Kellogg Spin-off Notes

November 2, 2023 Update

Merion Capital likes KLG

August 13, 2023 Update

On August 9th Kellenova hosted an investor day for access to the slides go here.

June 23, 2023 Update

From the ISI Consumer Conference in June 2023:

May 16, 2023 Update

Slide from the Q1 2023 slide deck:

June 24, 2022 Update

On June 21, 2022, Kellogg (K), announced that it would be breaking up into three separate companies.

Global Snacking Co

- 2021 sales and EBITDA of $11.4BN (81% of total) and $2.0BN (87% of total), respectively.

- Nearly 60% of its net sales come from global snacks, participating in growing categories and led by iconic, world-class brands including Pringles, Cheez-It, Pop-Tarts, Kellogg’s Rice Krispies Treats, Nutri-Grain, and RXBAR, among others.

- Less than a quarter of its net sales come from cereal in international markets, featuring world-class brands such as Kellogg’s, Frosties / Zucaritas, Special K, Tresor / Krave, Coco-Pops, and Crunchy Nut, among others. By remaining with Global Snacking Co., this international cereal business provides scale, continuity, and growth for the company’s Europe, Latin America, and AMEA Regions.

- About 10% of its net sales come from noodles in Africa, a rapidly expanding business.

- The remainder, less than 10% of its net sales, comes from frozen breakfast and the world-class Eggo brand.

- Geographically, North America will represent just under half of net sales, emerging markets about 30% of net sales, and developed international markets more than 20% of net sales.

- Outlook:

- Outlook is to grow faster than K currently grows. Consensus expects K to grow sales at a 2% CAGR.

- Hope is to expand margins through operating leverage, cost optimization, and more scale in emerging markets.

North America Cereal Co.

- 2021 sales and EBITDA of $2.4BN (17% of total) and $250MM (11% of total), respectively.

- The business is focused on ready-to-eat cereal in the U.S., Canada, and Caribbean.

- North America Cereal Co.’s portfolio is comprised of iconic, world-class brands such as Kellogg’s, Frosted Flakes, Froot Loops, Mini-Wheats, Special K, Raisin Bran, Rice Krispies, Corn Flakes, Kashi and Bear Naked.

- Outlook:

- Near-term, restore inventory and profit margins.

- Goal is stabilize revenue and expanding margins to drive earnings and cash flow.

- This will be the “value” business.

Plant Co.

- 2021 sales and EBITDA of $340MM (2% of total) and $50MM (2% of total), respectively.

- Anchored by the leading MorningStar Farms brand, Plant Co. will be a profitable, pure-play, plant-based foods company. This business offers a full portfolio of plant-based offerings across multiple product segments and eating occasions. Kellogg has grown MorningStar Farms steadily since its acquisition over 20 years ago, and the brand now has the highest share and household penetration in the frozen vegetarian/vegan category.

- Outlook:

- Increase penetration in the U.S. and eventually expand internationally.

- Expect growth to accelerate.

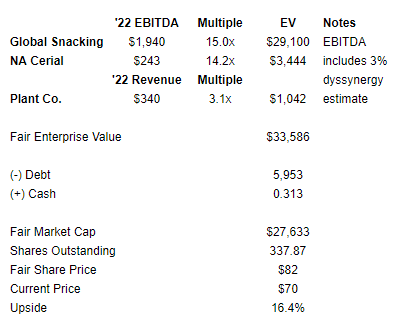

Valuation / Outlook

- Currently, K trades at 14x forward EBITDA and 15x forward earnings. Not expensive but not dirt cheap either (META is trading at 14x forward earnings!)

- Management would like “Global Snack Co” to re-rate to trade inline with MDLZ at 17.1x ’22 EBITDA. But it will probably trade at a discount (I estimate 15x).

- RemainCo wants to be viewed a “snack pure play” like MDLZ but has ~25% exposure to international cereal.

- At 15x, RemainCo is worth $29.1BN.

- “NA Cereal”

- It is the “value” play.

- It’s comps, POST and GIS trade at 14.2x and 14.3x ’22 EBITDA.

- At 14.2x EBITDA, it’s worth $3.4BN.

- “Plant Co” a profitable, pure-play, plant-based foods company anchored by MorningStar Farms.

- Its comps don’t generate EBITDA so we have to use revenue multiples OTLY trades at 2.2x ’22 revenue and BYND trades at 4.0x revenue.

- At 3.1x, “Plant Co” is worth $1BN.

Putting it all together, K is worth $82/share on a SOTP basis. Some upside from its current price but not enough to get me excited.

How to play it? It’s not actionable today (in my opinion), but there are two potential future opportunities:

1) If K sells off, LEAPs could be an attractive way to gain exposure. Volatility is low so LEAPs are inexpensive.

2) I expect both spin-offs to be sold indiscriminately as large cap PMs will have no interest in owning the small cap spin-offs. This could create an opportunity.

Additional Details

- Transaction will be tax free

- Expected to be complete by year end 2023

Kellogg Spin-off Slide Deck – June 21, 2022

Kellogg Spin-off Conference Call Transcript – June 21, 2022

Thank you. This is great info an analysis. A recent update is that the Plant Based business will no longer be spun off.

https://www.fool.com/investing/2023/08/30/kelloggs-good-companybad-company-spin-off-is-tough/