Westell Technologies – Odd Lot Special Situation

Ticker: WSTL

August 26, 2020

Current Price: $1.07

Odd Lot Cash Out Price: $1.48

Odd Lot Expected Return: 38% or $410 (999 x [$1.48-$1.07] )

Timing: Deal expected to close by end of Q3 2020 / early Q4 2020

Summary

Westell will be enacting a 1-1000 reverse stock split in order to reduce its number of shareholders to below 300 to delist and become a private company. Any shareholder who owns 999 shares or fewer will be cashed out at $1.48. As such, there is an opportunity to buy 999 shares of WSTL at $1.07 and have them cashed out at $1.48 in ~1 month, implying a return of 38% or $410. There is always risk in these types of trades that the transaction does close, but I believe that risk is low.

Background

On July 10, 2020, Westell Technologies announced that it will enact a 1-1000 reverse stock split allowing the company to delist from the NASDAQ Capital Market. Public companies can delist if they have fewer than 800 shareholders. The 1-1000 reverse stock split will reduce the number of Westell shareholders to below 800 enabling the company to delist. Following the delisting, the company will proceed with a 1-1000 stock split which will completely counter the previous reverse stock split.

Any shareholder who owns fewer than 1,000 shares will be cashed out at $1.48, significantly above where the stock is currently trading.

The reason for the delisting is it will save the company substantial costs and expenses associated with being a public company.

The company disclosed that it estimates saving of 0.9MM per year by going private.

Will the Transaction go Through?

To take advantage of this opportunity, you can buy 999 shares or fewer at the current price of $1.07 and get cashed out by the company at $1.48. This works out to a 38% or $410 (999 x [$1.48-$1.07] ) return in about a month.

The transaction is expected to close late in the 3rd quarter or early 4th quarter (September or November).

The risk is that the odd lot provision is removed or that the transaction is voided. This happens infrequently, usually when an odd lot opportunity becomes too popular (be careful who you share this opportunity with!).

However, my sense is this transaction has a high probability of closing due to several factors:

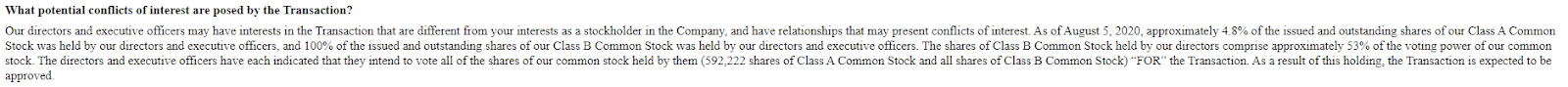

- For the delisting to move forward, a majority of the voting power of class A and class B shareholders have to approve the transaction. As shown in the screenshot below, Westell directors, through their class B shares, control 53% of voting power of the company. As disclosed in the proxy, they intend to vote in favor of the transaction. Of course, the directors could change their mind.

- Westell has plenty of cash on its balance sheet. As of Q2 2020, Westell has $21.9MM of cash and no debt. Westell’s currently has a market cap of $17.2MM and thus, WSTL is trading at a negative enterprise value. This means that 1) WSTL is cheap (no wonder management wants to take the company private and 2) WSTL could afford to buy back all shares outstanding. Thus, even if a large number of odd lot shareholders tender their shares, WSTL still has the flexibility to go through with the transaction.

- Westell also disclosed that it expects to pay $7.8 million to cash out odd lot shareholders. However, it noted, “The actual amounts paid for costs and the cash out of fractional shares will likely vary. This total amount could be larger or smaller depending on, among other things, the number of fractional shares that will be outstanding after the Transaction as a result of purchases, sales and other transfers of our Class A Common Stock and Class B Common Stock of the Company by our stockholders.” This language does not read like the company is too sensitive to how many shares it retires.

- At a cash out price of $1.48, $7.8MM implies that 5.3MM class A shares (43% of total) will be retired out of 12.3MM.

- Since the transaction was announced on July 10, 2020 (after the market close), 8.5MM WSTL shares have traded. I closely followed another going private transaction (Dynasil). In that transaction, 76% of shares that traded between the going private press release and the date of the transaction were “odd lot” shares.

- We have about 1 month until the shareholder vote (September 29, 2020) so let’s assume that 50% more shares trade or 12.8MM in total. Of those, 76% are odd lot shareholders (9.7MM shares). In this scenario, Westell would have to spend $14M.4MM to repurchase shares plus an additional $300k in administrative costs, so $14.7MM in total. As of June 30, 2020, Westell has $21.9MM in cash.

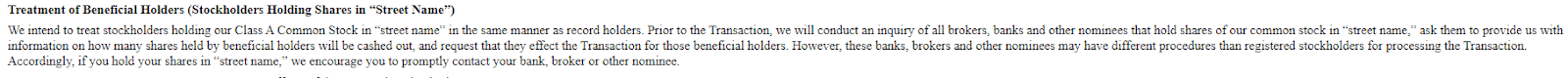

Another important positive factor is that Westell intends to cash out every “beneficial” odd lot shareholder with 999 or fewer shares. The company wrote the following in the proxy statement:

Many times, companies that delist “play games” with small shareholders and don’t recognize shareholders who hold their shares in “Street Name”. This is not the case with Westell. For further context on “Street Name” shareholders, here is a complaint letter to the SEC which explains the difference between shareholders who hold their shares in “Street Name” versus record holders.

Finally, there has been significant insider buying recently by President and CEO, Timothy Duitsman. This bodes well and implies that 1) he thinks shares are undervalued and 2) the transaction is likely to go through (he would probably be able to buy shares cheaper if Westell called off the transaction.

Downside Risk

If the transaction were to be called off, I believe shares would fall to $0.80 or lower given that’s where shares traded before the announcement.

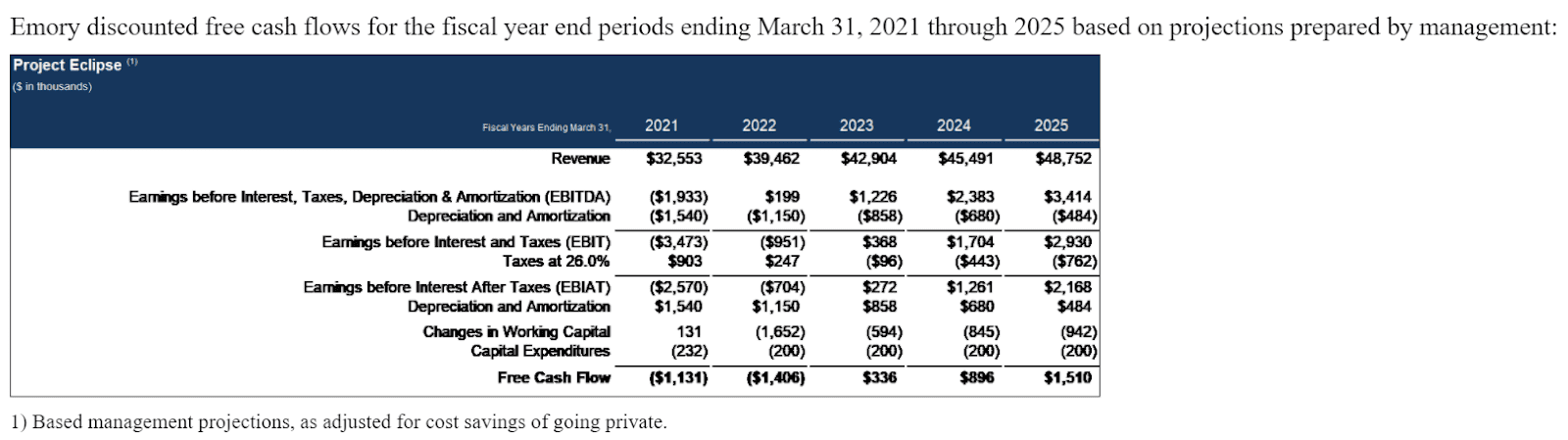

However, at that price or lower, I might hold onto my shares. After all the company is trading way below its cash level on its balance sheet and has big plans according to financial projections in the proxy statement.

Further, recent insider buying suggests that the company is a good value at current levels or lower.

Timing

There will be a board meeting on September 29, 2020, to approve the reverse split and delisting.

I imagine the transaction will be approved at the board meeting and the reverse stock split will occur shortly after the Board meeting.

I don’t currently own shares of WSTL but will likely buy them at some point in September.

Disclosure

Rich Howe, owner of Stock Spin-off Investing (“SSOI”), does not own WSTL shares but will likely buy them at some point in September. All expressions of opinion are subject to change without notice. This article is provided for informational purposes. Please do your own due diligence and consult with an investment adviser before buying or selling any stock mentioned on www.stockspinoffinvesting.com.

I bought my shares a while ago. I’ve noticed that volume has been averaging 200,000 shares a day which is higher than I expected. I figure a number of investors are lining up. There may quite a few odd-lot ones. From all I see mgt. is serious about this and I believe there is a very high probability that it will go through with a cash out in mid-October. Thanks for highlighting the idea. I’m always game for even $380 gains for only a half hour of work.

Thanks, Jim. Looks like it’s on track.

Thanks for sharing mgmt’s projections. Seems like they’re expecting a huge turnaround. Also thought this verbiage was interesting:

“We intend to continue to prepare audited annual financial statements and periodic unaudited financial statements and plan to make available to our stockholders audited annual financial statements through March 31, 2021 and may choose to do so thereafter after first considering the expenses.”

Seems like the co’ plans on going completely dark after March 31st, 2021.

Thanks for flagging that Eddie.