Colfax Corp Spin-off Notes

February 15, 2022 Update

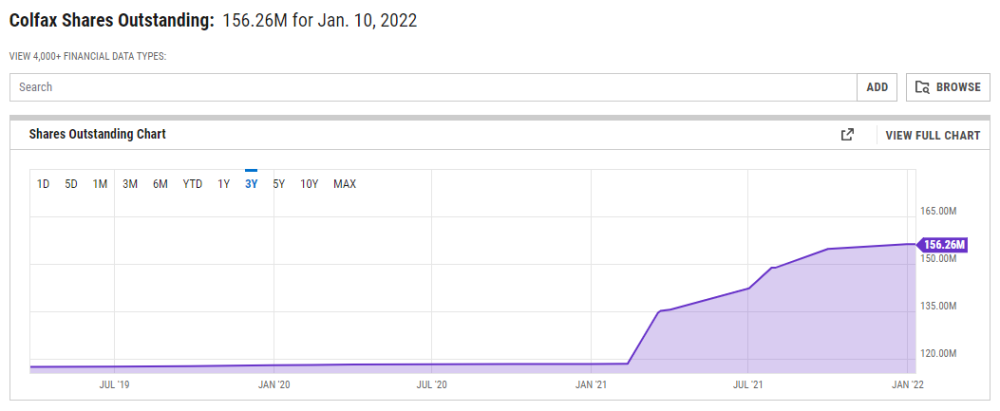

- I just realized that CFX issued a bunch of shares starting in February 2021 in the $40 to $50 range (currently trades at $42). If the shares are / were so cheap why were the issuing shares?

January 15, 2022 Update

Decent write up that gives an overview of the transaction (set for Q1 2022)

- After being hit hard over the past ~7 years Colfax’s spin now has an opportunity for recovery

- Especially considering the RemainCo will be a Medtech multiple instead of an industrial or conglomerate multiple

January 7, 2022 Update

- This is more of a split/separation less of a spin-off because RemainCo is significantly smaller ($1.5b revenue) than SpinCo ($2.4b revenue)

- Enovis (RemainCo) will focus on Medtech, specifically orthopedics (competing with Zimmer Biomet and Stryker), and ESAB (SpinCo) will focus on Fabrication and Robotics Technology, also selling industrial products like medical gas and alloys (competing with ITW and Lincoln Electric)

- Inside ESAB there are many opportunities – Medical & Specialty Gas Control ($3b market), Weldcloud Digital Solutions ($1b market), and 2nd Wave Robotics ($1b+ market)

- ESAB expects to grow 9-12% y/y

- In 2021 Enovis made $1.5b in revenue and ESAB made $2.4b in revenue by 2023 they expect $1.7-$2b and $2.6b (respectively)

- On February 28, 2022, Colfax will vote on whether or not to spin-off

Colfax intends to effect the reverse stock split and authorized share count reduction in connection with and immediately following the previously announced separation of its existing fabrication technology business, which will operate as ESAB Corporation (“ESAB”), and its specialty medical technology businesses, which will operate under the new name Enovis Corporation (“Enovis”). With a reverse stock split, the price of each common share is expected to increase so that a stockholder would have fewer but higher priced shares. A reverse stock split would not have any impact on the voting and other rights of stockholders, and would have no impact on the Company’s business operations or any of its outstanding indebtedness.

March 12, 2021 Notes

- Colfax Corp. (CFX) announced its plans to split its industrial and medical device businesses into two publicly traded companies. ESAB, Colfax’s welding equipment segment, is an industry leader with $2.2BN in sales. DJO, Colfax’s medical devices segment, generates revenue of ~$1.2BN. It focuses on the orthopedic market (shoulder implants, knee braces, etc.). The announcement makes a lot of sense as the businesses have nothing to do with one another and because they are already run independently. I need to spend more time on the sum-of-the-parts valuation to understand if the transaction will unlock value, but the stock is not cheap on an absolute basis. Current Colfax trades at 23x forward earnings and 13.3x forward EBITDA.

- “Now is the right time to build on the momentum in both businesses and enable each to better capitalize on its distinct opportunities,” Matt Trerotola, Colfax president and CEO said in a March 4 news release. “We believe a separation will better position each business to execute tailored strategies to deliver above-market growth, margin expansion and strong, consistent free cash flow.”

- The separation is expected to be completed in Q1 2022 as a tax-free distribution to shareholders.

Leave A Comment