Skip to content

Luby’s Inc (LUB) NotesRich Howe2020-10-22T08:59:47-04:00

Luby’s Inc (LUB) Notes

- Luby’s is a Texas headquartered cafeteria style restaurant chain.

- Seeking Alpha articles on the situation:

- On September 8, 2020, the company announced that it board of directors adopted a plan to intended to liquidate the company.

- The company estimates that distributions to shareholders would total $92MM to $123MM or $3.00 to $4.00 per share.

- Stock price is currently $2.76. So at midpoint, there is 27% upside, but liquidations usually take ~3 years.

- What are assets?

- From Schedule 14A: “As of August 26, 2020, we owned 69 properties, consisting of the underlying land and buildings thereon, most of which operate, or have operated in the past, Luby’s Cafeterias and/or Fuddruckers operations. The estimated value of those properties as of August 26, 2020, was $191.5 million.”

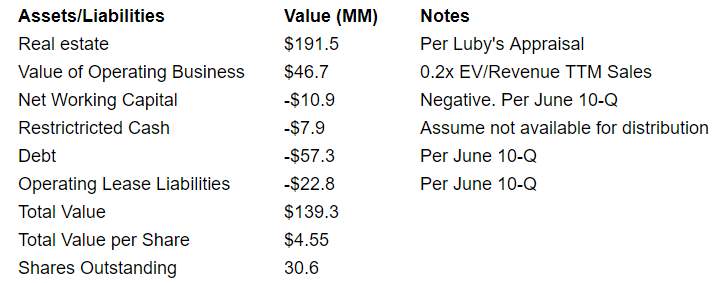

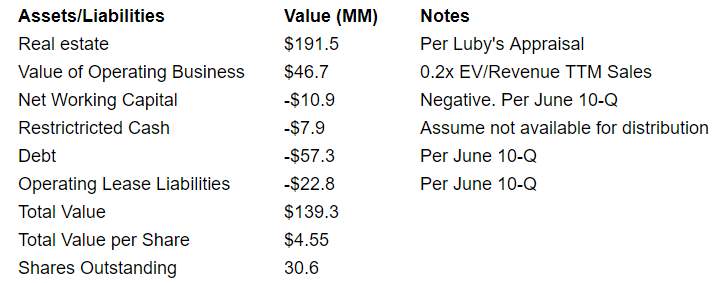

- Adding up assets and liabilities I get a value of $139.3MM or $4.55 per share.

- Importantly, this doesn’t take into account:

- Cash that will be burned or earned during distribution.

- Any wind down costs. Riviera Resources estimates winddown costs of ~$32MM so they can be significant.

- At first blush, management’s estimate of $3 to $4 in ultimate distributions sounds reasonable.

- However, its going to take 2-3 years at a minimum to complete the liquidation so I don’t think it’s worth investing yet.

- Recent reports indicate the CEO (Christopher Pappas) may make a bid for the entire company. This would be a positive but is hard to handicap.

Share This Story, Choose Your Platform!

Page load link

Leave A Comment