Lessons Learned Shorting Micro-Caps

In March, I wrote the article:

Ticker Confusion Leads to Opportunity Short ZOOM.

This is a follow- up article to share:

- How the trade worked out.

- Lessons learned.

In short (pun intended), the trade worked.

I was able to short 800 shares of ZOOM on March 17, 2020 at an average price of $9.84 for total proceeds of $7,871.

I bought back the stock (ticker had changed to ZTNO) on April 14, 2020 for $0.25 a share netting me a profit of $7,671.

Not bad for a month trade!

Here are some tips on how to find “obvious shorts” as well as some lessons learned.

Keep an eye out for anomalies like this. Every once in a while you will see a market anomaly that is creating an obvious short.

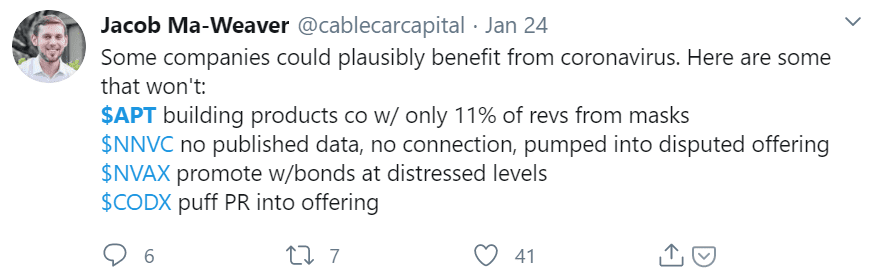

You can find them on Twitter.

In January 2020, I was alerted to an opportunity to short Alpha Pro Tech thanks to this tweet:

Thanks Jacob!

Twitter is great for identifying these “obvious shorts”. If you are not on twitter, I’ve found it very valuable.

I didn’t end up shorting APT until 1) I researched further and 2) it had moved significantly higher.

Here was my thesis at the time.

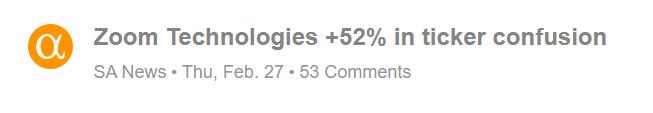

For ZOOM, I was alerted to the opportunity from Seeking Alpha.

Many times, these “obvious shorts” are hard to borrow, but be persistent. Try to short it over a number of days. If no shares are available, try back at a later time or in after hours trading.

Don’t be overly concerned with a high cost to borrow.

I paid ~50% interest throughout the period I was short ZOOM. For a company that is clearly worth zero, it was worth paying 50% daily interest or more to short it. Further, the way it is calculated, the interest cost is not as onerous as it sounds.

My daily interest fee was (1/360)*50% = 0.1%. My trade was outstanding for 28 days and so the total cost of interest that I paid was 28 * 0.1% = 2.8%.

Don’t make your position too large.

I’m always wary that, “The market can stay irrational longer than you can stay solvent.”

But the more experience I have shorting, the more respect I have for this quote.

I shorted ZOOM at a weighted average price of $9.84. At the time, I shorted it, the stock had gone up almost 10 fold due to ticker confusion and now had a $30MM market cap even though it had no operations and didn’t file financial statements.

Pretty good bet to go short, right?

Over the next couple of days, the stock continued to climb, and closed on March 20, 2020 at $20.90 and it peaked intra day at $60!!!

[A brief aside. A stock spike also happened when I shorted Alpha Pro Tech (discussed above). Check out the write up here. I (and subscribers) made ~50% on the trade, but it was a roller coaster, because the stock kept climbing after I had established my short. Another reminder to keep short positions relatively small.]

Alright, back to ZOOM.

Luckily, I didn’t check my account mid day when ZOOM was soaring. This would have been….stressful.

With the stock soaring, I went on offense.

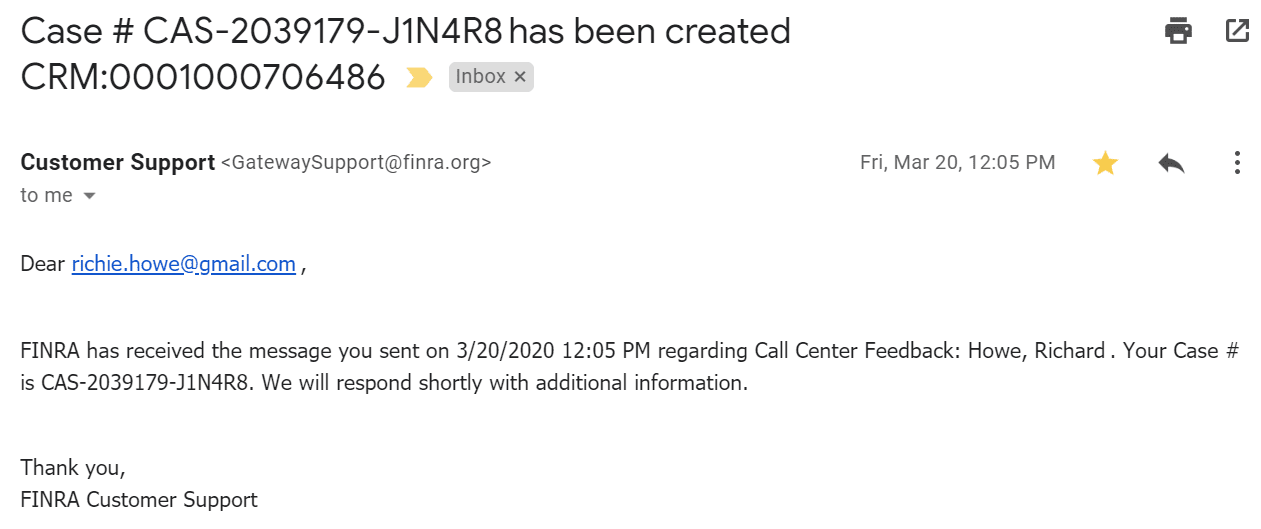

I contacted FINRA to let them know that people had been buying ZOOM mistakenly thinking it was the ZM.

I never heard back from FINRA, but here’s the confirmation email that I received to let me know that they had received my message.

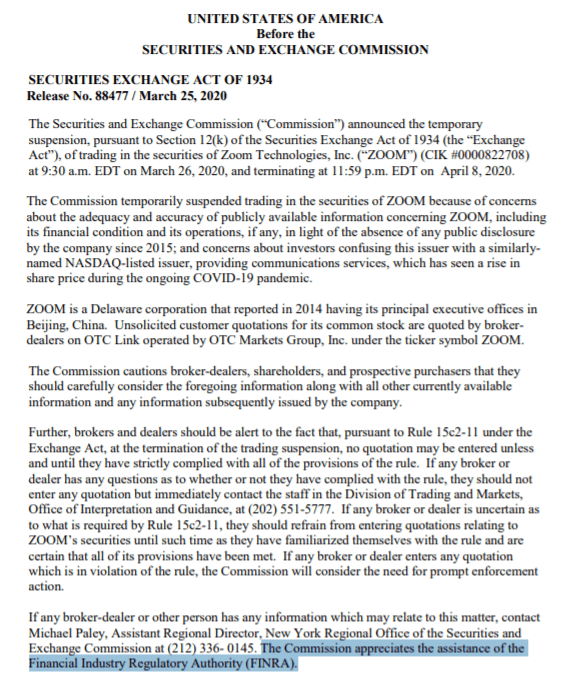

Five days later, the SEC announced that it was suspending trading of the stock from March 26, 2020 to April 8, 2020.

I won’t know for sure but perhaps my message to FINRA helped.

In its press release, the SEC gave FINRA a shout out as highlighted below.

In any case, I was excited but also worried.

I quickly googled “what happens when you are short a stock that gets halted”.

And found some concerning stories about not being able to close a position due to the trading halt but continuing to have to pay the high interest.

I called Schwab and they seemed confident trading would resume on April 9, 2020 when the halt would be lifted.

On April 9th, I placed an open “good until cancelled” sell order for all 800 ZTNO shares (the SEC changed the ticker from ZOOM to ZTNO) at a price of $0.50 but nothing happened.

Finally, on April 14, 2020, my order got filled at $0.25 and I netted a $7,671 profit in less than a month. I did have to pay ~$200 in interest costs so my real profit was ~$7,471.

Final Thoughts

I was recently talking with a subscriber about shorting, and he said, “You have to be able to withstand your position quintupling even if you know it’s going to zero”.

And I think he’s right.

For Zoom, the stock (for a brief moment) was trading 510% above my short basis (!!!!).

Despite the risk of extreme (and temporary) paper losses, I’m going to continue to take advantage of “obvious shorts”.

In fact, there is a bankrupt energy company that I’m looking into right now…

Leave A Comment