Emmis Communications Spin-Off Quick Summary – October 28, 2019

Resources from Emmis Communications

Spin-off Slide Deck Presentation – July 11, 2019

Spin-off Press Release – July 1, 2019

Investor Relations Contact Information:

Ryan Hornaday, EVP/CFO, rhornaday@emmis.com

Kate Snedeker, Media/Investor Relations, kate@emmis.com

Other Resources

Radio Industry Research – June 2019 (IBIS World)

Overview

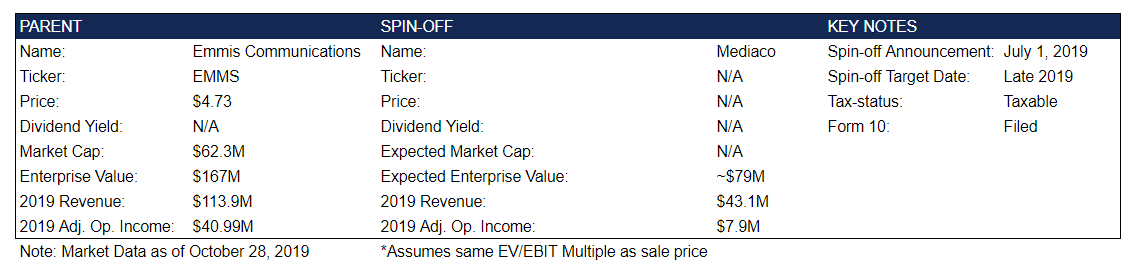

On July 1st, 2019, Emmis Communications announced that it would spin-off two of its radio stations in New York (WBLS-FM and WQHT-FM) in the formation of a new public company, Mediaco Holding, in conjunction with New York based investment firm Standard General. Closing of the transaction is subject to FCC approval and other customary closing conditions, and is expected to occur later this year. When the deal closes, Emmis will receive $91.5 million in cash, a $5 million note receivable, and 23.72% of the common equity in Mediaco, which will be distributed pro rata to Emmis shareholders in a taxable dividend. This transaction is expected to close by the end of the year.

Why the Spin-off?

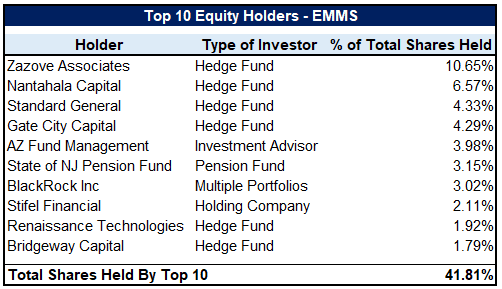

This spin-off was the result of a years-long restructuring effort that Emmis has undertaken over the last few years in which Emmis is actively trying to exit the secularly challenged radio business. Additionally, there was likely some shareholder pressure to monetize the assets they have, as six of their top ten largest shareholders are all hedge funds, with their top holder being a fund that owns over 10% of the business. In total, the top ten shareholders of this business own over 40% of all of the common equity, a high concentration.

Spin-off Overview

Company

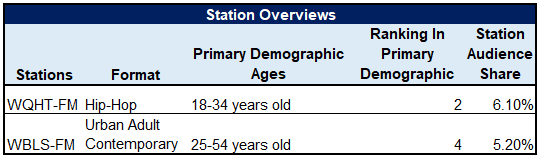

The new company will own two radio stations in New York, WBLS and WQHT.

To break down each station individually, WQHT-FM is also known as Hot 97, one of the most popular hip-hop stations in New York. They host shows and play music, with iconic New York DJs such as Ebro and Funkmaster Flex hosting shows and interviewing essentially any guest in the hip-hop industry. For the 18-34 year old demographic, this is the #2 most listened to station in New York.

WBLS-FM, also known as 107.5 FM, is the #1 R&B station in New York, and the #4 most listened to station by New Yorkers within the 25-54 age demographic. Additionally, the station boasts a daily weekday morning show with Steve Harvey, the iconic comedian and entertainer, and a Sunday morning show with Rev. Al Sharpton, the polarizing minister.

The radio business as a whole has stagnated in recent years, with consumers shifting preferences from radio to on-demand offerings such as podcasts and streaming music. However, Mediaco has strong positioning within a region that still consistently uses the radio, so they have been more insulated than others.

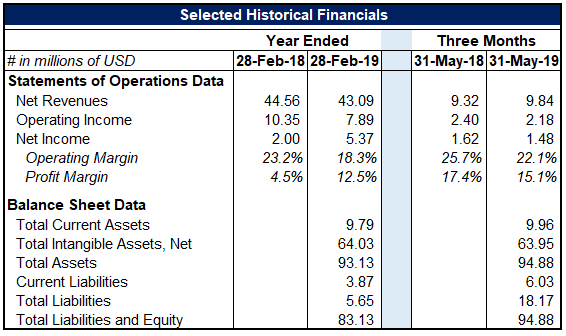

In fiscal year 2019, revenue and operating income declined as shown in the chart below. However, the business did grow in the quarter ending May 2019.

70% of revenue is derived from advertising (~87% local, ~13% national). The balance of revenue is derived from digital (on-line ads and video sponsorships), ticket sales, and sponsorship of events.

Industry

Overall, the Radio Broadcasting industry has remained resilient over the five years to 2019 amid fierce competition from alternative media formats. The industry has grown modestly, benefiting from a general increase in US advertising expenditure. Although radio stations and networks have lost many regular listeners to newer forms of audio entertainment, such as podcasts and music streaming, radio remains the widest-reaching media format in the United States. Moreover, growth in satellite radio, which is included in the industry, has offset weaknesses in terrestrial radio advertising.

Competition

Competitors in this space can depend on a variety of factors because, as with most sources of entertainment, radio broadcasting competes with any other type of entertainment. Podcasts, music streaming, and the rapid growth of satellite radio have placed significant headwinds on traditional terrestrial radio stations like the two stations that Mediaco operates. Sirius XM (owned by Liberty Media but trades under the tracking stock SIRI) competes heavily, as they own all of the XM radio stations on the satellite side, while some of the biggest terrestrial radio operators are Entercom (owned by CBS) and iHeartRadio (IHRT). It’s difficult to compare these on a multiple or margin basis, considering that these other firms have hundreds of stations in their portfolio, while Mediaco will only have two.

Customers

While specific customers for Mediaco are not broken out, no customer represents more than 10% of net revenues.

Quality of Business

Although the business is relatively small, this is still a high quality company. They own two of the largest and most popular music stations in the largest city in America. Additionally, this is a space in which capital intensity is very low.

Capital Structure

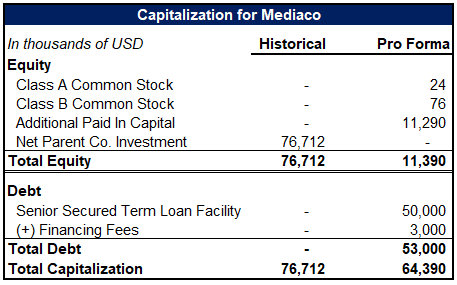

In conjunction with the spin-off, Mediaco will enter into a $50 million senior secured term loan facility. Additionally, a multitude of various funds and broadcasting companies will inject equity into the new firm, in order to capitalize the company.

Management

Specific executives that will run Mediaco have not yet been announced.

Potential for Indiscriminate Selling

Due to the size of the Mediaco (less than $100M market cap) and the specific owners within its equity stack, there is certainly potential for indiscriminate selling of Mediaco shares. Hedge funds (and pension funds and other asset managers that round out the top 10 shareholders list) could have some type of investment mandate that precludes them from holding a smaller name like this, or holding a name in which another fund is a controlling shareholder in the way that Standard General will be after this transaction closes.

Valuation

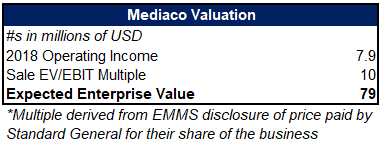

Emmis disclosed in its slide deck that it selling its stake in the Mediaco business for 10x trailing twelve month operating income. In 2018, the business generated $7.9MM of operating income, implying that the transaction values Mediaco at $79MM.

Our Thoughts

This transaction is interesting at a high level as the spin-off will be a very small company that generates significant cash flow.

Nonetheless, we will approach the investment cautiously given that:

- Standard General will own over 50% of the company (who knows how minority shareholders will be treated).

- The spin-off’s business (terrestrial radio) is secularly challenged.

- The spin-off will have significant debt.