Glaxo / Pfizer to Create Consumer Health Juggernaut

On December 19, 2018, GlaxoSmithKline (GSK) and Pfizer (PFE) announced that they would be merging their consumer health businesses into a joint venture. The joint venture is expected to close in the second half of 2019.

Within three years of closing, the joint venture will be spun off into a separate public company. The joint venture will have sales of $12.7BN. GSK will have a 68% controlling equity stake while PFE will own the remaining 32%. The combination will bring together a large category of consumer health brands, including GSK’s Sensodyne, Voltaren and Panadol and Pfizer’s Advil, Centrum, and Caltrate.

The Joint Venture will be the global leader in OTC products with a market share of 7.3% ahead of its nearest competitor at 4.1%.

Source: GSK Slide Deck

The company will be the global leader in OTC products with a market share of 7.3% ahead of all other competitors (Bayer and Johnson & Johnson are the largest) and have number 1 or 2 market share positions in all key geographies, including the US and China.

Pfizer intended to sell its consumer business, but was unable to agree on price with a number of suitors (including GSK). This announcement is a bigger deal for GSK as its consumer healthcare business makes up ~26% of revenue while it only makes up ~7% at PFE.

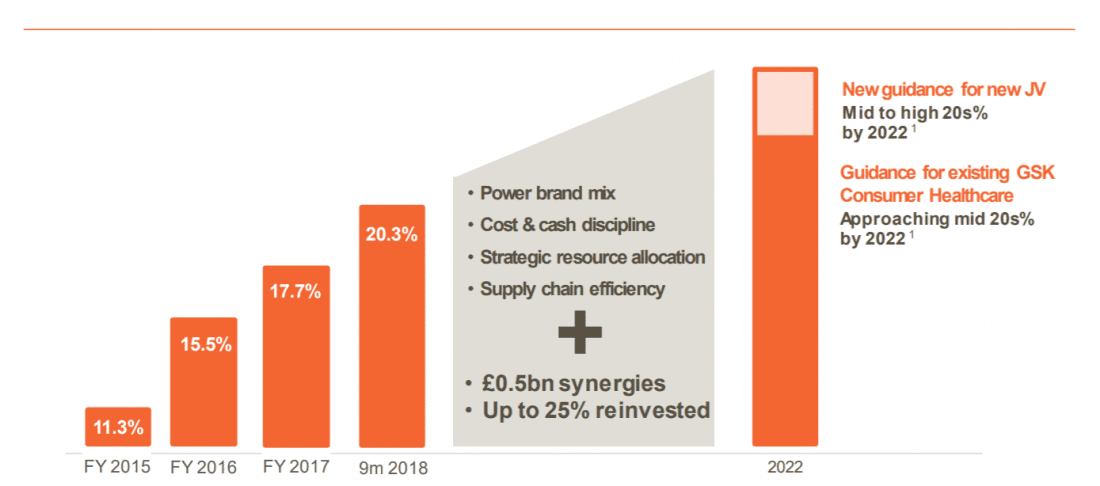

GSK believes the JV’s industry leading scale will enable it to synergies which will drive margin expansion as shown below.

Source: GSK Slide Deck

This company (once it’s public) will be a force to be reckoned with. However, it won’t be actionable for up to 4 years!

Company Resources

Healthcare JV Slide Deck – December 19, 2018

Presentation Transcript – December 19, 2018

Other Resources

WSJ: Pfizer, Glaxo to Create Over-the-Counter Drug Giant – December 19, 2018

Fierce Pharma: GSK, Pfizer go for Radical Makeovers with Giant Consumer Combo Destined for Spinoff – December 19, 2018

Leave A Comment