Subscriber Feedback

Hi there. Rich Howe here, founder of Stock Spin-off Investing.

You can read my full background here, but the short version is I’m a passionate investor who is obsessed with stock spin-offs.

I’ve invested in spin-offs ever since I read Joel Greenblatt’s classic You Can Be a Stock Market Genius in 2008. But starting in 2016, I transitioned my portfolio to invest mostly in stock spin-offs and special situations.

Why would I focus on stock spin-offs and special situations?

Because as Greenblatt famously wrote: “The facts are overwhelming. Stocks of spin-off companies significantly and consistently outperform the market averages.”

And study after study backs up that claim.

Rich Howe, Founder of Stock Spin-off Investing

Select Stock Spin-off Studies

Study #1

A J.P.Morgan study of 231 spin-offs and carve-outs between 1985 and 1998 found that during the first 18 months of trading, spin-offs outperformed the S&P 500 by 11.3% while carveouts outperformed by 10.1%

Study #2

In 2013, Credit Suisse took a fresh look at the performance of spin-offs. They analyzed spin-offs from 1995 to 2012. The study showed that spin-offs outperformed the S&P 500 by 13.4% in the first 12 months after the spin-off date.

Study #3

Deloitte and the Edge Consulting Group analyzed spin-offs that occurred between 2000 and 2014. They found that spin-offs generated a 22% return in their first 12 months of trading, outperforming the MSCI world index by 21%.

Study #4

In May 2018, we analyzed the returns of the Bloomberg U.S. Spin-off Index vs. the returns of the S&P 500. We found that the Bloomberg U.S. Spin-off Index generated a 511% return from December 2005 to May 2018, outpacing the S&P 500 by 314%.

“You can make a pile of money investing in spin-offs. The facts are overwhelming. Stocks of spin-off companies significantly and consistently outperform the market averages.”

– Joel Greenblatt, Founder of Gotham Capital, Generated 50% returns annually for a decade

While spin-offs as a category outperform, each individual spin-off will not outperform, sadly.

The Deloitte study referenced above (Study #3) found that bottom quartile spin-offs generated a year 1 return of -41%. Ouch. Investors who invest in spin-offs that they’ve only casually researched will get burned.

That’s where I come in.

For the past decade, I’ve invested in spin-offs, read every stock spin-off study available, and conducted proprietary analysis to identify the characteristics of successful spin-offs. I’ve learned what works and what doesn’t.

What to look for and what to avoid.

And that work has paid off. Stocks that I’ve officially recommended have performed well.

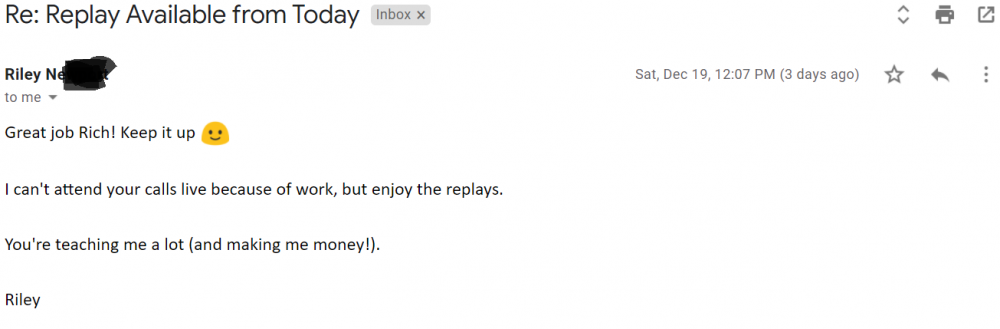

See below for performance of my closed recommendations.

Closed Recommendations

Our premium service is an ideal choice for investors who want to follow my best ideas.

Your subscription will include 1 new idea per month on average that has been carefully vetted and researched. Our focus will be to meticulously review the spin-off market to cherry pick the most profitable investments.

Just one successful recommendation has the potential to more than cover our service. Let’s assume you invest $20,000 in one of our recommendations, and it generates a 20% return. Your $4,000 profit would represent a nice return on your investment in our service.

Or we can look at it another way. The cost of hiring a full time special situations analyst is >$200,000. Instead of shelling out >$200,000, you can effectively hire me, a Chartered Financial Analyst with fifteen years of public equity and private equity experience working at large financial institutions, for $697. This is 99.7% cheaper than hiring a full- time analyst.

Special Situations

Periodically, we also publish “personal trade” special situations recommendations. These trades generally involve an “odd lot” opportunity which means they are only available to shareholders who own 99 or fewer shares not large institutions. They are attractive opportunities to earn a low risk $400 to $2,000 in as little time as two weeks.

Examples include, Eli Lilly’s split-off of its Elanco business (~$1,100 profit in 2.5 weeks) and Danaher’s split-off of Envista ($1,500+ profit in little over a month). And more recently, Xbiotech’s dutch tender offer (+$463 in profit in 17 days) and Westell Technologies‘ reverse split ($410 in 1.5 months).

So far, feedback has been excellent from my special situation recommendations…

Recent Interview with SNN Network

Frequently Asked Questions

Do you mainly focus on US spin-offs or will you follow international spin-offs as well?

Initially, our main focus will be on US spin-offs, but if we see any compelling international spin-offs, they will be included. We hope to build out our coverage of international spin-offs over time.

How do you track all spin-offs, especially international spin-offs?

We have access to a Bloomberg terminal which lists all (including international) spin-offs. In addition, we use google news alerts to monitor any news related to recently announced or imminent spin-offs.

How much time is spent researching a stock before it is recommended? How long are write-ups ?

We estimate that we spend ~40 hours researching and analyzing a stock before recommending it. The length of the write up will depend on the complexity of the investment. However, the length of our write-ups has historically varied from 6 to 18 pages.

Do you expect to focus primarily on small cap spin-offs?

Yes, we expect to focus mainly on small and micro cap spin-offs. However, if there is a compelling mid-cap or large cap, it will be included.

Will any non spin-offs be included in your recommendations?

While our primary focus will be stock spin-offs, we may include a non stock spin-off recommendation if we believe the stock represents a compelling risk/reward opportunity.

Once I subscribe, will I get access to previous newsletters?

Yes. The first newsletter was issued on July 6, 2018, and all historical newsletters are posted at the bottom of the Members page.

Are any discount codes available?

I offer a 20% discount if you subscribe for more than one year. Email me at Rich@stockspinoffinvesting.com if you would like access to this discount.

Why weren’t there any recommendations since 2016?

I didn’t recommend any new stock from 2016 until I launched my premium service because I was working full time at a large private bank 60+ hours per week and have a family and kids. So I didn’t have as much free time. Also, I still really liked all the stocks that I had recommended except for AFI (should have pulled the plug on that one earlier). I was doing a lot of work following those names and didn’t have time to add new recommendations given my other time commitments.

But starting in April 2018, I left my job and am 100% focused on this. It took me a while to get my first recommendation out as I was redesigning the site and setting up my business.

If I originally sign up for a monthly plan, can I change it to a yearly plan?

Yes just email me, and I will change your plan. If you request the change, the unused portion of your monthly payment will be credited towards the cost of the annual plan.