Ticker Confusion Leads to Opportunity to Short ZOOM (not ZM)

I’ve been a big fan of Zoom since I started using their service last year to record my live calls with subscribers.

And since the outbreak of Covid-19, everyone has been relying a lot more on the company.

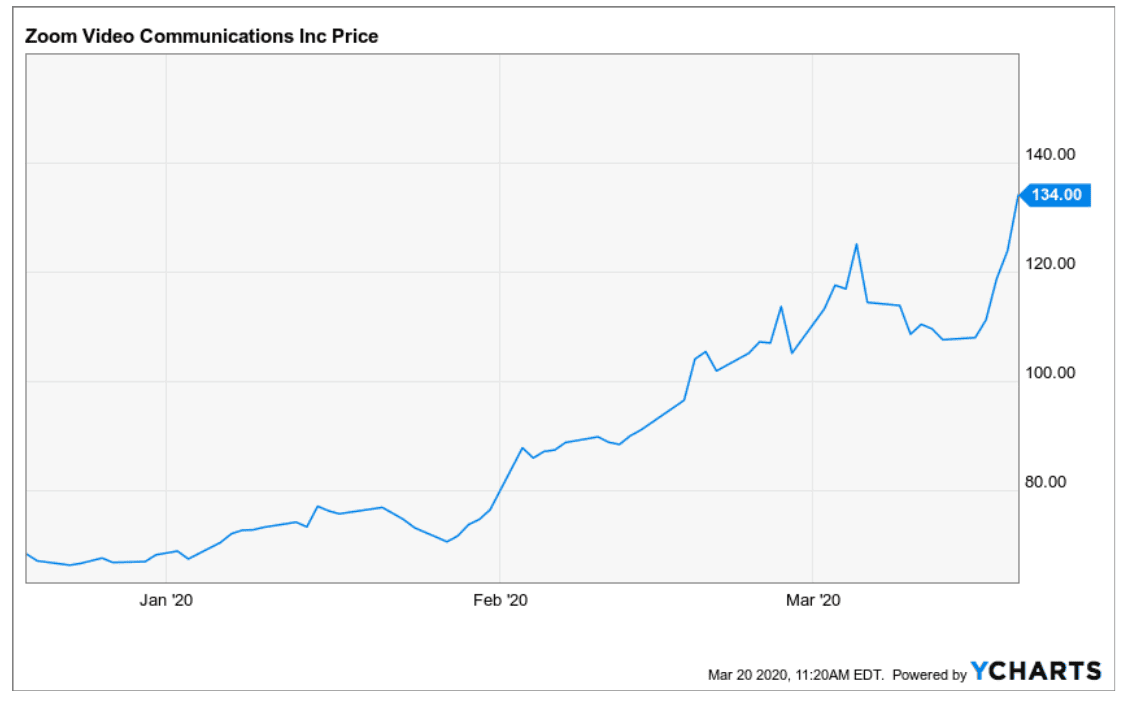

It’s no surprise that the stock has gone parabolic.

ZM is trading at a frothy 54x enterprise value to sales multiple and 1394x price to earning multiple.

But at least it’s generating revenue and earnings.

Want to know a company that is even more expensive?

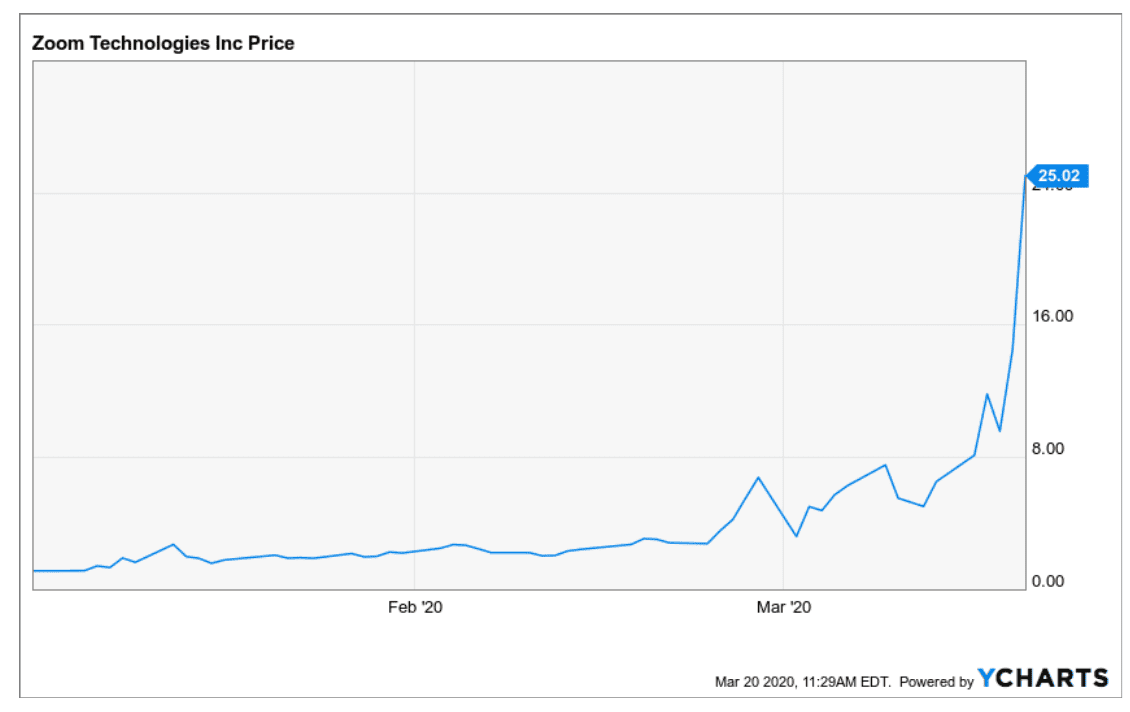

Check out Zoom Technologies (disclosure: I’m short).

It is a defunct Chinese company that hasn’t filed financials since 2015. Yet its stock has been going nuts in a case of ticker confusion.

People think they are buying Zoom Video Communications (Ticker: ZM), but buy Zoom Technologies (Ticker: ZOOM) by mistake.

Why does it matter to you?

Well you can short Zoom and profit when the stock ultimately crashes.

There aren’t many shares available, but there are some. I keep checking and 1 out of every 5 times I check, there are shares available to short. If shares aren’t available, just check back later in the day.

Ticker confusion is not new.

Back in 2013, Tweeter Home Entertainment (TWTRQ), a bankrupt electronics company, saw its share price soar because Twitter was on the verge of going public with the similar ticker TWTR.

Ultimately, FINRA halted trading in the bankrupt company to avoid further confusion.

If you are going to short ZOOM, remember to heed the words of John Maynarrd Keynes, “The market can stay rational longer than you can stay solvent.”

Don’t make the position too large as you could be forced to buy back the stock at a loss if it continues to surge and you don’t have enough capital in your brokerage account.

Leave A Comment