Spin-off Links – October 2023

There has been a TON of spin-off activity.

Let’s get right into it….

New Spin-off Announcements

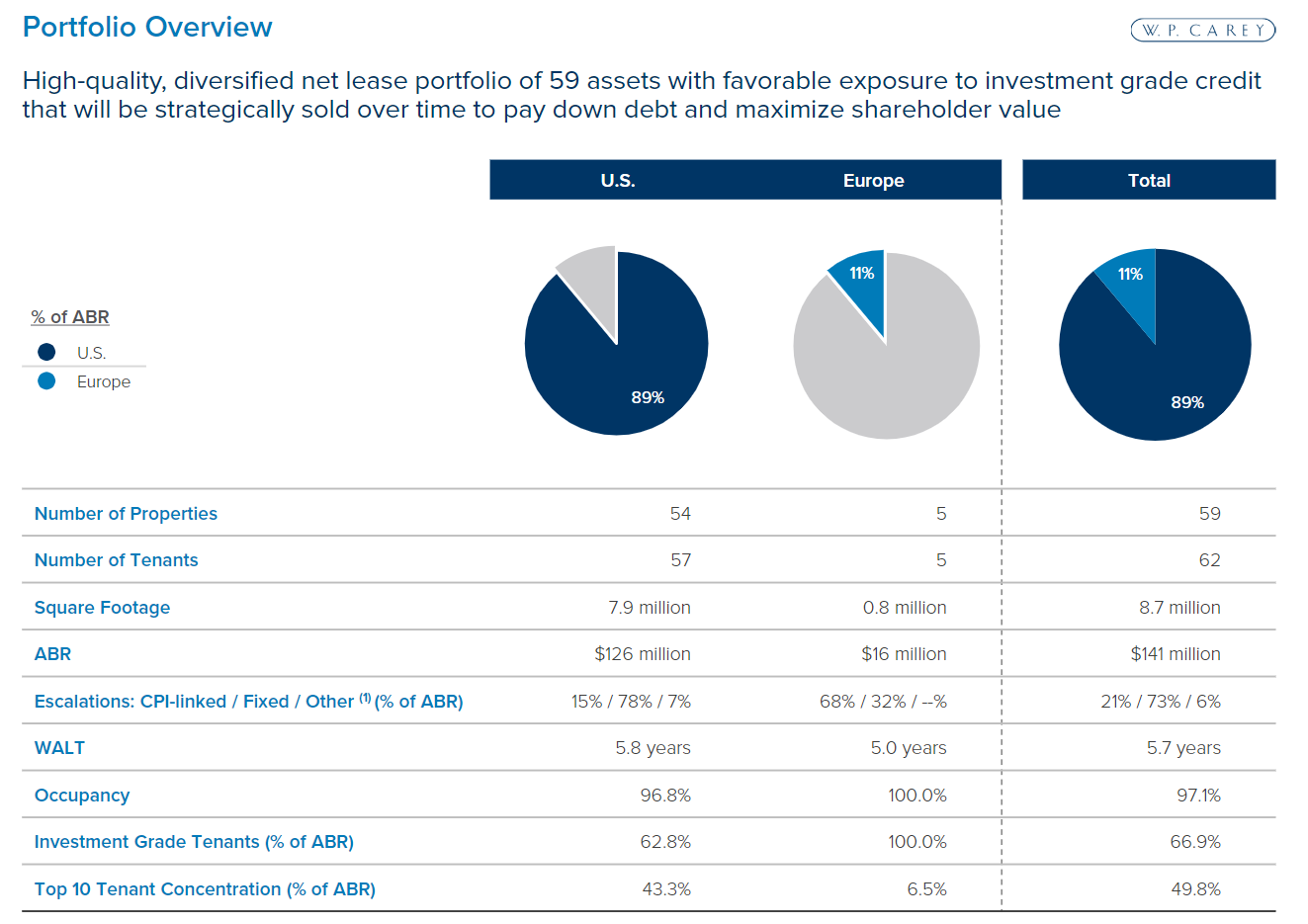

On September 21, 2023, W. P. Carey (WPC) announced that it will exit the office assets within its portfolio. It will sell 87 office properties and put another 59 into a new company which will be spun off.

The new company will be called Net Lease Office Properties (NLOP). Usually, spin-off transactions take 6-18 months to be completed, but WPC has clearly been working on this transaction for a while as the plan is for it to be completed by November 1. Further, the form 10 has already been filed.

NLOP is expected to comprise a portfolio of 59 high-quality office properties, totaling approximately 9.2 million leasable square feet primarily leased to corporate tenants on a single-tenant net lease basis. The vast majority of the office properties that will be owned by NLOP are located in the U.S., with the balance in Europe. NLOP’s portfolio will consist of 62 corporate tenants operating in a variety of industries, generating average base rent (ABR) of more than $141 million as of June 30, 2023.

The strategy of NLOP is going to be to sell its office buildings and distribute proceeds to shareholders. This looks like it could be a very interesting opportunity. It appears that WPC is selling at the bottom of the office cycle.

We should see some indiscriminate selling pressure once the spin-off takes place…

Recent Spin-offs

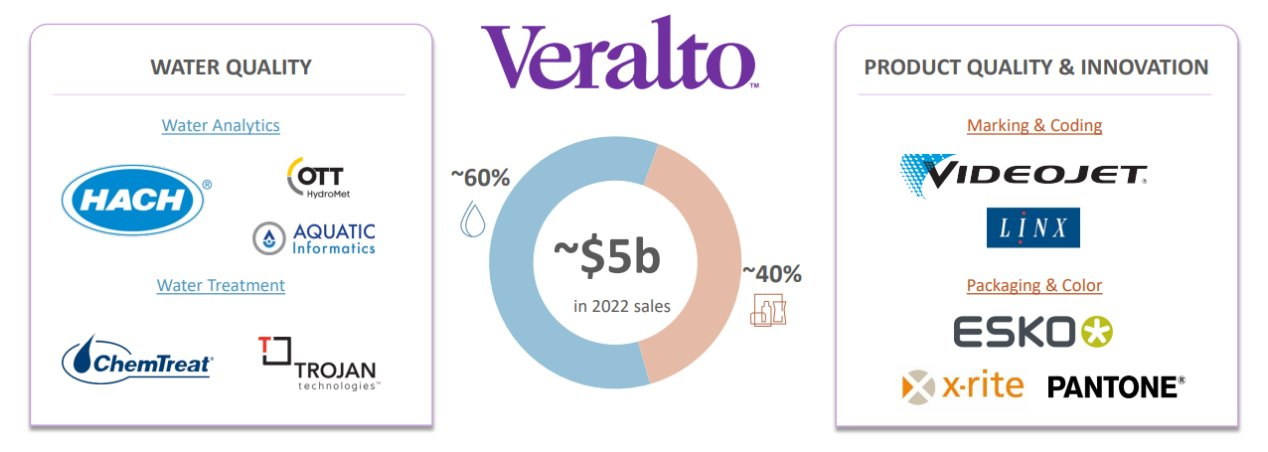

Danaher (DHR) spun off Veralto Corporation (VLTO) on September 30. Veralto is comprised of Danaher’s former Environmental & Applied Solutions segment (EAS).

Veralto is a leader in Water Quality (~60% of revenue) and Product Identification (~40% of revenue). It has a high-quality business with ~57% recurring revenue and ~26% EBITDA margins. Water quality businesses trade at mid to high teens EBITDA multiples while Production Identification businesses trade at mid to low teens EBITDA multiples.

Veralto is currently trading at ~$74. As such, it’s trading at 16x my 2024 EBITDA estimate. This seems like a reasonable valuation. If the stock sold off into the mid to low $50 range (12.5x EBITDA), I think it would be an attractive buy (I don’t expect indiscriminate selling pressure). My best guess is that Veralto will ultimately break up into a pure play water company and a pure play product quality & innovation company.

If VLTO traded in the low to teens on an EV/EBITDA basis, a break up would create significant shareholder value.

I recently published a deep dive with additional thoughts here.

Aramark (ARMK) spun off its uniform services business, Vestis (VSTS) on Sept 29.

Vestis generates revenue by selling Uniforms & Workwear, Towels & Aprons, Floor Care, and providing Linen Services. Operating metrics are back to pre-COVID levels.

It is a boring business but high quality given high customer retention and 92% recurring revenue.

Vestis management expects 5-7% organic growth over the next 5 years with EBITDA margins expanding 400-600bps. That margin expansion would be impressive.

Vestis has 2 public comps: Unifirst (UFF) which trades at 9.6x forward EBITDA and Cintas (CTAS) which trades at 20.8x forward EBITDA.

Vestis’ ROIC is higher than UNF but lower than CTAS.

At an 11x EBITDA multiple and 18x FCF multiple, VSTS would be worth $22.

On October 2, 2023, Kellogg (K) spun off WK Kellogg (KLG) in a tax-free transaction.

Shareholders received one share of KLG for every four shares of Kellanova/Kellogg.

The spin-off is a “value” play given its a leading player in the secularly challenged cereal market.

Management projects net sales of approximately $2.7 billion and adjusted-basis EBITDA of approximately $255-$265MM in 2024. It expects to improve its adjusted-basis EBITDA margins by 500 basis points by the end of 2026, through supply chain modernization and a stable top-line trajectory.

Management projects net sales of approximately $2.7 billion and adjusted-basis EBITDA of approximately $255-$265MM in 2024. It expects to improve its adjusted-basis EBITDA margins by 500 basis points by the end of 2026, through supply chain modernization and a stable top-line trajectory.

KLG is trading at $10. At that price, it’s trading at an EV/ FY ’24 EBITDA multiple of 5.3x. Its best peer is POST Holding (POST) which trades at 9.2x. However, POST is projected to grow while KLG is expecting a flat top line.

The big opportunity for KLG is margin improvement. It expects to generate 9.6% EBITDA margins in FY 2024 but management believes margins can increase to the mid-teens by FY 2026. This could be meaningful, but to get to that margin improvement KLG is going to have to invest $500MM.

Also that margin expansion will have to come with a flat top line.

KLG hasn’t generated positive free cash flow in the past 2 years and will have to pay interest on $500MM of debt.

KLG could be interesting depending on how cheap it gets, but I’m not in a rush to buy…

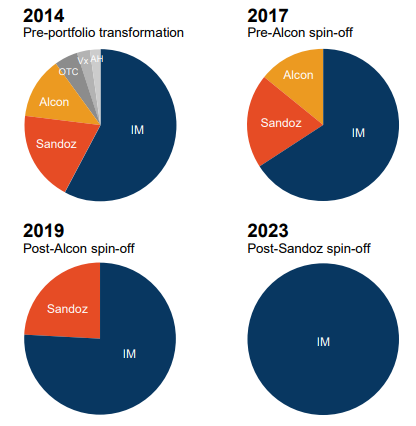

On October 4, Novartis (NVS) spun off Sandoz (SDZ), its generics and biosimilars business.

NVS includes all the boilerplate rationales for a spin-off (enhanced strategy, more efficient capital allocation, etc.), but this is the final step in Novartis moving from a conglomerate health care company to a pure play innovated health drug company (it previously exited the consumer health business and Alcon, its eye care business).

Sandoz generated $1.9BN of EBITDA and $9.1BN of revenue last year. The company develops and sells generic drugs and biosimilars.

Biosimilars are a key area of focus as the category is expected to grow at a 20% CAGR over the next 10 years. A biosimilar is a little like a generic version of a biologic drug, but there are differences. For example, unlike a generic drug, a biosimilar is not an exact copy of its brand name drug. But it works very similarly.

Management expects mid-single digit sales growth through 2023. It expects EBITDA margins to increas from ~18.5% to ~25%. Sandoz has ~$3BN of net debt (Net debt/EBITDA multiple of 1.7x) which seems reasonable. What is the stock worth? The best comp on the low end is VTRS, the former Mylan business which merged with Pfizer’s generics business. It trades at 5.7x forward EBITDA. At that valuation, SDZ would be worth $16 per share. But that probably isn’t the best comp. VTRS sold off its biosimilar business, has more debt, and lower expected growth. Another group of potential comps would be large cap pharma/biotech (PFE, AMGN, ROG, BMY) who all have modest revenue growth outlooks going forward. They trade at 8.6x forward EBITDA. At that multiple, Sandoz is worth $31. SDZ is currently trading at $27 which implies a EV/forward EBITDA multiple of 7.7x and a price to free cash flow multiple of 13.4x. Seems reasonable.

Upcoming Spin-offs

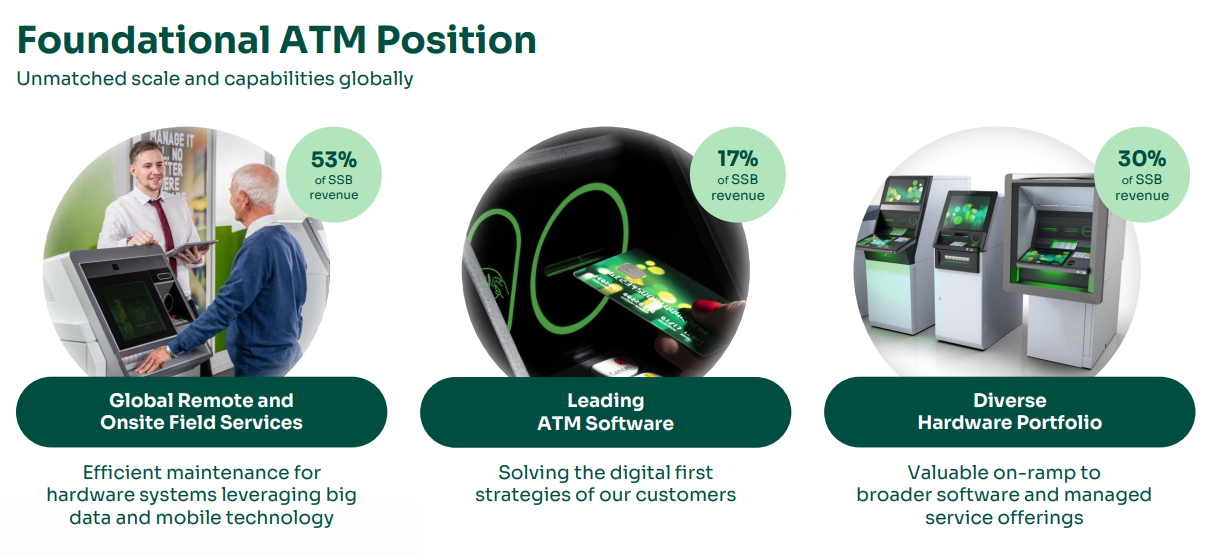

NCR Corporation (NCR) announced this week that it is moving forward with a spin-off its ATM business segment, Atleos, which was originally announced in September 2022. The spin-off is expected to occur on October 16, 2023.

The ATM spin Atleos, which will trade under the ticker NATL. It consists of Self-Service Banking, Payments & Network and Telecommunications and Technology businesses. It generated revenue of $4.1BN in 2022. The ATM company has a large installed base in the bank and retailer space. It will continue to capitalize on strong recurring revenues while shifting more of the business into new transaction types as well as digital currency solutions. This segment will be a more stable, cash generative business.

RemainCo will be renamed NCR Voyix (VYX). It will focus on the Retail, Hospitality, and Digital Banking segments. It generated revenue of $3.7Bn in 2023. This business sells point of sales hardware for retailers and restaurants with software and services alongside. These systems range from small business card readers to large self-checkout stations at the grocery store.

Neither business looks particularly attractive. The spin-off will face negative secular headwinds (people using cash less often) and will be burdened with 3x turns of leverage. The RemainCo is struggling versus TOST and FOUR.

Spin-off Links

- Happy to see Low Tide Investments back!

Good Write-up on WPC’s Upcoming Office Spin-off

– Good overview.

– I think the spin-off will be interesting as it will be a liquidation.

– Compelling pitch by Alta Fox

– “Cheapest Consumer Staple Company in the World”

Clark Street Value: Another Broken Biotech

– Interesting situation.

– Good write-up on an under the radar spin-off

Seth Klarman on Capital Allocators Podcast

– Finally got a chance to listen to this.

– Really great episode. Loved hearing about Seth’s entrepreneurial background and several special sit case studies.

4nukw5