AIG Spin-off (Life and Retirement Business) Notes

September 11, 2022 Update

Overview of upcoming IPO: AIG spinoff Corebridge valuation: Life and asset management business IPO timing and details

August 19, 2022 Update

- AIG will wait for a more favorable IPO window

April 6, 2022 Update

Good write up on SpinCo, Corebridge

- SpinCo has over $411b in client assets

- BlackRock will also be managing $150b of AIG’s assets

Good Morningstar Report on how the spin will help to turnaround AIG

- It seems that it is difficult to make good returns from Life Insurance meaning dumping the underperforming behemoth could lighten the load on the rest of AIG

- However, AIG has been able to capitalize on Life Insurance better than most (it is still an underperforming branch)

- Inversely AIG has been seemingly under capitalizing on P&C (Property and Casualty) Insurance assets compared to competitors

- P&C is usually an opportunity for higher returns in the industry

October 28, 2020 Update

- On October 26, 2020, American International Group (AIG) announced that the board approved a plan to separate the life and retirement business.

- Good Reuters article with background information.

- Morningstar Report.

- Credit Suisse Report.

- It also named President Peter Zaffino as CEO starting next year.

- The separation “will take a couple of years” and may be done through phases such as sales of minority stakes.

- Life Insurance and Retirement Business

- Accounts for 34% of AIG’s $49 billion in 2019 revenue.

- Large investment portfolio makes it highly sensitive to interest rates and current low rates have been a drag on earnings.

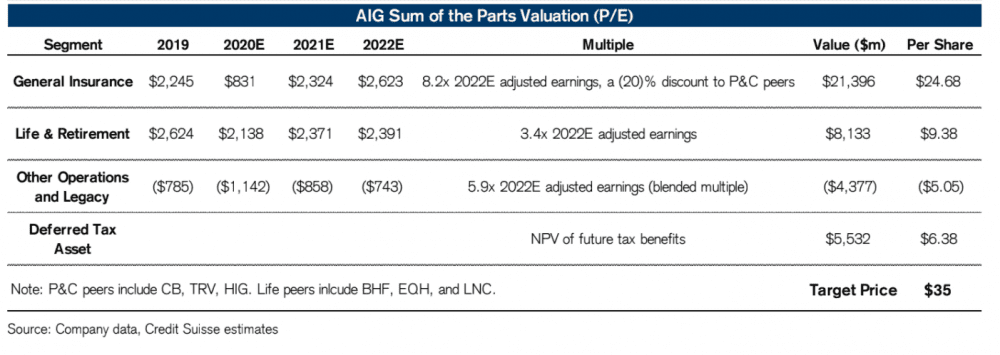

- Credit Suisse values the life insurance and retirement business at 3.4x 2022 earnings, inline with peers BHF, EQH, and LNC. Seems rather cheap!!

- General Insurance Business

-

- Represents 64% of revenue.

- Business is prone to swings from hurricanes, wildfires, and other catastrophic events.

- Credit Suisse values the general insurance business at 5.9x 2022 earnings, a 20% discount to P&C peers CB, TRV, and HIG.

-

- Credit Suisse SOTP values AIG at $35.

- Background

- AIG has struggled to right itself after a $182 billion U.S. taxpayer bailout in 2008 to save it from collapse.

- It has also had to work through losses from claims in prior years that led to more than $11.2 billion in unexpected reserve increases since 2015.

- In May 2019, AIG reported its first general insurance underwriting profit since the 2008 financial crisis.

- In 2015, Carl Icahn established a significant stake in the company and agitated for the company to be broken up. Hedge fund manager John Paulson also supported the break up. Icahn sold his stake in 2018.

Leave A Comment