Garrett Motion Spin-off

Garrett Motion (GTX), a spin-off of Honeywell (HON), began trading on Monday, October 1, 2018. GTX’s primary business is selling turbochargers to automobile manufacturers. GTX is in a cyclical business and will have significant long term liabilities ($1.7BN of debt and $1.7BN of obligations to Honeywell to cover asbestos and tax liabilities).

I was initially skeptical of GTX given:

- Its business is very cyclical, and we are in the later innings of the economic cycle

- It has significant debt and long term asbestos liabilities

- Its peers all trade at low multiples

- Internal combustion engines are facing secular headwinds from electric vehicles

However, I decided to take a fresh look at the stock to make sure I wasn’t missing anything.

Valuation

Let’s start by valuing GTX.

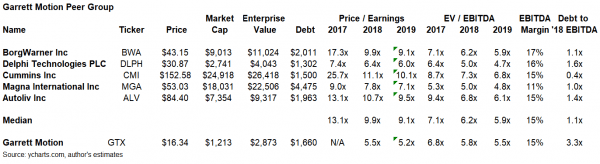

In GTX’s investor slide deck (slide 59), it mentions peers Borgwarner, Delphi, Cummins, Continental, Denso, Valeo, and Magna. My data provider (ycharts) has estimates for all of these companies except Continental, Denso, and Valeo so I excluded these names from my comp set. I added AutoLiv, another auto parts supplier.

As shown below, these peers trade at a median Price to ‘18 EPS of 9.9x and a median EV / ‘18 EBITDA of 6.2x.

GTX looks very cheap on a price to ‘18 earnings basis (5.5x vs. peers at 10.0x) and moderately cheap on an EV / ‘18 EBITDA basis (5.8x vs. peers at 6.2x). GTX’s EBITDA margins are inline with peers at 15%. GTX makes the argument that if one exclude its asbestos liability payments to Honeywell, it has ~20% EBITDA margin. I don’t agree with this exclusion as the asbestos payment will continue for the foreseeable future and is a cost of doing business as far as I’m concerned.

GTX’s has higher debt than peers (debt to ‘18 EBITDA of 3.3x vs. 1.0x), but intends to pay it down to 2.0x over time. I was initially super concerned with GTX’s debt load especially considering its asbestos liability. However, management estimates the weighted average cost of the debt will be ~4% and it doesn’t mature until 2026. These terms will give GTX more than enough time to make it through a recession.

I tend to think GTX deserves to trade inline with its peers. It you assume GTX should be valued at a P/E of 10.0x inline with peers, it would trade at ~$29, ~72% higher than its current price. If GTX traded at a EV / ‘18 EBITDA of 6.2x, inline with peers, it would trade at $19, ~14% above its current share price. Average those two price targets and you get $24.

Given its cheap valuation, GTX might be worth a short term trade.

The Downside

Let’s give some thought to the downside. Given we are in the later innings of the economic expansion, Garrett’s business would be hit hard in a recession. Borgwarner (BWA), Garrett’s closest peer, saw EBITDA decline by 51% in the last recession. In 2009, it traded at ~9.0x Annual EBITDA at its bottom (it’s counterintuitive, but cyclicals often trade at higher multiples when earnings are depressed). Let’s assume that we have a serious recession in 2020 and GTX EBITDA declines by 50% to $248MM. Let’s also assume that debt has been reduced by $400MM to $1.2BN.

If GTX traded at 9.0x EBITDA in this scenario, its implied enterprise value, market cap and stock price would be $2,236MM, $976MM and $13.13. Versus GTX’s current price of $16.42, the downside (20%) seems manageable.

Upside

In a more bullish scenario, let’s assume GTX grows earnings from $2.99 in 2018 to $3.30 in 2020 (5% CAGR). Now let’s assume it trades at a 10.0x Price / Earnings ratio. This implies a $33 price, 101% above GTX’s current price.

Where do I come out?

After looking at the upside and downside, GTX does look cheap. The one concern that I haven’t mentioned is the secular headwind it faces as electric vehicles take share from internal combustion engines.

Here some good articles that discuss electric vs. internal combustion vehicles:

WSJ – Will Electric Vehicles Replace Gas Powered Ones?- November 2017

Bloomberg – Electric Vehicles’ Day Will Come, and It Might Come Suddenly – August 2018

Bloomberg – For Electric Cars, Focus on the Small Picture – August 2018

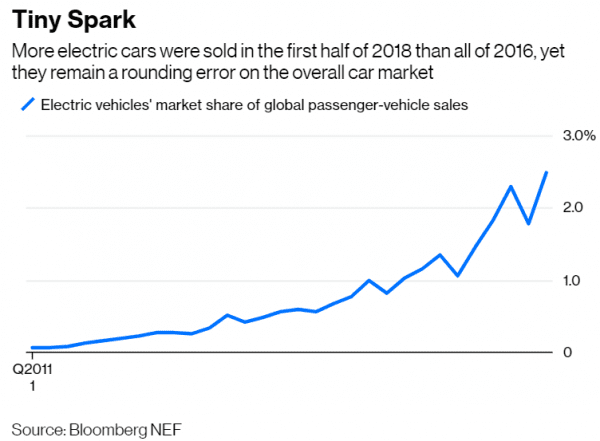

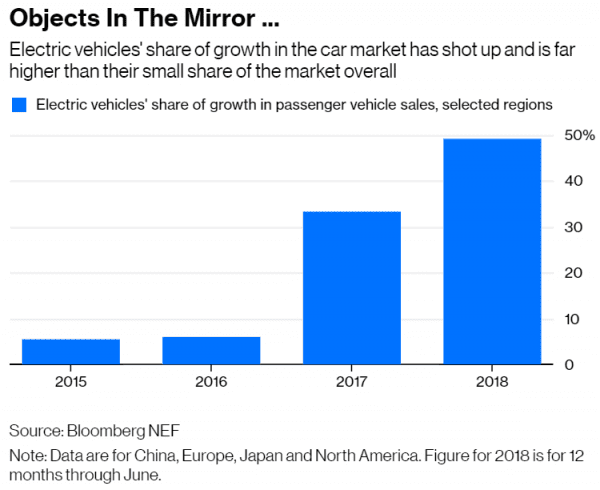

As shown in the charts below, electric cars represent a tiny portion of the global car market, but they are growing significantly.

To me, electric cars continuing to take share from internal combustion cars seems inevitable. GTX drives vast majority of its revenue and earnings by selling turbochargers for internal combustion engines. While GTX does produce some revenue from electric cars, it is so small that the company doesn’t break it out.

I believe the secular headwind from the increasing proliferation of electric vehicles will limit GTX’s top-line growth prospects and pressure GTX’s valuation multiple over the long term.

This is keeping me on the sidelines for now.

Richie,

I look forward to following your research and making some money. Today I reviewed your website from my desktop computer and the information flowed quite clearly. Last week I used my ipad and found the presentation less clear. it seems like my ipad did not have the capacity to present the info clearly. i’m not sure what the solution is, but I thought you should know.

All the best, Bill

Thanks for the comment, Bill. Also, thanks for the feedback on how the website looks from the ipad. I’m going to speak to my developer to see if he can help.

Best,

Rich

This is quite an interesting spinoff. Seems like a cheap binary option: lose all or home-run type of thing. Did you have the chance to look into management incentives?

I agree that it looks interesting, Concalo. While it has rebounded from its lows, it’s still down significantly from its initial spin-off price. I think there is very little risk that it goes to zero in the near to medium term. Longer term, there is the secular risk from increasing proliferation of electric vehicles. However, this will take a long time to play out and I think there will probably always be a demand for internal combustion engines. Not everything will go electric. The bigger risk that I’m worried about is the auto cycle. It appears to have peaked or is close to peaking. However, GTX’s valuation is NOT demanding.

In terms of management incentives, 10MM shares (13% of shares outstanding) are reserved for incentive compensation. So management will have every incentive to get the stock price up.