Post Holdings IPO of BellRing Brands – Update November 21, 2019

Resources from Post and BellRing Brands

Announcement of closing of IPO – October 21, 2019

Prospectus – October 17, 2019

Edited transcript of POST earnings conference call August 8, 2019

Post reports results for the third quarter – August 1, 2019

Post announces intent to IPO Active Nutrition – November 15, 2018

Other Resources

PowerBar Maker BellRing Climbs After $480 Million IPO – October 16, 2019

IPO Update: BellRing Readies $525 Million U.S. IPO – October 3, 2019

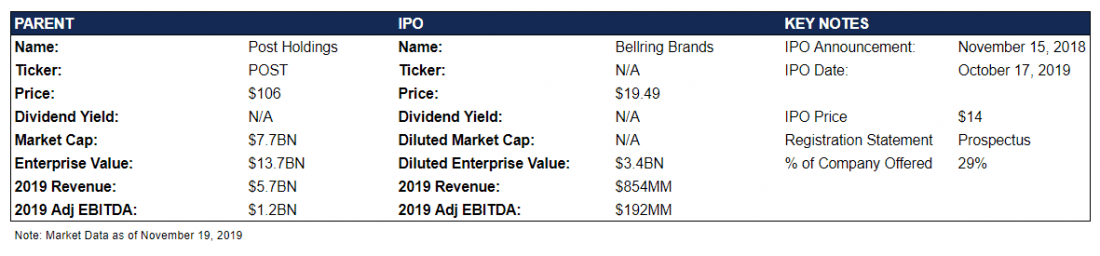

Successful IPO of BellRing Brands Completed

The company issued 39,428.571 Class A shares at a price of $14 on October 17, after initially indicating a price range from $16 to $19 per share. Now priced at about $19.49, the strength reflects a company that appears well positioned to benefit from consumers’ enduring interest in healthy living.

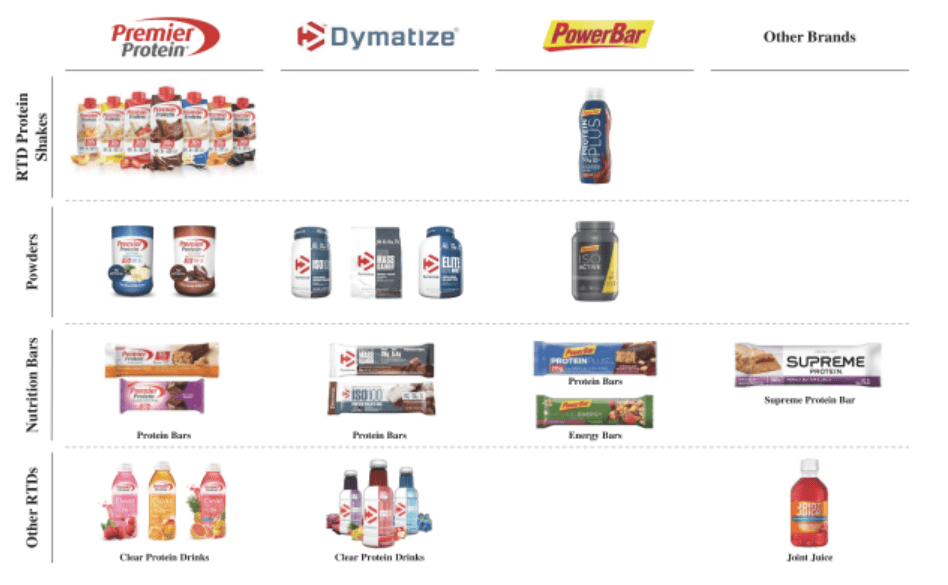

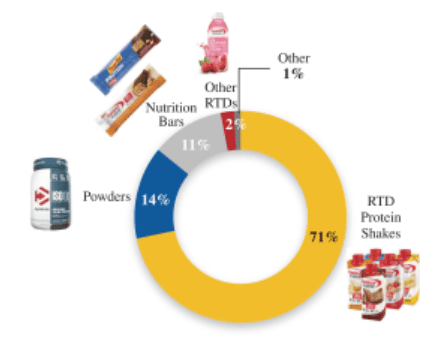

Their leading products are ready to drink (RTD) protein shakes. The others are shown in the illustration below. As we said in our quick summary a few weeks ago, the company’s sales have been growing at an annual rate of 30% since 2014, and the outlook remains positive. Recent slowing is a result of inadequate inventory, not a reduction in demand.

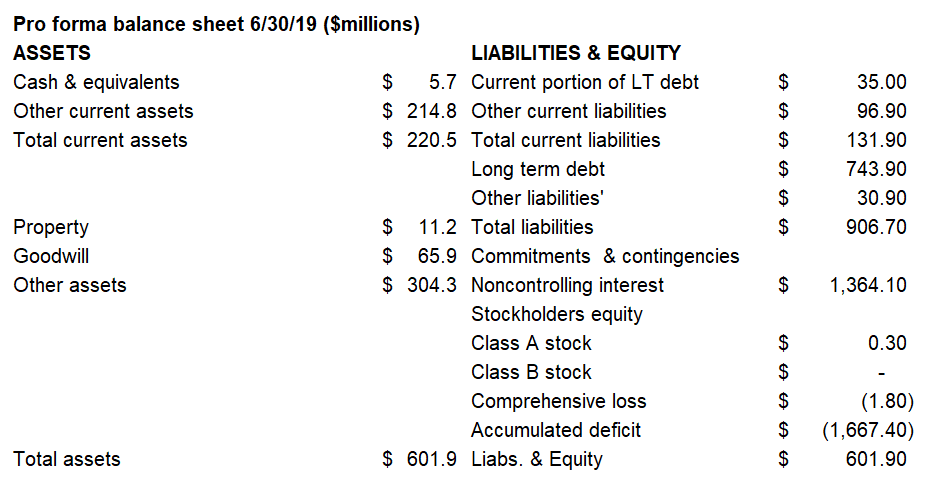

Capital Structure

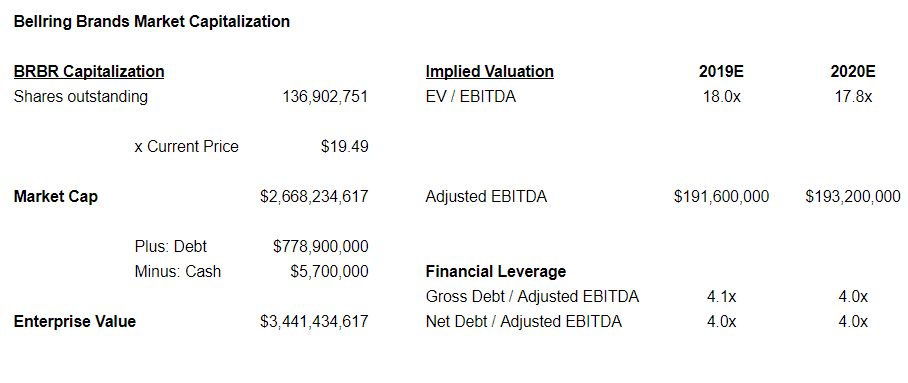

BellRing’s capital structure entails huge dilution. Yes, it is true that the 39MM shares just offered represent 100% of BellRings Brands, Inc.. The undiluted enterprise value is $1.5BN. Dividing that EV by EBITDA of $192MM yields a multiple of 7.6x. What a deal for a fast growth company!

But their only asset is BellRing Brands LLC. POST will hold 97,474,180 units of that LLC that can be at some point converted into the same number of Class A shares in Bellring Inc. The fully diluted enterprise value (assuming the conversion of Post’s shares) goes way up to $3.4BN, giving us a EV/EBITDA ratio of 18.0x. In our Quick Summary, we estimated that a 16.0x EV/EBITDA multiple would be appropriate. Thus, the current valuation seems fair to slightly expensive.

The pro forma balance sheet is not the strongest. There’s a big accumulated deficit and Post saddled the company with substantial debt. The proceeds from the IPO and the long term debt are being used by Post to retire their bridge loan and other debt that totals about $1.2BN. BellRing’s resulting debt consists of a revolving credit facility and a $700MM term loan, both of which mature in 2024. Now averaging about 7.5%, the interest rates are variable and are based on the higher of the Prime Rate, the Fed Funds Rate or LIBOR.

Why the IPO?

According to the press release that announced the spin-off, the IPO would create “a scalable, high growth asset with dedicated capital resources and the strategic flexibility to pursue both organic and M&A opportunities”.

Post’s Active Nutrition segment has been the star segment within the company. The business has achieved rapid growth in recent years.

We assume that management believes that by selling 29% of the stock to the public, the value of the 71% retained will increase Post’s market cap, thereby maximizing shareholder value.

The IPO seems timely because there is a great deal of interest among consumers in products that promote good health. Post management believes “the business’s growth characteristics and high cash flow conversion advantageously position it to be a consolidator across a wide range of opportunities”.

The Company & The Industry

How Does BellRing Brands Make Money?

To review, the company’s products are primarily protein shakes, bars, powders, and nutritional supplements. Their brand names now include Premier Protein, Dymatize, PowerBar, Supreme Protein and Joint Juice. Their largest customers are Costco and Walmart (Sam’s Club). Those two accounted for approximately 71% of the net sales in fiscal 2018.

In addition, the products are sold in other clubs, mass merchandise, grocery, drug, specialty and convenience stores as well as online. They use a flexible sales model that combines a national and international direct sales force, broker network and distributors. An “asset-light platform” is employed whereby they outsource their manufacturing work consisting of co-manufacturers and third party logistics providers. These arrangements enable the company to focus on sales and marketing, brand management, customer service and research and development.

Their model requires modest capital expenditures averaging less than 1% of sales over the last three years. Management believes that their margin profile, with low capital expenditures and limited working capital requirements, enables high cash flow generation and financial flexibility for acquisitions.

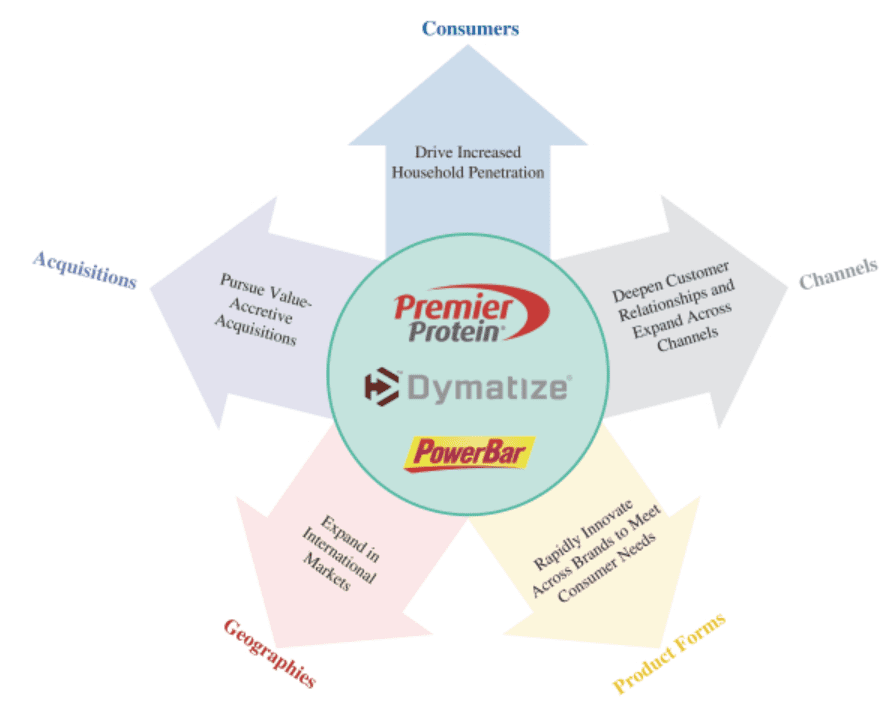

Strategy

BellRing’s strategy is summarized effectively by the following illustration from their prospectus.

Drive Increased Household Penetration – For example, their RTD Premier Shake business has a #1 position in the market yet penetration is still very low within households, now at 5%. Other nutrition categories have 24% penetration.

Deepen Existing Customer Relationships and Continue To Expand Across Channels – Management believes there are significant growth opportunities in their existing club, FDM ((food, drug & mass), eCommerce and convenience channels.

Rapidly Innovate Across Brands to Meet Evolving Consumer Needs – BellRing expanded their 30 gram RTD protein shake business from three flavors in 2015 to seven flavors in 2018, which contributed 38% of the total net sales increase of Premier Protein RTD shakes since the end of fiscal 2015, and accounted for 25% of fiscal 2018 net sales of Premier Protein. Other extensions could be embraced.

Expand BellRing’s Presence in International Markets – The US market is their largest, but they believe that the international market is expected to grow from sales of $15.6BN in 2018 to sales of $21.1BN in 2021, representing a CAGR of 11%.

Pursue Value-Accretive Acquisitions – Food and beverage is a highly fragmented industry. Management believes there are many opportunities to pursue value-enhancing acquisitions.

Strong Fundamentals and Recent Growth

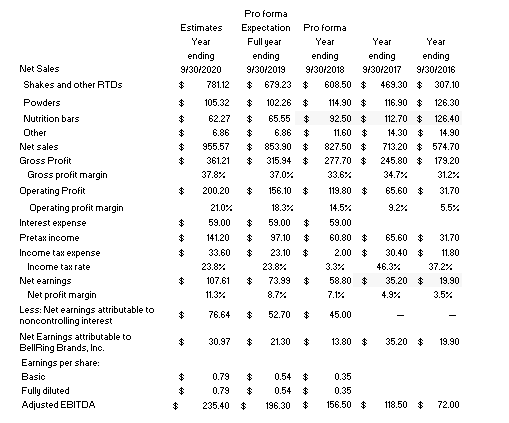

The company has been quite successful. Take a look at the table below. When they report their sales for their full fiscal year which ended on September 30, I’m looking for about $854MM in revenue. That would imply more than 14% annual growth over the last three years.

Margins are expanding. The shakes revenue is the leader and appears to have grown at a 30% rate over the same period. EBITDA grew at a 40% annual rate. (Remember that a big part of the business belongs to Post as represented by the portion that goes to “non-controlling interests”.) Their Premier Protein shakes brand has achieved category-leading status with sales greater than $2.0MM based on Nielsen household data for all outlets for the 52 week period ended July 27, 2019.

Growth in recent quarters has slowed. Delays in planned incremental production capacity by their third party contract manufacturer network caused a shortfall in capacity in the face of continuing strong customer demand.

Inventories were below acceptable levels at September 30, 2018. These factors have resulted in lower than expected RTD protein shakes sales in the year to date. However, inventory levels will recover and we expect growth to accelerate next year.

Industry

BellRing operates in the $32.7BN global convenient nutrition category according to Euromonitor data for 2018. It’s a growing category within the industry, does not appear to be highly influenced by economic swings, and it seems to be in front of favorable secular trends. At $17.1BN for 2018, the US market is the largest and most developed market in the world and grew at a CAGR of 9% between 2014 and 2018, and is expected to grow to $21.2BN by 2021.The company believes that the category is driven by consumers’ increased desire and dedication to pursue active lifestyles and a growing interest in high quality nutrition, health, and wellness.

In addition, consumers have become more aware of the numerous benefits of protein consumption. Additionally, a recent “state of the snack food industry” report states that consumers are increasingly eating more frequently throughout the day. Studies reflect the broader trend that mainstream consumers, not just fitness enthusiasts, are looking for convenient, protein-enriched food and beverage products that can be consumed on-the-go as nutritious snacks or as meal replacements. New consumer consumption and increasing consumption from existing consumers are fueling growth in this category. These statistics and trends, together with a modest household penetration of just 5% for BellRing’s RTD protein shakes, demonstrate significant room for further growth.

Competition

BellRing Brands faces stiff competition in the convenient nutrition category and competes with many nutritional food and beverage players, as well as manufacturers of private label products. Many of the competitors offer similar, or a wider range of products, and may offer their products at more competitive prices. Competition in the industry is based on product quality, taste, functional benefits, convenience, brand loyalty and positioning, product variety, product packaging, shelf space, price, promotional efforts and ingredients. Some of the principal competitors have substantially more financial, marketing and other resources than BellRing. Such deep pocketed big players include Kellogg, General Mills, Kraft Heinz and Pepsi (Quaker Oats).

The category also includes a number of smaller competitors, many of whom offer products similar to BellRing Brands’ products and may have unique ties to retailers. Herbalife Nutrition, Medifast, Natural Grocers, Nature’s Sunshine Products, Vitamin Shoppe and Weight Watchers are all public companies that appeal to the same consumer.

Customers

Consumers in the US and internationally purchase BellRing products through several channels including club, FDM, eCommerce (such as Amazon), convenience (such as 7-Eleven) and specialty (such as The Vitamin Shoppe) stores. BellRing maintains a particularly strong leadership position in the club channel based on Nielsen household panel data for the 52 week period ended July 27, 2019 and has developed long-standing relationships with customers such as Costco and Sam’s Club. Continued expansion in FDM represents an opportunity to leverage existing relationships with key retail partners such as Walmart, Target, Kroger and Walgreens to grow BellRing’s presence. Expansion in FDM and eCommerce increases consumer exposure of their products. They believe such exposure will drive repeat purchases and increase penetration across all channels.

Management and Incentive Compensation

The following people serve on the executive team at BellRing:

Robert V Vitale Executive Chairman

Darcy Horn Davenport President & CEO

Douglas J. Cornile SVP Marketing at Premier Nutrition

Paul A Rode Chief Financial Officer

Robert V. Vitale has served as the Executive Chairman since September 2019, has been the President and Chief Executive Officer of Post, and a member of Post’s board of directors, since November 2014. Previously, Vitale served as Chief Financial Officer of Post from October 2011 until November 2014. He served as President and Chief Executive Officer of AHM Financial Group, LLC, a diversified provider of insurance brokerage and wealth management services, from 2006 until 2011 and previously was a partner of Westgate Equity Partners, LLC, a consumer-oriented private equity firm. Mr. Vitale earned his undergraduate degree from St. Louis University and his MBA from Washington University.

Darcy Horn Davenport has served as President and Chief Executive Officer since September 2019 and will serve as a member of the Board of Directors. Davenport has served as President of Post’s Active Nutrition business since October 2017 and as President of Premier Nutrition. She previously served as General Manager of Premier Nutrition from October 2014 to November 2016 and Vice President of Marketing from October 2011 to October 2014. Prior to joining Premier Nutrition, Ms. Davenport served as Director of Brand Marketing at Joint Juice, Inc., a liquid dietary supplement manufacturer, from May 2009 to October 2011, when it combined with Premier Nutrition. Ms. Davenport earned her undergraduate degree from Princeton and her MBA from New York University’s Leonard N. Stern School of Business.

Douglas J. Cornille has served as Senior Vice President, Marketing of Premier Nutrition, since July 2015. Prior to joining Premier Nutrition, Cornille was Brand Director at Clif Bar & Company, a manufacturer of various food products, from August 2011 to July 2015 and was Senior Brand Manager at Dreyer’s Grand Ice Cream Holdings, Inc., a manufacturer of ice cream and frozen yogurt, from September 2003 to August 2011. Cornille earned his undergraduate degree at Rhodes College and earned his MBA from Duke University.

Paul A. Rode has served as Chief Financial Officer since September 2019. Rode has served as Chief Financial Officer of Post’s Active Nutrition business since May 2015 and as Chief Financial Officer of Consumer Brands from November 2014 to May 2015. Rode earned his undergraduate degree from the University of Kentucky and his MBA from Northwestern University’s Kellogg School of Management.

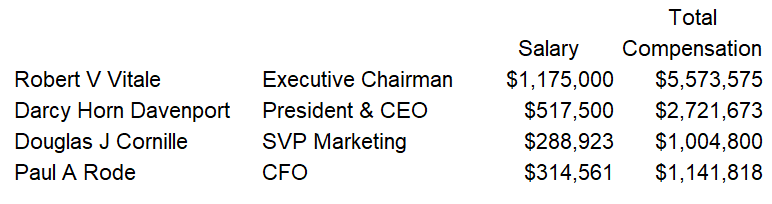

Executive Compensations Programs have not yet been developed. The company plans that a Corporate Governance and Compensation Committee will engage an independent compensation consultant to advise on the development of the compensation programs, and warns that the compensation programs that they adopt may differ materially from the current Post programs.

The following table outlines recent compensation for the key officers of the company. I believe the increased responsibility of all but Vitale, will require that compensation will be materially increased. Of course, participation in stock options will be a key component of the new plan.

Potential for Indiscriminate Selling

Post Holdings is a $7.5BN market cap company and is a member of the S&P 400 Midcap Index. On the surface, BellRing Brands is a $693MM market cap company with 39.4MM shares issued and outstanding. Managers of S&P 400 Midcap Index funds will be selling BRBR. Remember that POST still has the right to 97.5MM units of BellRing Brands LLC which can be converted on a 1 to 1 basis into Class A BellRing Brands Inc. stock. On a fully diluted basis, BellRing’s market cap is $2.7BN. I believe it’s safe to assume that Post will liquidate that holding a some point. This could represent an “overhang” of BellRing Class A supply which could have a depressing influence on the stock. Nevertheless, I believe BellRing’s favorable fundamentals may prevent any indiscriminate selling.

Valuation

Large and well established packaged foods company that offer a convenient nutrition category such as Kellogg, General Mills, Pepsi (Quaker Oats) and Nestle sell at enterprise value to EBITDA ratios averaging 17x the last 12 months EBITDA.

These companies are very diversified and have a long history of successful operations, though they are mature. Small companies that are more concentrated in the category (such as Herbalife Nutrition, Medifast, and Nature’s Sunshine Products), yet have a better growth potential, sell at an average of 10.4x the last 12 months EBITDA.

At 18x EBITDA, BellRing Brands looks fairly valued. The company is growing and has a solid base, but is very concentrated on the protein shakes business. Moreover, they are highly dependent on on out-sourced producers for product and their customer base is also highly concentrated. At 12x EBITDA, the company would be a solid investment.

Risks

The prospectus outlines the normal exhaustive list of risks such as economic cyclicality and the loss of appetite for BellRing’s products, and many others. Nevertheless, there are real risks with an investment in this company, especially relating concentrations.

As shown above, any hiccup in the RTD market would hurt BellRing, with 71% of sales associated with those products. In addition, the company is highly dependent on their relationship with CostCo and Walmart, where 71% of sales come from. Other customers such as Target, Kroger and Walgreens are growing, but concentration remains a risk today. BellRing is currently dependent on a limited number of third party contract manufacturers and suppliers for the manufacturing of most of their products, including one manufacturer for the substantial majority of their RTD protein shakes. The company relies on a limited number of suppliers for certain ingredients and packaging materials.

BellRing Brands will have significant debt and high leverage, which could have a negative impact on their financing options and liquidity position. Finally, Post continues to control BellRing and will have the ability to control the direction of their business.

Leave A Comment