Dupont Split-off (Nutrition and Bioscience) Notes

December 11, 2020 – Notes

- On December 16, 2019, DuPont du Demours (DD) announced that it would be merging its Nutrition and Bioscience division with with International Flavors & Fragrances Inc. (IFF).

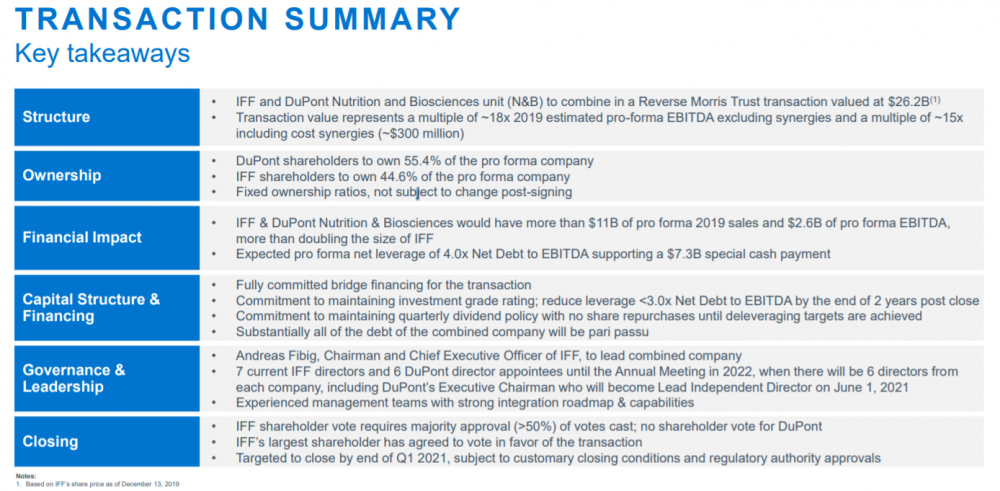

- Here are the terms of the transaction:

- Transaction slide deck.

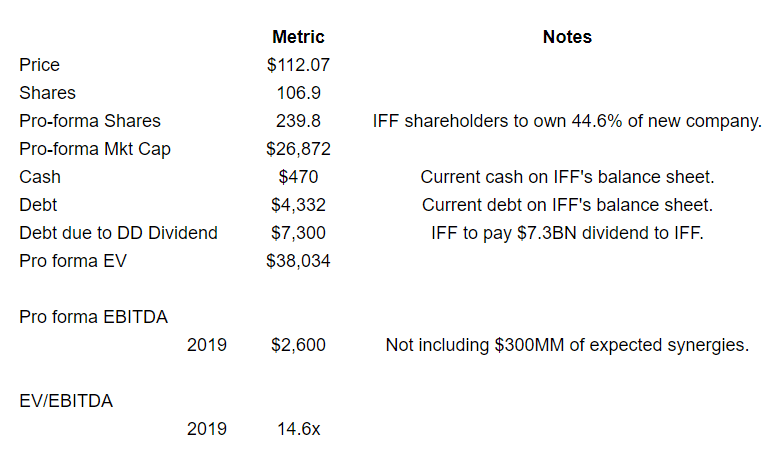

- Pro forma for the merger, IFF is trading at 14.6x

- This valuation seems a little expensive at first blush, but the business is extremely high quality with competitive advantages.

- Main competitors include: Givaudan, Firmenich (private), and Symrise.

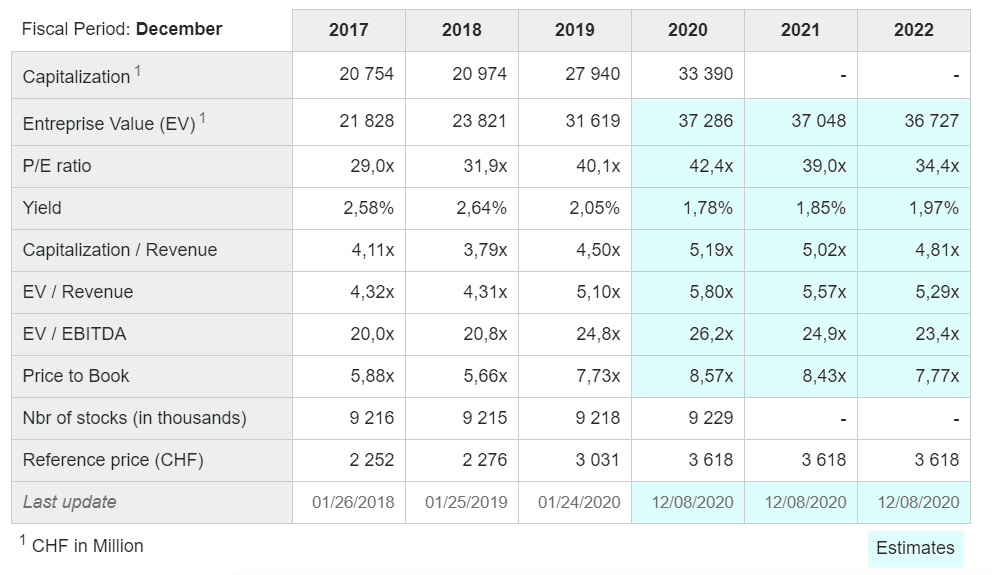

- Givaudan trades at 24.8x 2019 EBITDA.

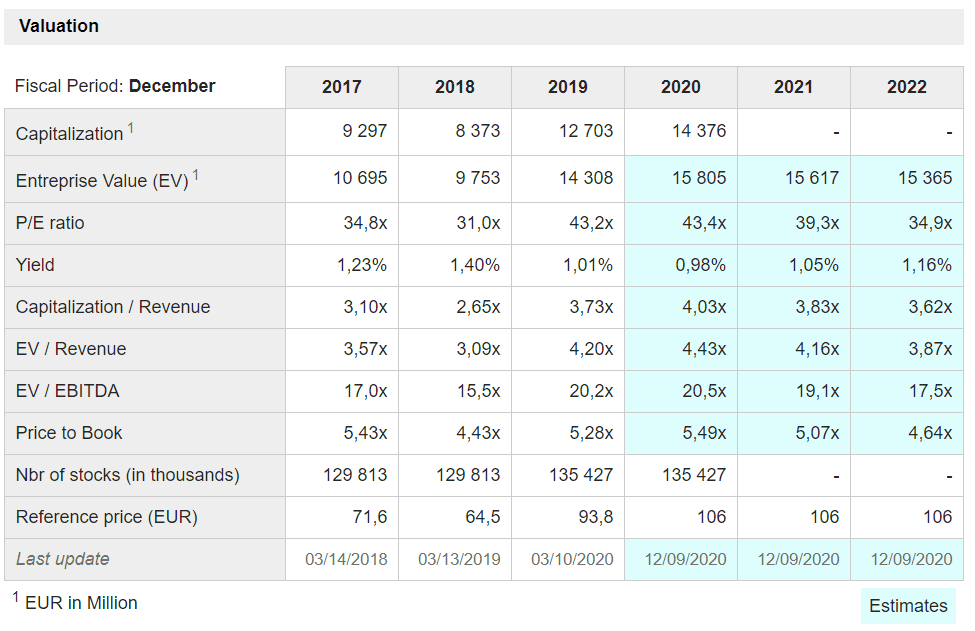

- Symrise trades at 20.2x 2019 EBITDA.

- So IFF looks quite reasonable on a relative basis.

- The transaction is expected to close on February 1.

- There have also been some filings that suggest the transaction will be done through a split off (DD shareholders have the ability to receive DD shares or IFF shares) which might create an odd lot opportunity.

- On the DuPont’s latest conference call, it said it hadn’t made the decision whether a spin off or split off made the most sense.

Steve Tusa

Can you just maybe comment on the – there was a bit of a change of language in the last filing with regards to the IFF transaction around your decision on whether you’re going to spin or split. Can you maybe just talk about what your thoughts are there? Looks like maybe a split is more likely, but you want to obviously maintain the flexibility and optionality with the kind of whole cleanup spend dynamic. Maybe just talk about what your latest thoughts are on that front.

Ed Breen

Yes, Steve. We will be making that decision by mid-December. And we truly have not made a decision yet. I wouldn’t put a leaning one way or the other on it. We took some language change, because we wouldn’t do a hybrid type approach. We’ll pick one or the other, and that was the change in language. But no decision at this point in time. I wouldn’t read anything into it.

- The decision will be made in mid-December.

- The transaction is expected to close on Feb 1. If DuPont goes with a split off, it will likely make that announcement in early January.

- If DuPoint does announce the split off and there is an odd lot provision, I would recommend buying 99 shares of DD and exchanging them for IFF shares. I would probably lean towards not hedging the IFF shares because the stock looks relatively undervalued versus comps.

December 4, 2020 – Notes

https://www.morningstar.com/articles/1009450/dupont-is-materially-undervalued

https://ir.iff.com/news-releases/news-release-details/iff-shareholders-approve-merger-duponts-nutrition-biosciences

Leave A Comment