CommScope Spin-off (Home Networks) Notes

February 17, 2022 Update

- CommScope decided to delay the spin-off indefinitely.

Before I turn the call over to Kyle to discuss our financial results in more detail, I want to update you on our previously announced plans to spin-off our Home Networks business during the second quarter of 2022. Then I’ll provide my thoughts on how our CommScope NEXT transformation initiative is progressing.

Regarding Home Networks, our Board of Directors has determined that is – it is in the best interest of both CommScope and the future independent Home Networks business that we delay the execution of spin-off. This decision was not an easy one, but was taken out the thorough consideration of the current supply chain environment and its negative impact on Home Networks business performance. Although, Home Networks ended 2021 with a backlog in excess of $1 billion, the business has been contending with an acute shortage of semiconductor chips and higher input costs that have resulted in revenue and adjusted EBITDA significantly below our expectations for 2021.

We now believe that chip shortage will persist throughout 2022. Given these unique circumstances, we believe the most prudent course of action is to defer the spin-off of Home Networks from CommScope, until we see a more normalized and predictable supply environment. I want to emphasize that this delay has no impact whatsoever on our commitment to spinning off the home business. Both CommScope and Home Networks will be stronger and better positioned for success as separate businesses. And we intend to execute the spin-off as soon as market conditions allow. Although, we will monitor the situation on an ongoing basis, we currently do not have a firm timeline for restarting the home spin-off.

January 20, 2022 Update

Good write up on the reasoning for spinning off the Home Networks Branch of CommScope

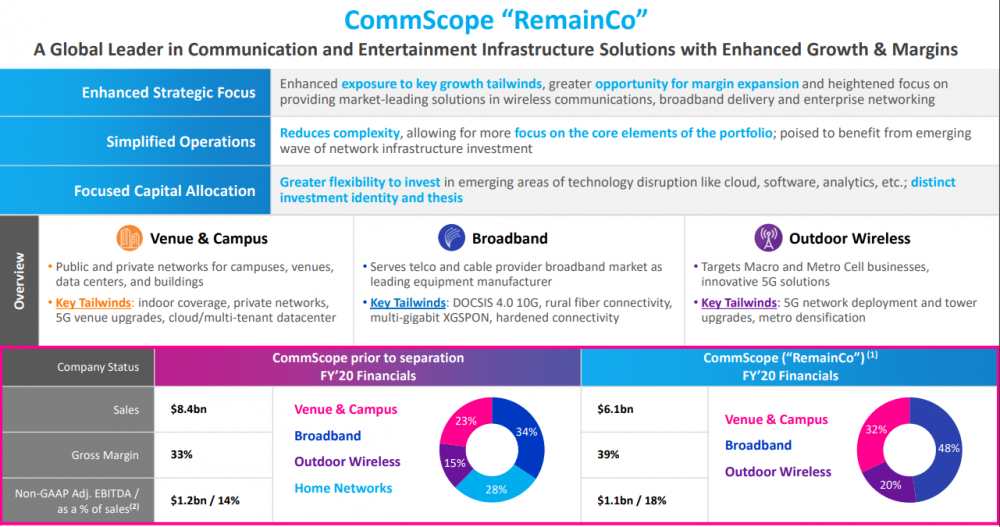

- By spinning off Home Networks CommScope better sets itself up for a stronger (more pure-play) future.

- The Home Networks also seems like a branch to be cautious about, It is being spun off because of its poor margins and performance (to help the RemainCo)

January 9, 2022 Update

- CommScope has shifted the expected spin time to be in Q2 2022 from Q1 2022

- The spin will still be its Home Networks Business

- The Home Networks Business accounts for a third of CommScope’s net sales making $2.4b net sales in 2020 and $2.6b net sales in 2019

- Although Home Networks is the least efficient of CommScope’s branches with only $131m adjusted EBITDA in 2020 and $210m adjusted EBITDA in 2019

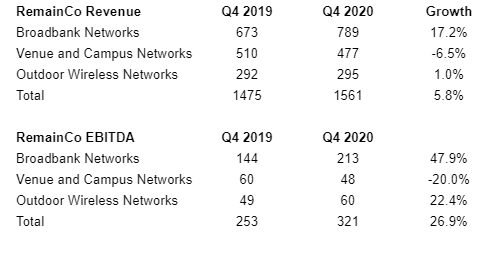

- The branches of CommScope that will make up RemainCo include Broadband, Outdoor Wireless, and Venue & Campus

- In the Q3 2021 Earnings Presentation CommScope demonstrated the difference between CommScope with Home Networks and without

- CommScope currently (RemainCo with SpinCo), adjusted EBITDA margin went from 15.8% in Q3 2020 to 12.3% in Q3 2021

- The same time period RemainCo (without SpinCo) adjusted EBITDA margin went from 19.5% in Q3 2020 to 16.2% in Q3 2021

- Further, CommScope with SpinCo adjusted EBITDA shrunk by 24% and RemainCo without SpinCo only shrank by 12%

[2020 Annual Report]

[SpinCo]

The Home segment comprises the former Consumer Premises Equipment business and the segment includes subscriber-based solutions that support broadband and video applications. The broadband offerings in the Home segment include devices that provide residential connectivity to a service provider’s network, such as digital subscriber line and cable modems and telephony and data gateways which incorporate routing and Wi-Fi functionality. Video offerings include set top boxes that support cable, satellite and Internet Protocol television content delivery and include products such as digital video recorders, high definition set top boxes and hybrid set top devices.

[RemainCo]

The Broadband segment provides an end-to-end product portfolio serving the telco and cable provider broadband market. The segment brings together the Network Cable and Connectivity business with the Network and Cloud business and includes converged cable access platform, passive optical networking, video systems, access technologies, fiber and coaxial cable, fiber and copper connectivity and hardened closures.

The OWN segment focuses on the macro and metro cell markets. The segment includes base station antennas, RF filters, tower connectivity, microwave antennas, metro cell products, cabinets, steel, accessories, Spectrum Access System and Comsearch. As the Company’s wireless operator customers shift a portion of their 5G capital expenditures from the macro tower to the metro cell, the portfolio will strategically help to make the transition smooth and cost-effective.

The VCN segment targets both public and private networks for campuses, venues, data centers and buildings. The segment combines Wi-Fi and switching, distributed antenna systems, licensed and unlicensed small cells and enterprise fiber and copper infrastructure.

[Special Analyst Call on 12/14/2021]

Michael McCloskey

And anything you can tell us about leverage on the business, debt structure, dividend back to CommScope and anything additional there?

Charles Treadway

Yes. As all of you know, and you’ve seen our results, the home EBITDA has declined since last year. This is going to have an impact on us in terms of leverage we could put on this business, but we will update you all when we get more information here.

April 15, 2021 Update

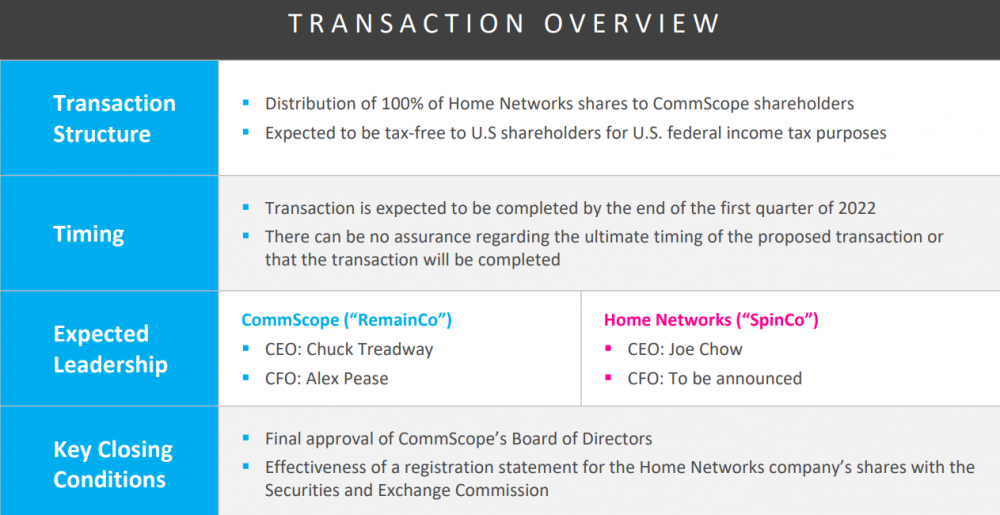

- On April 8, CommScope Inc announced that it will spin off its Home Networks business in a tax free transaction in Q1 2022.

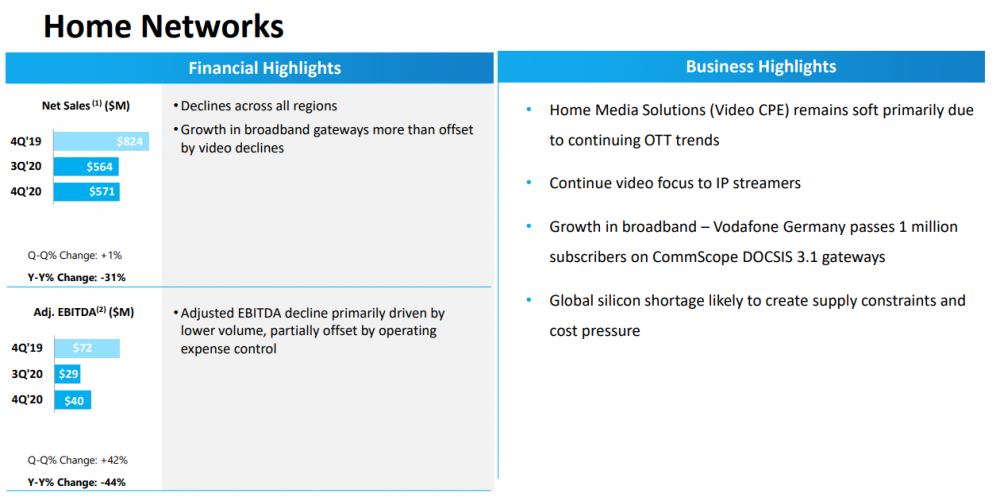

- The Spin-off will be consided the “bad” business. In the last quarter, revenue declined by 31% and adjusted EBITDA declined by 44%. Home Networks provides set top boxes for customers that want to watch cable. Given cord cutting, this is a business in secular decline.

- The RemainCo will keep the better businesses that are growing as shown below.

Leave A Comment