GE Healthcare Spin-off Overview

Questions or comments? Leave them in the comment section below and I will get back to you.

Updated on June 26, 2018

On June 26, 2018, General Electric (GE) announced that it intends to monetize 20% of GE Healthcare and distribute the remaining 80% to shareholders on a tax-free basis. The transaction is expected to be completed over the next 12-18 months (Q2 2019 to Q4 2019).

GE Healthcare Notes

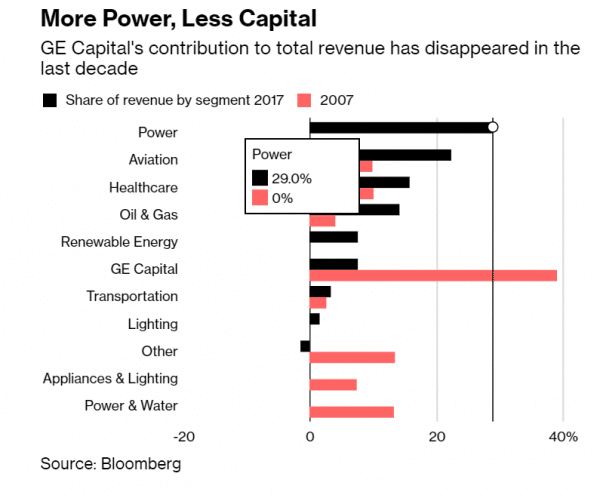

- GE will narrow focus to Aviation, Power and Renewable Energy

- The announcement is the conclusion of a yearlong strategic review by CEO John Flannery that has been tumultuous for GE employees and investors.

- The company will be focused around its power, aviation and renewable energy businesses. These units, which accounted for more than $70 billion of GE’s $122 billion in revenue last year, mostly sell turbines to power plants and engines to jet makers.

- Healthcare to become standalone company; GE expects to monetize 20% and distribute remaining 80% of GE Healthcare to shareholders tax-free

- Plans to fully separate Baker Hughes, a GE company (BHGE) within 2-3 years

- GE believes this will allow the company to de-lever significantly; Clear path to reduce debt by $25 bill

- ion, achieve Industrial

net debt to EBITDA of less than 2.5x by 2020 and further de-risking GE Capital - GE is also making changes to its organizational structure:

- The new GE Operating System will result in a smaller corporate headquarters focused primarily on strategy, capital allocation, talent and

governance - It will result in better execution, increased speed and is expected to generate at least $500 million in corporate savings by the end of 2020

- Under the new GE Operating System, most resources and services traditionally held at the headquarters level will be realigned to the businesses

- The new GE Operating System will result in a smaller corporate headquarters focused primarily on strategy, capital allocation, talent and

- Dividend:

- GE expects to maintain its current quarterly dividend until GE Healthcare is established as an independent entity.

- GE Healthcare dividend is expected to be in-line with healthcare industry

- GE parent dividend will be inline with industrial peers

- Payouts in health care are typically lower, so the combined dividend between GE and the spin-off will probably be less than current levels

- The announcement clears away lingering concerns over GE’s debt while laying out a plan to monetize several major assets, said Nicholas Heymann, an analyst with William Blair & Co.

- GE shares rose 8% in Tuesday afternoon trading to $13.78—the best gain in three years but still worth half what it was a year ago. It now sports a market value of $120 billion, compared with a peak of $594 billion in 2000 when GE was the most valuable U.S. company.

- GE Healthcare Notes

- Generated revenue of over $19BN in 2017 (+5% growth); operating profit of $3.5BN (18.3% operating margin); $800MM in D&A according to 2017 20-k so I estimate EBITDA at $4.3BN

- >100% FCF conversion

- GE expects ~3% revenue growth in 2018 and 5%+ operating profit growth

- The business makes equipment ranging from M.R.I. machines to products that aid cellular technology research

- The exit from health care mirrors a similar move by Siemens AG, the German industrial giant that’s dramatically simplified its conglomerate structure in recent years

- The Munich-based manufacturer, which competes with GE in areas such as power-generation and medical scanners, sold shares in its Healthineers subsidiary in March, marking the country’s second-biggest initial public offering in almost two decades.

- Baker Hughes General Electric

- GE plans to fully separate its 62.5% interest in BHGE in an orderly manner over the next two to three years

- The exit from the Baker Hughes stake — to occur over the next two to three years — will end GE’s brief, rocky tenure in the oil and gas market.

- GE began an aggressive expansion of its crude operations in 2007 with the $1.9 billion acquisition of equipment-maker Vetco Gray, building on a small set of assets. Over the next seven years, GE shelled out more than $10 billion on additional deals, buying companies such as Wellstream and Dresser.

- Just as GE Oil & Gas was becoming one of the company’s most prominent businesses, the market collapsed. The price of crude plummeted more than 60 percent over 2014 and 2015. With demand down sharply, the division has weighed on GE’s financial results.

- GE Capital

- GE continues to work to make GE Capital smaller and more focused on supporting its core industrial

businesses - The company intends to materially shrink the balance sheet of GE Capital targeting sales

of $25 billion in energy and industrial finance assets by 2020 - The company is assuming an

approximately $3 billion capital contribution to GE Capital in 2019 - GE is actively exploring options to reduce its insurance exposure

- GE continues to work to make GE Capital smaller and more focused on supporting its core industrial

Our Thoughts on GE Healthcare Spin-off

GE Healthcare will be an interesting company with low-to-mid single digit revenue growth and expanding margins in a defensive industry, an appealing proposition given we are in the late innings of economic expansion. In 2017, GE Healthcare generated $19BN of revenue and $4.3BN of EBITDA. Siemens subsidiary, Healthineers, appears to be a good comparable. Thermo Fisher (EV/ TTM EBITDA: 19.3x, EV/TTM Revenue: 4.7x) and Agilent (EV/ TTM EBITDA: 16.3x, EV/TTM Revenue: 4.0x) are also decent comps although they aren’t as oriented towards large capital goods. Assuming GE Healthcare can trade at 15.0x EBITDA implies an enterprise value of $64.5BN (Taking the low end of the TMO/A valuation range implies implies a GE Healthcare enterprise value of $64.5BN (33% of GE’s current total).

Given this transaction isn’t going to happen for 12 to 18 months, there is plenty of time to do additional work.

Resources from GE

Press Release (June 26, 2018)

Transaction Slide Deck (June 26, 2018)

No Form 10 Available

Other Resources

Motley Fool – GE Stock Could Double Investors’ Money (August 20, 2018)

Seeking Alpha – GE: The Healthcare Unit, By The Numbers (July 13, 2018)

WSJ – GE Narrows Focus to Power, Aviation in Latest Revamp (June 26, 2018)

Bloomberg – GE Exits Health, Oil as CEO Shrinks Onetime Titan to Save It (June 26, 2018)

Leave A Comment