International Paper Spin-off Notes

January 7, 2020 Update

- International Paper announced that it entered into an agreement to divest its 90.38% shareholding interest in Olmuksan International Paper to Mondi Group for roughly €66 million ($81 million). Per the agreement, the company will sell its corrugated packaging facilities in Turkey.

- The Olmuksan corrugated packaging business generates annual revenues of approximately €150 million ($185 million). Olmuksan International Paper operates three corrugated facilities in Turkey and is focused on serving customers in the food, agriculture, heavy-duty and industrial sectors. The deal is expected to close in the first half of the current year.

- Last October, the company announced its decision to sell the corrugated packaging business in Turkey due to bleak economic conditions in the country. The move supports International Paper’s strategy to serve markets from an advantageous position. The company is focused on expanding corrugated packaging business in the EMEA region over the long haul.

- The sale price to revenue multiple was 0.44x versus the entire company’s EV/Sales multiple of 1.5x.

December 3, 2020 Update

- International Paper (IP) announced that it will spin off its Printing Paper business in order to focus the company on Industrial Packaging.

- Spin-off presentation.

- This is extensive slide deck which reviews IP’s different businesses.

- Spin-off:

- Upon completion of the spin-off, Jean-Michel Ribiéras, currently senior vice president, Industrial Packaging, will become the chief executive officer of the new company.

- John V. Sims, currently senior vice president, Corporate Development, will serve as SpinCo’s chief financial officer. The remainder of the SpinCo leadership team and board of directors will be announced over the next several months.

- As a standalone entity, in addition to a portfolio of leading brands, SpinCo will have approximately:

- $4 billion in sales

- 8 mills with 2.9 million metric tons of annual capacity and 0.4 million metric tons of coated paperboard capacity

- SpinCo is not expected to initially pay a dividend and its dividend policy will be determined by its board of directors following the completion of the transaction.

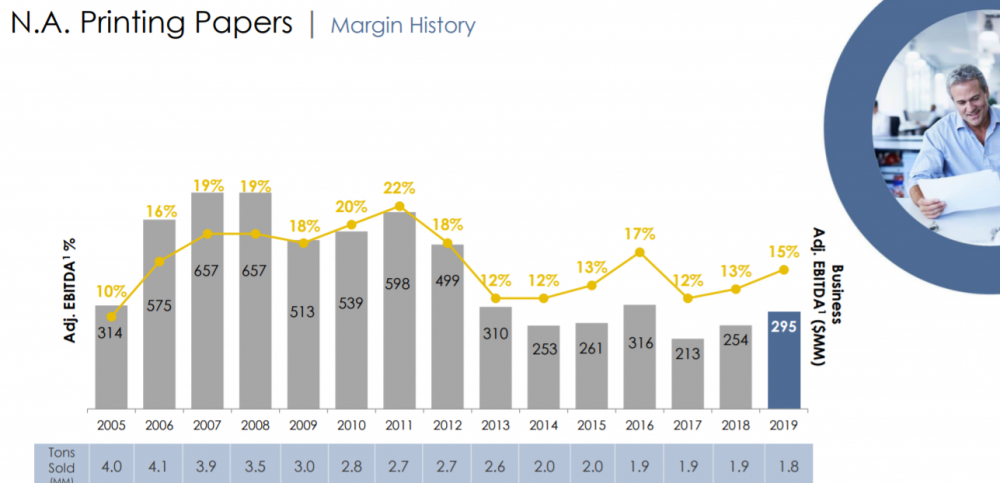

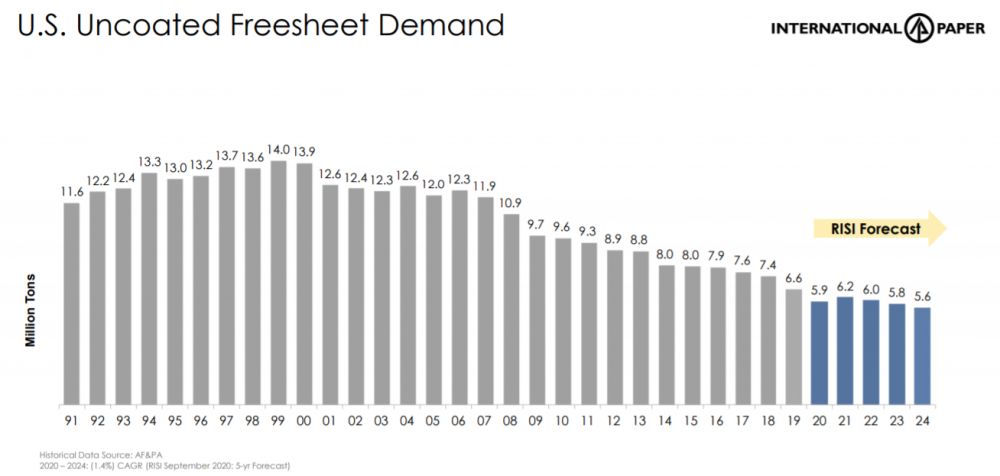

- The spin-off will be a company to avoid or sell right when you receive it because:

- 1) The business is in secular decline. People are printing less and less.

-

- 2) IP will hold 19.9% of shares of the spin-off to sell at a later date. So there will be an overhang on the stock.

- RemainCo:

- International Paper intends to accelerate profitable growth in Industrial Packaging in North America and Europe, the Middle East and Africa and improve the returns of its Global Cellulose Fibers business. International Paper will continue its joint venture with Ilim Holdings in Russia.

- The company intends to reduce its cost structure and accelerate earnings. International Paper will be a streamlined, more-agile organization and expects to generate an additional $350 – $400 million of annual earnings by the end of 2023, including $50 – $100 million in annual incremental earnings growth and $300 million in structural cost reductions. International Paper remains committed to its current capital allocation framework, which is the foundation for driving shareowner value.

- Following the completion of the transaction, International Paper expects to have approximately:

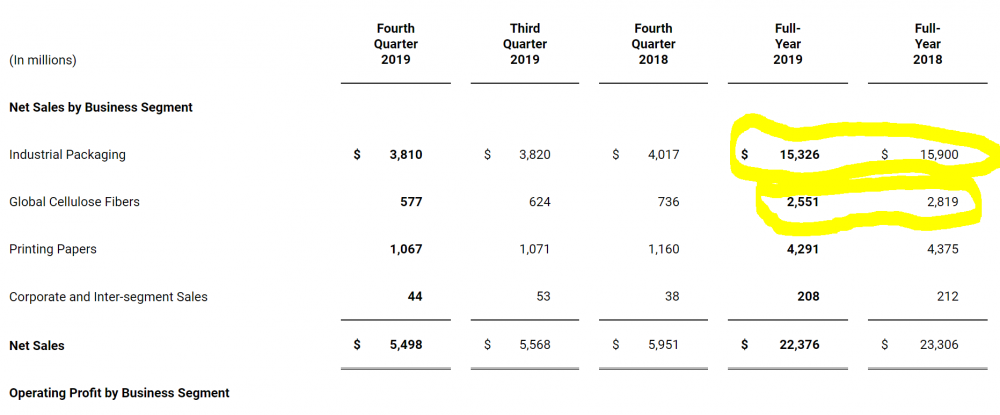

- $17 billion in sales, 85% in Industrial Packaging and 15% in Global Cellulose Fibers

- 20,000 customers

- 20 containerboard mills with 14.5 million tons of annual capacity

- 8 pulp mills with 3.2 million metric tons of annual capacity

- 220 converting facilities

- 350 packaging designers

- 3,500 packaging formers at customer locations

- Consistent with International Paper’s longstanding capital allocation policy of paying a competitive and sustainable dividend at 40 to 50% of free cash flow, International Paper expects to reduce its current dividend by 15 to 20% in proportion to the cash generated by SpinCo upon completion of the spin-off.

- Annual dividend is currently $2.05. Assuming a 20% cut, the new annual dividend will be $1.64. At the current price, the company is generating a yield of 3.3%.

- The RemainCo could be interesting, however, it will be a bit of a turnaround as sales for both industrial packaging and global cellulose fibers declined in 2019.

- Timing: expected to be complete by late Q3 2021.

- Expected to be tax free.

- The transaction will be implemented through the distribution of SpinCo shares to International Paper shareowners. International Paper will retain up to 19.99% of the shares of SpinCo at the time of the separation, with the intent to monetize and provide additional proceeds to International Paper.

Leave A Comment