Aimco Spin-off Notes

June 3, 2021 Update

- Excellent update that outlines the bull case for AIV:

December 17, 2020 Update

- Aimco (AIV) completed its spin-off of Apartment Income REIT (AIRC) on December 15, 2020.

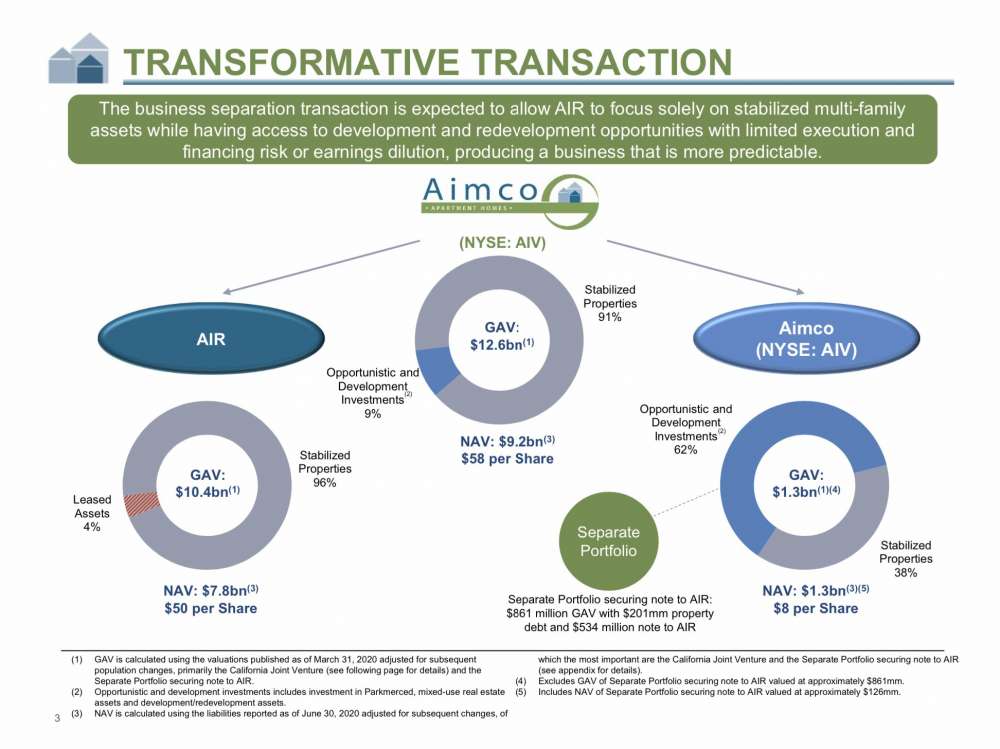

- Here is the estimated NAV for both entities.

- Currently, the spin-off (AIRC) trades at $40, a 20% discount to NAV.

- The parent company (AIV) trades at $4.50, a 44% discount to NAV, and looks more interesting.

- The other interesting aspect about the parent company is its getting kicked out of the S&P 500 index effective Monday, December 21, 2020, and is not getting put into the S&P 400 Midcap or S&P 600 Small Cap index. Thus, there should be heavy indiscriminate selling pressure tomorrow (December 18, 2020) which will be the last day for index funds to sell.

- I’ve spent a lot of time analyzing stocks getting kicked out of the S&P indexes and have found that on average stocks decline by ~8% on average on the day before the effective day of exclusion. In other words, you can short them in the morning and close in the afternoon and make ~8%.

- In the case of AIV, I think it may be a nice opportunity to take advantage of indiscriminate selling to buy the stock towards the end of trading tomorrow (December 18, 2020).

- AIV is a hodgepodge of real estate assets that will be sold to und new developments. I’m digging into it further.

- Some questions:

- What exactly is the strategy?

- Is NAV a good estimate of what the company will be able to generate by selling its assets to fund future developments?

- Will there be any tax liability?

- How long will it take to sell their assets?

- Where does the company expect to invest the proceeds?

- Any plans for a dividend or share repurchase given the current discount?

- NAV of Aimco is $8. What is that made up of? How much is real estate vs. Cash?

November 25, 2020 Update

- Aimco (AIV) has a net asset value of $58. It currently trades at ~$32 and the board of the company believes the spin-off will help close the gap.

- Land & Buildings, an activist hedge fund, is against the transaction as they believe:

- It won’t close the gap to NAV

- It will obscure management’s decade long poor track record

- Land & Buildings is attempted to call a special meeting to allow shareholders to express their thoughts on the potential spin-off, but the company appears to have rebuffed those efforts.

- Here’s the presentation that the activist investor published.

- They seem to have some interesting points:

- Spin-off will be taxable and could create up to $8 in tax liabilities (not sure how accurate this is). Chairman and CEO will incur no tax on units and will initially serve as CEO of both companies, potentially doubling up on compensation.

- All options should be considered to increase shareholder value including a sale of the company.

- Some thoughts:

- The spin-off will be taxable so there will be no restriction on a sale. It might get purchased after the spin-off is complete.

- Notes from Transaction Conference Call

- Benefit of spin-off:

- Simplicity

- Low Leverage

- Higher Income

- Refreshed tax

- Higher dividend

- Wholly independent

- Aimco:

- Opportunity focus on an emerging set of opportunities in development and redevelopment

- Have identified a pipeline of opportunities for accretive investment and look forward to growing that.

- Provides investment flexibility to look at a range of choices and transactions that will now be off the table for Apartment Income REIT because they might be in the shorter term more dilutive or more complicated or better measured by net asset value creation than FFO.

- Or because they may involve more non recourse leverage than would be acceptable to apartment income REIT.

- Will be independent.

- Goal in splitting the company in two is 1) to create an ideal way to participate in multi family and 2) to create increased opportunity for growth for both entities.

- Q&A

- Was this transaction driven by opportunities that you had to pass up in the past? How much was due to criticism of previous deals (Park Merced inside the REIT)?

- Transaction has been a long time coming.

- It’s really about what is the ideal way to own apartments today.

- Came to the realization that the assets are best owned in a very simple transparent vehicle that is really easy to understand.

- Think the REIT structure achieves this.

- Will be a bell weather way to invest in apartments.

- Aimco won’t be in S&P 500 so probably will experience selling pressure?

- For Aimco, it will be back to the future.

- Will be well capitalized.

- Will have a vehicle with lots of appetite for interesting transactions.

- It will likely be a REIT for two years because of tax reasons. It will be a future decision whether or not it stays a REIT.

- How will relationship be between two companies going forward regarding development and redevelopment opportunities?

- Two are completely independent.

- Can work together but are under no obligation.

- Haven’t seen as many spin-offs in REITs because they are no longer tax free. Talk about the taxable consequences?

- Think it doesn’t matter because most of investors are tax advantaged.

- For AIR, there is a great advantage to having a stepped up basis.

- Can do transactions without having to weigh income tax consequences, without having to make stock dividends of taxable income related to those transactions.

- For taxable shareholders, it’s no fun to pay taxes. But the benefits are such that it repays the cost on a present value basis (not sure what this means!?).

- Basically taking out all the complicated stuff out of the REIT and improving the balance sheet, but the problem with this is at least optics of conflict going forward. What is timeline for new CEO at Aimco?

- To the extent that there are conflicts, there are also opportunities. It’s just embedded in the Aimco DNA to be collaborative with all of partners including Apartment Income REIT or others in the industry.

- Currently working on five projects together. See how that project goes.

- Not in a hurry to hire new CEO. Want to make a thoughtful decision. Want to make sure the person fits into the collaborative culture.

- Transaction costs and separation costs of doing transaction? Company today has $45MM of G&A. What will be pro forma G&A? Also, balance sheet. What is interest rate going to look like? How much debt are you refinancing?

- That’s a lot of questions probably better handled once we have a filing on those issues.

- Don’t want to over estimate or under estimate costs.

- How did you decide which properties would be spun off and which would stay with Aimco?

- Followed the same rule.

- Let apartment Income REIT the pick, first choice of what would be the right asset to be in the REIT. Stabilized yield generating projects.

- Was this transaction driven by opportunities that you had to pass up in the past? How much was due to criticism of previous deals (Park Merced inside the REIT)?

- Benefit of spin-off:

October 1, 2020 Update

- Aimco (AIV) announced on September 14, 2020 that it intends to break up into two companies: Apartment Income REIT (AIR) and Aimco.

- AIR, a newly formed, self-managed real estate investment trust will provide a simple and transparent way to invest in the multi-family sector: ownership with public market liquidity of a diversified portfolio of apartment communities, with low financial leverage, limited execution risk, best-in-class operations, and sector low management costs.

- Aimco will retain its growing business of developing and redeveloping apartment communities while also pursuing other accretive transactions.

- Here’s a good CNBC article on activist Real Estate Investor, Land & Buildings, who is against the breakup.

Mr Kraft My name is Gerald J Howard. I am the accountant for Charles H Revson. He is stockholder in Aimco.

I need to know what the specific tax consequences are to the step up in basis is for his stock in 2020

Gerald J Howard 631-422-0705 geraldhwrd26@gmail.com

Hi Gerald, I’m sorry that’s not my expertise. i would reach out to the company’s investor relations department.