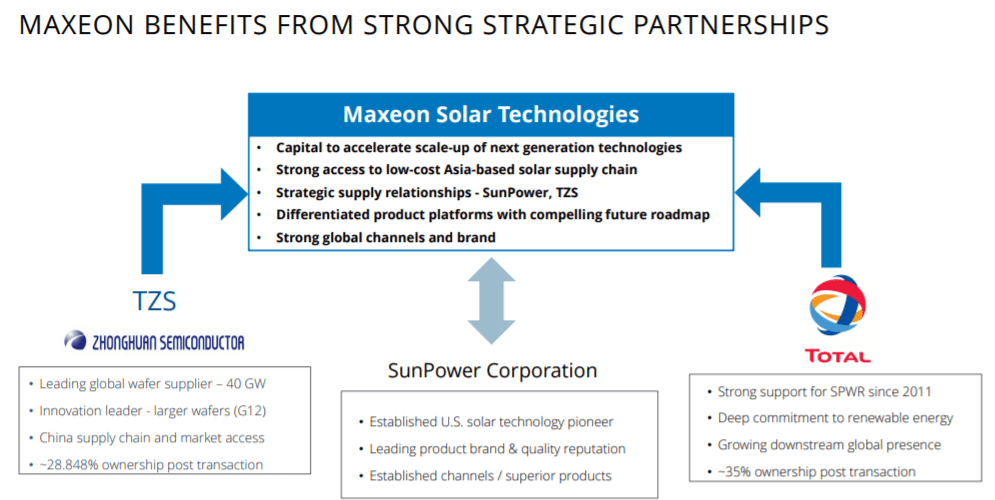

The separation was structured to facilitate an investment by Tianjin Zhonghuan Semiconductor (TZS) Co., Ltd . TZS is a supplier of silicon wafers and long-time partner of SunPower, having cooperated on seven joint ventures and development projects since 2012. TZS invested $298MM in exchange for 28.8% equity ownership of the Maxeon Solar. This investment implies a $1,034MM valuation for the company.

Total S.A, a major shareholder of SunPower, owns ~35% of the new company. Each SunPower shareholder received one Maxeon Solar share for every eight SunPower shares. “Regular-way” trading began on August 27. The stock traded in the high $38 range in “when issued” trading but declined sharply in the first day of trading. It bottomed at $15, but has since rallied to $20.05.

Why the Spin-off?

The key idea of the spin-off was initially conceived to accommodate the TZS investment. Importantly, the investment facilitates a scale up that may not have been possible in the near term. It would appear that TZS is primarily interested in the growth potential of the international business, particularly in Asia and China specifically.

TZS also probably saw the potential for valuation improvement. The Form 20-F explains the traditional rationale that with two distinct publicly traded companies, management believes that SunPower and Maxeon Solar will be better-positioned to capitalize on significant growth opportunities and better focus resources on their respective businesses and strategic priorities.

As an independent company with significant new capital, management believes that Maxeon Solar can scale their panel technologies more quickly and expand product offerings. Though the continuing relationship with SunPower in both branding and US distribution is beneficial, the company will have increasing opportunities to expand sales opportunities with other customers around the world.

Spin-off Overview

Company

Maxeon is one of the leading global manufacturers and marketers of premium solar power technology. Headquartered in Singapore, they manufacture their solar cells in Malaysia and the Philippines, assemble solar cells into panels in France, Mexico and China (through a joint venture, Huansheng, 20% owned), and sell their products across more than 90 countries. During the fiscal year ended December 29, 2019, 23.9% of sales (by megawatt) were to North America, 28.1% to EMEA, 42.8% to Asia Pacific and 5.2% to other markets.

The company claims a significant solar panel technology lead over its competitors. Their solar cells and panels have the highest conversion efficiency in the industry, a measurement of the amount of sunlight converted by the solar cell into electricity. They achieve this performance through two product technologies: the “Maxeon Line,” which utilizes what they call “ interdigitated back contact” (“IBC”) technology, and the “Performance Line,” which utilizes their “shingled cell” technology. Focused on roof top applications for the residential and light commercial markets, the Maxeon Line technology enables their panels to last longer and more effectively resist degradation. They believe that their technology allows the delivery of 35% more power using the same area of a conventional solar cell and an 8% better energy yield. They claim the industry’s lowest degradation rate, offer a 25 year warrantied lifetime and what are thought to be superior aesthetics.

For the Performance Line, primarily focused on large commercial and power plant markets through their joint venture with Huansheng, their technological advantage is the result of a “solar cell-shingling” manufacturing process that enables the panels to deliver more electricity, have higher reliability and greater resilience to environmental effects as compared with the products of competitors. The company rightfully boasts a well established supply chain, long-term customer relationships, and good brand recognition. Their manufacturing facilities are well located for logistical purposes and in some of the fastest growing markets. The Performance Line was initially targeted at the large-scale commercial and utility-scale power plant markets, but has proven to be attractive to customers in the distributed generation markets as well. During the fiscal year ended December 29, 2019, approximately 48.3% of our sales were products in Maxeon Line and the other 51.7% were products in the Performance Line, with 63.4% of total volume sold for distributed generation applications and approximately 36.6% for power plant applications.

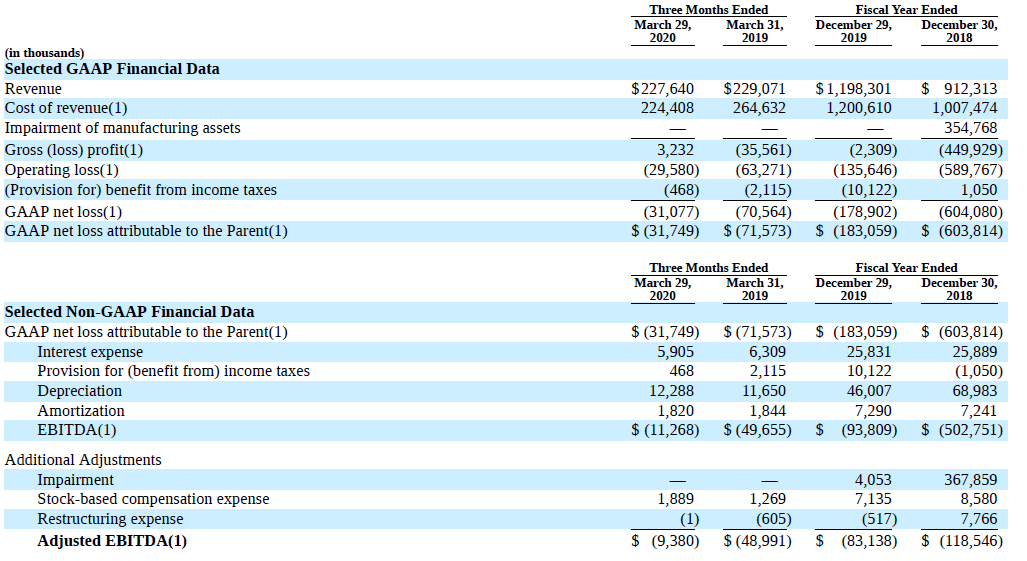

Maxeon’s revenue advanced 31% in 2019 and though the net loss is substantial, it was much less than in 2018. The unaudited pro forma combined statement of operations shown below gives effect to the spin-off and the investment of TZS as if these transactions had occurred on December 31, 2018.

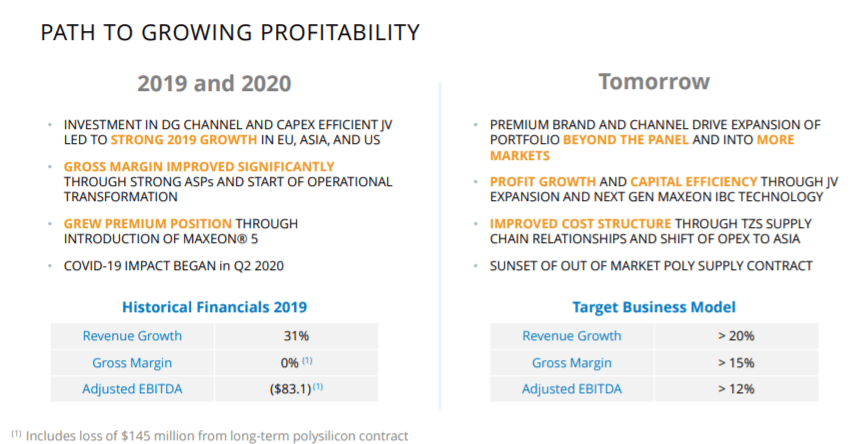

A very important thing to note is that the -$83MM in EBITDA referenced above includes a $145MM loss from a long-term, above market, polysilicon contract (see footnote in slide below). This contract will expire in 2022.

Adjusting for this contract, the company made $62MM in adjusted EBITDA in 2019.

The company’s guidance during their July Investor Day included the following slide.

Company Strategy

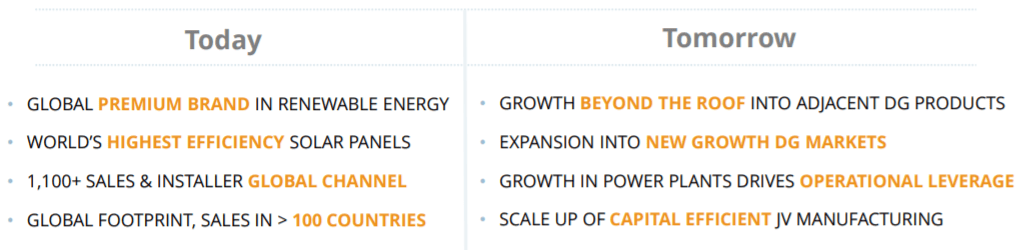

Maxeon Solar envisions strong international growth and embracing opportunities “beyond the roof”. This slide from their July investor day captures their ambition.

More specifically, Maxeon will market its solar panels under the SunPower brand into the global solar power market under a multi-year exclusive supply agreement to be entered into with SunPower. SunPower and Maxeon will cooperate to develop and commercialize their Maxeon 7 next generation solar panel technology, with early stage research conducted by SunPower and deployment-focused innovation and scale up carried out by Maxeon Solar. Management believes that this will allow the company to increase its distributed generation market share and accelerate profit growth. The investment by TZS will finance continued scale-up of Maxeon 5 and 6 capacity, one of the company’s most important priorities. The build out of existing facilities will provide increased scale and a simpler process. The result is expected to be a 50% reduction in capital intensity, cost per watt, factory space requirements, and reduced cell conversion cost relative to the Maxeon 2 technology. Another company goal is to take full advantage of the TZS relationship and others in Asia to access the low-cost Asia-centric supply chain and to expand their global channels to market. Other strategies include optimization of the supply relationships with SunPower and Huangsheen, leveraging their established distributed generation channels, enhancing financial performance with premium pricing and lower costs, and establishing direct access to capital markets. Centering their operations in Asia will also enable them to drive costs lower.

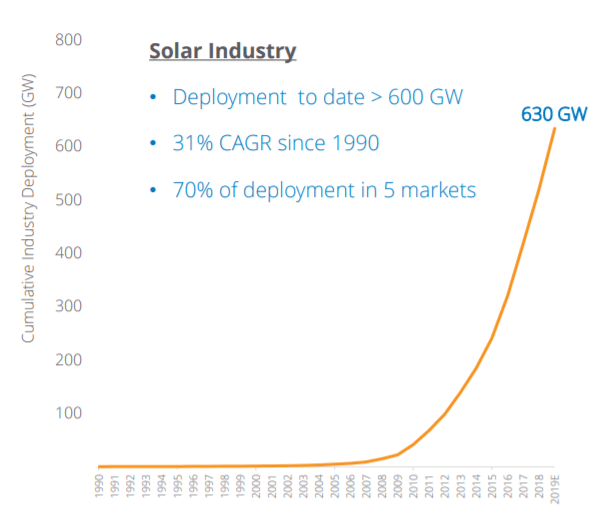

Industry

Solar has become one of the fastest growing renewable energy sources over the last few decades. Solar power is now the largest component of incremental global power generation capacity. According to recent estimates from Wood MacKenzie, through effective investments and projects, the solar market has achieved more than 600 GW of global installed capacity as of 2019, representing an average compound annual growth rate of 40% since 2009, with significant acceleration in the most recent years.

The two primary application segments are distributed generation (“DG”), mainly for residential and commercial rooftops systems, and UPP for large ground mounted power generation systems. During 2019, total industry shipment volume mix was approximately 46% DG and 54% UPP according to Wood MacKenzie. The solar panel manufacturing industry is fragmented, with no player holding a market share of over 10% of 2019 shipments according to PV Infolink. Nine of the top ten (by volume) manufacturers are based in China.

As solar technology has developed, manufacturing costs have declined and performance has improved. Today, solar power, together with enhanced balance of system technology, has among the lowest levelized cost of energy (“LCOE”) of all major energy sources.

In the long term, this trend is expected to continue and even accelerate, according to Bloomberg New Energy Finance. By 2050, solar technology is expected to represent more than 40% of global electricity capacity, with a balanced distribution among key regions worldwide—a significant increase compared to its current penetration of approximately 5% of global capacity. Renewable is one of the most relevant topics and targets of government incentives and policies. Concern about fossil fuels’ affect on the environment is at the forefront of political debate. Solar energy addresses this concern.

Solar equipment manufacturing will consolidate around a handful of leaders that compete on technological innovation and the lower costs that come with technology innovation and scale. The market is characterized by continually changing technology and improving features such as increased efficiency, higher power output and enhanced aesthetics. Companies are developing new technologies such as thin-film solar panels, concentrating solar cells, solar thermal electric and other solar technologies that are likely to provide energy at lower costs. Solar panel prices are trending lower as new technologies result in lower costs.

Meanwhile, distributed generation has emerged as a fast-growing market that complements the utility-scale solar power plant market. Maxeon Solar addresses the distributed generation opportunity in the residential and commercial rooftop segments. In the large-scale and utility segment, their Huansheng Performance Line joint venture is the platform that may allow scalings in a capital efficient manner.

Competition

In the solar industry, there are several types of competitors: solar panel manufacturers like SunPower (and recently spun off Maxeon), component manufacturers, companies that install and often finance solar installations, and solar power companies that sell their output. Many regulated utilities have embraced solar power generation. SunPower appears to be the largest manufacturer that serves residential and medium sized commercial enterprises. They are known to provide the most efficient solar panels, those that are most effective in converting solar energy into electricity. However, the company’s cost per watt in doing so is high and has hampered revenue growth. Revenue has declined on average almost 10% per year for each of the last 3 years ending 12/31/19. Revenue for the last 12 months at SunPower was $1.8 billion, and the EBIT margin was 3.8%. Pro forma revenue for Maxeon for 2019 was $1.2 billion, up from $912 million in 2018. EBIT was negative. The other major solar panel manufacturing competitors are First Solar (annual revenue of $3.1 billion), Canadian Solar ($3.6 billion) and Jinko Solar ($4.6 billion). First Solar is probably the biggest provider of solar panels for utility scale generators, but has had lackluster revenue growth and is not currently profitable. Canadian Solar specializes in massive production of low efficiency, low cost panels, with most manufacturing in China. Revenue growth has been only slightly better than First Solar’s, at about 4% per year, but their EBIT margin is just over 10%. Jinko rivals Canadian Solar as a big scale manufacturer of low cost but less efficient solar panels. The company’s revenue growth was 10% per year over the last 3 years. EBIT margins are about 6%.

Until a sharp August rally, SunPower stock had been down significantly over the past year. The 1 year performance of the panel manufacturers pales in comparison to the component manufacturers (Enphase Energy and SolarEdge) and installers (Vivent Solar and Sunrun), all up over 100%.

Other companies that are big factors in the solar industry but are not really comparable to Maxeon include Tesla (a big installer), NextEra Energy (a regulated Florida electric utility), and AES, an big unregulated alternative energy generation company. Other industry participants include Hanwha QCELLS Corporation, JA Solar Holdings Co., Trina Solar Ltd., Panasonic, LG Solar and LONGi Solar. In addition, universities, research institutions, and other companies have brought to market alternative technologies, such as thin-film solar technology, which competes with Maxeon’s photovoltaic technology in certain applications.

Customers

Maxeon sells their solar panels and balance of system components primarily to dealers,

project developers, system integrators and distributors. For a two year term, the biggest customer will be SunPower. Maxeon will enter into a Supply Agreement with SunPower whereby SunPower will purchase products for use in residential and commercial solar applications in Canada and the United States. SunPower will be required to purchase, and Maxeon will be required to supply minimum volumes of products during each calendar quarter of the term. During the fiscal quarter ended March 29, 2020 and fiscal year 2019, Maxeon had sales of $69.0 million and $426.5 million, respectively, to SunPower. Other than SunPower as of March 29, 2020, they had one customer that accounted for at least 10% of revenue. Maxeon

has over 370 sales and installation partners in the Asia Pacific region, over 750 in the Europe, Middle East and Africa region, and 25 in Latin America. More than 75% of MW sold during the fiscal year ended December 29, 2019 was made into markets outside of North America. While they expect that North America will continue to represent a key market, they anticipate continuing to sell the majority of products outside of North America in the future.

Quality of Business

SunPower has developed high efficiency solar panels but they have been expensive in terms of cost per watt. Consequently, revenue growth has been nonexistent, and profitability has been elusive. The pro forma numbers in the Form 20-F for Maxeon look better. For the fiscal year ended 2019, revenue advanced 31%, and adjusted EBITDA was -$83 million vs. -$118 million last year. The March quarter showed a slight decline in revenue and adjusted EBITDA of -$9 million vs. -$49 million.

As highlighted above, it’s important to note that the loss in 2019 includes a $145MM loss from a long-term, above market, polysilicon contract. This contract will expire in 2022.

The March quarter was affected by the Covid 19 virus, a serious problem (see Risks below). The additional capital from TZS will allow the development of more advanced panels and build scale which should enhance profitability. When fully ramped up, the company claims that the cost per watt challenge that has impeded profitability will have been solved. However, their ambition to address the large scale utility market will remain a big challenge as others are already targeting that market aggressively. Interest expense is $25 million per year and a lot of debt is due in 2023 and the convertibles (see Capital Structure below) mature in 2025. Leverage is fairly high with the ratio of assets to equity at 2.27. The conversion of the 6.5% notes will be dilutive. They indicate that capex of $385 million is planned in the 2020 – 2022 period. Cash commitments for the period following March 31, 2020 are listed as $473 million in the 20-F (page 122), the majority of which are inventory purchase agreements. That’s a lot of money for a company with negative EBITDA. Though the outlook for the solar industry is very exciting, the quality of Maxeon’s business is not as good as alternatives. Even at the “right price” I’d rather own a diversified solar ETF, such as the Invesco Solar ETF (TAN). An acquisition by a Tesla, NextEra or AES or some other entity with strong financial resources is a possibility.

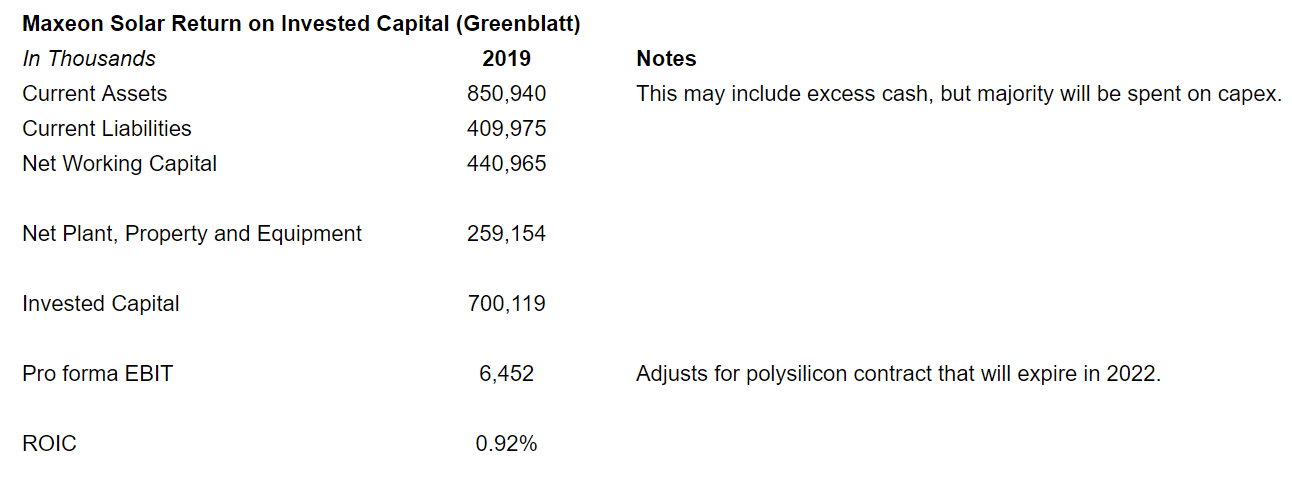

From a Greenblatt ROIC perspective (see chart below), the business does not generate positive returns on invested capital although that will probably change once Maxeon scales up and the unprofitable polysilicon contract expires. Nonetheless, this is a rather low quality business.

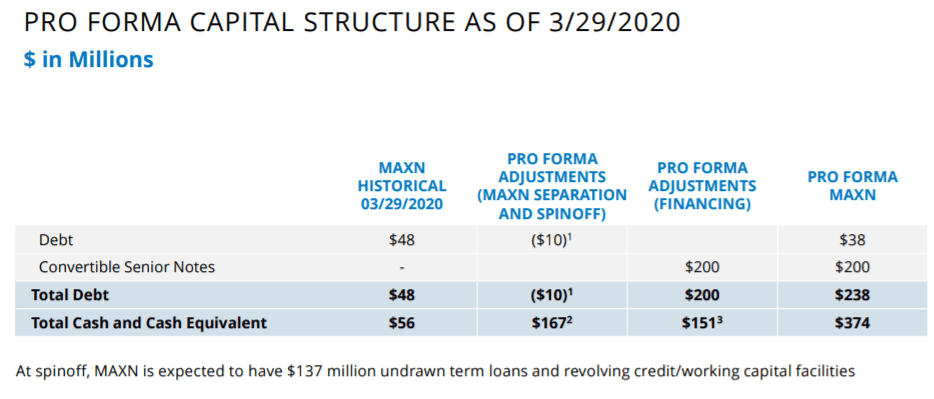

Capital Structure

Maxeon completed a major financing that was required for the spin-off to be completed. They issued $200 million of 6.5% “green” convertible notes due in 2025, In addition, they arranged $75 million in term loans, and a $50 million working capital facility, all due in 2023.

Management and Incentive Compensation

SunPower Technologies business unit leader, Jeff Waters, will take on the role of CEO of Maxeon Solar. Current SunPower CEO, Thomas H. Werner, will remain at Sun Power. The management team is well experienced, but the length of service with SunPower is somewhat limited. Jeff Waters, has served in his current position only since January 2019 but does have 15 years of experience as an executive in the technology industry. He came from Isola, where he worked from Silicon Valley as the company’s president and chief executive officer. Prior to Isola, Waters was senior vice president and general manager with Altera Corporation and also held a variety of executive positions with Texas Instruments/National Semiconductor in both the U.S. and Japan for 18 years, including in global sales. Waters holds a bachelor’s degree in engineering from the University of Notre Dame, a master’s degree in engineering from Santa Clara University and a master of business administration from Northwestern University. He holds 13,227 shares of SunPower stock. His salary last year was $563k, the bonus was $1 million, he received $3.9 million in SunPower stock, $557k from a non-equity incentive plan, $29k in other perqs, bringing the total 2019 compensation to $6.1 million. Not bad! Maybe too good.

The Chief Financial Officer, Joanne Solomon, is an executive with more than 30 years of experience but only joined the SunPower in January this year. She most recently served for three years as Chief Financial Officer for Katerra Inc. Prior to this, she worked for 16 years at Amkor Technology, Inc., roles including CFO. Ms. Solomon began her career at Price Waterhouse, received her Master of Business Administration, International Management, from Thunderbird School of Global Management, and her Bachelor’s Degree in Business Administration (Accounting and Finance) from Drexel University. She owns less than 1% of SunPower common stock

The Chief Legal Officer, Lindsey Wiedmann, has been with SunPower for a decade and will lead Maxeon’s global legal and sustainability teams. During her decade with SunPower, she has

provided legal expertise in the areas of project finance and development, mergers and acquisitions, joint ventures, corporate governance, compliance,disputes and other significant matters in support of the residential, commercial and power plant business units globally with legal teams in France,Mexico and the United States. Ms. Wiedmann was also the lead SunPower attorney for 8point3 Energy Partners LP’s initial public offering in 2015 and nearly three years of acquisitions and operational activity as a public company. Prior to joining SunPower, Ms. Wiedmann spent six years practicing project finance at Latham & Watkins LLP in San Francisco and Singapore. Ms. Wiedmann received her Bachelor of Science degree from University of California, San Diego and her Juris Doctor degree from Columbia Law School. She owns 2,695 shares of SunPower stock.

The Chief Operations Officer, Markus Sickmoeller, is responsible for manufacturing, quality, supply chain, cell technology deployment and environment, health and safety globally. He joined SunPower in late 2015 to start the Maxeon 3 cell factory in the Philippines. He became head of operations for SunPower in July 2019. Previously, Sickmoeller was Chief Operating Officer of SiliconLine GmbH in Germany. Before that Markus held positions in operations and research and development in the semiconductor industry for more than two decades with Siemens, Infineon and Qimonda in Germany, Malaysia and Taiwan. Sickmoeller holds a Diploma degree (Master of Science equivalent) in Electrical Engineering from the University of Braunschweig, Germany and a Doctorate Title in Optoelectronics from the University of Ulm. He holds 7,925 shares of SunPower.

Peter Aschenbrenner, the Chief Strategy Officer, has more than 40 years of solar industry experience. Aschenbrenner is the Chief Strategy Officer. Prior to Maxeon Solar he served as SunPower’s Executive Vice President of Corporate Strategy and Business Development, responsible for driving the company’s strategy, mergers and acquisition and business activities. Previously, he was the company’s Vice President of Marketing and Sales, where he established the SunPower brand and oversaw development of the industry’s first dealer etwork program. Prior to joining SunPower, Aschenbrenner served as Senior Vice President of Global Operations at AstroPower, Inc., a solar product manufacturing company. He has more than 40 years of solar industry experience, including management positions at Siemens Solar, PV Electric GmbH and ARCO Solar. Mr. Aschenbrenner graduated from Stanford University in 1978 with a Bachelor of Arts degree in product design. Aschenbrenner holds 19,161 shares of SunPower.

The SunPower proxy provided information on CEO Waters 2019 compensation, however, information on the other leadership team at Maxeon was not provided. Employees have historically participated in SunPower’s stock-based compensation plans. As of December 29, 2019, the total unrecognized stock-based compensation related to outstanding restricted stock units was $16.3 million. It is expected to be recognized over a weighted-average period of 2.6 years. Maxeon expects to implement compensation and stock based incentives plans similar to those now in place at SunPower.

Potential for Indiscriminate Selling

It appears that there has been some selling pressure for Maxeon.

It traded at ~$37 in the when issued market and declined 50% on its first day of trading. It has recovered slightly and recently closed at $20.05.

Valuation

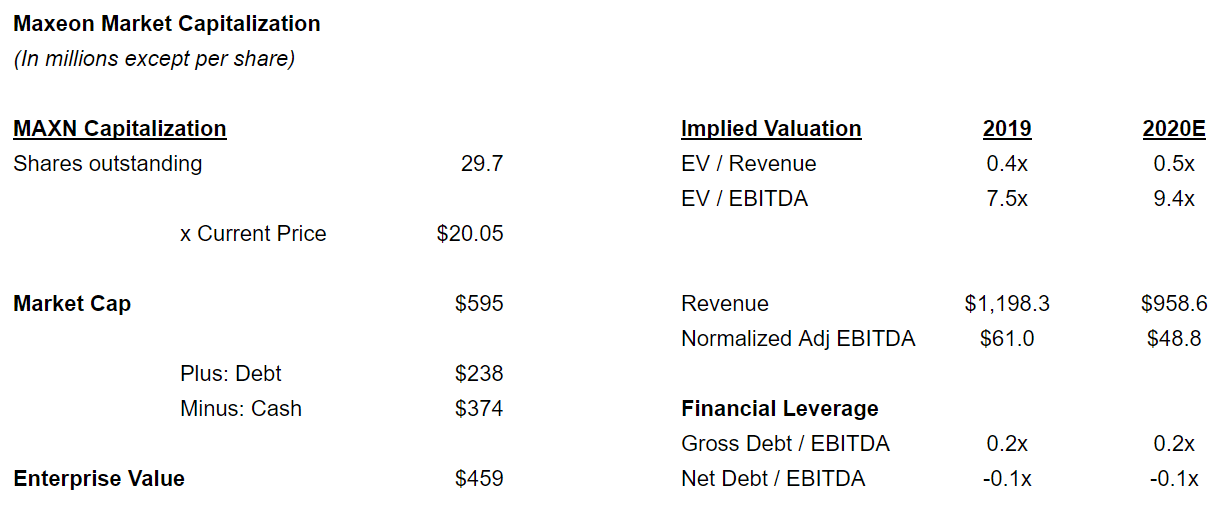

TZS paid $298 million for 28.848% of Maxeon. The price implies that Maxeon is worth $1,033 million or $34.80 per share. This is probably a good starting point for a fair valuation analysis.

At its current share price ($20.05), MAXN is trading at an EV/2019 revenue multiple of 0.4x. 2019 revenue is probably a good year to use as it represents “normalized” revenue. This year, I expect revenue to decline by ~20% given pandemic related hiccups. In 2021, the company should return to growth.

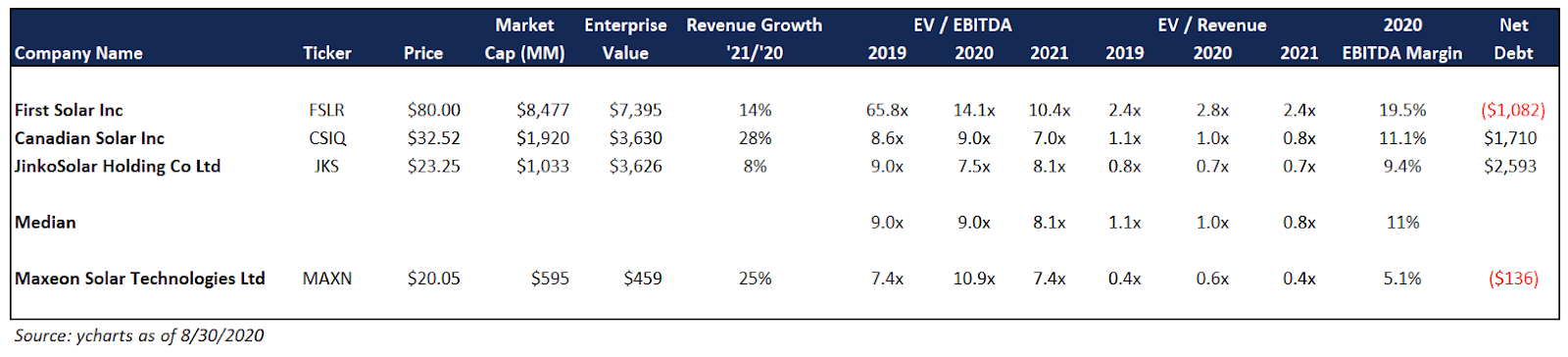

When looking at solar company comparables, the industry participants show a wide variation in their fundamentals as well as their valuation. The component makers have enjoyed much better revenue growth and margins in the last three years and their valuations are much higher than the panel manufacturers.

The panel manufacturers (First Solar, Canadian Solar, and Jinkosolar) are the best comps.

Given Maxeon is currently sub scale and financials are punished by its above-market polysilicon contract ($145MM annual loss in 2019), the best way to look at valuation is on an EV/Revenue basis.

I also think that 2019 is the best year to use because it represents a “normal” year.

As such, it’s clear that MAXN, at 0.4x 2019 is trading at a sizable discount to peers. Let’s ignore First Solar as its EBITDA margins are higher than Maxeon’s target margins. That will leave us with Canadian Solar and JinkoSolar which trade at 1.1x and 0.8x 2019 revenue.

If Maxeon traded 0.8x 2019 revenue, it would be worth $37.

One other positive for Maxeon is it has net cash on its balance sheet while Canadian Solar and KinkoSolar have significant debt.

There are other solar companies that trade at premium valuations to Maxeon, but they are primarily focused on solar panel installations.

For instance, Sunrun (RUN) trades at an EV/revenue multiple of 11.0x and recently announced that it is acquiring Vivint Solar (FSLR) for a 10x revenue in a stock deal. Since then Vivint’s stock price has almost tripled and the stock currently trades at an EV/revenue multiple of 14.2x.

Seems just a bit frothy. Both Sunrun and Vivent have higher gross margins (30% and 44%, respectively), but both are losing money right now and will continue for the foreseeable future.

Despite the seemingly obvious undervaluation of Maxeon Solar, I’m approaching the situation cautiously as I’ve been burned before buying poor quality businesses that are cheap (such as Arlo).

If the stock were to drop below $15, I believe the stock would be a buy with a very nice risk reward.

Risks

COVID 19 is a big risk.The virus has affected how teams around the globe work and how they operate the company, including manufacturing, selling, installing and servicing. Their priority has been to enhance already stringent health and safety standards to protect the employees, customers and those in the communities they serve, while they attempt to manage market impacts. Actions include temporarily reducing the salaries of certain of the executive officers, temporarily implementing a four-day work week for a portion of our employees,and the temporary idling of their factories in France, Malaysia, Mexico and the Philippines. All of their factories resumed production as of May 2020 in accordance with the relevant local restrictions and with additional safety measures to protect their employees. They are trying to contain costs, and hope that their strong market position will allow continuing growth when the virus is controlled. The discussion of these Covid 19 risks is very prominent in their Form 10 Registration Statement. The following statement is particularly ominous, especially from a company that is spinning off a money losing operation with a healthy level of debt . “Our ability to meet our payment and other obligations under our debt instruments depends on our ability to generate significant cash flows. In light of reduced demand and general economic uncertainty related to the COVID-19 pandemic, we cannot assure you that our business will generate cash flows from operations, or that future borrowings will be available to us under our existing or any future credit facilities or otherwise, in an amount sufficient to enable us to meet our payment obligations under our debt and to fund other liquidity needs. If we are unable to generate sufficient cash flows to service our debt obligations, we may need to refinance or restructure our debt, sell assets, reduce or delay capital investments, or seek to raise additional capital. There can be no assurance that we will be successful in any sale of assets, refinancing, restructuring, or capital raising effort.”

Upon consummation of the spin-off, Maxeon will report under the Exchange Act as a non-U.S. company with foreign private issuer (“FPI”) status. Consequently, they will not be required to file 10Qs with the SEC and are exempt from certain other provisions required of US companies. However, they will be required to fill an audited annual report 20F within four months following their fiscal year end. It seems likely that they will give up their FPI status if the US business becomes larger, their officers and directors are more than 50% US citizens. In addition, they are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). This designation reduces the need for reporting historical financial information, executive compensation, and other information normally required of registered US companies.

Price competition is an important risk. Maxeion’s solar panels are sold at higher prices in the market as compared with lower cost conventional solar cells, such as thin-film, due to their products’ higher efficiency. Given the general downward pressure on prices for solar panels driven by increasing supply and technological change, the company is continually challenged to lower costs to remain competitive.

Tariffs could hurt their business

The reduction of government incentives could cause revenue to decline because, at present, the cost of solar power generally exceeds retail electric rates in many locations and wholesale peak power rates in some locations.

They may be classified as a U.S. corporation for U.S. federal income tax purposes under Section 7874, which could result in Maxeon Solar being subject to U.S. federal income tax indefinitely.

Thanks for the article.

It would be nice if you had also covered, in more detail, the Green Note, which, it seems to me, is actually being used as a way for funds to short the common without having to buy back their shares in the open market. I could be wrong, but it seems to be a particular risk (increased volatility, during the initial stage of the trading.

There is also a dilution protection agreement offered to TZS and Total for no consideration, which may well end up being dilutive for everyone else.

Thanks for the comment Jacob. It’s a really good point, and I didn’t fully understand the pricing of the green note until after MAXN began trading. Lesson learned for me. I agree that the recent downward pressure has most likely been caused by investors shorting the stock to hedge convertible bond positions.