Limited Time Offer Only Available Through April 17, 2024!

Interested in options trading but not sure where to start?

Have you checked out other option trading services and found them to be:

- Too complex – do they assume extensive prior options trading experience?

- Unclear investment thesis – are they just playing ticker symbol bingo?

- Too risky – do they assume you can risk and lose thousands of dollars?

- Too much trading – do they assume you can place trades all day, every day, and send you trades too frequently to be useful?

- One trick ponies – is it the same options strategy over and over again?

- Too expensive – do they charge outrageous fees that you can’t be certain will ever be worthwhile?

I’m Rich Howe, author and publisher of the Stock Spin-off Investing Newsletter, and I’ve put together a new service that addresses each of those major issues for investors – regardless of options trading experience levels!

Welcome to SSI: Ultra Options Advisory!

SSI: Ultra (our short name) addresses every drawback to the most common problems of existing options trading services, including:

- Clear explanations – we walk you through each trade with exact, concise instructions, so you are never unsure of our goals, objectives or the trades you need to make

- Defined investment rationale and goals – our trades overwhelmingly arise from the highest conviction ideas from my stock spin-off and special situation newsletter, so are backed by deep levels of fundamental and statistical research

- Strict risk controls – for every trade that we recommend, we clearly state the maximum upside, maximum downside and risk-reward ratios; we are always transparent about the risk-adjusted return potential

- Manageable trades – we guarantee a minimum of two (2) trade ideas per month, so you will have time to study the research, understand the trade, and act on your own timetable. Of course, we often exceed this minimum, but never to the point where you are bombarded with emails and alerts!

- Variety of strategies – we view SSI: Ultra as a tool for teaching investors to be confident options traders and this means using different strategies for different situations; our recommendations have run the gamut from covered calls to short puts to bear and bull spreads… to our most recent – a highly profitable Iron Condor!

- Great Value – SSI: Ultra’s regular subscription price is already among the most affordable that we have found, but for this re-opening we are offering a special, limited-time deal. Scroll down to see more…

But… we don’t just “talk the talk”…

Here’s an example of the trade profile of a recent SSI: Ultra Bear Call Spread strategy recommendation. EVERY options trade that we recommend, gets an individual trade profile like this one, so our subscribers know, at a glance, exactly what to expect and whether the trade is of interest to them:

Trust me: after you’ve seen this on your first SSI: Ultra option trade, you will wish EVERY option and stock recommendation you get came with a similar profile!

There’s just one catch – SSI: Ultra will close to new subscriptions on April 17 and this special offer ends…

As I said earlier, by way of introduction to those who don’t know my work, I’ve written and published the Stock Spin-off Investing newsletter for 6 years and have reached over 1,000 satisfied subscribers. But, doing the fundamental stock and deep-dive, 10-K research that powers my spin-off and special situations service is a full-time job, and an intrinsically different skill set from trading options. So, I knew I needed additional technical and trading expertise to provide the ideal options advisory service that I had in mind.

Let me introduce you to the rest of the team, Bruce Harper, CFA.

Here’s Bruce in his own words…

“I graduated with an undergraduate degree in Econometrics from Stanford University and earned my MBA in Finance from UCLA.

My experience with options goes back almost 30 years, even prior to beginning my career in the treasury department of a Forbes 100 company. I went on to senior positions in treasury, including managing the company’s investment portfolios, where I used options not only for hedging corporate currency and interest rate risk exposure, but also in the course of running top decile and quartile ranked institutional fixed income and balanced investment portfolios respectively.

Somewhere along the way, I found the time to earn my CFA designation (between having three young kids and a full time job, I have to give all the credit to my wife). I have been actively using options in my personal portfolio since graduate school, when our intro to options professor ran a version of the stock picking contest… except you were only allowed to use options and whomever finished with the most money, won. It was quite an eye-opening education: some of my classmates would have become millionaires, while others would have literally lost their tuition money, all in the space of a few weeks.

I’m most excited about being able to share just how useful and versatile options are; there’s an options strategy that will accomplish almost any goal. I’m confident that the ones we recommend are going to significantly enhance the potential for returns of our positions in the Stock Spinoff Investing portfolio!”

Bruce’s focus will be to:

- Recommend option overlays to enhance the risk/reward of my stock recommendations.

- Recommend mispriced options related to companies undergoing extraordinary change.

Some ideas will be focused on absolute return. Others will be focused on income. And some will be a combination of the two. Our goal is to provide a variety of option trading strategy recommendations – so we get the benefits of diversification and are not dependent on bull or bear markets to be profitable!

Every trade idea SSI: Ultra Advisory puts out will also explicitly quantify risk, in terms of maximum dollar loss potential, and the circumstances and probability, wherever possible, under which a worst-case situation might occur.

Can we guarantee that we will only have profitable trade ideas? Of course not, but we will do everything to make sure that you can evaluate every idea with a fully informed, risk-adjusted, cost-benefit framework.

That’s not all…

If you subscribe now, you will also get instant access to Bruce’s special report, My Greatest Option Trade Ever – the G.O.T.E.!

This report is available for $297, but you will get immediate access to this highly informative case study with your subscription to SSI:Ultra.

In it, he describes the exact strategy and security that resulted in trades that had over a +80% win rate, and produced approximately 342% annualized return on his capital-at-risk. More importantly, he lays out the key insights into successfully trading options that he made while executing this trade.

This is a must-read for every aspiring options trader!

Click here to sign up today. Remember, after April 17 we will stop accepting new subscriptions, and the free report and special pricing offers will no longer be available.

———————————————–

What exactly does a subscription to SSI: Ultra include?

(1) Instant Access to Bruce’s special report: My Greatest Option Trade Ever, that describes in detail how he found and capitalized on a market inefficiency that was hiding in plain sight!

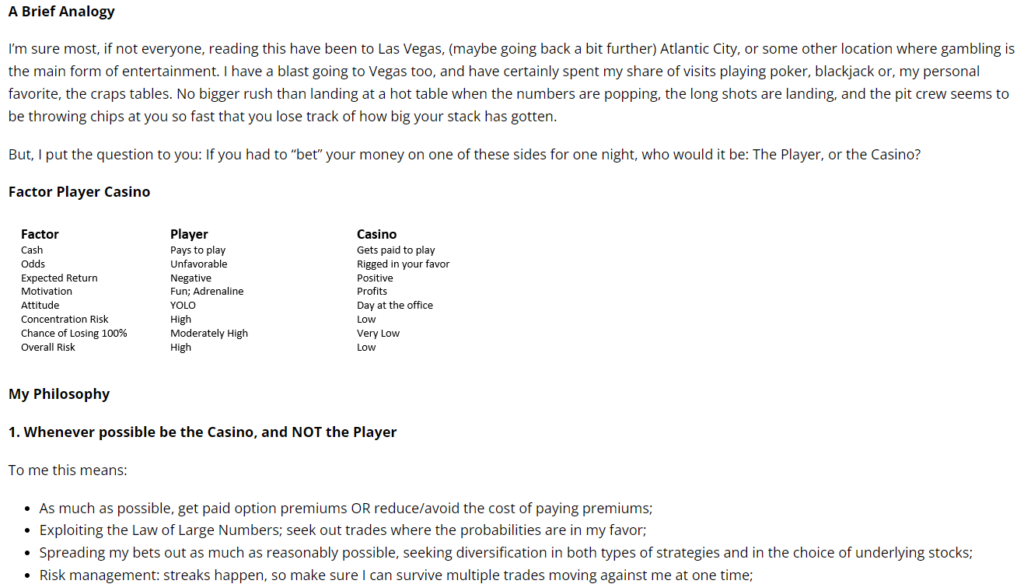

(2) Our SSI: Ultra Trading Philosophy and the “Secret” to Profitable Options Trading Guide, which lays out our trading methodology in a clear, informative and easy to understand style. Here’s a brief excerpt:

(3) At least 2 actionable options trades per month.

Sign up today to get our latest recommendation – an options trade idea with a 4X return potential!

Sign up here today to make sure you are among the first to get it.

(4) A highly readable, weekly market recap email. Click here to see an example.

(5) A live chat room to interact with Bruce/Rich and other subscribers.

(6) Educational reports to learn the intricacies of the options market.

What kind of options trades do we recommend?

Again, we are looking to use almost every option trade strategy at our disposal, so we don’t want to be pigeonholed, but here are three example of ones that we have done recently:

(1) Opportunistic Trades on Spin-off Stocks that I Know Very Well

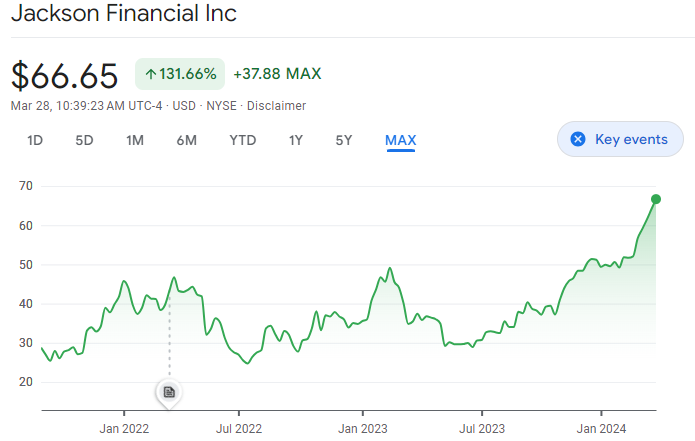

A good example is Jackson Financial (JXN).

Jackson is a name that I know very well and have been recommending since the time of the spin-off.

Jackson has performed very well. +100% (including dividends) and counting….

But there have been peaks and troughs.

One such trough occurred in May when JXN reported Q2 earnings.

Investors were concerned with volatility of Jackson capital ratios as well as weak annuity sales.

From my perspective, the sharp share decline was an overreaction. Jackson was well capitalized and weak annuity sales made sense given heightened market volatility.

At the time, Jackson management reiterated its guidance to return $500MM to shareholders through dividends and buybacks (20% of JXN’s market cap), implying strong confidence in the future outlook. Further, two JXN executives purchased stock in the open market following the share swoon.

But, wanting to get an even better price, Bruce and I recommended SELLING PUTS on JXN. The downside would have been a high double-digit yield on our capital at risk but the trade worked out even better… subscribers who followed our recommendation ended up buying JXN below $29, including the option premium that we earned.

The result: we are up +120% in JXN, not including the 10% yield in dividends we’ve collected on our cost basis in the stock.

(2) Special Situation Trades

The second bucket of option trades takes advantage of patterns in the market associated with “special situations.”

Here’s a good example…

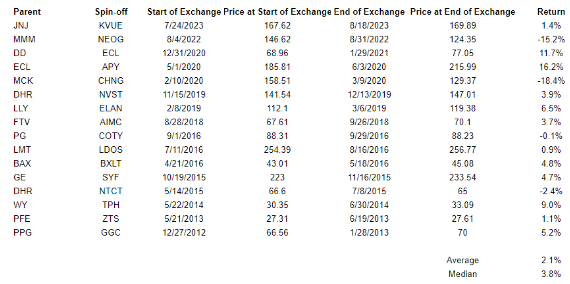

Every so often a parent will spin off a division via a split off.

The way the transaction works is as follows…

The parent offers shareholders the opportunity to exchange shares of the parent’s stock for shares of the spin-off company’s stock.

To incentivize the exchange, those that participate in the exchange usually get $108 of spin-off stock for every $100 of parent stock (the incentive varies from transaction to transaction).

I usually recommend buying the parent co and participating in the exchange, especially, because these transactions usually have “odd lot” provisions that eliminate proration for small shareholders.

But there is another way to play this trade with options…

Because these transactions often appear to offer a “free lunch” (i.e. trading $100 for $108), there is usually strong demand for the parent’s stock in the month leading up to the exchange offer. As a result, the parent’s stock usually rises.

If you look back at the last 16 such transactions, the parent’s stock price has risen by 2.1% on average. See full data below.

If you expect a stock to be flat to up over a defined period, a Bull Put Spread is an excellent, low-risk income strategy to employ. (If it sounds complicated, don’t worry – we walked our subscribers through the exact steps they needed to make the trades.)

And that’s exactly what we did when JNJ announced plans to split off KVUE in 2023.

The result: The trade performed as we anticipated, generating a profit of $90 per spread in just 22 days.

(3) Market / Index Trades

The third bucket of options trades takes advantage of market seasonality, reversion to the mean, and other index patterns.

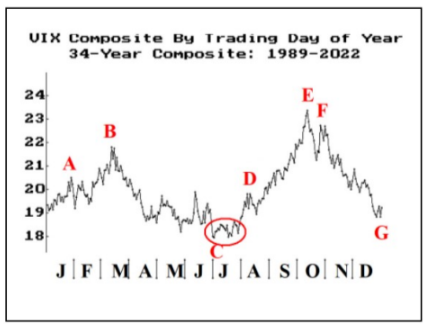

The best example of this is a VXX Bear Call Spread that we recommended in October.

An inverse of the Bull Put, the Bear Call Spread is a great strategy to use if you expect a security to decline in value.

In this case, we thought a VXX Bear Call Spread was timely for two reasons.

(1) The VXX is designed to track the VIX Composite. The VIX historically peaks in October and then steadily declines through year end. See the chart below.

(2) The VXX is a “downward biased” security. So betting on it to decline is usually profitable.

The result: the trade worked out to perfection, generating a profit of $348 per Spread contract in 34 days.

“Yeah but what’s it going to cost?”

As I mentioned, keeping the cost reasonable was a major priority for us.

In doing market research, we found that options advisories cost anywhere from $2,000 to $20,000 per year.

Bruce and I decided to launch at an extremely affordable rate of $1,997. We wanted it to be a “no-brainer” relative to the value that you will receive.

You can sign up for $1,997 here.

But to make the deal even more enticing, we are offering a shorter subscription period for you to test out advisory, risk-free.

Sign up today and lock in the best deal that I’ve ever offered.

An annual subscription to SSI: Ultra costs $1,997.

But today, you can get 5 months of access to SSI: Ultra for just $497.

This is the lowest price that we have ever offered for SSI: Ultra but it is only available for a very limited time!

But that’s not all: remember, if you subscribe to SSI: Ultra today, you will get immediate access to Bruce’s special report: My Greatest Option Trade Ever (a $297 value).

In 5 months, if you choose to renew for another 5 months, the going forward rate will be $697.

Sign up here for our special 5 month offer now, before it goes away forever.

Money Back Guarantee

Better yet, I offer a 30 days 100% guarantee.

If you decide, SSI: Ultra is not a fit, just email me at rich@stockspinoffinvesting.com and I will process your refund.

What about after 30 days?

If you are unhappy with your subscription after 30 days, I’m happy to offer a pro rata refund.

Sign up here today to try SSI: Ultra risk-free.

Frequently Asked Questions (FAQ)

Why do you close SSI: Ultra to new subscriptions?

Primarily for two reasons: First, we want to ensure that we can provide the level of service that our subscribers deserve. And second, we want to make sure that our recommendations do not result in order volumes that could potentially distort the pricing of options that we are trying to trade.

Is Ultra for Options Experts?

No. If you are an expert, high-frequency options trader, this service is most likely not for you.

But if you are a beginner/intermediate options trader and interested in learning different options strategies and how to apply them profitably, this is probably the best option advisory service for you to get started with. We will teach you a variety of option trading strategies, and show you how you can apply them to other stocks you own or might want to own in your portfolio.

How Soon Should I Expect A Recommendation?

Sign up today and get our latest trade recommendation – an exceptional spread trade with the potential to return 4X your capital at risk!

What Options Approval Level Does SSI: Ultra Require?

You should be approved for at least Level Two option trading and have at least $5,000 of cash or margin capacity in your brokerage account to participate. The majority of our trades will require far less but this insures you’ll be able to participate in bigger trades.