Crane Co (CR) Spin-off Notes

April 2, 2023 – Update

Crane Co (CR) will break up into two public companies on April 3: Crane Co and Crane NXT. Crane Co, the spin-off, will retain the Crane name/ticker and be comprised of the Aerospace & Electronics and Process Flow Technologies (valves/pumps) businesses. The current CEO (Max Mitchell) and current CFO (Rich Maue) will go with the spin off. The spin-off is trading in the when issued market at $75. With 57.3MM shares outstanding and net debt of $125MM (at the midpoint), Crane Co will have a market cap of $4.3BN and an EV of $4.4BN. Guidance for 2023 is EBITDA of $321MM and EPS of $3.55. It’s trading at 13.4x EBITDA. According to Morgan Stanley, the median takeout multiple for Aerospace and Defence companies is 14.1x. Another potential good comp is Pentair Valves & Controls which was acquired by Emerson in 2016 at 14.1x EBITDA. Crane Co looks reasonably valued to me.

Crane NXT, the RemainCo, is comprised of the Payment and Merchandising Technologies. The company has supplied currency to the Federal government since 1879 and has been the sole provider since 1964. It provides currency for several other countries as well. It also supplies technology solutions that detect and authenticate payment transactions. Crane NXT is a good business with high returns on capital. But it’s hard to know the right valuation multiple for it given secular headwinds facing paper currency. Crane NXT is trading at $38 in the when issued market. With shares outstanding of 57.3MM and net debt of $650MM, Crane NXT has a market cap of $2.2BN and an enterprise value of $2.9BN. 2023 guidance is for EBITDA of $346MM and EPS of $3.80. As such, it’s trading at 8.2x EBITDA and 10x EPS. This seems cheap but not quite a no brainer given secular growth concerns. I was hoping for a juicy dividend but the company will only pay out 15% of EPS which implies a 1.5% dividend yield.

February 6, 2023 Update

Good Overview on Crane Spin-off

April 22, 2022 Update

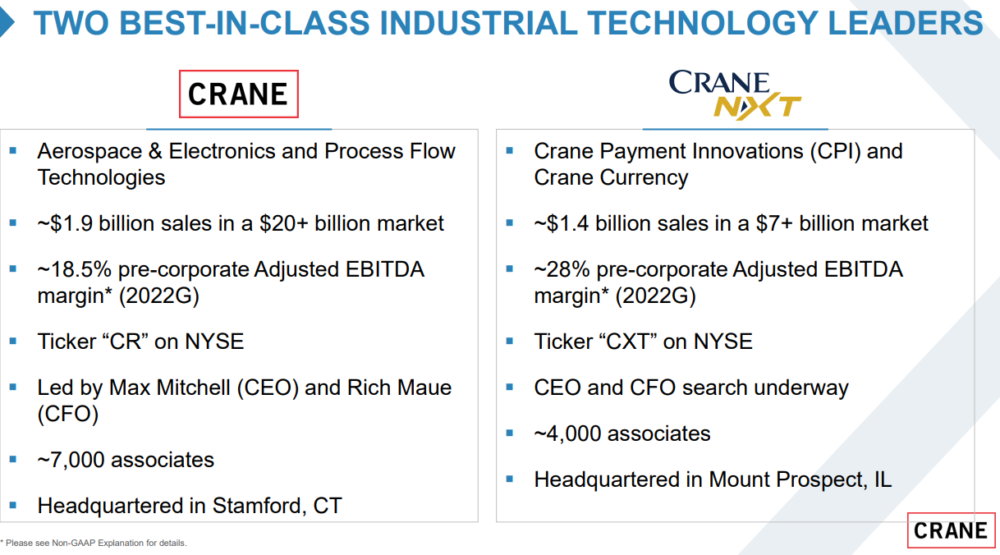

Crane Co (CR) announced on March 30, 2022, that it would break up into two public companies.

Crane Co (the spin-off) will retain the Crane name/ticker and be comprised of the Aerospace & Electronics and Process Flow Technologies businesses. Expected sales in 2022 of $1.9BN and EBITDA of $352MM (18.5% EBITDA margins pre corporate expenses). The current CEO (Max Mitchell) and current CFO (Rich Maue) will go with the spin off.

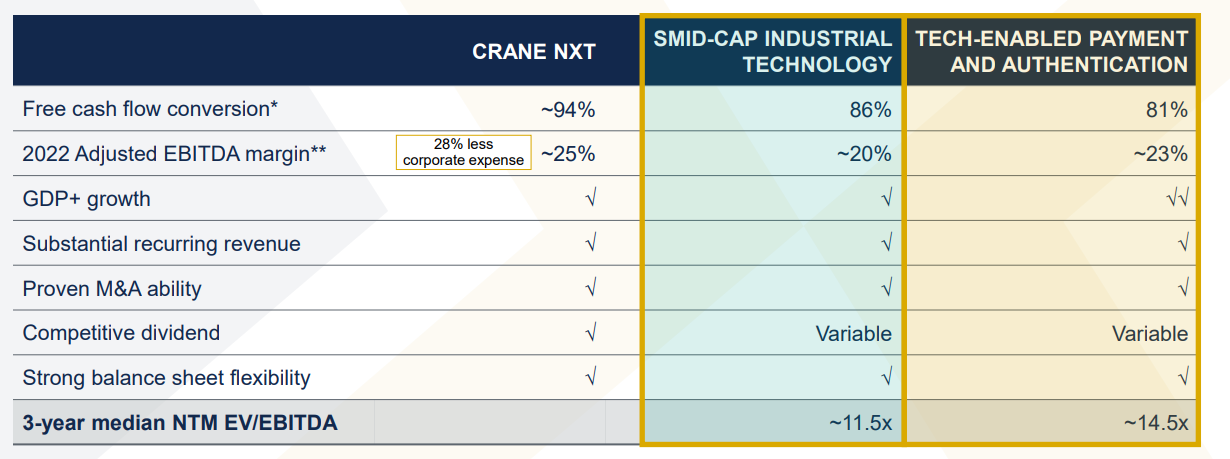

Crane NXT (the RemainCo) is comprised of the Payment and Merchandising Technologies. Expected sales in 2022 of $1.4BN and EBITDA of $392MM (28% EBITDA margins pre-corporate expenses). Part of the stock’s appeal will be an attractive capital return policy including a competitive dividend. Crane NXT slide deck.

The spin-off is expected to be a tax free transaction that is completed within 12 months.

Initial Thoughts

The stock seems pretty compelling at first blush. Pretty defensive.

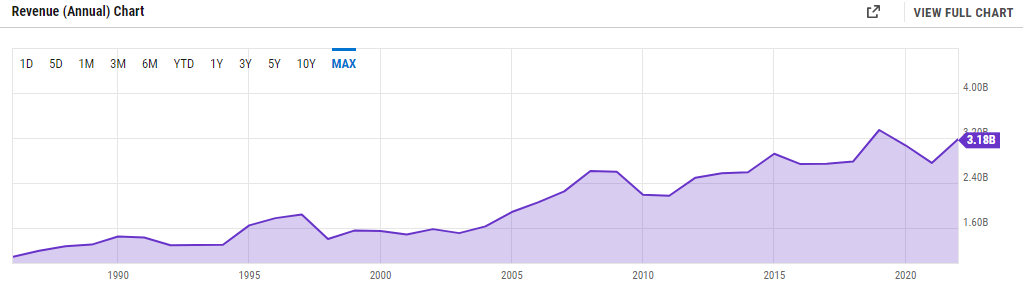

The stock sells off hard during recessions but revenue is not that cyclical.

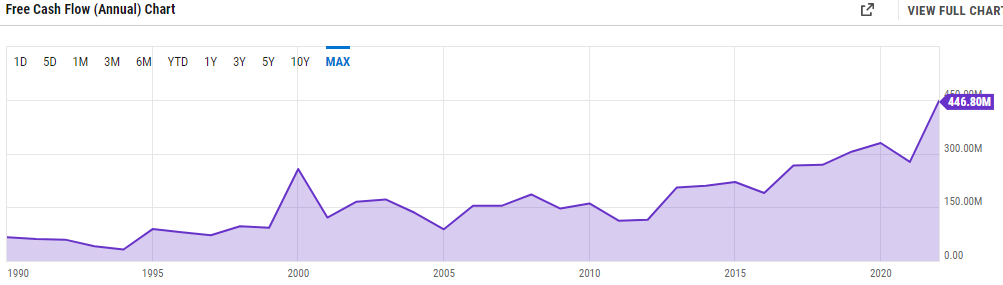

And it always stays free cash flow positive, even in recessions.

The stock seems very reasonable on an absolute basis at 13.7x FCF, 14.3x forward earnings, and 9.7x on EV/forward EBITDA.

Also, I’m impressed with how much thought has already gone into the spin-off preparation. Check out all these presentations which make a compelling case. Clearly management feels strongly about the potential for this to unlock value and has given it a lot of thought.

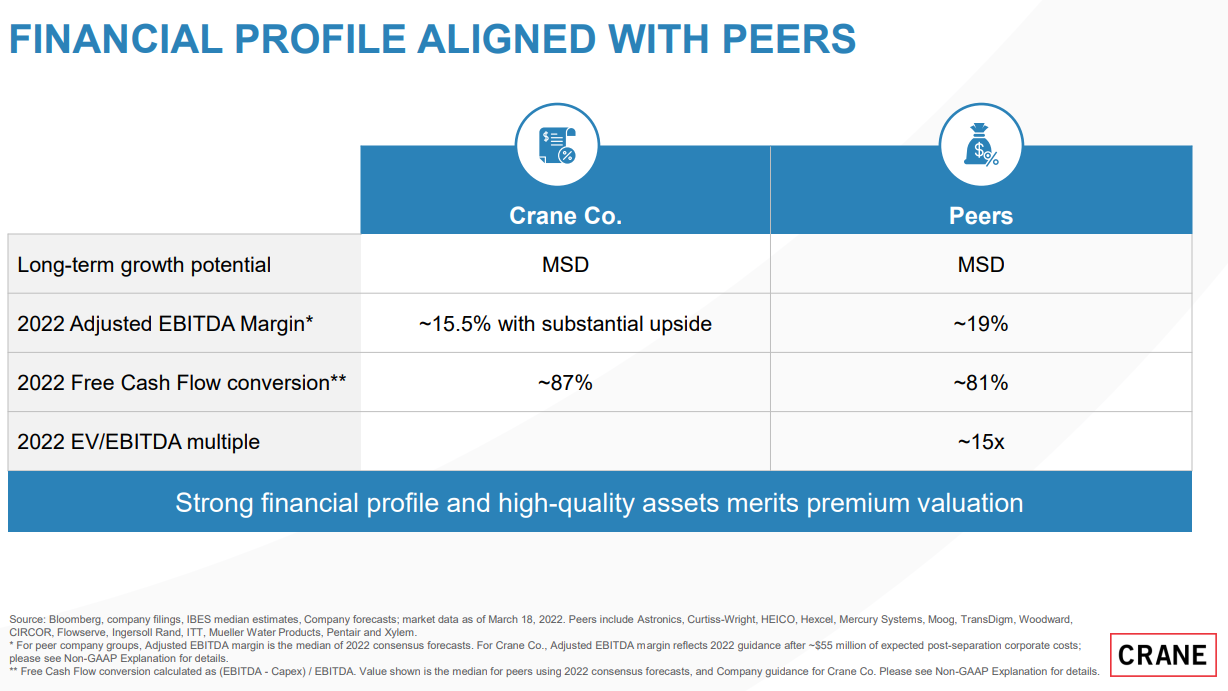

Management believes both the spin-off and the RemainCo should trade at a higher valuation ( I need to vet this).

Crane NXT (RemainCo)

CraneCo (Spin-off)

Finally, this stock hasn’t been written about much on Twitter, Value Investors Club or Seeking Alpha. This is usually a good sign.

Reading their 10-K and Proxy statement is a delight. Very honest and open communication. Feels like the ethics of the founder are still alive.

Check out their detailed discussion on actual results from their long-term strategy in Feb-2022 proxy statement (page 46ff.):

“We actively pursued numerous acquisitions with a focus on adding capabilities and scale. No transactions were completed during 2021 due to highly elevated market prices, and our rigorous and financially disciplined approach to acquisitions”. Wow – communication of inaction which ultimately is shareholder value positive! Great to read from a management with a growth strategy that is at least partially depended on M&A.

Management has skin in the game and compensation is aligned with shareholders. They seem to be cleaning house by getting rid of their asbestos liabilities and selling of the materials division. The spin-off fits the same narrative. Noteworthy that 20% of shares are held by Crane Foundation as well which adds to the long-term outlook the management communicates.

Strong balance sheet paying back long-term debt from COVID in full early. Recent significant share repurchases are a positive signal.

Shame they are in a cyclical, capital intensive industry dependent on capex by their customers.

And except from the aero business which has some moat through FAA approved products, I don’t see how their products are very differentiated. Although there are some safety & reliability considerations from their customers, so brand could play a role for their flow products?

Crane NXT seems to be very dependent to popularity of paper-cash, which long-term is poised to decrease, although very gradually.

CR is still connected to some environmental risks as well long-term (see 10-K risks).

When checking some valuation metrics from their peer group I don’t see that they are currently trading at a significant discount to their peers or in absolute terms. Their profitability metrics seem to be in the upper range though and they are not trading at a premium. Growth is lacking a bit, so valuation seems fair for now with upside potential when considered as pure-play and when one-time charges subside.

Could be a solid pick with holding period of 2-3 years, potentially favorable entry before the spin-off. As none of the parts seems to be dumped garbage they both could trade at higher valuations instead of selling off initially.

Add me on twitter for further discussion: @HrtmnMax

Thanks for the comments Max. I agree the set up looks favorable.

What is the total return on this to-date (ie., through May2023) if you would’ve bought the day before the spinoff? Assuming you’ve hold both the companies…The tickers are CXT and CR, I believe. Thanks!