Naspers Spin-off Quick Summary

Overview

On March 25, 2019 Naspers Limited (NPN:SJ/NSPNY) announced that it intends to spin off its 31% stake in Tencent Limited (HKG:0700) along with other internet assets. The transaction is expected to take place no earlier than the second half of 2019. It is not yet clear if the spin-off will be taxable.

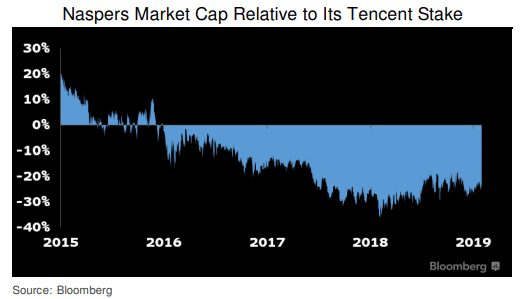

Naspers acquired the Tencent stake in 2001 for $32MN USD, which now has a market value of about $144BN USD. Naspers currently has a market cap of $106BN, representing about a 27% discount to its stake in Tencent. Management hopes the spin-off will shrink the discount.

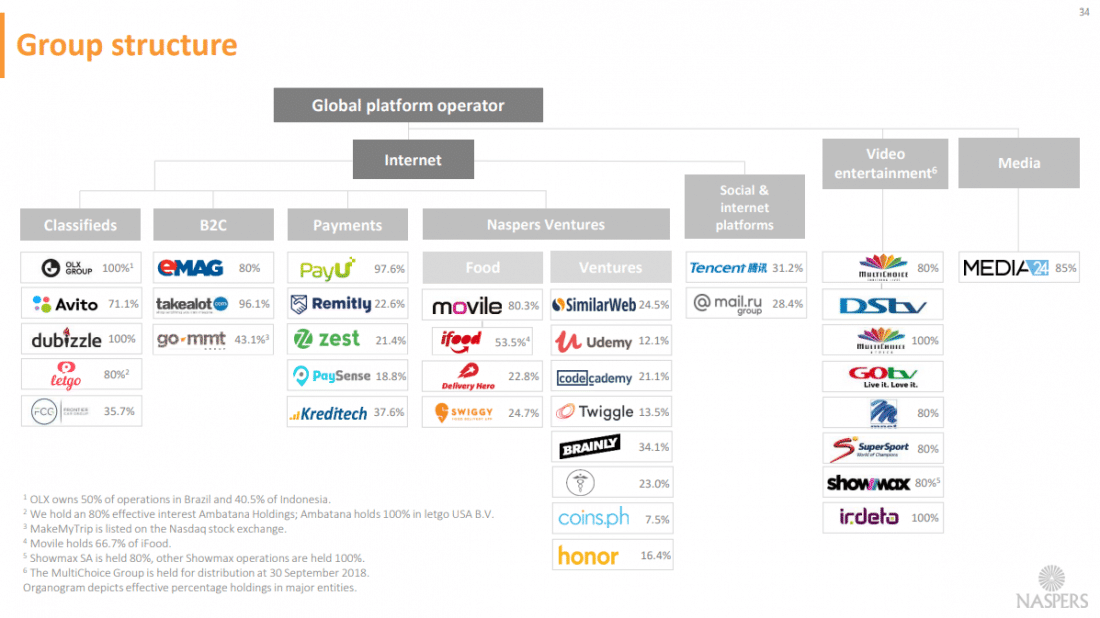

Naspers currently holds ownership of a portfolio of internet retail, travel, payments, food delivery, video entertainment, and media businesses. Brands include investments in Letgo, DeliveryHero, Udemy, Codecademy, MultiChoice, and of course Tencent, among others. The spin-off will include its Tencent stake as well as all internet assets outside of South Africa, leaving significant assets like Takealot and Media24.

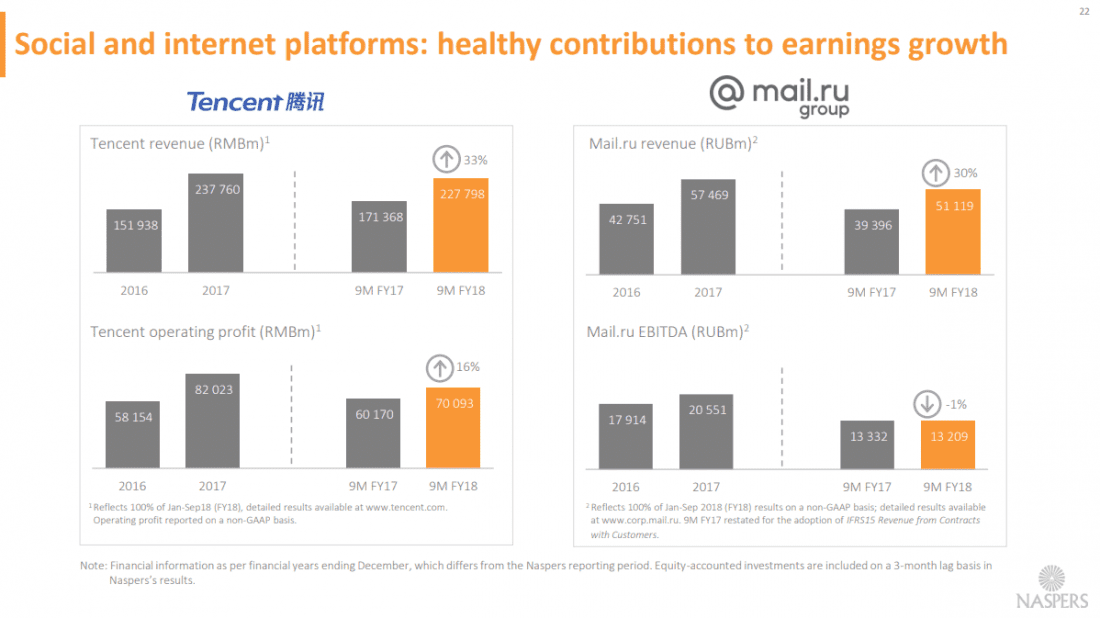

Tencent, based in China, operates a portfolio of social networks, payments, entertainment, information, utilities, platform, and AI businesses. Most notable is WeChat and its surrounding payments platform. Tencent currently has a market value of $466BN USD. Naspers is able to monetize its stake by selling its shares in the market and also by collecting the 0.26% dividend yield.

Background

In the spin-off press release, management noted Naspers’ outsized weighting in the Johannesburg Stock Exchange (JSE) index. Naspers’ stock has seen incredible growth, and its weighting has increased from 5% to 25% over the last 5 years, which has created unique market dynamics. Most significant, the weighting has exceeded most institutional investor’s single stock limits, which has caused forced selling.

The spin-off transaction is expected to help address this market issue and is the next significant action by management to create shareholder value. In order to provide flexibility, shareholders will be given the option to take shares in the new entity or more shares in Naspers, up to yet to be specified limits.

At 25% of the market value of the JSE, Naspers also seems to have outgrown its exchange. By listing the new entity on the Euronext Amsterdam, Naspers appears to be looking to attract international investors. The move will give Naspers a much wider set of potential shareholders, with funds able to own European assets dwarfing those active in South Africa. There will also be a secondary listing on the JSE.

Naspers CEO, Bob van Dijk, said:

“Forming and listing a new, global consumer internet group on Euronext Amsterdam is a significant step for Naspers. It will provide a strong platform to attract incremental investor capital, which is well-aligned to our growth goals. The listing will present an appealing new opportunity for international tech investors to have access to our unique portfolio of international internet assets. It will comprise some of the world’s leading and fastest-growing internet companies that are playing an increasingly important role in helping people improve their daily lives in some of the most exciting markets on the planet. As well as opening up investment to a broader category of investors, the listing aims to reduce our weighting on the Johannesburg Stock Exchange, which we believe will help us maximise shareholder value over time.”

One issue may be that Naspers will continue to own 75% of the new yet to be named entity while only 25% of shares will be floating.

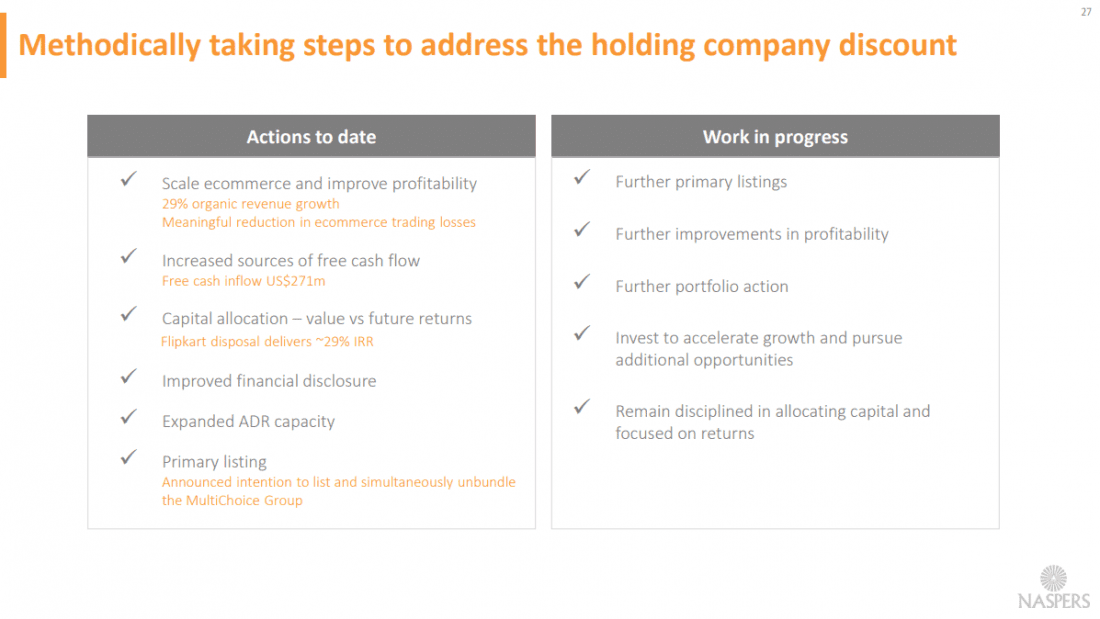

Analysts believe Naspers will continue to invest in additional start ups in order to find “the new Tencent.” For example, in March 2018 Naspers sold a 2% stake in Tencent for $9.8B, but did not return capital to shareholders. Instead, the company is continuing to lock up cash in an illiquid venture capital fund. With the amount of dry powder held by private equity funds right now, it seems investors are worried about Naspers’ ability to identify enough attractive opportunities to justify not returning capital to shareholders. Right now, the discount implies reinvestment of Tencent proceeds will be invested at a loss.

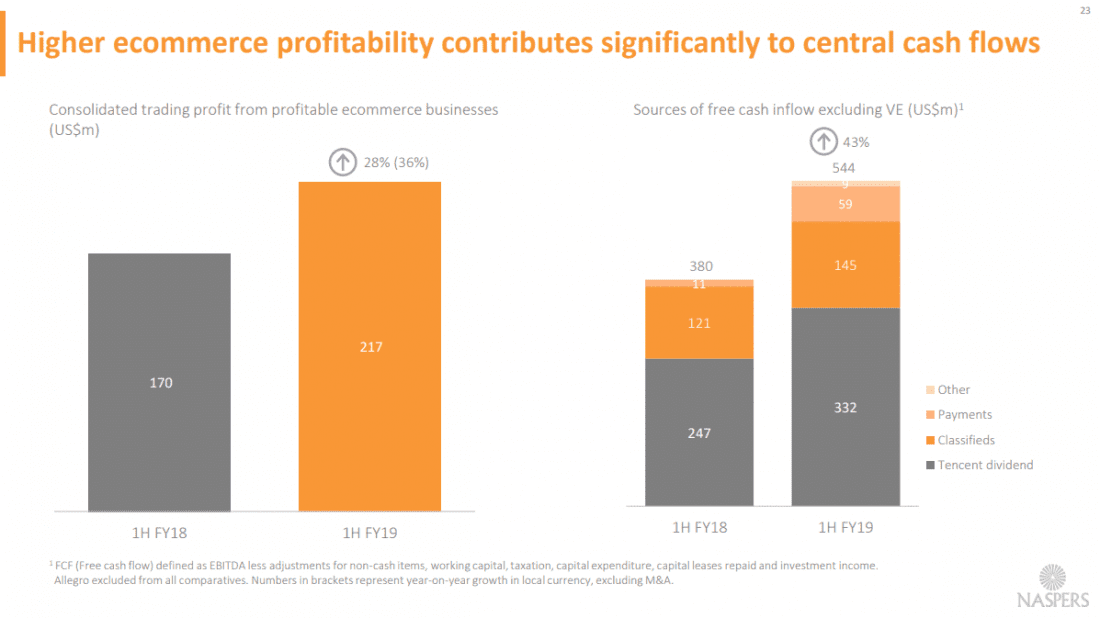

However, it does seem as though Naspers is trying to be more friendly to shareholders. Recently, Naspers has increased the capacity of Naspers’ US ADS programme, trimmed its stake in Tencent, and exited several businesses. The company is also attempting to drive growth across its core internet businesses while turning its online classifieds business and several of its other early-stage investments to profitability. But, in order to close the valuation discount, management must prove it can add value by either spending its cash pile from divestments on attractive new ventures or by making investor-welcomed share repurchases or special dividends.

Lastly, on March 4, 2019, Naspers completed the spin-off MultiChoice Group Limited (MSCA) on the JSE to existing Naspers shareholders creating a new entity with an initial market cap $3.5BN USD. Management commented that the transaction was part of their strategy to unlock value.

Overall, it looks like management is making the right actions to finally shrink the significant discount between the market value of its stake in Tencent and its own shares. However, management has not made any commitments to liquidate and redeploy proceeds from the stake, and further has even agreed to refrain from selling additional shares until at least March 2021. If Naspers were to liquidate a significant portion of its shares, it would likely have to sell those shares at a discount. When Naspers sold a 2% stake in March 2018, it had to sell at a 8% discount to where Tencent was trading. As such, some discount for the Tencent shares is warranted. It is also unclear what tax implications could arise when dealing with both South African and Dutch law. RemainCo Naspers or Tencent may be a more straight-forward investment as opposed to the new, complex entity.

Resources from Naspers

Naspers Spin-Off Press Release (Media Statement) – March 25, 2019

Naspers Spin-Off Press Release – March 25, 2019

Naspers Semi-Annual Report Slide Deck – November 30, 2018

MultiChoice Spin-off Press Release (Naspers) – March 4, 2019

Head of Investor Relations – Eoin Ryan – (eoin.ryan@naspers.com +1 347-210-4305)

Other Resources

Seeking Alpha – Unicorns in the Stable – April 25, 2019

Investors to Naspers: Show Us the Tencent Money – Barron’s – March 29, 2019

Naspers plans to spin off its Tencent stake and other holdings – Economist – March 30, 2019

Europe’s Brand New Tech Company Doesn’t Have a Name – Fortune – March 30, 2019

Naspers to Separate Tencent Stake, Web Assets in Dutch Listing – Bloomberg – March 25, 2019

Why there is value in Naspers – NedGroup Investments

The Naspers discount: who’s really to blame? – Sanlam Private Wealth – June 6, 2018

Leave A Comment