Solventum Spin-off Deep Dive

March 31, 2024

Summary

On April 1, 2024, Solventum (SOLV), 3M’s health care spin-off will begin regular way trading. The stock closed at $70 in the when issued market. It could trade well on its first day given that it will be added to the S&P 500 and may experience buying pressure from index funds.

Solventum is a diversified health care company generating revenue from the following sources:

- Med Surgical (51% of revenue)

- Dental Solutions (21% of revenue)

- Health Information Systems (20% of revenue)

- Purification and Filtration (8% of revenue)

Revenue growth over the past 3 years has been relatively stagnant and management expects that to continue (2024 revenue guidance is 0% to -2%). MedSurg has been growing nicely, but the other three segments have been modestly shrinking.

The company’s strategy leaves much to be desired. If you flip through the analyst day presentation, there are a lot of buzz words like “accelerate revenue growth,” “drive margin expansion,” and “disciplined commercial model and execution,” but the company offers few concrete examples of what can be done. Compare Solventum’s analyst day deck to Vestis’ and the difference is stark. Vestis walks through case studies in granular detail of margin improvement and revenue acceleration opportunities, while Solventum investor presentation speaks in generalities. I think this is due to the new management team being hired so recently (the CEO was hired 6 months ago). I think the management team needs time to formulate an operational plan to return the business to growth.

Despite operational challenges, Solventum looks cheap in the when-issued market at $70/per share. SOLV is currently trading at 8.4x 2024 EBITDA. Peers generally trade in the low double digit multiple range, however, most peers are growing, at least modestly. At 12x 2024 EBITDA, SOLV would trade at $120/share.

SOLV might end the day strong on its first day of trading given that it is expected to be added to the S&P 500 effective before trading begins on April 1.

Resources from MMM

Spin-off Press Release – Jul. 26, 2022

Form 10 – Feb. 21 2024

Investor Relations

Kevin Moran

Senior Vice President, Solventum Investor Relations

kmmoran@solventum.com

Other Resources

Combat Arms Earplugs Settlement Set to Exceed 98% Participation Milestone – Jan. 29, 2024

Combat Arms Settlement Program Website

3M Announces Combat Arms Settlement – Aug. 29, 2023

Solventum Analyst Day – March 19, 2024

Overview

On July 26, 2022, 3M Company (“3M”, ‘MMM”) announced its plan to separate its health care business into an independent public company. The separation is to take place through a pro rata distribution by 3M of at least 80.1% of the outstanding shares of common stock of a newly formed company, Solventum Corporation, which will hold 3M’s health care business. SOLV is currently trading in the when issued market.

3M will retain responsibility for non-Health Care related litigation, including those related to Combat Arms Earplugs and PFAS.

The spinoff is intended to be tax-free for US federal income tax purposes.

Why the Spin-off?

MMM includes all the boilerplate rationales for a spin-off including:

- “Tailed capital allocation”

- “Enhanced management focus”

- “Improved operational agility”

But the primary reason MMM is pursuing a spin-off is to unlock value.

MMM currently trades at 8x forward EBITDA. MMM’s health care peers generally trade at 12x or higher. Thus, the spin-off should unlock value.

In addition, another element that likely motivated MMM to spin off its health care business is the dark cloud of litigation currently looming over MMM, causing the company to trade at depressed valuations.

Management’s rationale for spinning off the health care business would then be to have the market ascribe the higher multiple to the business that management feels it deserves, unencumbered by the weight of litigation.

Solventum (SpinCo) Overview

Company

Solventum is made up of 4 operating segments:

Management believes the global addressable market is projected to grow at an annual rate of 4-6% from 2024 through 2026.

The 4 Operating Segments

MedSurg (Formerly Medical Solutions): Comprised 56% of 2023 sales

This segment delivers solutions in the form of advanced wound care and surgical supplies. The advanced wound care sub-segment can be further broken down into Negative Pressure Wound Therapy (NPWT), Advanced Wound Dressings (AWD), and Advanced Skin Care (ASC).

The surgical supplies sub-segment can be further broken down into surgical solutions, intravenous (IV) site management, and hospital consumables.

The brands are sold both direct and through distributors to hospitals for use in operating rooms, inpatient care units, and central sterilization, as well as out-of-hospital settings, including ambulatory surgical centers, skilled nursing facilities, long-term facilities, and patient homes.

MedSurg competitors:

The advanced wound care market is highly competitive, particularly in the United States and Europe, with principal competitors including Smith & Nephew, Medela, Mölnlycke, Coloplast, and Convatec.

It is a dynamic market, featuring ongoing commercialization of new wound care products, high levels of strategic mergers and acquisitions, and disruptive new entrants and emerging players specifically focused on cost-effective wound care solutions.

Solventum’s infection prevention and surgical supplies solutions are offered in highly competitive and fragmented end markets, especially in the United States and Europe. Principal competitors in this segment include Becton Dickinson, Hartmann, ICU Medical, Medline, Cardinal Health, Fortive, Steris, MDF Instruments, BSN, Smith & Nephew, and Welch Allyn.

MedSurg Segment Financials:

MedSurg sales were flat over the past three years suggesting that this segment of the business is not growing. Moreover, the high degree of competitiveness for both categories of the MedSurg segments does not bode well for growth in this segment. Moving forward, it is not likely that this business will see much in the way of growth.

Dental solutions (Formerly Oral Care Solutions): Comprised 16% of 2023 sales

This segment provides a comprehensive array of dental and orthodontic products that span the life of the tooth.

The products are intended to address clinical needs in prevention, restoration, replacement, and malocclusion correction.

Prevention

The solutions serve both channel and end customers and include larger dental organizations, smaller practitioner groups, sole practitioner clinics and distributors.

Dental solutions segment competitors:

The dental market is highly competitive, with players ranging from very large broad-based multinational companies to localized or specialized suppliers and start-ups. Principal multinational competitors within the oral care market include Dentsply Sirona, Envista, Straumann, and Align Technology, all of which compete with both dental and orthodontic solutions, and Ivoclar, which competes with only dental solution offerings.

In recent years, there have been significant acquisitions and new collaborations in the oral care market segment, especially in digital dentistry. These moves are indicative of a dynamic dental market, where new market entries in digital technologies, artificial intelligence and 3D printing are accelerating.

Dental Solutions Financials:

The dental solutions segment, much like the MedSurg segment, has been flat over the past three years. Given the high degree of competitiveness, it is not likely that this business will sustain much growth in the future.

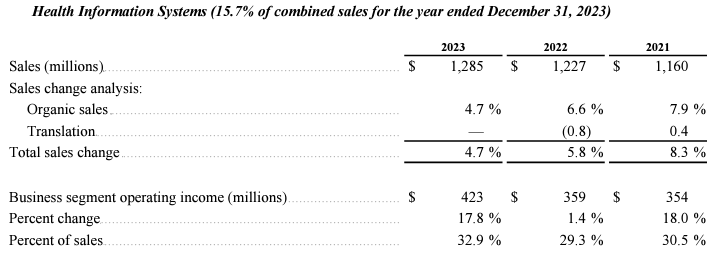

Health Information Systems: Comprised 16% of 2023 total sales

This segment provides an array of software solutions and services that are designed to eliminate revenue cycle waste, create more time to care, and support the shift to value-based care. The health information system business has been around for 35 years which has offered Solventum the opportunity to develop a data-rich understanding of the healthcare landscape.

Based on internal estimates, over 75% of US hospitals use at least one of Solventum’s software solutions.

The solutions are generally delivered to customers as an integrated workflow or set of workflows that involve both digital software-based solutions and related services which are currently benefiting from advancements in AI.

The solutions offered can be split into 3 categories:

The solutions are utilized by a variety of customers across inpatient, outpatient, and ambulatory settings as well as payers and government agencies. The company’s representative channel and end customers are made up of large healthcare providers, regional health systems, payers, and other third-party solution providers.

Health Information Systems segment competitors:

The health care software technology market and the healthcare information technology (HCIT) industry in general, is highly competitive and dynamic, characterized by the continual introduction of new products and technologies.

Principal competitors include R1 RCM, Ensemble, Optum/Change, Google, Amazon (AWS), Microsoft (Nuance), Epic, Cerner, Athena, and a host of start-up technologies actively working to disrupt the areas of revenue cycle management and clinician productivity.

In the United States, the market for value-based care software solutions is highly fragmented and subject to continuous entry of new competitors. Today, Solventum competes primarily with Optum, Cotiviti, Inovalon and Vizient, among others.

The market is even more fragmented internationally. Outside the U.S., Solventum competes primarily with local players in the respective country or region, some international players such as IQVIA, Cerner/Siemens, and Dedalus, and new market entrants.

Health Information Systems Financials:

The health information systems segment has grown modestly (3.4% CAGR) over the past 3 years. Given the high degree of competitiveness present in the healthcare software technology market, one would not expect this business to experience much growth in the future.

Purification and Filtration (Formerly Separation and Purification Sciences): Comprised 12% of 2023 total sales

This segment provides purification and filtration solutions designed and marketed for use in the manufacturing processes of biopharma and medical technologies, such as cell and gene therapies, vaccines, and hemodialysis, as well as in the manufacturing of microelectronics, food and beverage products, and water filtration for commercial and residential applications.

The solutions offerings can be split into 4 categories:

Purification and filtration segment competitors:

The Purification and Filtration segment competes against established global filtration companies such as Danaher, Merck KGaA, Sartorius, Pentair, Repligen, and Entegris.

Solventum’s ability to compete with these larger, established filtration competitors lies in its ability to consistently bring disruptive technology, such as 3M™ Harvest RC, to the market.

Regional competitors appear with frequency. The company’s ability to compete with these smaller, regional competitors lies in the quality of its products, full range of solutions, and global presence.

Purification and Filtration Financials:

Sales in the purification and filtration segment have been flat over the past 3 years.

Solventum can be described as a stagnant business without much in the way of growth prospects. While there isn’t much cyclicality to the business, its 4 segments are characterized by high degrees of competitiveness making it unlikely that it will ever see strong growth.

For each of the last three years, Solventum has generated over $1.6 billion of cash from operating activities and over $1.4 billion of free cash flow. The business has delivered greater than 20% operating income margin and greater than 25% adjusted operating income margin for each of the last three years.

Management has provided the following guidance on March 19, 2024 for FY2024:

- Organic revenue growth of -2% to 0%

- Adjusted EPS of $6.10 to $6.40

- FCF of $700MM to $800MM

Two important points stand out relating to the forward guidance: the organic revenue growth is expected to be flat, which lends further support to the claim that this is a stagnant business; and the FCF number that represents one half of what the company generated in each of the last 3 years.

Company Strategy

The company strategy consists of the following:

- Investing in markets with highest growth potential

- Continuing to deliver customer-centric innovation

- Accelerating growth through strategic M&A and partnerships

- Driving margin expansion and free cash flow generation

The company has mostly employed boilerplate language in discussing its strategy. There is nothing in the company’s strategy that suggests that growth will ever surface.

Management and Incentive Compensation

Bryan C. Hanson – CEO (Sept. 2023 – )

- Became Chief Executive Officer of 3M’s Health Care Business Group in September 2023 and will be appointed as CEO in connection with the distribution.

- Served as Chairman of the Board of Directors of Zimmer Biomet, a global medical technology company with annual revenues over $7 billion, from May 2021 to August 2023, and as President and Chief Executive Officer and a member of the Board of Zimmer Biomet from December 2017 to August 2023. His time as CEO of Zimmer wasn’t particularly noteworthy from a stock appreciation perspective.

Wayde McMillan – CFO (Nov. 2023 – )

- Became CFO of 3M’s Health Care Business in November 2023 and will be appointed as CFO in connection with the distribution

- Served as Executive Vice President, Chief Financial Officer and Treasurer of Insulet, a medical device company, from March 2019 to November 2023

- From January 2015 to February 2019, served as Chief Financial Officer and Vice President of Finance of the Minimally Invasive Therapies Group at Medtronic plc., a medical device company

- From November 2006 to January 2015, prior to Medtronic’s acquisition of Covidien plc, a medical device company, Mr. McMillan held a variety of leadership positions at Covidien, including Chief Financial Officer and Vice President of Finance of the Medical Devices Group & U.S., Chief Financial Officer and Vice President of Finance of the Surgical Solutions Business Unit, and Vice President Finance and Controller of the Respiratory and Monitoring Solutions Business Unit.

Incentive compensation has not yet been made available. The stock incentive plan has yet to be filed by amendment.

Capital Structure

Solventum will be capitalized with ~$8.3 billion of debt at an estimated weighted-average interest rate of 5.8%. It will have $600MM of cash and cash equivalent.

Solventum’s debt is rated BBB-, the lowest rating that is considered investment grade.

Additional details related to Solventum’s debt:

I think Solventum will be able to service its debt easily given its recession resistant business.

Valuation

Solventum looks cheap in the when-issued market at $70/share. It is trading at ~8.4x 2024 EBITDA guidance and 11x 2024 adjusted EPS guidance.

Peers trade in the low-to-mid EV/EBITDA multiple range but are generally growing modestly (SOLV’s guidance calls for revenue growth of 0% to -2%). Further, management is new and doesn’t appear to have a concrete strategy to accelerate revenue growth.

If Solventum were to trade at 13.3x, it would be worth $130.

Risks

- 3M is the sole source of supply for certain chemical materials and inputs used in products of the Health Care Business (including transparent IV film dressings, biological indicators for sterilization assurance, medical securement tapes, and dental composites and cements) that accounted for approximately $3 billion of the revenue of the Health Care Business for fiscal year 2023, including a material with a manufacturing process proprietary to 3M that is used in products of the Health Care Business accounting for approximately $2 billion of revenue for fiscal year 2023. The business will be harmed if 3M does not satisfy the requirements during the term of the supply agreement, and Solventum’s failure to ensure a continuing supply of these materials or find acceptable substitutes, or the costs Solventum incurs in doing so, could have a material adverse effect on the business.

- Solventum may face potential liabilities related to PFAS (“forever chemicals”), which could adversely impact Solventum’s results.

- Litigation overhang on Solventum relating to Bair Hugger MDL. Over 6,000 claimants alleged that Solventum’s Bair Hugger increased surgical site infections. To ballpark the liability, if Solventum agreed to pay 2x the ~$25k per claimant that the Combat Arms settlement worked out to be, the

liability would be a manageable $300 mil, before insurance recoveries.

Disclaimer

All expressions of opinion are subject to change without notice. All published emails/articles/correspondence is provided for informational purposes. We do not warrant the completeness or accuracy of this content. Please do your own due diligence and consult with an investment adviser before buying or selling any stock mentioned on www.stockspinoffinvesting.com.

‘SOLV might end the day strong on its first day of trading given that it is expected to be added to the S&P 500 effective before trading begins on April 1.’

Wouldn’t all funds holding SP500 already have 3M in their portfolio and therefore receive the shares for Solventum? Should be more or less neutral, but limit the selling pressure