PDL Spin-off (LENSAR, INC) Notes

9.28.2020 Update

- PDL BioPharma (PDL) is a $365MM market cap healthcare company that manages a portfolio of companies, royalties, and products.

- The company recently approved the spin-off of LENSAR, INC (LNSR).

- Here is the latest information statement (Form 10) for LENSAR.

- LENSAR has a very informative website that I would recommend checking out to learn about the company. Also, the company has a good slide deck.

- In a nutshell, LENSAR designs, develops and markets a laser system for the treatment of cataracts and the management of pre-existing or surgically induced corneal astigmatism.

- The distribution is NOT tax free.This is good from my perspective as it means the company doesn’t have to wait 2 years to sell itself.

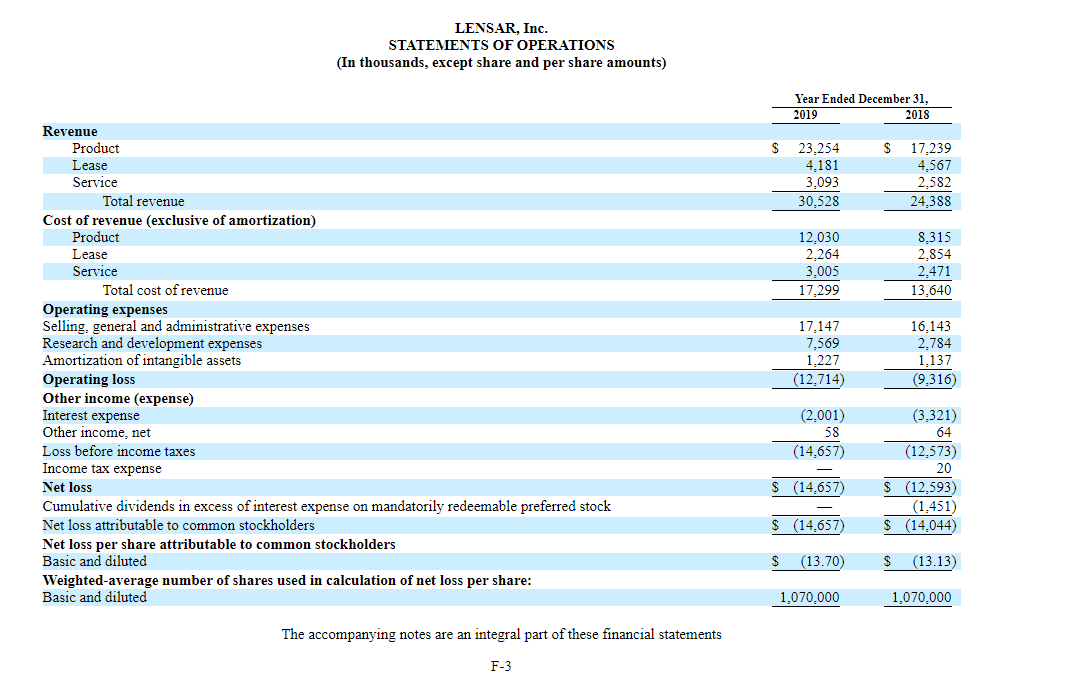

- As shown below, prior to the pandemic, the company had grown revenue at a solid clip. Revenue growth in 2019 was 25%.

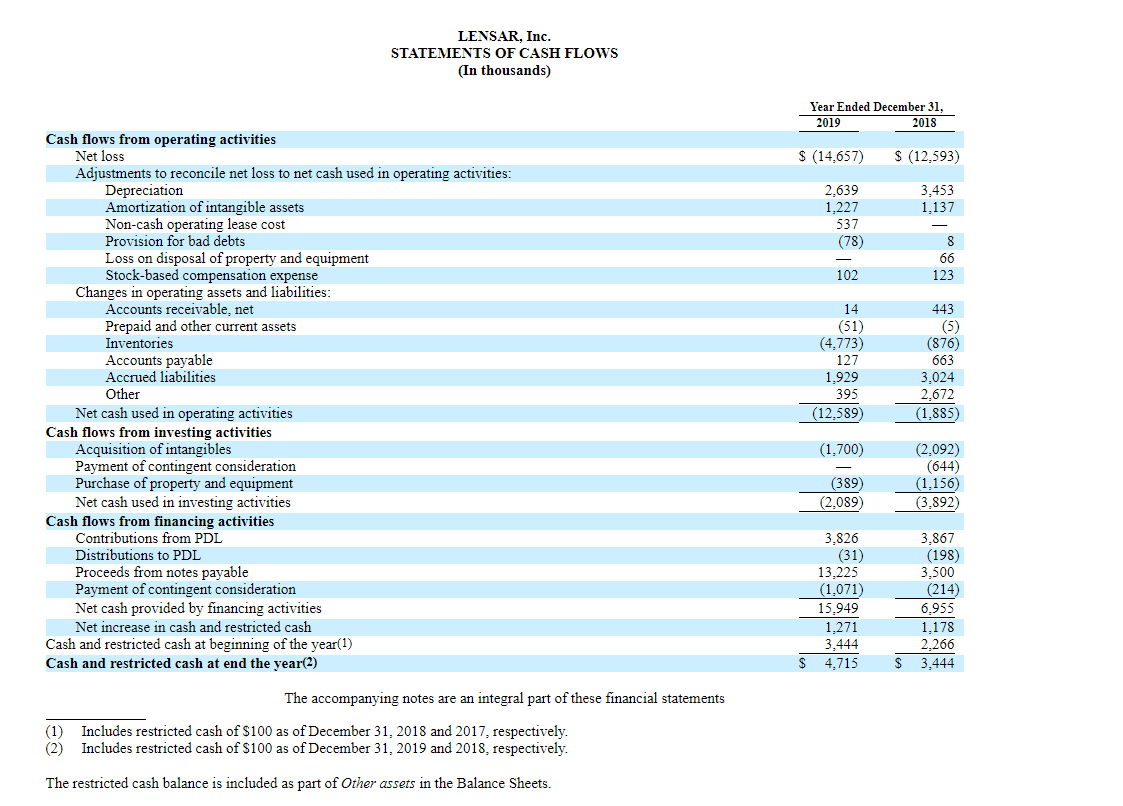

- In 2019, LENSAR burned $12.589MM of cash from operations. In the first 6 months of 2020, LENSAR lost $12.6MM from operations or $25.2MM annualized. However, depreciation and amortization for the year will be ~$4MM, thus, the company is on pace to lose ~$21MM annually on a cash basis going forward, assuming no rebound in procedures (conservative).

- In its Form 10, LENSAR stated that its liquidity is sufficient to support its operations at least through June 20, 2021. Given that LENSAR will be capitalized with $41.7MM of cash and no debt, I believe the business should be funded for at least two years.

- LENSAR hosted a webcast in which it discussed its business. The replay is available here.

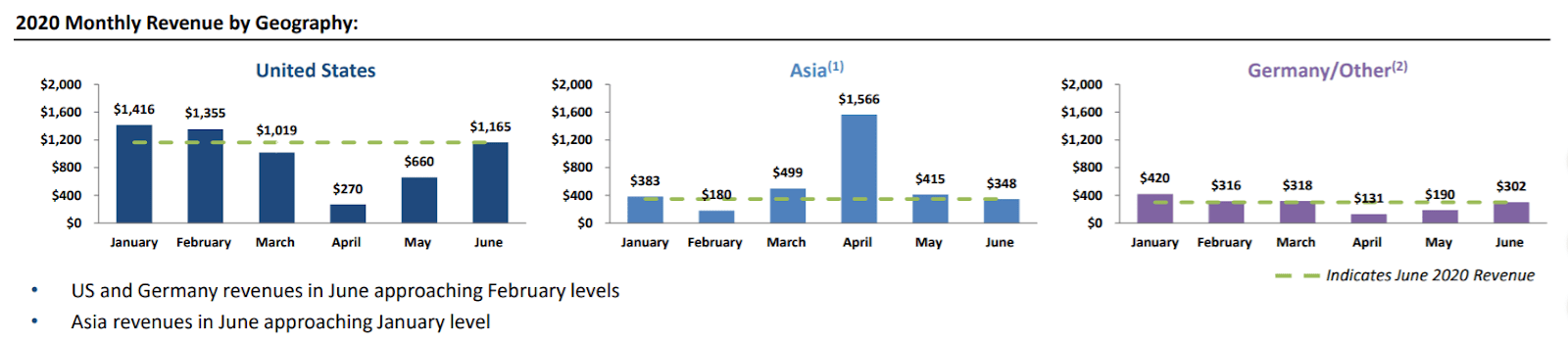

- In 2020, the business has taken a bit due to medical procedures being delayed.

- I would expect the majority of these procedures to come back given that they are medically necessary.

- In its slide deck, the company discloses that May was the company’s worst month with sales down 43%, but sales rebounded sharply and I would expect that trend to continue once July and August sales data is released.

- Valuation:

- From reading the Form 10, I learned that PDL originally acquired its ownership stake in LENSAR through bankruptcy!

- PDL provided debt financing for Lensar between October 2013 and May 2017. Eventually, the debt was converted into equity during a Chapter 11 restructuring.

- PDL acquired the vast majority of LENSAR (~85%) through the Chapter 11 process. However, it also acquired more of the company in two additional transactions were disclosed in the Form 10 where PDL bought additional shares.

- On July 21, 2020, 740,740 shares were given to PDL in exchange for $8.0MM of cash. Implies $10.80 per share valuation or $115MM market cap.

- On August 24, 2020, 746,767 shares were issued to PDL for $8.3MM. Implies $11.11 share price or $115MM market cap.

- These valuations were probably decided on with the help of an advisor so it’s a good place to start from a fair valuation analysis. Alos, it’s interesting that the valuation increased slightly in August vs. July. The only way to justify that is that the business must have improved month over month.

- LENSAR will have no debt and $43MM of cash or $3.96 per share.

- From reading the Form 10, I learned that PDL originally acquired its ownership stake in LENSAR through bankruptcy!

- Notes from Webcast:

- The cataract market is large and growing.

- 70% to 90% of cataract patients have astigmatism.

- Pre-covid, revenue was growing at 20%.

- Compete in premium market, but are looking to expand into non-premium.

- 79% of revenue (rental, per procedure fees, consumables) is recurring (need to double check if this is actually the case).

- LENSAR is investing in a next generation laser workstation called ALLY.

- The benefit is it will allow surgeons the ability to perform more advanced procedures in a single operating room with a single device (want to learn more about this).

- Targeting the launch of ALLY in the second half of 2022. So in two years. Going to take a while.

- Analyst questions:

- What are normalized margins looking out to 2025?

- Normal med device margins. (I interpret this to be 15%-20% EBITDA margins)

- Competition?

- Company thinks they are in a really strong position.

- Company believes it has technological advantage. Hard to evaluate.

- Carinova (french company) working on a similar technology, but LENSAR thinks its tech is superior

- What are normalized margins looking out to 2025?

- Initially, PDL which is liquidation wanted to sell LENSAR, however, the sale environment was not ideal with the pandemic.

-

-

- This could be a red flag. KLX Inc tried to sell KLX Energy but didn’t receive attractive offers and decided to sell it off. At the same time, the pandemic is a pretty good excuse as to why LENSAR wasn’t sold for a high price.

-

-

- Additional Questions to explore.

- What % of revenue is truly recurring?

- What caused LENSAR to go bankrupt in 2017? What has changed since then?

- What are the benefits of ALLY workstation (next generation laser)?Will ALLY be more profitable?

- My conclusion:

-

- Micro-cap spin-offs historically have performed very well, and I will watch LNSR closely.

- The company believes that 79% of revenue is effectively recurring (I need to better understand this) and the unit economics look attractive (product revenue has 56% gross margins and should expand with sale growth).

- Nonetheless, I would likely only be interested in this stock if it traded below its net cash on its balance sheet ($3.96).

- While we could see indiscriminate selling, I’m not too hopeful given that PDL Pharma is already a micro-cap.

- Micro-cap spin-offs historically have performed very well, and I will watch LNSR closely.

-

Leave A Comment