Ecolab – Upstream Energy Spin-Off Quick Summary

Overview

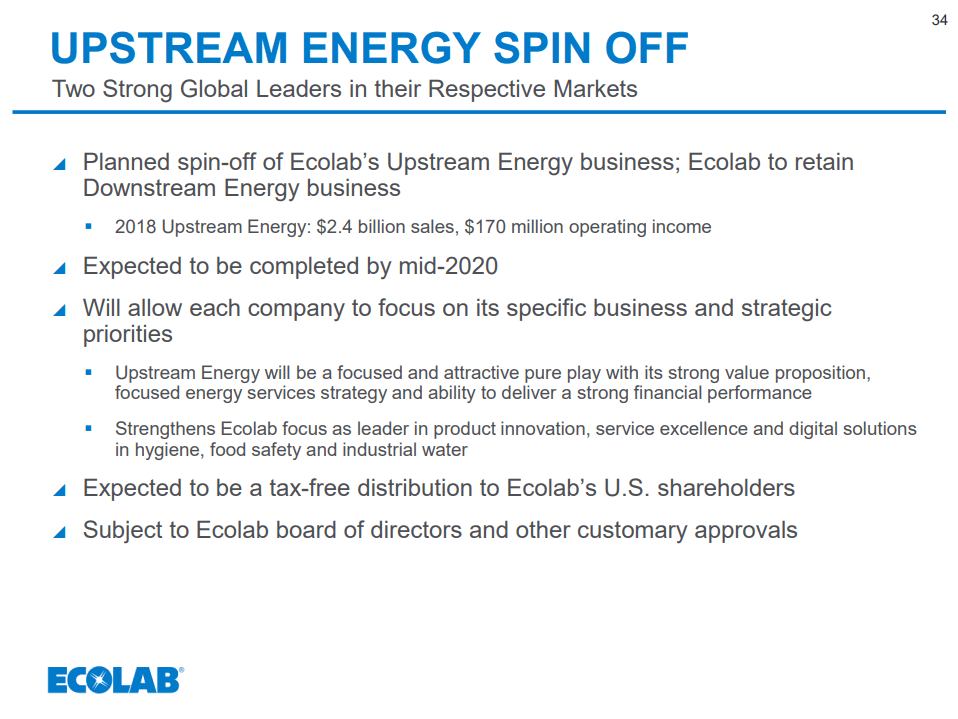

On February 4, 2019 Ecolab (ECL) announced that it intends to spin-off its Upstream Energy business as an independent public company in a tax-free transaction. SpinCo will consist of the Oil Field Chemicals production business (80% of SpinCo sales), as well as the WellChem drilling and well completion chemistry business (20% of SpinCo sales). After the spin-off, ECL (Remainco) plans to retain the Downstream business, which serves refineries and petrochemical plants, as well as all other business segments. The spin-off is expected to be completed in mid-2020.

Background

The Upstream business is composed of the Wellchem and Oil Field Chemicals businesses. These businesses provide chemicals that assist with crude oil and natural gas production, pipeline gathering/transmission systems, gas processing, heavy oil and bitumen upgrading, water management and enhanced oil recovery. Key products include additives for drilling and well stimulation, corrosion inhibitors, oil dispersants, flow improvers, lubricant additives, many others.

The spin-off is driven by management, which believes the Upstream Energy business has the potential to be “a market-leading pure-play global provider of oil and gas production, drilling, and completion product and service solutions.”

Management believes that the two upstream businesses have grown distinctly different from other segments within Ecolab, therefore eliminating operating synergies. Management claims the Upstream Energy business unit can benefit from operating as a stand-alone public company, as well as being a more focused and attractive pure play to both investors and customers.

Ecolab says that the rise of shale in the US has changed the upstream businesses, and they no longer align with other company operations such as water treatment and institutional cleaning. According to Ecolab CEO Douglas Baker, they “evolved into more specialty chemical–type businesses, which require increasingly different operating disciplines and expertise.”

For the full year 2018, the Upstream Energy business recorded sales of $2.4BN, operating income of $170MN (7.1% segment operating margin vs. 13.27% total company), and EBITDA of approximately $340MN. However, management expects spin-off related costs of ~$35MN which are expected to be offset by increased cost savings initiatives.

In 2018, the Energy segment as a whole grew both sales and operating income mid-single digits despite an inflationary delivered product cost environment. Heading into 2019, management expects strong sales volume, accelerating pricing, as well as improving operating margins despite forecasting slower but still robust end market growth. Delivered product costs are still expected to increase, but at a slower pace than 2018. In addition to this, management has guided another $125MN in savings over the next few years for Ecolab (RemainCo) on top of the previously forecasted $200MN in savings.

Diving deeper into Upstream 4Q18 results, sales grew modestly with continued growth in the well stimulation business, as well as modest growth in production sales. However, results faced a hard comparison from last year, which was positively impacted by large initial shipments for a customer startup field.

After the spin-off, SpinCo is expected to raise new debt in order to pay the dividend to ECL, which is expected to be used by RemainCo for a combination of share repurchases and debt paydowns. Despite taking on leverage, management states that Upstream Energy’s strong balance sheet and free cash flow should provide the company with a strong BB credit profile with approximately 2.0x Net Debt/EBITDA. This compares to competitor Baker Hughes (BHGE) at 1.6x.

We are struggling to find great comps for the Upstream spin-off. For now, we will use Baker Hughes (BHGE) and Apergy (APY).

BHGE trades at 15.4x ‘19 EBITDA while APY trades 12.1x ‘19 EBITDA. Assuming EBITDA stays flat in 2019 at $340MM and the spin-off deserves to trade inline with APY, a reasonable estimate for its enterprise value is $4.1BN. As the spin-off gets closer, we will fine-tune our analysis.

Resources from Ecolab

ECL Spin-Off Press Release – February 4, 2019

ECL Spin-Off Webcast – February 5, 2019

ECL 4Q18 Earnings Press Release – February 19, 2019

ECL 4Q18 Earnings Slide Deck – February 19, 2019

ECL 2018 Investor Presentation – February 19, 2019

Other Resources

Ecolab Plans To Spin Off Its Upstream Energy Business By Mid-year 2020 – NASDAQ – February 4, 2019

Ecolab Expects Double-Digit Earnings Growth in 2019 (Sort of) – Motley Fool – February 20, 2019

Leave A Comment