Dell Spin-off (VMWare) Notes

November 20, 2020 – Notes

-

Dell earnings jump on demand for remote work technology

- Increased demand for desktops and notebook computers as more people are working from home.

- Revenue increased 3% to $23.5BN, ahead of consensus expectations.

- Adjusted EPS were $2.03, ahead of consensus at $1.42.

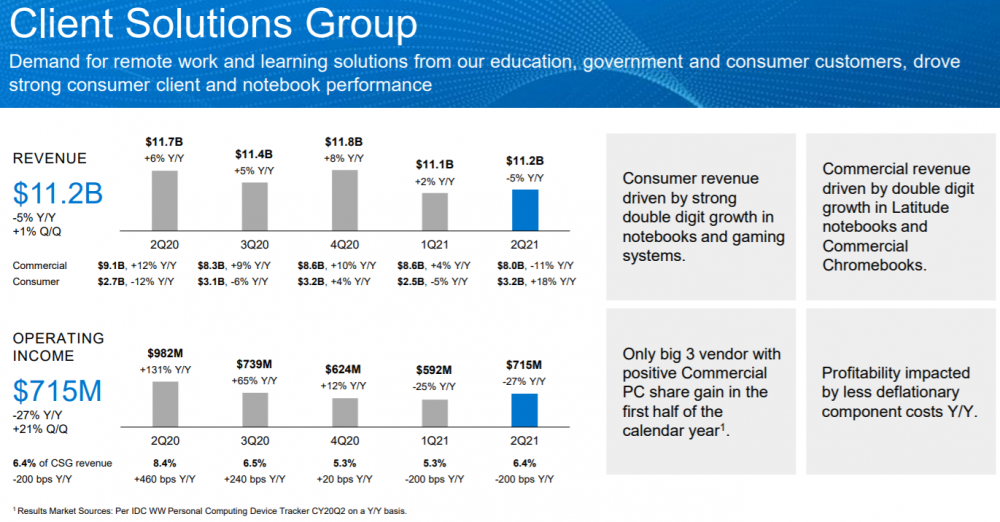

- Client Solutions Group (desktop PCs, notebooks, and tablets) saw revenue up 8% y/y to $12.29BN.

- Notebook orders increased 24%.

- Commercial Chromebook orders doubled.

- Premium laptops (XPS and Alienware) saw a 43% increase in orders.

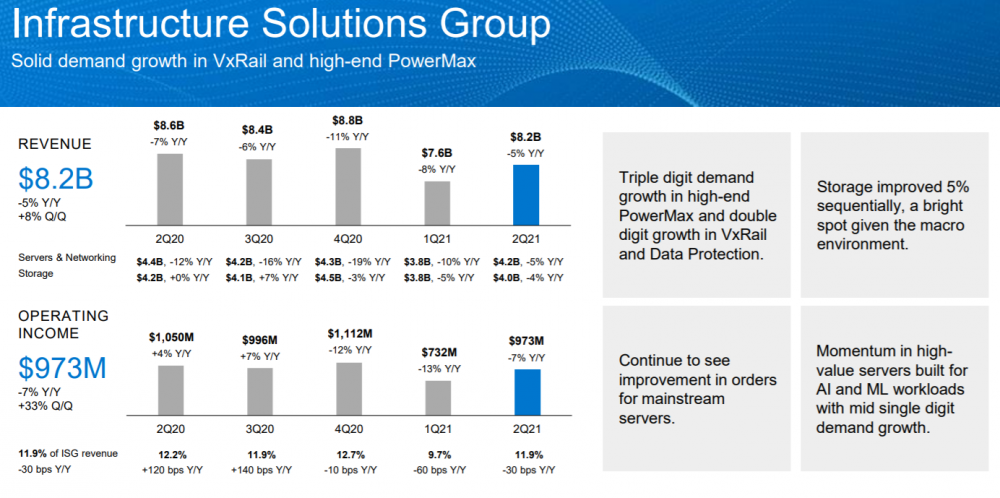

- Infrastructure Solutions Group (data center business) saw revenue decline by 4% y/y to $8.0BN.

- VMWare reported revenue growth of 8% to $2.89BN.

- Here’s what Dell said on the quarterly call about the spin-off:

Finally, before I turn it over to Jeff, I want to touch on the amended 13D we filed in July regarding our exploration of potential alternatives with respect to our ownership interest in VMware.

We believe a tax-free spin could drive significant shareholder value by simplifying our capital structures and enabling greater strategic flexibility, while maintaining a strong commercial partnership between Dell and VMware. Both Dell and VMware have publicly highlighted mutual interest and the potential benefits of such a transaction and have engaged on key work streams including mutually beneficial commercial arrangements and Dell’s expectation of a substantial cash dividend to VMware stockholders in connection with such a transaction.

As a reminder, the earliest a transaction could close would be September 2021 with an announcement coming between now and then assuming we can come to an agreement. There is also the possibility that we will not do anything and we would maintain our current ownership structure. With that said, we will not address the discussions any further or take questions related to this topic on today’s call.

November 13, 2020 – Notes

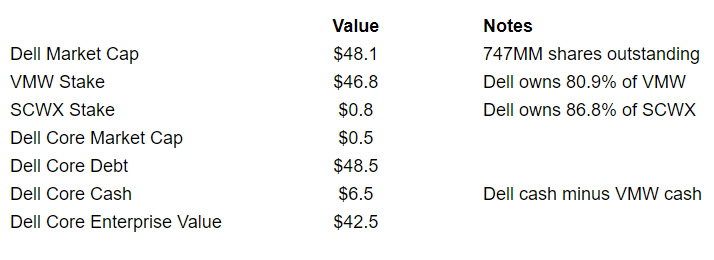

- Here is how I’m thinking about Dell’s valuation.

- Dell currently owns 80.9% of VMWare (VMW). At current prices that worth $46.8BN.

- Dell currently owns 86.8% of SecureWorks Corp (SCWX) . At current prices that’s worth $768MM.

- Dell’s current market cap is $48.1BN.

- So Dell’s stub value (Dell market cap minutes stakes in VMW and SCWX) is valued by the market at an equity value of $512MM.

- Dell does have substantial net debt. As of 9/30/2020,

- What does Dell’s core business consist of?

- Client Solutions Group:

- Infrastructure Solutions Group

- What are these businesses worth?

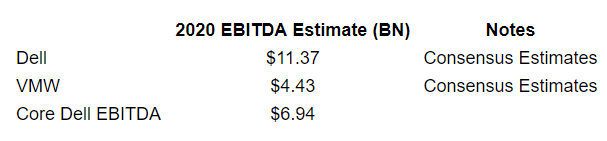

- First let’s start with EBITDA estimates.

- Using sell side consensus, we can back into what EBITDA Core Dell is expected to earn: $6.94BN. See math below:

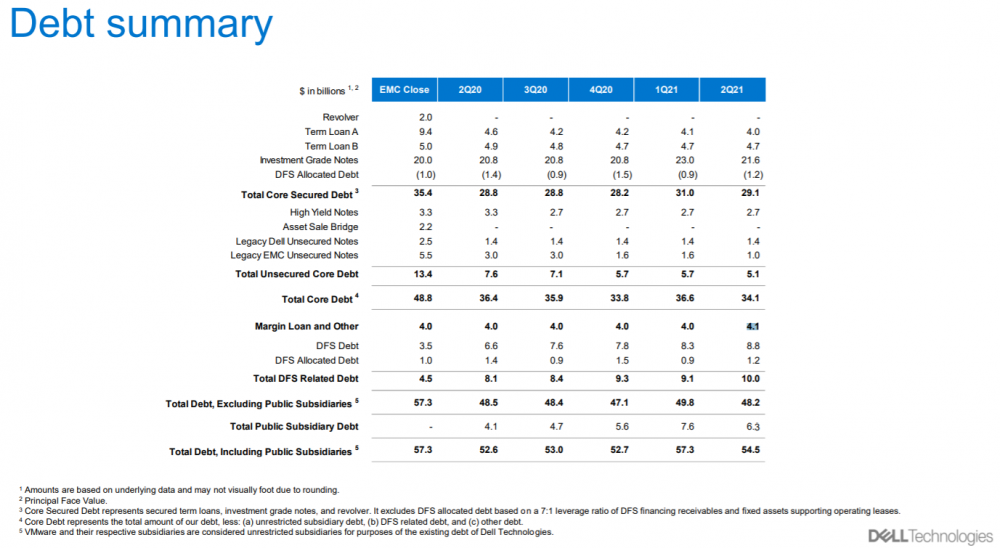

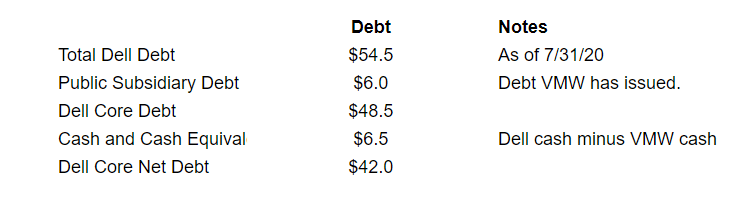

- Now let’s look at Dell’s debt.

- As of the most recent quarter, Dell has total debt of $54.4BN as shown above.

- While Dell views its “core” debt as $34.1BN, it gets there by backing out total public subsidiary debt (debt that VMW has issued), DFS Related debt (this means debt that is backed by receivables and other assets), and margin loan (a loan backed by its stake in VMW).

- I don’t think this is valid. Why should DFS related debt or the margin loan be backed out?

- DFS debt is debt. Dell will have to pay it back. Unless I’m mistaken.

- The margin debt will have to be paid back when the VMW spin-off is complete.

- I agree that it makes sense to back out public subsidiary debt (debt that VMW has issued) because VMWare is responsible to pay it back, not Dell.

- I don’t think this is valid. Why should DFS related debt or the margin loan be backed out?

- So I view Dell’s core debt as $48.5BN.

- If you back out Dell’s net cash and equivalents (Dell cash minus VMW cash), you arrive at a core net debt number of $42.0BN, as shown below.

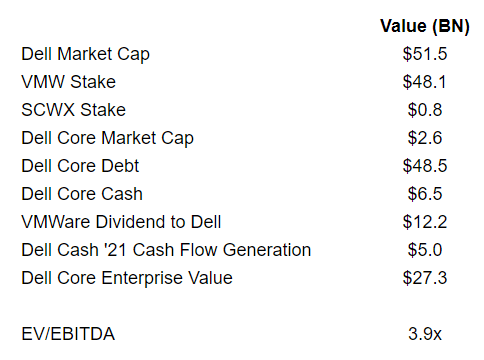

- So currently, Dell’s core (post VMW spin-off) enterprise value is $42.5BN as shown below.

- Two other factors need to be taken into account

- Dell will generate significant cash flow between now and the time of the spin-off. I estimate ~$5BN (typical annual free cash flow generation by Dell).

- VMW currently has net debt of $1.5BN.

- It could increase its net debt to $12.2BN and pay that to Dell as a dividend and VMWare would still only have a net debt / 2021 EBITDA multiple of 3.0x. This seems very reasonable. I could see VMWare going up to a 4.0x debt multiple.

- If you factor in this cash that Dell will receive, its expected Enterprise Value after the spin-off is complete is currently

-

- And Dell is trading at an EV/EBITDA multiple of 3.9x. This looks too cheap. Credit Suisse thinks Dell Core deserves to trade at 6.0x EBITDA.

- A 6.0x EV/EBITDA multiple implies a ~$66BN market cap and $88 share price. This implies 27% upside from Dell’s current share price of $69.

- I will do additional work to finetune my analysis and evaluate it on a price/free cash flow basis as well.

October 1, 2020 – Notes

- On July 15, 2020, Dell Technologies (DELL), announced that it is exploring spinning off its 80.1% stake in VMWare (VMW). This transaction has long been rumored and makes a lot of sense. Currently, Dell has a market cap of $46BN and its VMW stake is worth $47.6BN.

- Dell has significant debt and a potential spin-off will help it de-lever. We expect that the transaction will most likely be accompanied by a significant dividend from VMW to DELL.

- Any spin-off would be tax free and wouldn’t take place until September 2021 (5 year anniversary has to pass before tax free spin-off is possible).

- VMWare, a software company, is more attractive than Dell, a hardware (computer, monitor, and servers) company. It has been rumored that Dell wants to buy the remaining stake of VMW that it doesn’t already own. However, Dell already has $57BN of debt, and it would be challenging to raise additional debt to fund the buyout of VMW.

- Further, Silver Lake, which owns 28.6% of Dell, supports a tax free spin-off.

- This setup looks compelling. Dell is clearly undervalued, but I’m not going to recommend it yet. The transaction is not confirmed and will not take place until late 2021. As we move into 2021, there could be an interesting opportunity to short VMW and buy Dell (similar to MTCH/IAC trade).

- Good CNBC article (9/29/2020) on the benefits for VMWare becoming 100% independent.

I smell an opportunity here. Looks to me that both companies will benefit from the spinoff. Not sure I can trust Michael Dell yet. Starting to analyze this. Plenty of time before Q4 20221 spin. In meantime will hold DELL for any advantage from repricing by Mr. Market.

Still doing my DD but VMW is easier to value than DELL and initially shows more upside. That conclusion may change as I understand the situation better.

Do you have any new insights on this DELL / VMW situation?

Okay, so my question is “What is the justification for VMWare providing a separation payment to Dell at the spin?” If there is no separation payment, which is usually justified by debt on the parent’s books that is attributable to the child’s growth and development, and I don’t see that spelled out in Dell’s books, then I estimate a range for EV/EBITDA of 6.1 to 6.6 (today).

From the 2021 10-K:

“Neither Dell Technologies nor any of its subsidiaries, other than VMware, Inc., is obligated to make payment on the VMware Notes. None of the net proceeds of the VMware Notes are made available to support the operations or satisfy any corporate purposes of Dell Technologies, other than the operations and corporate purposes of VMware, Inc. and its subsidiaries. See Note 6 of the Notes to the Consolidated Financial Statements included in this report for more information about VMware, Inc. debt.”

On DFS debt, Dell maintains the debt is non-recourse to Dell, but to its customers:

“DFS Debt

The Company maintains programs that facilitate the funding of leases, loans, and other alternative payment structures in the capital markets. The majority of DFS debt is non-recourse to Dell Technologies and represents borrowings under securitization programs and structured financing programs, for which the Company’s risk of loss is limited to transferred loan and lease payments and associated equipment. The following table presents DFS debt as of the dates indicated. The table excludes the allocated portion of the Company’s other borrowings, which represents the additional amount considered to fund the DFS business.”

SO maybe the $34.1B figure is more correct, and that is what I used to get my range of 6.1 – 6.6 for EV/EBITDA …

Hi Rob, the justification is DELL has a lot of debt and wants to delever / extract some value before spinning off VMW. By math, as of Q1 2021, VMWare has virtually no debt right now ($4.71BN of cash and $5.0BN of LT debt). Consensus expects VMW to generate EBITDA of $4.4BN in its current fiscal year. VMW could lever up to 3x net debt to ebitda to support a $10BN to $15BN pre-spin dividend to dell. This is the dividend amount that has been rumured in the press.

The size of the separation payment is directly related to how much value there is or is not in Dell, I guess: a $13B parting gift makes all the difference between undervalued and “not at all undervalued” for Dell.

Hello Rich,

Are you recommending Dell at this point? Secondly, do you have any recommendations on BAM Re yet?

Best,

Charlie

Hi Charlie!

I’m not recommending Dell yet although I think it’s worth $120. More to come!

No official recommendation for BAMR. I think it should trade at a slight premium to BAMR (right where it’s trading). Here’s my deep dive: https://stockspinoffinvesting.com/portfolio_tags/bamr/

What is the cost basis of the spun-off shares, and how much of the DELL cost basis remains with DELL?