American Outdoor Brands Spin-off Quick Summary – December 12, 2019

Resources from American Outdoor Brands

Spin-off Slide Deck Presentation – November 14, 2019

Spin-off Press Release – November 13, 2019

Spin-off Webcast Replay – November 14, 2019

Investor Relations Contact Information

- Elizabeth Sharp, VP of Investor Relations

- Phone: (413) 747-6284

- Email: lsharp@aob.com

Other Resources

Smith & Wesson Parent Plans Split – Wall Street Journal, November 13, 2019

Political Climate Forces American Outdoor Brands To Split – SGB Media, November 14, 2019

NYTimes: How America’s Oldest Gun Marker Went Bankrupt – May 1, 2019

Overview

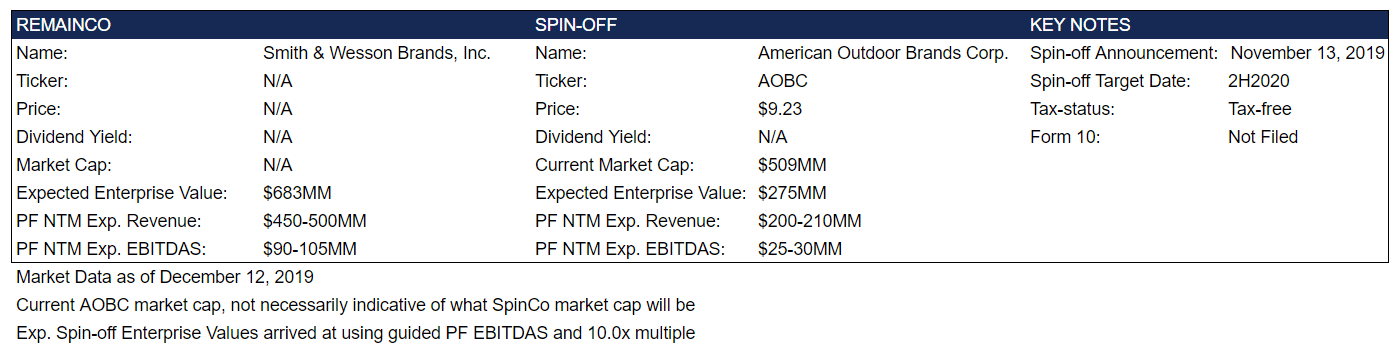

On November 13, 2019, American Outdoor Brands announced its intention to separate its two business segments into two independent publicly traded companies. In this tax-free transaction, current AOBC shareholders will own 100% of the shares of both new companies. The RemainCo will be AOBC’s Smith & Wesson business, while the SpinCo will be the outdoors brands. Management expects further details to be solidified, including the Form 10 filings, capitalization of the business, and roadshows, in the first half of 2020, with the transaction expected to close at some point in the second half of 2020.

Why the Spin-off?

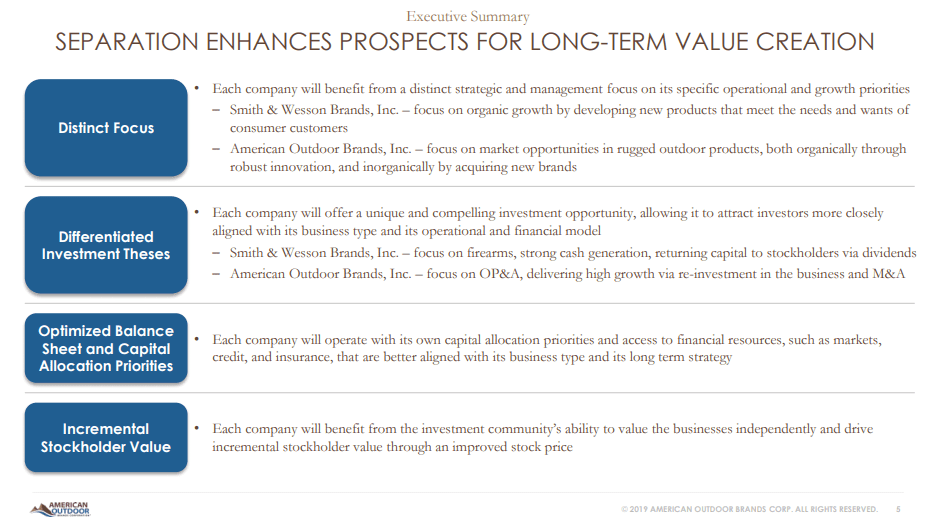

In their press release and accompanying slide deck, management outlined four reasons for the spin-off transaction. First, each company will be a pure-play in their industry, focused on their core competencies. The second point, intertwined with the first point, is that each business will offer a differentiated investment thesis to focused investors that want more targeted exposure to the two lines of business. Third, management believes that a separation of the businesses will allow each business to better optimize its capital structure and allocation priorities, focusing investor capital and FCF on areas that each individual business unit needs versus spreading capital across the two divisions. Finally, by executing this transaction, each unit of the business can be valued independently, suggesting that the market is discounting the value of one or both of the businesses because they coexist under the same corporate umbrella.

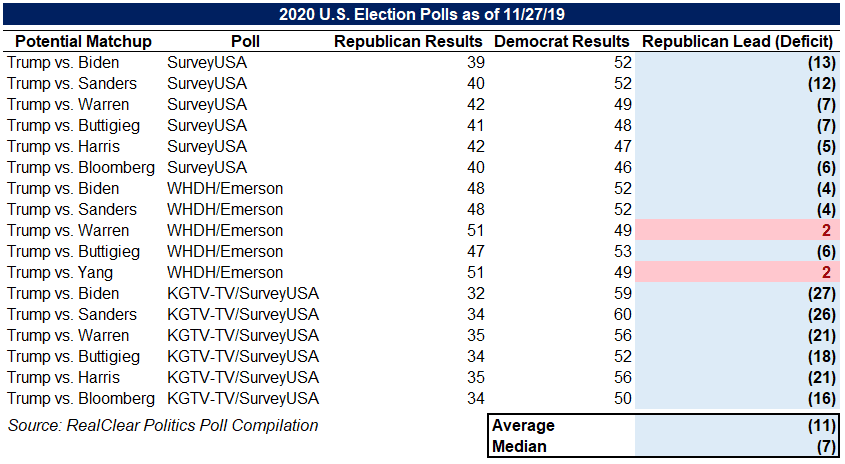

Cutting through the corporate platitudes, there seems to be a solid strategic rationale for the deal. On the Smith & Wesson side, there really aren’t any pure-play gun companies that are publicly traded, save for Sturm, Ruger & Co. Additionally, outdoor brand companies are a relatively fragmented space with most of the companies operating in a relatively diversified sense, selling other products besides just outdoors apparel, making the SpinCo an interesting play as well. Looking through the ESG and political lens of the situation, the separation could also open considerably more fund flows into AOBC. Many investors with an ESG focus have chosen in recent years to divest AOBC shares from their portfolios due to their affiliation with the weapons brand Smith & Wesson, so investors could reasonably expect to see investors that left the name for ESG reasons become buyers yet again. Additionally, with the 2020 election coming up and gun control measures a central point of debate, Smith & Wesson could see a surge of sales due to potential political fears. Historically surrounding elections, gun sales spike if a Democrat, especially a more progressive one, looks like they will be in a position to win the election, as customers may believe that they will not be able to or will face more difficulties purchasing a firearm after the election.

Spin-off Overview

Company

For the first publicly traded company that will emerge on its own after this transaction, Smith & Wesson will be analyzed. Smith & Wesson is a stalwart name in the firearm industry, delivering firearms and firearm-related products to consumers for over 160 years. The bulk of their revenue is derived from selling long guns and handguns, with additional ancillary revenues coming from their Gemtech Suppressor brand and their Precision Components manufacturing arm. The company does not sell these products directly to consumers, but rather to retailers who eventually sell the products to end users.

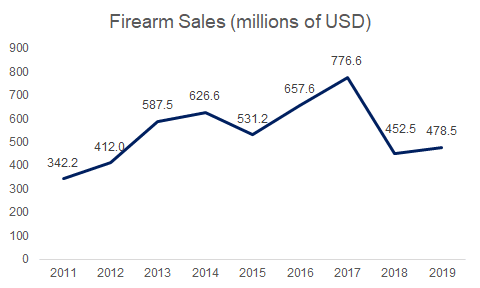

Demand drivers for this business have been relatively choppy, with waves of customers coming in to purchase firearms during tense political times, so forecasting is relatively difficult in this industry. However, management has stated that Smith & Wesson is expected to generate solid cash flows, with a focus on organic growth and a plan to return capital to shareholders via dividend payments.

From a margin perspective, this company is a decent business, with PF Expected EBITDA margins of ~20%. Pricing power is pretty solid in the industry, especially with the name brand reputation that Smith & Wesson carries. A luxury product like a Smith & Wesson firearm commands a higher price, and it is rather difficult for upstart companies to move into the space considering the business’s capital intensity, R&D demands, and massive regulatory barriers. It is incredibly difficult to get certified to manufacture firearms in the United States, especially so in modern, politically tense times.

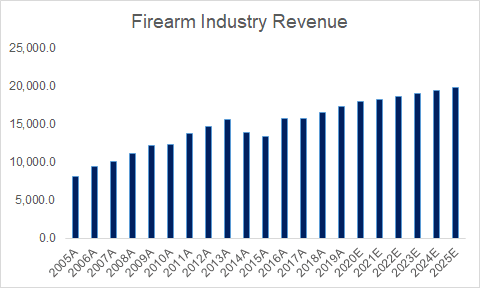

The business itself isn’t necessarily sensitive to typical business cycles, but rather pretty closely levered to political cycles. As mentioned earlier, if Democrats appear likely to win and implement stricter gun control laws in America, consumers rush to buy guns before more regulations come into place. If a Republican is then elected afterwards, much like the result of the 2016 election, this mass of sales slows considerably, especially when compared to prior periods of frenzied sales. As seen in the graph below, according to FactSet data, sales appear to ramp into both 2012 and 2016, with the difference being a Democrat won the presidency in 2012, leading to continued sales growth, and a Republican won in 2016, leading to a slowdown in sales.

Industry

The firearm industry as a whole has experienced a considerable degree of volatility over the past few years, driven by political pressures to increase gun control, a move that would severely impact Smith & Wesson’s business. However, with projections suggesting that it is unlikely that Democrats take the White House and Congress in 2020 and an extremely low likelihood of any significant gun control measures being passed, analysts are projecting less consumer panic buying and a normalization of growth rates.

Source: IBISWorld

Competition

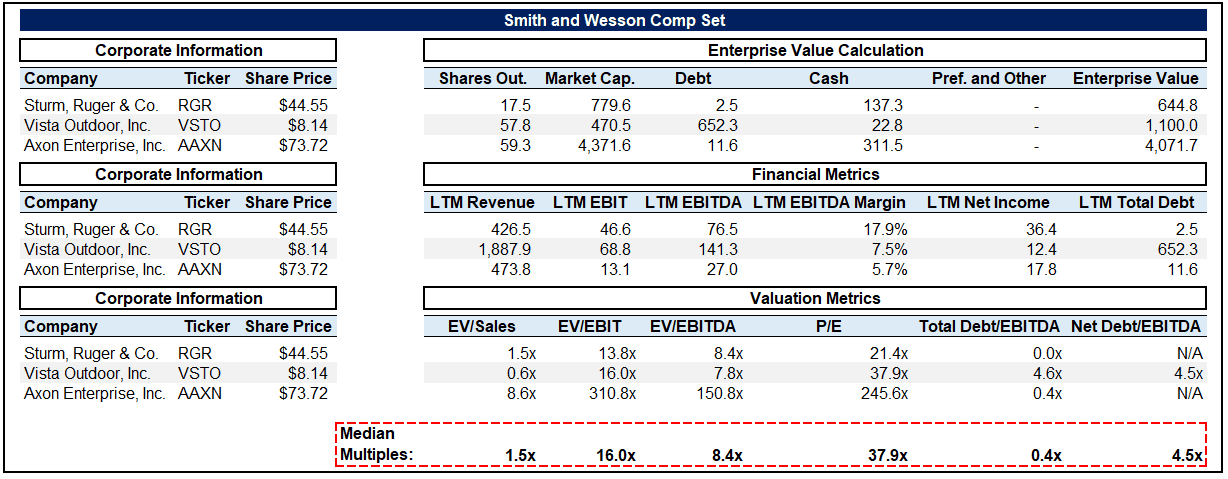

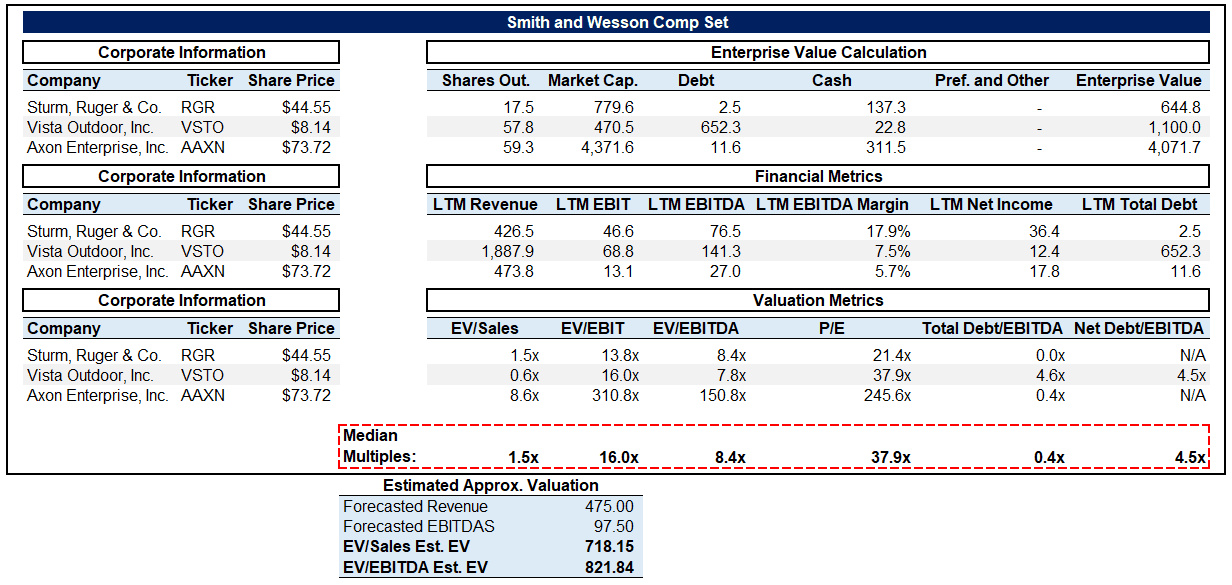

The firearm industry as a whole consists of a few different brands, mostly focused in America. On the publicly traded side, these can be essentially boiled down to three companies: Sturm, Ruger & Co, Vista Outdoor, and Axon Enterprise. While there are some minimal differences in how these companies operate in relation to Smith & Wesson, they are all leaders in the U.S. firearms market. There is not much in the way of financial information released regarding Smith & Wesson, especially considering they haven’t been a standalone company, but the only other pure-play firearms comp (RGR) appears to be a solid business, with 18% EBITDA margins and a very manageable debt load.

Customers

Customers of Smith & Wesson are essentially firearm sellers, such as a sporting goods store or local firearms shops. In this sense, there are very minimal customer concentrations in the space, and demand will come from end users dictating retailers orders.

Quality of Business

As noted before, firearm manufacturing, while relatively politically treacherous, is a pretty high quality business. Granted, it is rather capital intensive, as these companies need to pour money into manufacturing, in addition to the need for constant R&D spend in order to keep up with competitors from an innovation perspective. Requisite data in order to calculate more detailed metrics for determining the quality of this business (ROIC, etc.) is not available until the Form 10 is filed later in 2020.

Capital Structure

The proposed capital structure for this transaction has not yet been announced. Management has stated that each business will be capitalized according to its own needs, a distinct advantage over the current capitalization of AOBC. All of the members of AOBC’s bank group of lenders have signed off on the potential transaction, indicating that access to capital markets for both businesses should not be an issue of concern for investors.

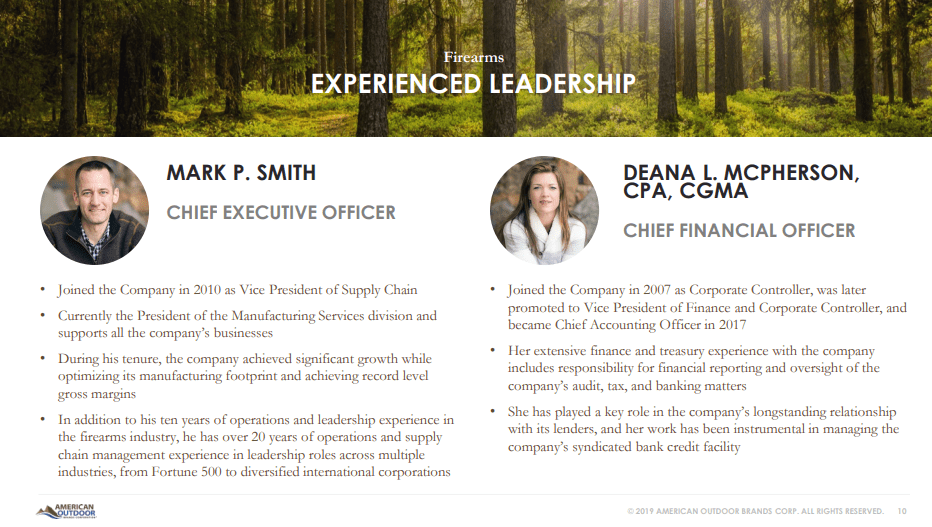

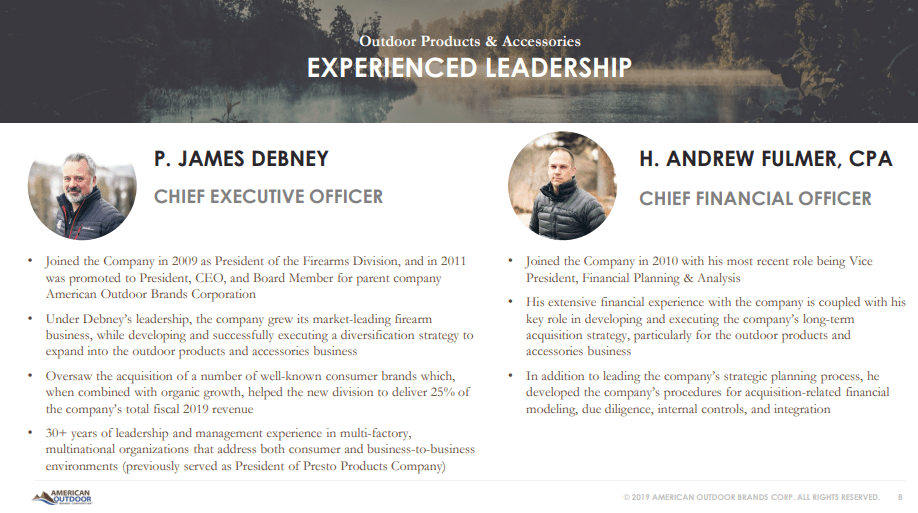

Management

Management for the two newly formed companies has been announced, allowing the companies to proceed with spin-off planning and execution with key leadership teams already in place. For the firearms business, Mark Smith will lead the company as CEO, and Deana McPherson will be the CFO. The outdoors brand will be managed by P. James Debney as the Chief Executive Officer and H. Andrew Fulmer will be the company’s Chief Financial Officer.

Firearms Leadership Team

Outdoor Brand Leadership Team

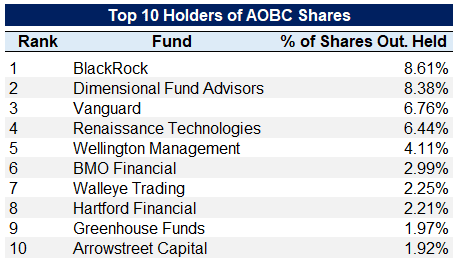

Potential for Indiscriminate Selling

From an ESG perspective, it is clear that there could certainly be some indiscriminate buying and selling of the new shares of both companies. On the firearms side, investors that do not want to hold shares of gun companies may sell the shares they receive in the spin-off, although anyone that wanted to divest from weapons would have probably already sold their AOBC shares. More interestingly, however, will be the potential for indiscriminate buying of the outdoor brands shares. Many indices and fund managers were forced to divest from AOBC for ESG reasons, and the split of the two companies could create an opportunity for them to get back into the name on the outdoor brand side without having to have any association with the firearms segment of the business.

Valuation

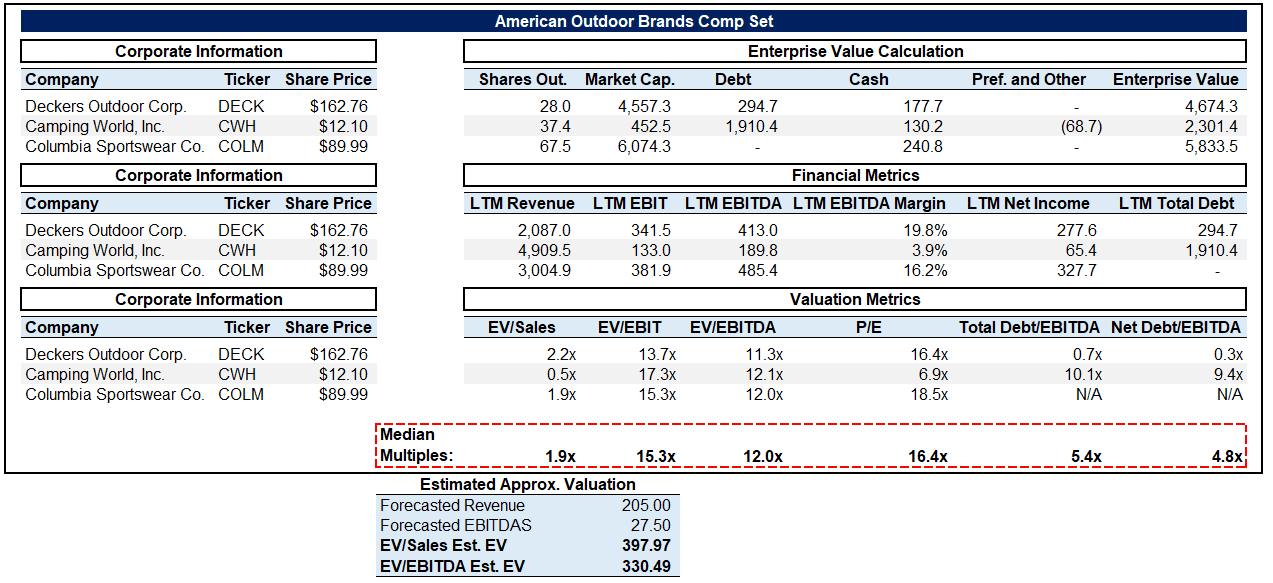

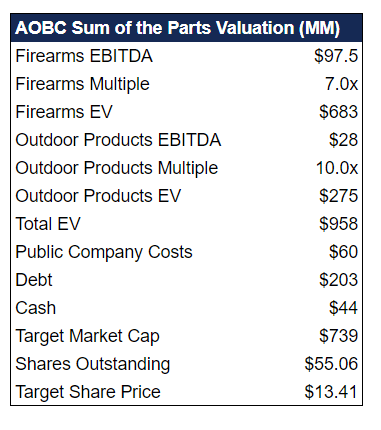

While it’s relatively difficult to triangulate a fair value range without access to quite as much financial information as necessary, by taking a comps EV/EBITDA multiple multiplied by forecasted pro forma EBITDAS for each business, investors can get an idea of what each business might be valued at on its own.

Our Initial Conclusion

AOBC has rallied significantly since the spin-off announcement. Nonetheless, the stock looks fairly attractive heading into 2020, especially if you think a Democrat will win the 2020 election.

Assuming the Outdoor Products spin-off deserves to trade at 10.0x EBITDA (a discount to peers at 12.0x) and RemainCo (Smith & Weston) trades at 7.0x (a discount to RGR at 8.4x), a fair enterprise value appears to be $958MM.

From that estimate, we can subtract $60MM ($10MM capitalized at 6x) for public company costs and $143MM of net debt.

This yields a fair market cap of $739MM and share price of $13.41, significantly above AOBC’s current price of $9.25, as shown below. Note, this is my initial estimate, and I will fine tune it once the Form 10 is filed.

The other positive factor benefiting AOBC is that 2020 is an election year. If a Democrat wins the election, gun sales should experience a sharp acceleration. If President Trump is reelected, gun sales should continue to grow modestly (no acceleration), but there shouldn’t be a sharp decline.

One thing that I want to better understand is whether investors will be more likely to invest in the Outdoor Brands business once it is spun off. ESG focused investors have avoided the company due to its focus on gun manufacturing. The Outdoor Brands business will not manufacture guns, but it will still manufacture many gun accessories. Therefore, I question whether ESG investors would be open to buying shares in the spin-off.

Leave A Comment