Alliance Data Systems (ADS)

May 20, 2021

Brian Vereb, IR

Summary

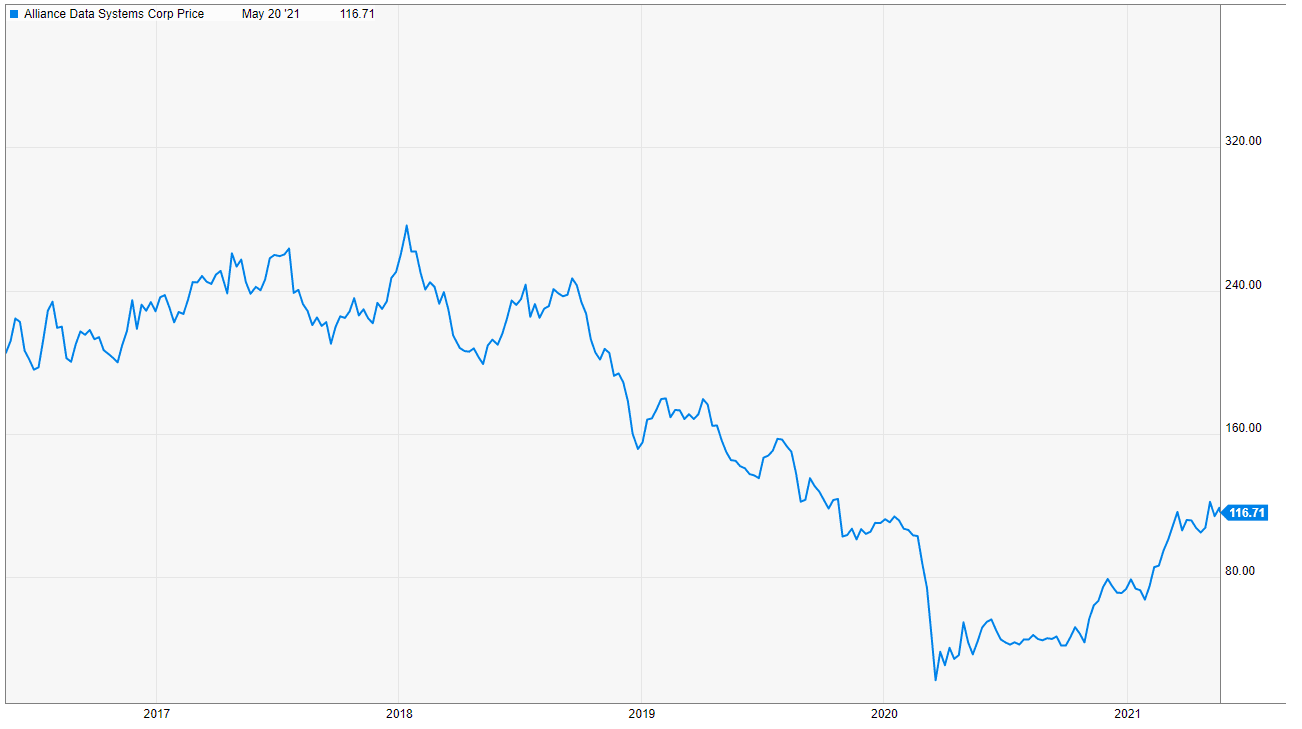

On May 12, 2021, Alliance Data Systems (ADS) announced that it would be spinning off its LoyaltyOne segment by the end of the year in a tax free transaction. I had a call with Brian Vereb of investor relations to run through the basics. I have a lot more work to do, but I’m positively predisposed to the stock. On a consolidated basis, ADS trades at 7.8x forward earnings. Pre-pandemic it traded at 12.3x forward earnings. About a year ago, ADS bought in a new management team. The old management team had over-promised and under-delivered on its growth strategy. I think the spin off of the loyalty program is positive as it will increase focus for the company. Further, I believe the Loyalty spin-off will trade on a EV/EBITDA and P/FCF basis while the RemainCo will trade on a P/E basis. This should unlock value.

Notes From Conversation

Rationale for the spin-off?

New CEO (came from Citi) started a year ago. He wanted to focus on the card services business. He wanted that to be the focus and to divest everything that was none core. So this is consistent with his strategy.

For a long time, resources have been pushed towards card services and LoyaltyOne has been ignored.

Spinning off the loyalty business will be accompanied with a dividend back to the remainco which will enable it to de-lever so that its leverage is more inline with peers.

That will eventually enable ADS to return to share buybacks/dividends.

Is your main business providing white label credit cards for retailers like J.Crew?

It used to be, but now it’s broader than that. Provide credit cards, direct installment, and other digital solutions. Acquired Bread, a buy now, pay later company and that is also helping growth.

Why has stock performance over the past 5 years been so weak versus peers?

Prior management team was focused on growth at all costs and ultimately under-performed expectations.

Synergies from previous deals never materialized.

Credit quality has always been good. Losses are higher than other credit card companies, but that’s by design based on demographics.

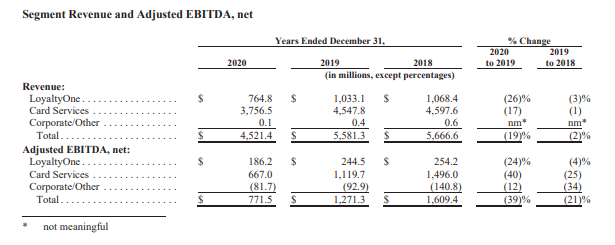

How has LoyaltyOne business (spin-off) performed?

The business takes no credit risk. It generates revenue/EBITDA/earnings when customers use their loyalty points. It’s mainly based on travel so it took a big hit in 2020, but the company is expecting a strong rebound in the second half of 2021.

The company recognizes revenue when customers book travel, not when they actually travel. So it’s likely that travel booking using points ramps up by the second half of 2021.

What is long term growth rate for LoyaltyOne business (spin-off)?

2021 will be a strong snap back year due to people booking travel, but in 2022 and beyond it will be more modest (GDP type growth).

LoyaltyOne will also try to expand its Loyalty programs to accelerate growth.

Once spin-off is complete, who will be best comps for the remainco?

Historically, analysts have comped ADS to Synchrony Financial (SYF). But you could argue that ADS deserves to trade at a slight premium given its Bread (Buy Now, Pay Later) acquisition and other digital offerings which are accelerating growth.

Are there any good comps for the spin-off?

Not really. [I think the best way to value this is on an absolute basis. I think a 10x EBITDA multiples seems fair]

How many dissynergies will this cause?

LoyaltyOne has been run independently for many years. For better or worse, it was never really integrated. Thus, there won’t be many dissynergies. There will be public company costs though (public listing, management team, D&O insurance, etc.).

Leave A Comment