Why You Need to Use Twitter

I’ve wanted to write this article for a while.

I delayed it time and again because I wanted to add more material. But I figure I will just publish this version, and then update the article over time.

From 2006 to 2018, I worked at a large investment manager and then at a large US investment bank and didn’t really see the use for Twitter.

It just seemed like a bunch of people arguing with one another.

I also couldn’t access Twitter from my work computer so that didn’t help.

Once I started working full time at Stock Spin-off Investing, I started spending more time on Twitter.

I would soon discover it’s a gold mine in many ways.

It Will Make You Money

Twitter is one of my favorite sources of new investment ideas.

But don’t take it from me, listen to the pros.

Here’s Gavin Baker, former Fidelity OTC portfolio manager and current managing partner and CIO of Atreides Management.

Or listen to Connor Haley, founder of AltaFox Capital.

Who’s Connor?

Oh, he’s just generated an 86.4% annualized gross return (60.6% net) since launching his fund and is currently the third highest ranking member on Micro Cap Club.

I will personally share two profitable ideas that I sourced from Twitter in 2020.

The first is P10 Holdings (PIOE). I bought the name after learning about it from Dave Waters and Tim Erikson who both separately posted about it frequently.

At the time that I invested, P10 owned a collection of rapidly growing private equity general partnerships and was trading at about 5x free cash flow. Private equity is a great business (locked up capital, high fee, and high margin) with secular tailwinds.

I’ve sold half my position, but I’m up 160% (or $10,300) on my remaining position. Thanks Dave! Thanks Tim!

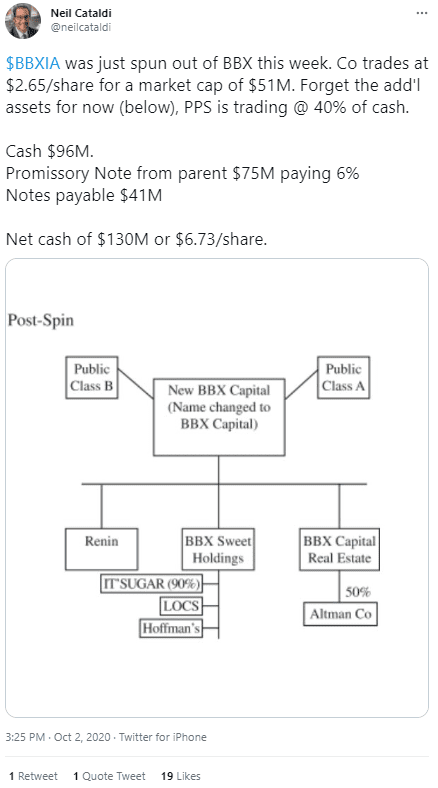

The next idea is BBX Capital (BBXIA), which was a tiny spin-off which began trading in October 2020.

I closely follow spin-offs but this one had slipped under the radar. It was tiny and there were some corporate governance concerns and so I didn’t spend much time on it until I saw Neil Cataldi tweet this.

To summarize, you had a recent spin-off trading at 39% of the cash that it had on its balance sheet (with no debt). Better yet, the company has operating businesses and real estate that are worth even more.

I quickly recommended the name to my subscribers and bought it myself. We are up about 123% and book value per share is $16.24 so there is still some good upside remaining.

Thanks Neil!

It Will Get You a Job

A good friend of mine, Eddie, ran a site (with his partner Mike) called Low Tide Investments. He formerly posted on there and on Twitter under the handle LowTideInvest.

Through Twitter, he’s been able to meet like minded investors, exchange ideas, and become a better investor.

When he recently applied for a micro cap analyst position, the hiring manager picked Eddie for the job mainly because Eddie had demonstrated his equity research abilities and interest online.

Another example is Alex Jones, another friend, who I met through Twitter (we traffic in the same stocks).

Alex is very active on Twitter and built a good following with great calls on Manitowoc, Orion Engineered Carbons, and others.

He recently announced that he accepted a job as an analyst at a long/short hedge fund in Seattle. Alex recently told me, “No doubt Twitter is why I got this job.”

It Will Help You Find Talented Employees

I posted the following job description and received 40 high quality applications within 48 hours.

I was blown away.

Through this post, I found out about the Davis Center for Portfolio Management at the University of Dayton. I’ve worked with three interns from Dayton who are incredibly talented. I’ve also worked with several excellent non Dayton interns who helped me grow my business.

If you have a job opening, I highly recommend you post it on Twitter.

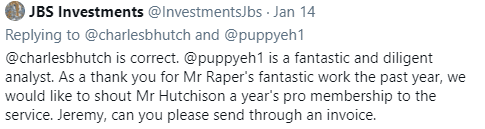

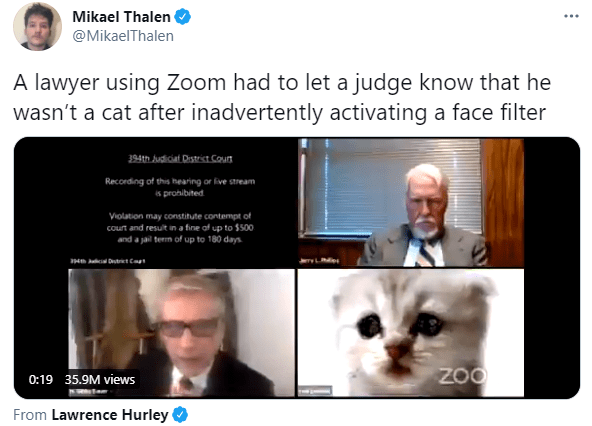

It Will Make You Laugh

About once a week, a video shows up in my Twitter feed that makes me literally lol.

Here are the last two:

It Will Make You Cry

Well maybe not cry.

But everyone makes Twitter out to be this hardcore world where everyone is hurling insults (I think Tim Ferriss refers to it as the Wild Wild West).

And while there is plenty of that, I’ve seen many random acts of kindness that are cool to witness.

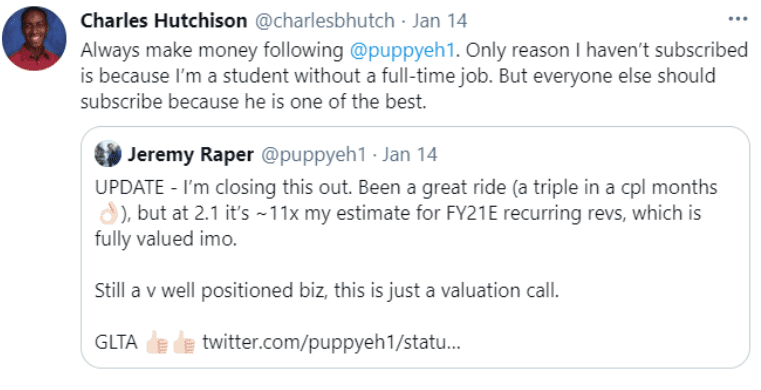

Here is one of them.

Charles Hutchison retweeted one of Jeremy Raper’s posts to basically spread the world at how good an analyst Jeremy is.

And then a few seconds later, JBS Investments replied that they would like to pay for Charle’s subscription to Jeremy’s service.

Where else will you see a complete stranger basically giving another stranger $1,000?!

How to Get Started on Twitter

If you don’t have a Twitter account, sign up!

Who should you follow?

Twitter will no doubt have some good suggestions, but one way to find some good follows is by doing the following:

For a stock you like, search “$” then the ticker. So if you wanted to search for Apple’s stock, you would search “$AAPL”.

If you find someone that is posting interesting stuff about $AAPL, follow them.

Repeat this process for your portfolio, and you will build a good list of people to follow.

Any other benefits from Twitter that I forgot to mention?

Comment below!

This is great. I also didn’t get the appeal of Twitter for a long time but over the last year or so I’ve really come to value it. I’ve learned so much and the opportunity to interact directly with incredibly talented investors is hard or even try to put a value on.

Completely agree, Matt!

Excellent article, Jeff.

Thanks Hewitt!