Initial Thoughts on Sandoz

September 25, 2023

On October 4, 2023, Novartis will spin-off Sandoz, its generics and biosimilars business.

Let’s start with the basics.

NVS shareholders will receive 1 share of SDZ for every 5 shares of NVS.

Why is NVS spinning off SDZ?

NVS included all the boilerplate reasons for the spin-off including:

- Enhanced strategic and management focus.

- Ability to pursue independent growth strategies

- More efficient allocation of capital

- Clearer alignment of incentives with performance objectives

- Distinct investment thesis.

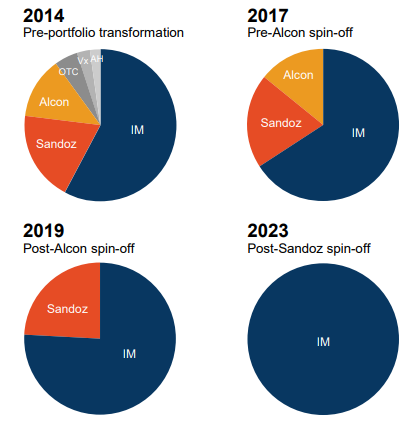

But if you cut through the jargon, this is Novartis’ final step to complete its transformation from a diversified healthcare company to a pure play innovative health company:

Further, Sandoz, which focuses on generic drugs, has been a drag on growth and margins.

Nonetheless, Sandoz has a high quality business that is attractively positioned.

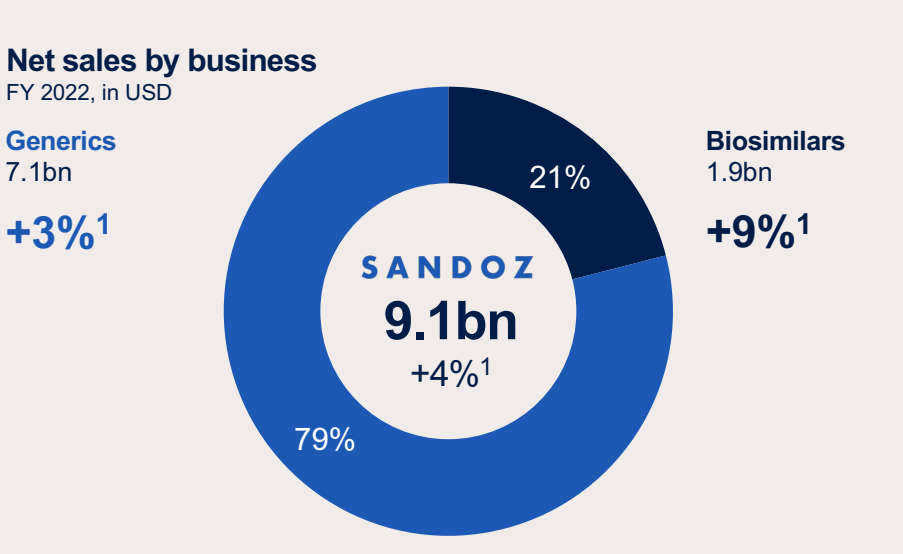

Last year, it generated $1.9BN of EBITDA and $9.1BN of Revenue.

Sales are diversified by geography:

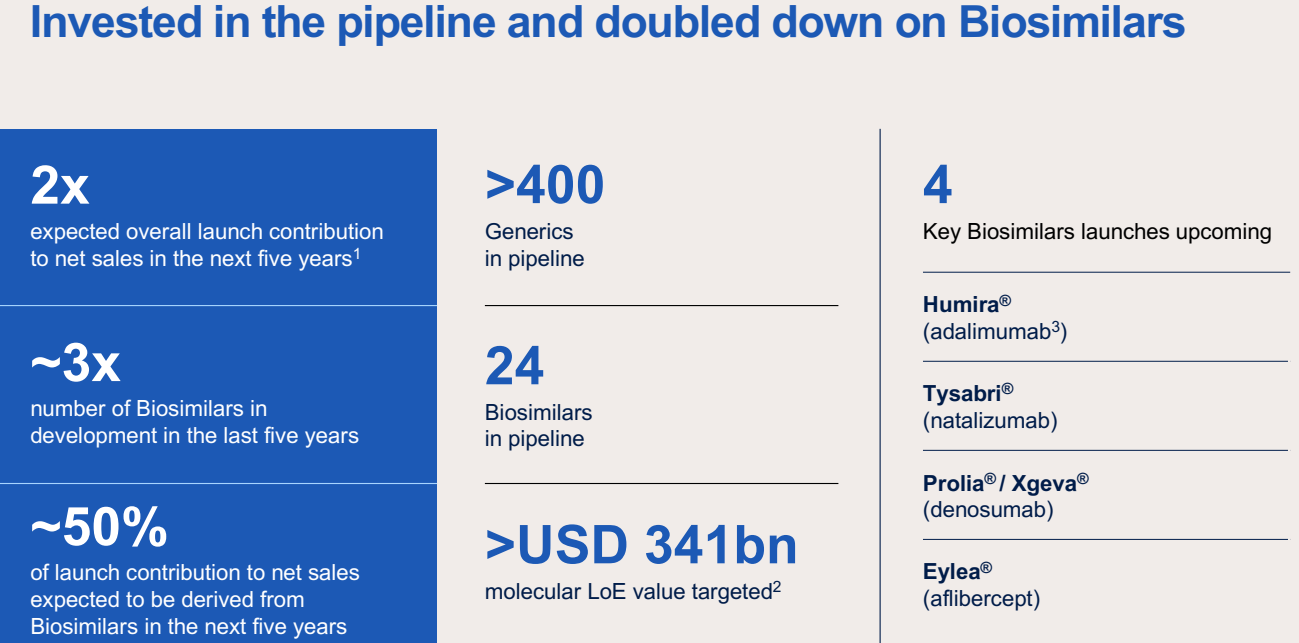

A key focus for Sandoz is biosimilars.

A biosimilar is a little like a generic version of a biologic drug, but there are differences. For example, unlike a generic drug, a biosimilar is not an exact copy of its brand name drug. However, they are tested and compared to brand name drugs.

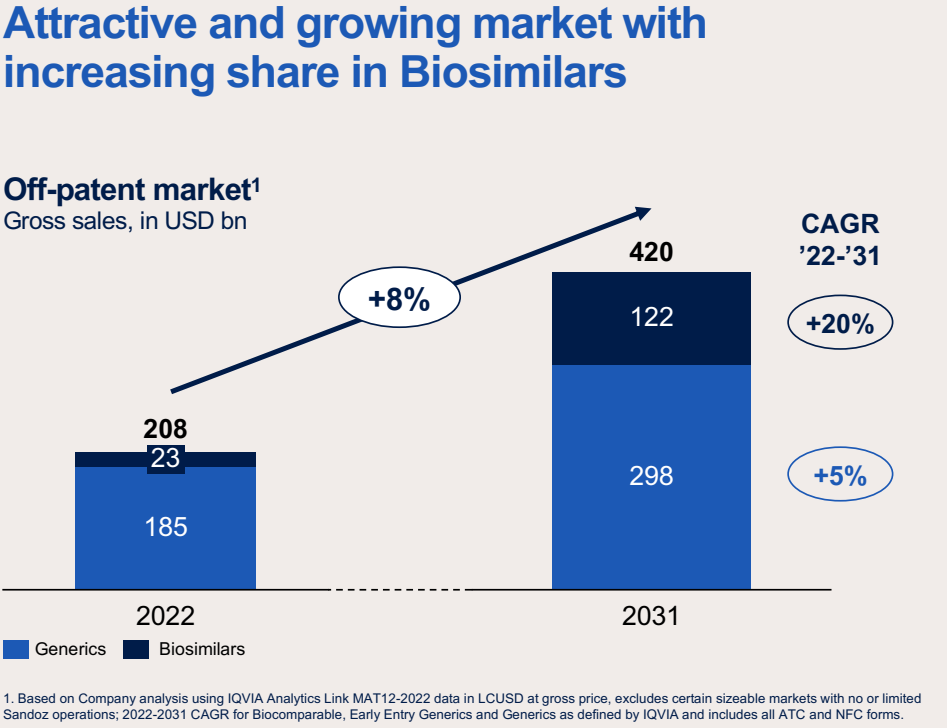

Management believes the biosimilar market will grow rapidly:

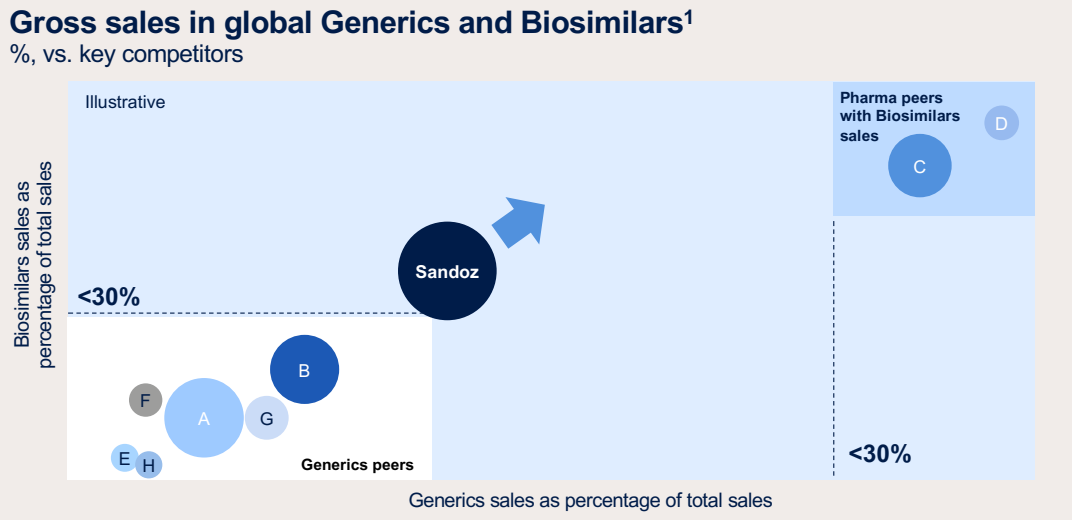

And that $SDZ is well positioned to benefit from that growth:

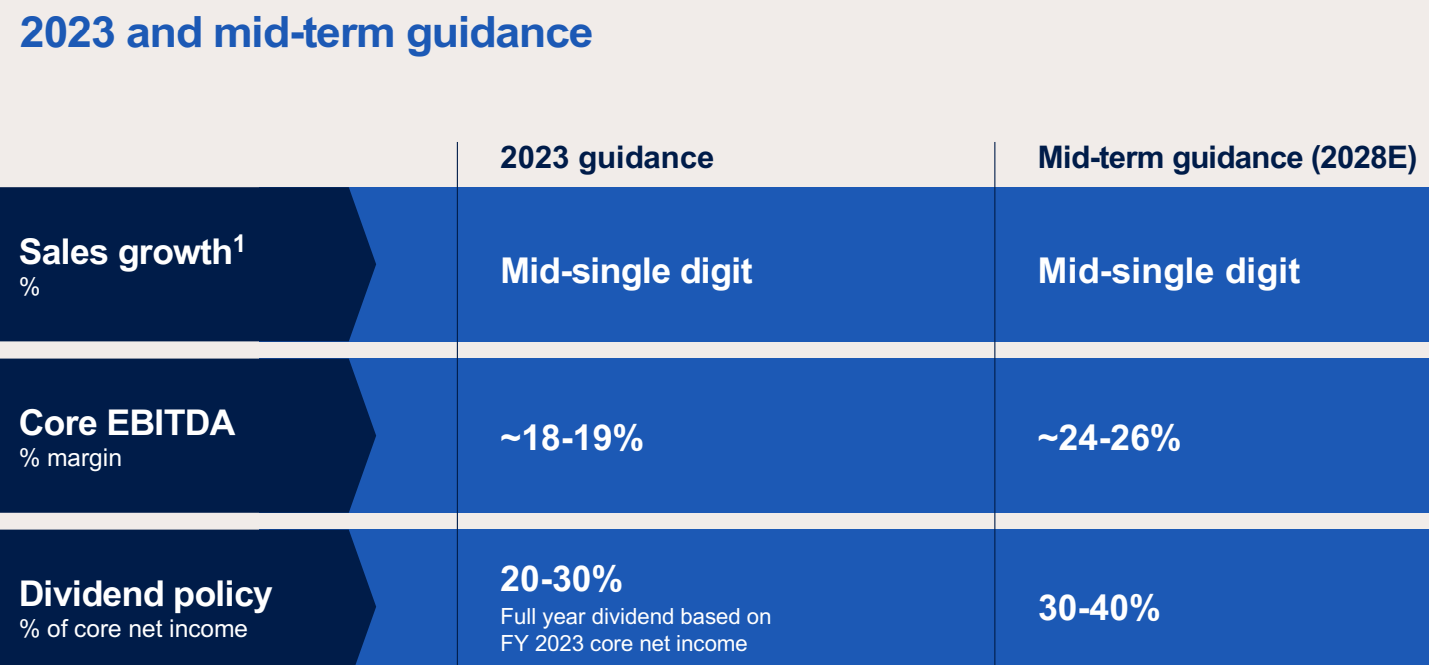

Management expects mid-single digit sales growth through 2023. It expects EBITDA margins to increased from ~18.5% to ~25%.

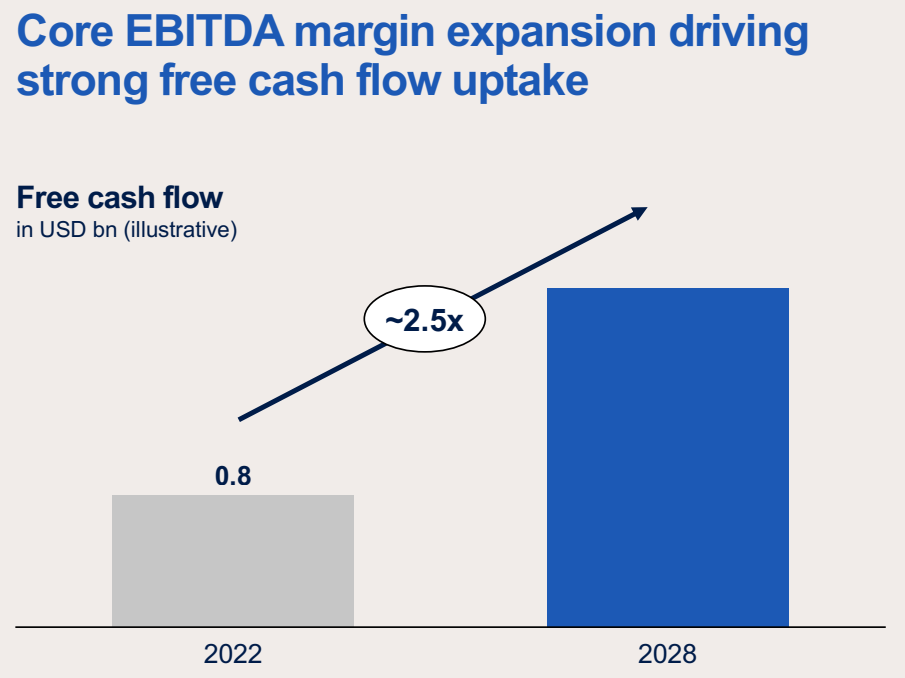

Management believes EBITDA margin expansion will drive strong free cash flow growth:

Sandoz will have ~$3BN of net debt (Net debt/EBITDA multiple of 1.7x) which seems reasonable.

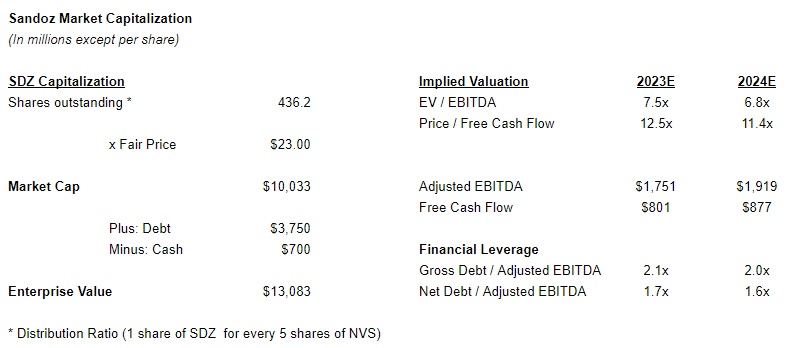

NVS will distribute 1 share of SDZ for every 5 shares of NVS.

What is the stock worth?

The best comp on the low end is Viatris (VTRS), the former Mylan business which merged with Pfizer’s generics business.

It trades at 5.7x forward EBITDA.

At that valuation, SDZ would be worth $16 per share.

But that probably isn’t the best comp as VTRS sold off its biosimilar business, has more debt, and lower expected growth.

Another group of potential comps would be PFE, AMGN, ROG, BMY, and PFE who all have modest revenue growth outlooks going forward.

They trade at 8.6x forward EBITDA.

At that multiple, Sandoz is worth $27.

Where do I come out?

SDZ is probably worth more than VTRS but less than its large cap pharma peers.

A 7.5x EBITDA and 12.5x FCF seems reasonable.

At that valuation, Sandoz is worth $23 per share.

Here’s additional info:

Prospectus:

https://www.sandoz.com/sites/sandoz_com/files/Sandoz-Group-AG-Prospectus-2023-08-17.pdf

Slide Deck:

https://www.novartis.com/sites/novartis_com/files/2023-sandoz-capital-markets-day-presentation.pdf

Leave A Comment