SSI: Ultra – Recommendation #5 – JXN Short Put

May 19, 2023

Ticker: JXN

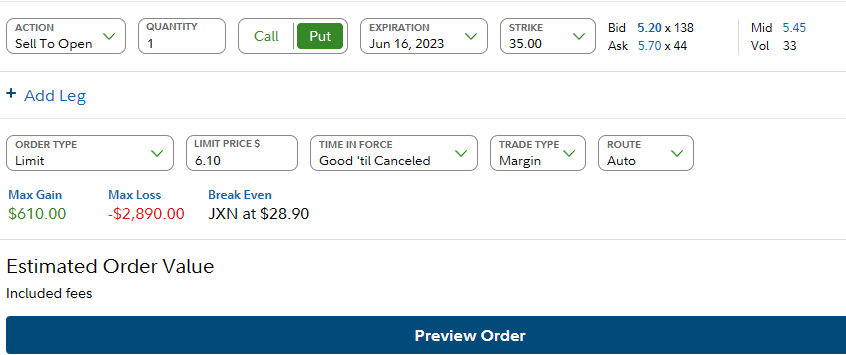

TRADE INSTRUCTIONS

Sell to Open JXN Jun 16 2023 $35 PUT (not the Call!)

Aim for a NET CREDIT of $6 to $7 per contract (you will receive between $600 and $700 in option premium as income into your account).

Notice that I have set the target credit level higher than where the option is currently trading. That’s because we are going to be patient on this trade; we think that the market should provide us with an even better entry point in the very near future, and part of our strategy will be squeezing as much premium option as we can via forward rolls.

Keep in mind that you need will to have around $3000 in cash or the equivalent in margin available on your account per contract that you sell prior to making this trade.

This is how the trade looks on Fidelity’s platform, but the order should appear similar regardless of which brokerage you are using.

INVESTMENT RECAP

JXN Current Price: $30.15

Market Cap: $2.5 Billion

Stock Price Target: Below $29

Upside: +85% (assuming we hit SSI’s target price of $54)

- JXN’s stock price has suffered this year from a combination of a) a weaker market for its main product, variable annuities, b) an overall negative financial impact from its portfolio hedging practices, which are a necessary risk-management tool and c) general market apathy towards all financial stocks, heightened by the (on-going) increasing interest rate cycle and the recent regional bank deposit crisis.

- The good news is that ALL of these current headwinds are temporary and, under normal conditions, will eventually turn around with a little patience. In the meantime, the business is sitting on a demographic gold mine, spitting out tons of cash, and returning healthy chunks of it to shareholders through a meaty dividend (8% yield) and regular stock buybacks.

- For a cyclical business, there’s no better time to buy than when it’s going through trough market conditions such as these. That’s reflected in JXN’s valuation metrics, which are at quite attractive levels: trading at 5x cash, 23% of sales and 31% of adjusted book value. That’s between 50-60% of the levels that nearest competitor Brighthouse Financial trades at, and about a third of what insurance giant AIG is selling for at the moment.

- That’s not to say that it can’t get cheaper in the short-/medium-term, so we want to pay ourselves a healthy dividend (via option premium) in the meantime, while taking every possible opportunity to roll these puts and get our eventual acquisition cost as low as possible.

- This bullish but balanced analysis of JXN was posted on Seeking Alpha a couple of days ago. While clearly biased, it does a nice job of explaining the factors driving the weak operating results we’ve seen so far this year, as well as summarizing the cyclical nature of its earnings pattern.

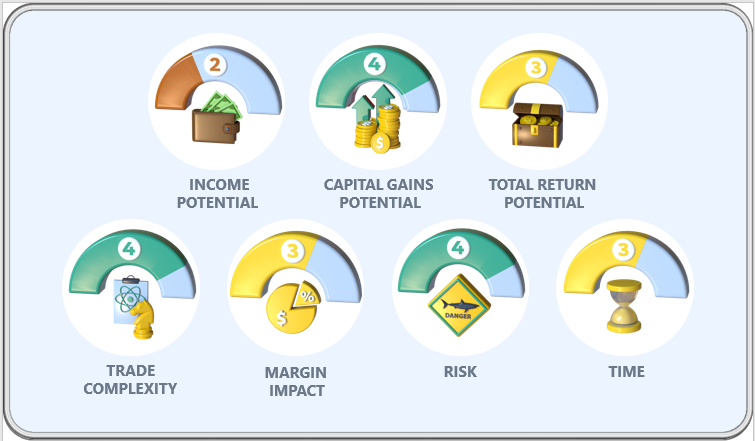

TRADE PROFILE

For a more in-depth discussion of each of these ratings, please visit the Trade Ratings Guide page here.

TRADE DETAILS

We are going back to the short put playbook that we previously used with TSVT and IAC, with the intention of ultimately purchasing the stock at an effective price in the mid-$20s. Building on the fundamental analysis that Rich and other analysts have done, we think that sub-$30 is a terrific valuation for JXN, knowing the strength of its future prospects and the cyclical nature of its earnings.

RISKS

Just as a reminder: The expectation with this strategy is that we will eventually allow the option to be exercised and the stock put to us. Taking a page from our playbook with IAC, until we allow the put to be exercised, we be actively looking for additional chances to roll these options, earning more premium income, and thus, opportunities to lower our final JXN acquisition cost.

Having effectively employed this strategy already, we want to take advantage of the recent sell-off in JXN to build out a position that will give us a high level of recurring income in the short-term, and the potential for higher capital gains down the road.

Risk to the Downside: The total amount at risk is going to be around ~$2900 per contract (counting the premium we receive from selling the put). That’s the MOST cash that we can lose in this trade, if the stock price declines to zero.

Risk to the Upside: None. Once again, if the stock price is above $35 at expiration in 4 weeks, we can choose to let the option expire and pocket the premium cash for a quick +17% return. Just to be clear, our intent is to own the stock, so we would most likely write another put at that point.

Anyways, good luck to everyone and let us know your thoughts via email or on the Discord channel!

Leave A Comment