Newmark Spin-off Details

On November 30, 2018, BGC Partners (BGC) will distribute 0.4613 shares of Newmark Class A shares for every Class A share of BGC. NMRK originally IPO’d ~15% of its shares in December 2017 at $14/share. It is currently trading at ~$9. First day of trading will be Monday, December 3, 2018. Following the spin-off, NMRK’s float will increase from 23 million shares to 150 million shares.

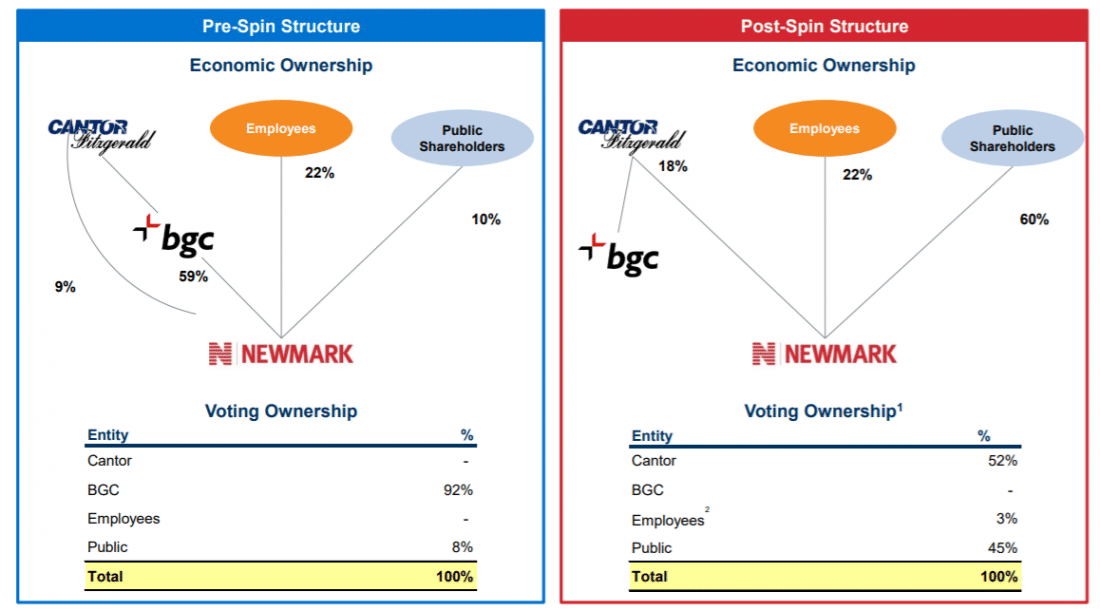

See below for pre-spin and post-spin ownership structure of Newmark.

Source: Newmark Investor Presentation

Importantly, Cantor Fitzgerald will own 52% of the voting shares of NMRK and public shareholders will own 48% of voting shares after the spin-off. As Cantor Fitzgerald will own 18% of NMRK post spin-off, it is incentivized to make decisions that maximize shareholder value. However, it’s important to note that Cantor Fitzgerald has effective control of the company and minority shareholders are basically along for the ride.

There is also the potential for conflicts of interest. For instance, Cantor Fitzgerald was one of the underwriters for Newmark’s IPO. Another example: Newmark and Cantor are partners in real estate joint ventures.

Rationale for the Spin-off

BGC Partners and Newmark note all the typical reasons for the spin-off:

- Enhanced ability to invest in growth

- More flexibility to return capital to shareholders

- Increased liquidity in the stock market

Newmark Business Overview

Newmark is a full service commercial real estate services business. Newmark was founded in 1929 and originally concentrated on New York. In 2011, it was acquired by acquired by BGC.

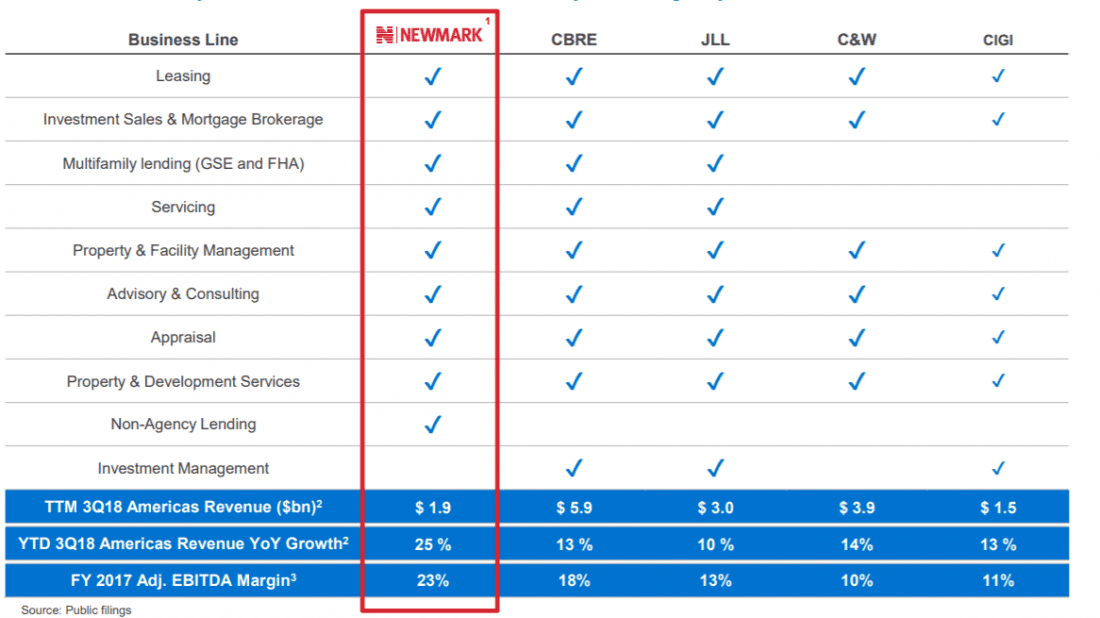

The firm has made numerous acquisitions and as a result, has a broad array of service offerings as shown in the chart below.

Source: Newmark Investor Presentation

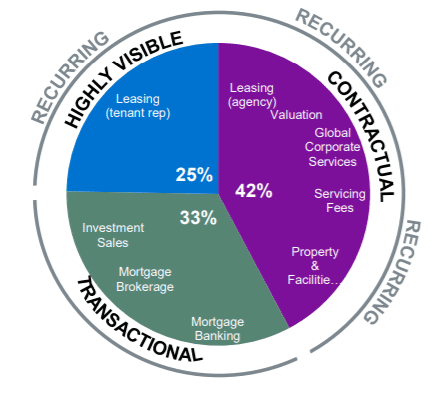

Management views 67% of revenue is recurring (highly visible or contractual) as shown in the chart below.

Source: Newmark Investor Presentation

We don’t completely agree that valuation and global corporate services are 100% recurring, but clearly they are stickier than mortgage banking and investment sales.

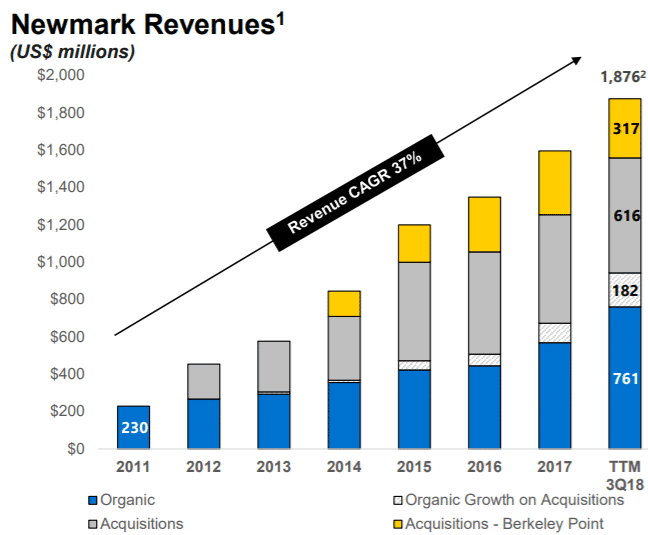

While acquisitions have been a major driver of revenue growth since 2011, organic revenue has grown at a compound annual growth rate of 18% from 2011 to Q3 2018. Newmark plans to continue to grow through acquisition, including outside of North America (it is primarily focused on the United States).

Source: Newmark Investor Presentation

Industry Overview and Competition

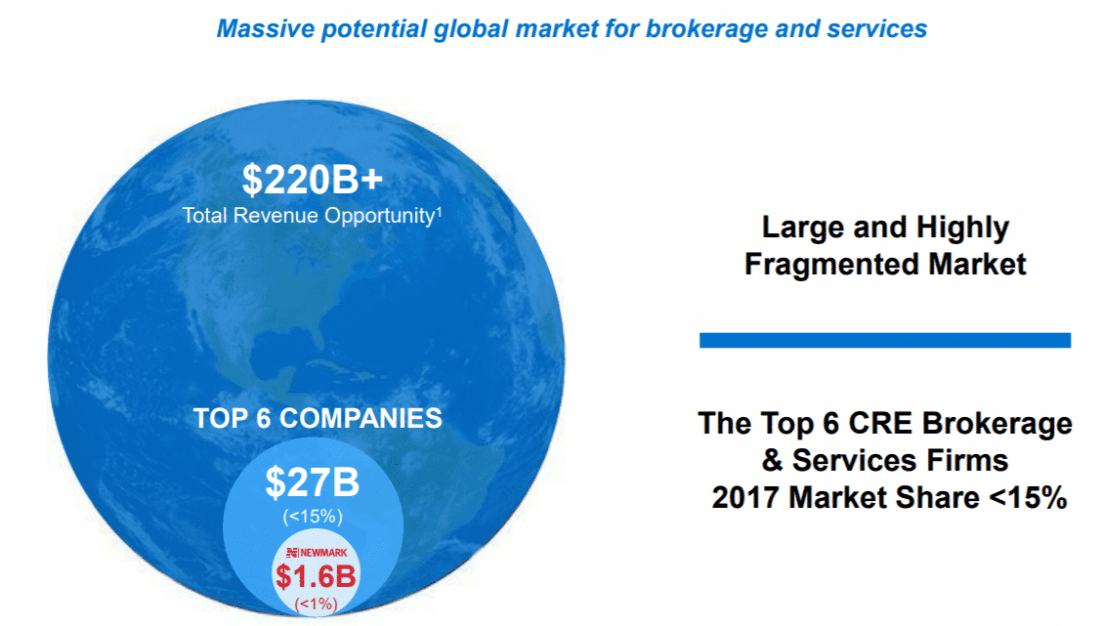

The commercial real estate services industry is a more than a $200 billion global revenue market. A significant portion of the business resides with smaller and regional companies.

Source: Newmark Investor Presentation

As such, the top 6 commercial real estate firms have consolidated the market and are expected to continue to do so.

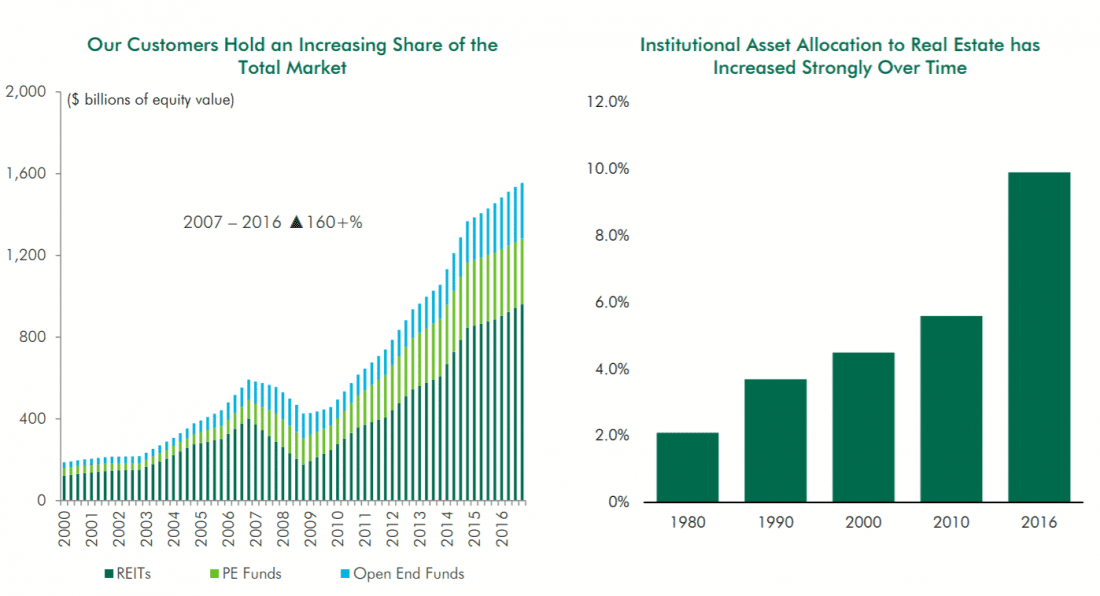

A key driver of demand for the commercial real estate services industry is that institutions are increasing their investment allocation to real estate. These investment institutions are more likely to outsource services than legacy owners.

Source: CBRE Investor Relations Presentation

Newmark’s largest competitors are CBRE Group, Jones Lang LaSalle, Cushman and Wakefield, Colliers International Group, and Savills Studley, Inc. They are all public.

Newmark derives almost all of its revenue from the United States while Newmark’s largest U.S. listed competitors generate ~40% to ~50% of revenue internationally.

Valuation

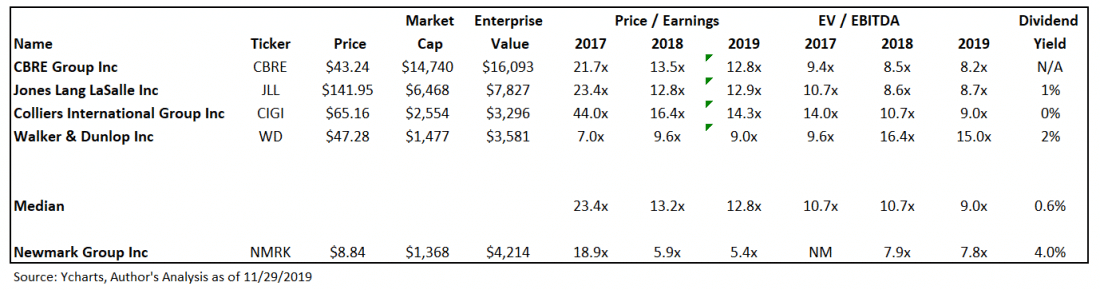

If you run a comp sheet quickly, NMRK looks cheap both on a P/E and EBITDA basis as shown below.

However, there are a couple important factors to note. First, NMRK deserves to trade at a discount as Cantor holds 52% of the voting shares of the company. Second, NMRK is focused on the United States and isn’t as diversified as its competitors. Finally, Newmark’s adjusted EBITDA and adjusted earnings add back a significant portion of non-cash charges related to equity compensation.

Through Q3 of 2018, NMRK has booked $132MM of “net income and grant of exchangeability to limited partnership units.” This is basic equity compensation and it occurs because Newmark is structured as a partnership and employees accept equity as a large portion of their compensation.

Management has guided to 2018 adjusted EBITDA of $528MM (midpoint). If you subtract $176MM ($132MM annualized) of equity compensation, EBIDTA declines to $352MM, and NMRK is trading at 12.0x ‘18 EBITDA not 7.9x.

Given these adjustments, I don’t think NMRK looks particularly cheap versus peers. Further, there will be significant dilution going forward due to significant equity compensation and additional acquisitions.

Resources from Company

NMRK Presentation – November 19, 2018

NMRK 2017 10-K – April 30, 2018

NMRK S-1 – December 12, 2017

Other Resources

Value Investor Club BGCP Write Up – July 16, 2018

Leave A Comment