Daimler Spin-off (Truck Business) Notes

December 14, 2021 Notes

- On December 10, 2021, Daimler AG spun off 65% of Daimler Trucks and retained the remaining 35%.

- Shareholders of Daimler AG received 1 share of Daimler Trucks for every 2 shares owned.

- Here is the Daimler Truck Capital Markets day presentation.

- Daimler has 823MM shares outstanding is recently closed at 33 EUR per share. Thus, it’s market cap is currently $27.2BN EUR.

- Consensus expects the business to generate 3.03 EUR of EPS in 2022. Thus, the stock is trading at 11.4x 2022 earnings.

- Trucking peer, Volvo is trading at 11.9x. On a P/E basis, Daimler Truck looks fairly valued.

- It’s a little tricky to get a full handle on Daimler Truck’s pro forma balance sheet, but based on what is available on its IR website, I believe the company has net debt (including underfunded pension obligation) of 14.0BN EUR.

- Thus, it’s enterprise value is 41.2BN EUR. Consensus expectations for 2022 EBITDA is 4.7BN EUR. Thus, it’s trading at 8.8x 2022 EBITDA (assuming my EV calculation is right). Volvo trades at 5.4x.

- Daimler Truck intends to pay out 40% of earnings as a dividend. If it generates 3.03 of EPS in 2022 and pays out 40% of it (1.21), it implies a dividend yield of 3.6%. This isn’t too juicy but should provide some measure of downside protection.

- Daimler looks like a fine company at a fair price but doesn’t look particularly compelling to me.

February 4, 2021 Notes

- Daimler announced that it will spin off a majority stake in its heavy truck business. It had previously been rumored that the the business would go public via an IPO but I view a spin-off as more attractive.

- The spin-off is expected to take place before year end.

- The remainco will be renamed Mercedes-Benz.

- The shares would be traded on the Frankfurt exchange.

- “Daimler’s truck unit could be worth about 29 billion euros ($35 billion) if valued at multiples similar to Volvo AB, although it would need to substantially improve returns to justify that valuation, Deutsche Bank analysts wrote in a January report. Sanford C. Bernstein estimated Wednesday that the business could be worth 35 billion euros.”

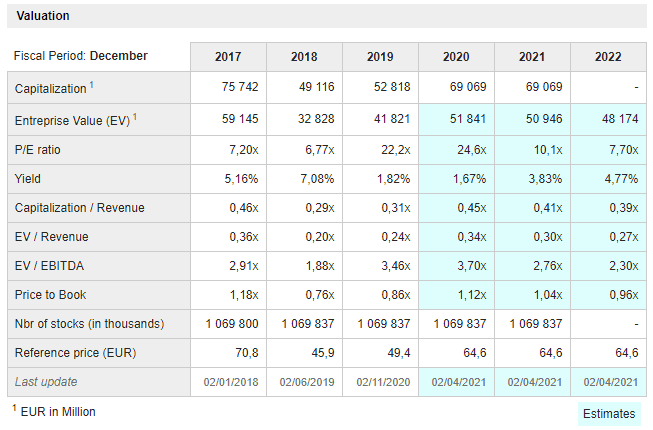

- Daimler’s current market cap is 69 billion euro.

- This is Daimler’s current valuation.

- As you can see, Daimler trades at a cheap valuation (EV/2020 revenue of 0.34x).

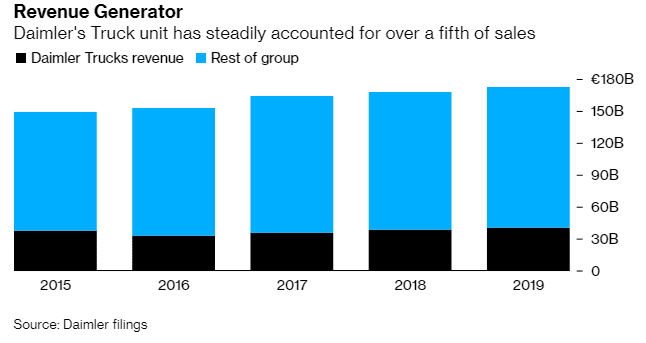

- The benefit of spinning of its Truck division, is Truck companies trade at higher multiples.

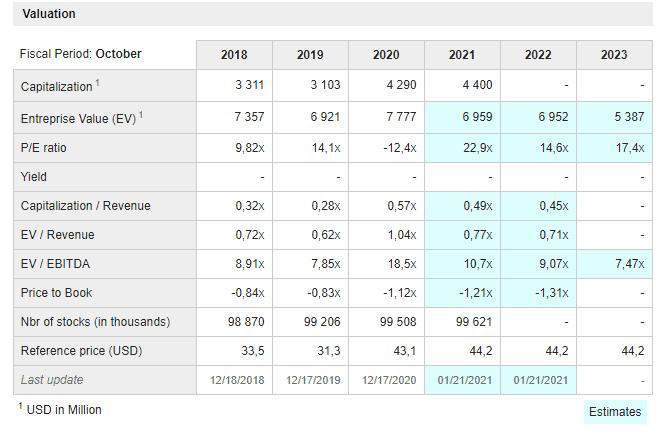

- Navistar International (NAV) is trading at an EV/202 revenue multiple of 1.04x.

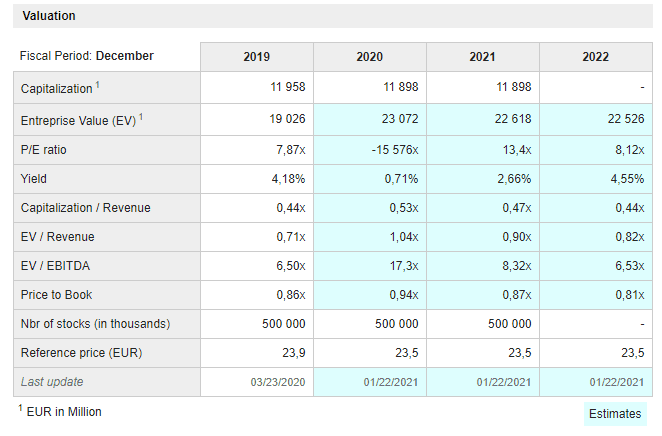

- Traton (Volvo’s trucking business) IPO’d in 2019 and trades an EV/2020 revenue multiple of 1.04x.

- This is an interesting siituation that I will do more work on.

- Good articles:

Leave A Comment