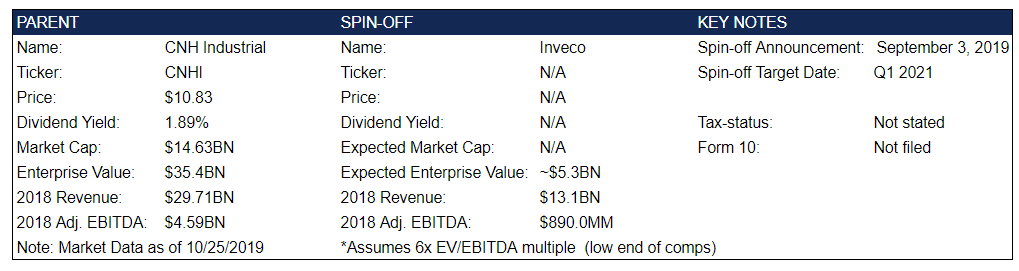

CNH Industrial Spin-Off Quick Summary – October 25, 2019

Resources from CNH Industrial

Spin-off Slide Deck Presentation – September 3, 2019

Spin-off Press Release – September 3, 2019

Investor Relations Contact Information – Noah Weiss, Head of North America Investor Relations

- Phone: (630) 887-3745

- Email: investor.relations@cnhind.com

Additional Resources

Podcast Episode – Southwestern Asset Management – Minute 40 – Quick Thoughts on CNH Industrial (CNH)

Overview

On September 3, 2019, CNH Industrial (CNHI), a global industrial company focused on farm and construction equipment, announced that it would spin off its truck business, named Inveco in early 2021 into a separate company with revenue of $13.1BN. The remaining business will include the tractor business, the construction equipment business, and special vehicles (such as firefighting trucks), and is expected to generate $16BN of revenue. The driver behind the decision is limited synergies between the two groups. Further, agg equipment companies trade at higher multiples than trucking companies. According to Factset, CNHI trades at 7.7x 2018 adjusted EBITDA. In contrast, Deere trades at 15x 2018 EBITDA.

As of now, the parent company has not mentioned whether the spin-off will be taxable or tax-free, but CNHI has retained investment banking advisors to support the planned transaction so investors and analysts should likely see more details in the coming months.

Background

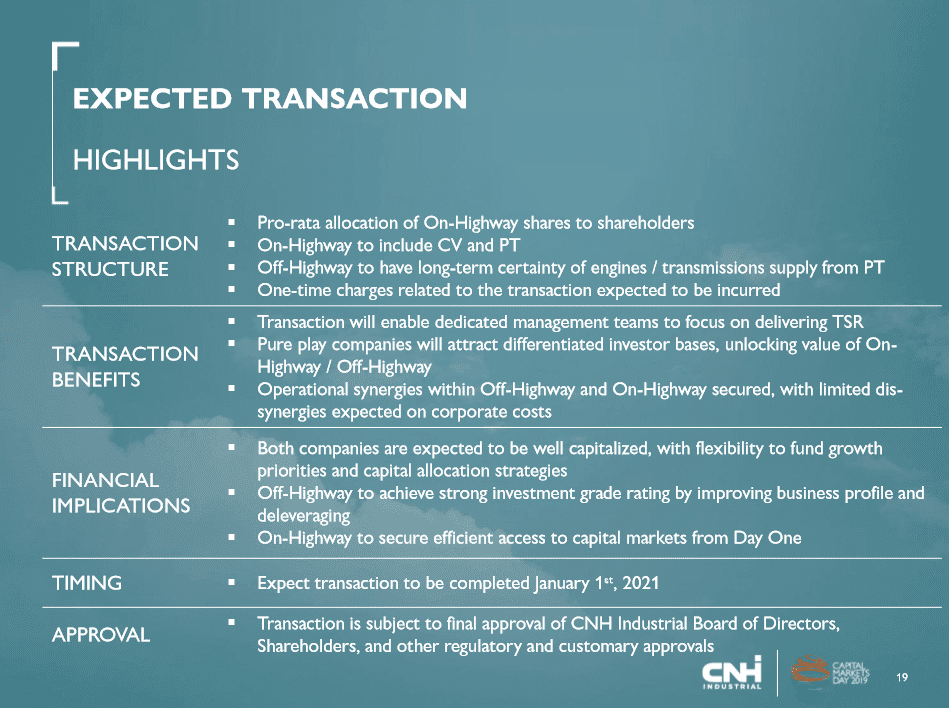

As mentioned above, the main catalyst for the spin-off is driven by management noting that there are very limited synergies between the SpinCo and the ParentCo. Additionally, as also mentioned above, agricultural equipment companies (the ParentCo) tend to trade at higher multiples than trucking companies (the SpinCo). The market has clearly responded well to this, as the common stock has traded up a bit over 6% since the announcement was made a few weeks ago. Per management, the spin-off includes Inveco, Inveco Bus, Heuliez Bus and the Fiat Powertrain (FPT) commercial brands, with combined expected revenues of around $16BN.

Although activist investors weren’t the driving force behind the transactions, famed activist Paul Singer and his fund Elliott Management reportedly took a stake in CNH after the announcement of the spin-off. Elliott was also said to have had multiple meetings with company executives and the firm’s largest shareholder, the Agnelli family, who owns 29% of the stock with 42% of its voting rights.

From a business description perspective, the “On-Highway” business that will be separated includes its commercial vehicles and powertrain segments. These units focus on industrial vehicles, from large trucks to buses and powertrain engines.

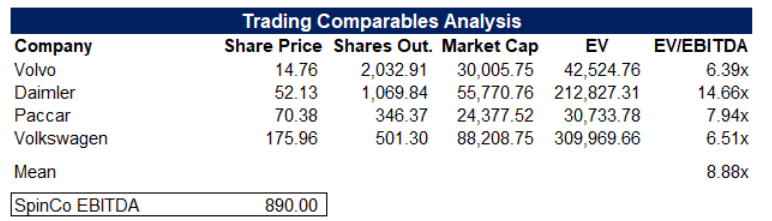

In terms of publicly traded competitors, comps focus on other, similar industrial trucking businesses. Main comps include Volvo, DAF, Daimler, and Paccar, all of which focus extensively on industrial trucking. An added benefit of the spin-off will be the opportunity for freedom for the trucking business, allowing it to expand and compete more effectively with its peers that focus more exclusively on trucking.

Source: Factset

Source: Factset

To be conservative, we can assume that Inveco will trade at the low end of its comp set at 6.0x EBITDA implying a $5.3BN enterprise value.

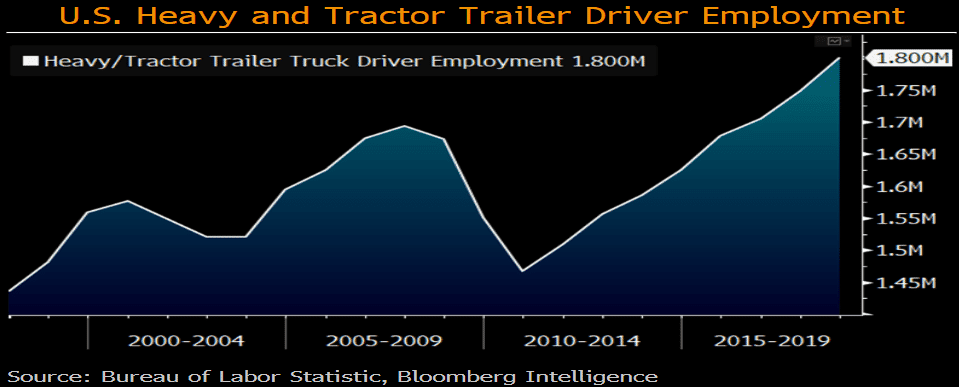

The spin-off’s business is very cyclical as trucking tracks the overall economy, especially the strength of the individual consumer, since more goods will be transported when consumers are doing well and consuming more. In a macro climate in which global growth is slowing, the trucking business will not be very attractive. Additionally, trucking faces the combined headwinds of volatile fuel prices and an increasing shortage of drivers, driving up wage costs.

Our Initial Thoughts

At a high level, this is an interesting transaction. I would expect Remainco’s business valuation to improve once the spin-off is complete in early 2021. It doesn’t have to trade at parity to Deere (at 15x EBITDA) to be a profitable trade.

Nonetheless, Deere isn’t a perfect comp for the Remainco as Deere is focused purely on agriculture equipment while Remainco is focused on construction equipment, specialty vehicles in addition to agriculture equipment.

Leave A Comment