Sphere Entertainment Co Deep Dive

May 3, 2023

Summary

I think the Sphere has the potential to be an attractive entertainment asset and the current valuation of Sphere Entertainment Co (SPHR) looks cheap.

But I think it’s a messy story that isn’t going to get much cleaner any time soon.

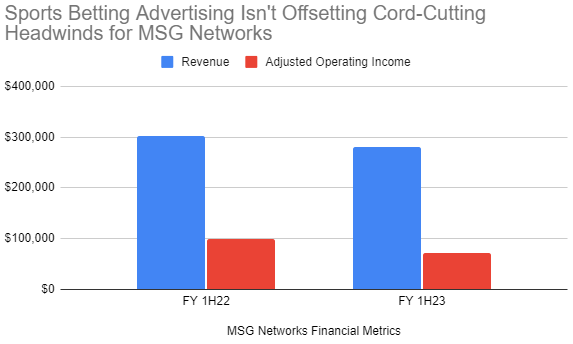

Sphere revenue and EBITDA will eventually ramp up but MSGN revenue declines will be a large headwind (I don’t believe MSGN’s DTC product, MSG+, will generate enough revenue to offset pressure from cord cutters).

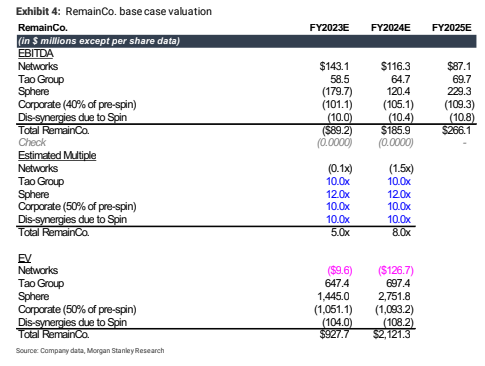

Morgan Stanley estimates that Sphere Entertainment Co will generate $196MM of EBITDA in FY 2025.

At $30 per share, SPHR is trading at an enterprise value of $1.5BN.

Thus, it’s trading at an EV/ ‘25 EBITDA multiple of 7.5x.

This seems cheap but reasonable to me.

The Sphere will probably track towards $200MM+ of EBITDA and then stabilize.

MSGN will continue to shrink and could go negative.

It has long term contracts to make escalating payments to the Knicks, Rangers, Sabres, and Devils for the right to televise the games. Yet the top line is shrinking due to cord cutting.

Yes the SOTP valuation would point to a higher valuation, but aren’t spin-offs consummated so that investors don’t have to do SOTP valuations?

Resources

McIntyre Q1 2023 Letter which Highlights SPHR – May 1, 2023

Sphere Entertainment Co Pro Forma Financials – April 24, 2023

Bloomberg Article on Struggle that RSNs are Facing Due to Cord Cutting – March 3, 2023

YAV Podcast Transcript on MSGE – December 4, 2021

Sinclair’s RSNs face bankruptcy, sale rumors amid wide streaming launch – September 22, 2022

Overview

On April 20, 2023, Madison Square Garden Entertainment Corp (MSGE) spun off its live entertainment business.

The spin-off kept the name and ticker of the parent: Madison Square Garden Entertainment Corp (MSGE).

The stock is trading at $32 and looks fairly valued to me. I published an overview here which covers the company’s assets and valuation.

To me, the more interesting part of the transaction is the RemainCo which changed its name to Sphere Entertainment Co and trades under the symbol SPHR.

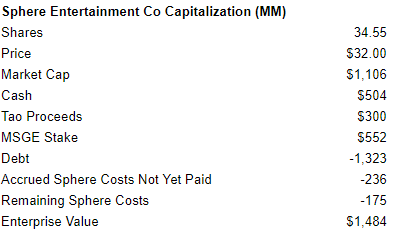

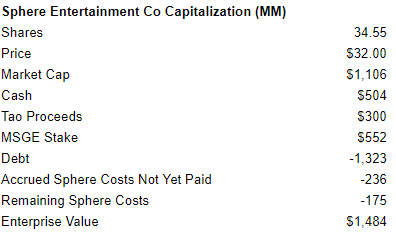

Sphere Entertainment Co Capitalization

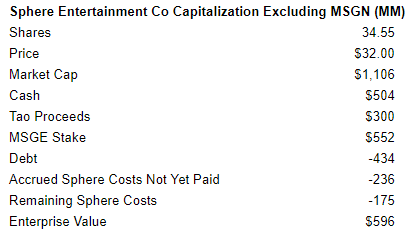

Sphere trades at $32 and has 34.55MM shares outstanding.

Thus, its market cap is $1.1BN.

It has $504MM of cash.

It will receive $300MM in proceeds from the sale of Tao.

It owns 33% of MSGE which is worth $551MM (MSGE trades for $32).

It has debt of $1,323MM, accrued but not yet paid costs of $236MM and additional costs to complete the Sphere of $175MM..

Adding it all up, and we get an initial enterprise value of $1.5BN.

For a $1.5BN enterprise value, investors get two assets:

- The Sphere,a Las Vegas based, state-of-the-art, arena that the Company has spent $2.0BN to construct (estimated total construction cost of $2.2BN).

- MSG Networks, a regional sports network, that the Company bought in 2021 for an enterprise value of $1.6BN.

At a high level, the valuation looks very interesting….

Let’s dig deeper into the assets.

Sphere Overview

MSG Sphere is a new type of entertainment venue that has been in development for the past couple of years by MSG.. The venue is planned to be a massive spherical structure that promises a “revolutionary concert and entertainment experience.”

The first location will be in Las Vegas and will look like this:

Construction is almost complete and it currently looks like this:

The MSG Sphere is designed to be an immersive, next-generation entertainment venue that will utilize cutting-edge technology to enhance the viewing and listening experience.

The spherical shape of the venue is intended to provide an all-encompassing visual and audio experience, with advanced acoustics and visual effects that can be customized to suit different events and performances.

Some of the proposed features of the MSG Sphere include:

- A spherical exterior with a diameter of approximately 360 feet (110 meters)

- A seating capacity of up to 18,000 people, depending on the configuration

- Advanced sound systems and acoustics, including directional audio technology that can deliver different sounds to different parts of the audience

- An LED exterior that can display high-resolution images and videos

- A programmable LED ceiling that can create immersive visual effects, such as simulated starry skies or abstract patterns

- Augmented reality technology that can create interactive and immersive experiences for audiences

Originally, management estimated it would cost $1.2BN to construct, and would generate “a double digit return” on investment.

But cost estimates were continually increased and management now estimates the total cost will be $2.175BN.

What kind of earnings will the Sphere generate?

If we assume a double digit return – say 15% – on the original cost estimate of $1.2BN, we can expect the Sphere to generate $180MM in EBITDA on a normalized basis.

Assuming an 8x multiple, the Sphere is worth $1.4BN.

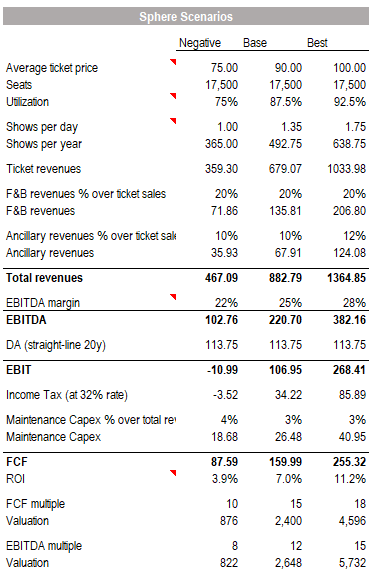

A subscriber shared his Sphere analysis with me and his estimates are a little higher.

In his scenario, the Sphere will generate $220MM of EBITDA and $160MM of FCF.

These assumptions look reasonable to me, and if they play out perhaps the Sphere is worth $2-$2.6BN.

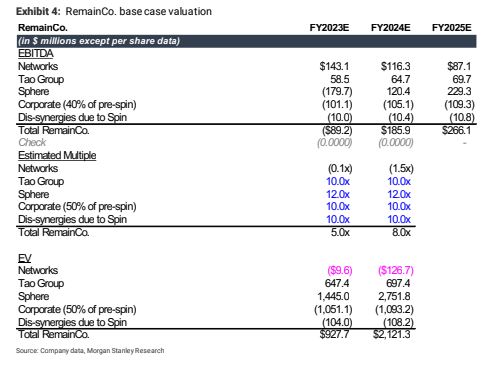

Morgan Stanley estimates (below) the Sphere (venue not the entire company) will generate $229MM of EBITDA in FY 2025.

At an 8x multiple, the Sphere would be worth $1.8BN.

To conclude, I think the MSG Sphere is probably worth between $1.5BN and $2.5BN.

MSG Networks (MSGN)

MSG Networks is a regional sports network.

It is focused on broadcasting sports content related to teams based in the New York metropolitan area.

MSG Networks’ programming includes live game broadcasts, pre- and post-game shows, analysis and commentary programs, and other sports-related content. Some of the teams that MSG Networks has broadcast rights for include the New York Knicks (NBA), New York Rangers (NHL), New York Islanders (NHL), New Jersey Devils (NHL), New York Liberty (WNBA), and Buffalo Sabres (NHL).

Madison Squash Garden Entertainment bought out MSGN in 2021 for a 4% premium to MSGN’s latest stock price.

Both MSGE and MSGN shareholders were unhappy with the deal (James Dolan controlled the voting shares of both companies and could force the merger through).

At the time, MSGN had an enterprise value of $1.6BN.

MSG Networks has been hurt by cord cutting…

As more viewers have turned to streaming services, the number of subscribers to traditional cable and satellite TV services has declined, leading to a decrease in revenue for companies like MSG Networks. In addition, some viewers who still have cable or satellite TV subscriptions may opt for lower-priced packages that do not include regional sports networks like MSG Networks, further reducing the company’s audience and revenue.

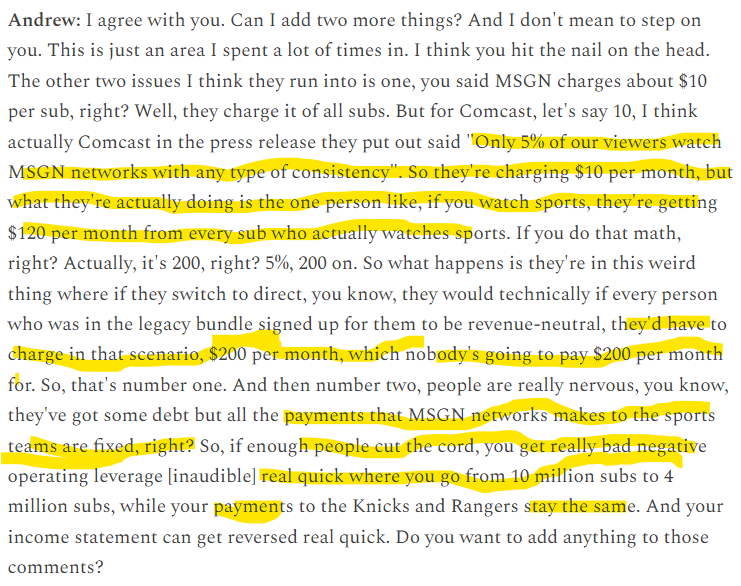

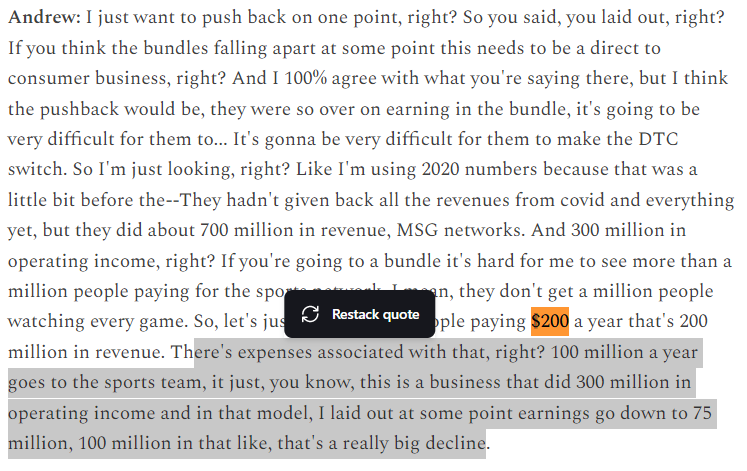

Here’s Andrew Walker (from Yet Another Value Blog) explaining the issues MSGN faces from cord cutting far better than I can:

The key takeaway is that MSGN would have to charge $200/month to be revenue neutral if everyone that watches sports via cable now switches to MSGN’s DTC offering (yet to be launched).

A $200/month price point is implausible.

Thus, MSGN has been over monetizing and the transition to DTC is going to be painful.

The financial trends bear this out.

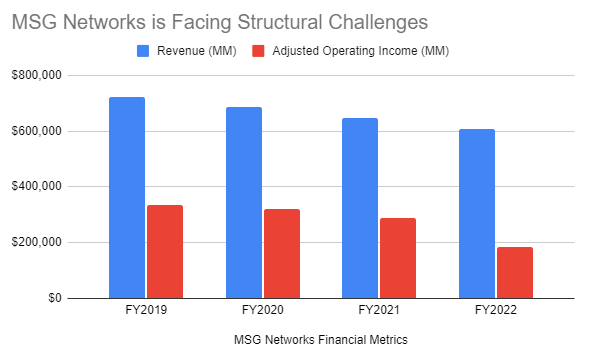

MSGN generated adjusted operating income of $335MM in fiscal year 2019.

But it’s been declining steadily since then.

What is the steady state earnings power of MSGN over the long term?

Again, let’s bring in Andrew Walker of Yet Another Value Blog:

In the scenario laid out above (MSGN business model goes DTC), operating income stabilizes at $100MM.

And maybe that business is worth 12x operating income or a $1.2BN enterprise value?

But revenue is going to be declining for the foreseeable future and will be a drag on consolidated results.

What about the upside?

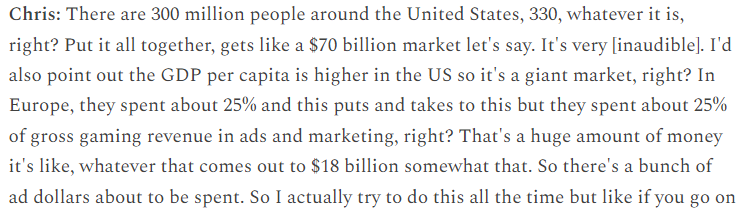

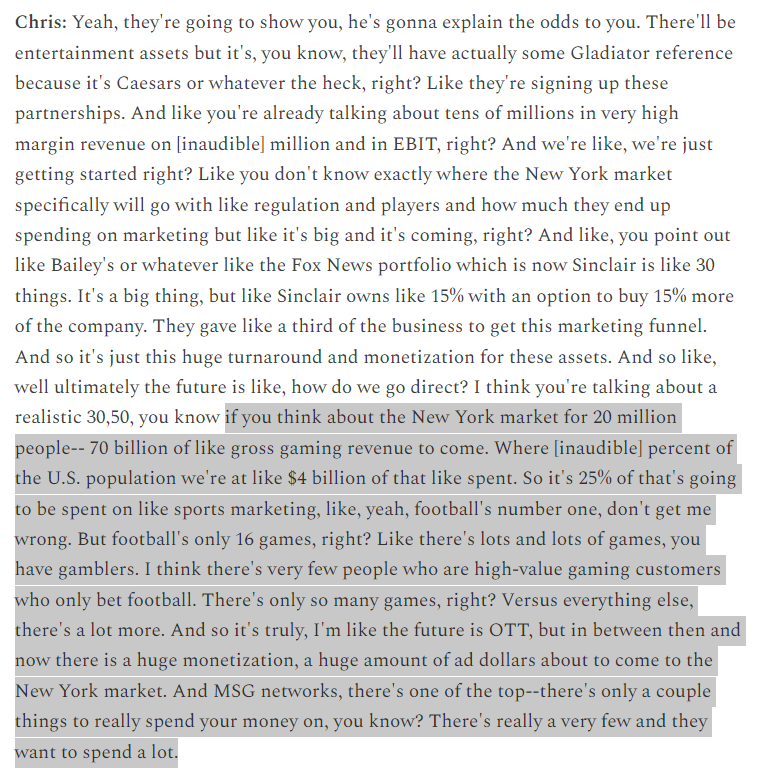

One upside driver could be sports betting advertising. Here’s portfolio manager, Chris McIntyre, from that same MSGE podcast interview:

So long story short, there could be $1BN of annual sports betting marketing being spent in the New York area and MSGN should benefit disproportionately from that spend.

The problem is sports betting has been legal in NY since in Jan 2022 and the benefit from sports betting advertising hasn’t offset structural headwinds from cord cutters….at least, so far:

What about MSG Networks DTC product?

MSG+ will launch this summer (2023).

It will broadcast games for the NBA’s New York Knicks, as well as the NHL’s New York Rangers, Buffalo Sabres and New Jersey Devils. The streaming service will cost $29.99 a month, or $309.99 annually.

How many subs with MSG+ reach?

There are ~24MM people in the greater New York metro area. Assuming 5% of them are diehards and want to subscribe directly implies 1.2MM subs at peak.

At $300/year cost (assume some people don’t subscribe for the whole year), we could eventually see $360MM of revenue.

Finally, we could see some advertising revenue (see sports betting discussion above).

MSGN currently has annual revenue of $600MM (FY 2022).

In an optimistic scenario, it will ultimately be able to generate $360MM of revenue from its DTC product.

While MSGN’s DTC product will help to mitigate cord cutting, it won’t be able to completely offset it.

Further the DTC product won’t immediately get to 1.2MM subs.

Diamond Sports DTC product launched in June 2022.

Diamond Sports is an unconsolidated subsidiary of Sinclair Broadcasting Group. It owns and operates 19 regional sports networks (RSN) that go by the “Bally Sports” brand.

Diamond Sports shared 3 scenarios of how many paid streaming subs it would get by December 2022:

The most optimistic scenario was 975k.

The middle scenario was 683k.

The low scenario was 309k.

As of year end 2022, Diamond Sports Group had 200k subscribers as disclosed in a footnote on the second to last page of this filing.

Diamond Sports estimates its addressable market (households) at 87MM per slide 17 of this deck.

It estimated that it could ultimately get to 5% penetration.

6 months into its DTC launch, its penetration is 0.2%.

Assuming the same penetration rate six months into the summer launch of MSG+, the DTC service would have ~55,000 paid subs by December 2023.

At a $300/year average price point, it would be generating $16.6MM of DTC revenue on an annualized basis by December 2023..

This would be a nice contribution to the top line but isn’t likely to offset the headwinds from cord cutting.

In FY 2020, MSGN revenue fell by $35MM, in FY 2021, it fell by $38MM, in FY 2022, it fell by $39MM, and in the first half of FY23, it has fallen by $20MM ($40MM on annualized basis).

MSG+’s contribution is unlikely to offset the secular pressure from cord cutting.

If MSG+ were to generate 200,000 subs within its first 12 months of launch, in-line with what Diamond Sports Group generated, I would be impressed as it would present $60MM of annual revenue.

But I think that’s unlikely given the Diamond Sports Group owns RSNs for sports teams that have an addressable audience of 87MM fans (slide of 17 of this deck) versus potential fans 24MM in the greater New York metro region.

Further, $60MM of additional revenue would be mostly offset by the ~$40MM of revenue declines that MSGN is on pace to realize.

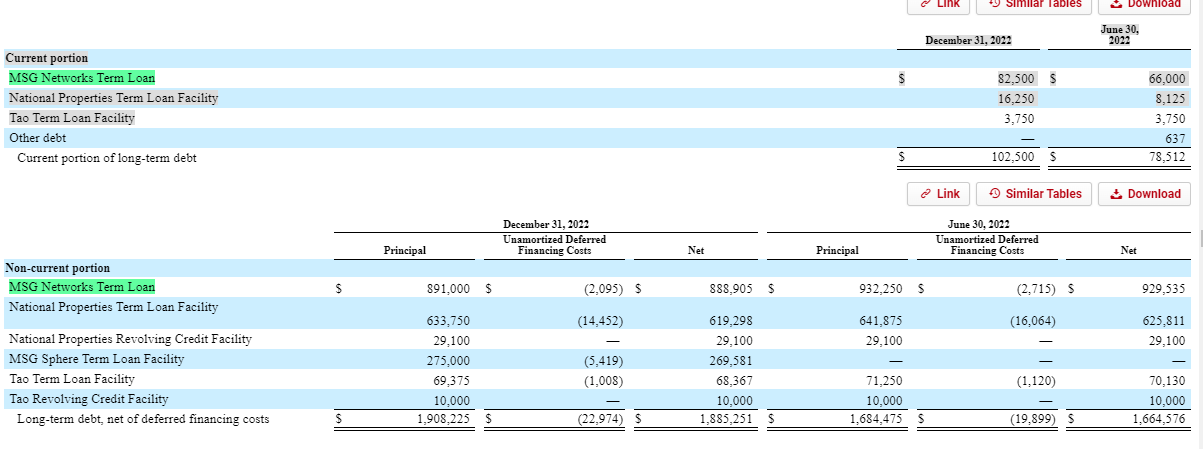

MSG Networks Debt

The other issue with MSGN is it carries $889MM of debt that is due in 2024.

From a valuation perspective, I would almost prefer management to turn over the keys of MSGN to the creditors because it would wipe out $889MM of debt.

In this scenario, the remaining company would be trading at an enterprise value of $596MM.

And for an enterprise value of $526MM, you would own the Sphere, which MSG spent $2.2MM to construct (24% of replacement cost).

Another way to think of it is on an earnings multiple basis.

Assuming the Sphere will ultimately generate $200MM of annual EBITDA, investors would own it at a 3x multiple.

But unfortunately Dolan will not give MSGN to the creditors.

A more likely scenario is Dolan using the cash flow from the Sphere to support MSGN as it tries to pivot away from the bundle towards DTC.

Putting it All Together

I think the Sphere has the potential to be an attractive entertainment asset and the current valuation of Sphere Entertainment Co (MSGN) looks relatively cheap.

But I think it’s a messy story that isn’t going to get much cleaner any time soon.

Sphere revenue and EBITDA will eventually ramp up but MSGN revenue declines will be a large headwind (I don’t believe MSGN’s DTC product, MSG+, will generate enough revenue to offset pressure from cord cutters).

Morgan Stanley estimates that Sphere Entertainment Co will generate $196MM of EBITDA in FY 2025 (I adjusted to remove its Tao estimate as the asset has been sold).

At $32 per share, SPHR is trading at an enterprise value of $1.5BN.

Thus, it’s trading at an EV/ ‘25 EBITDA multiple of 7.5x.

This seems cheap but reasonable to me.

The Sphere will probably track towards $200MM+ of EBITDA and then stabilize.

MSGN will continue to shrink and could go negative.

It has long term contracts to make escalating payments to the Knicks, Rangers, Sabres, and Devils for the right to televise the games. Yet the top line is shrinking due to cord cutting.

Yes the SOTP valuation would point to a higher valuation, but aren’t spin-offs consummated so that investors don’t have to do SOTP valuations?

What Would Get Met Excited?

- MSGN Spin-off.

- If this were to happen, I think the stock would be a home run. I don’t know if this is possible given how challenged MSGN’s outlook is. Debt holders would probably sue for fraudulent conveyance.

- Strong signs of traction from MSGN’s DTC product.

- This will launch this summer. If it were to hit 200,000 subs by December 2023, I would be very impressed.

- Huge success at the Sphere.

- $200MM of EBITDA is a reasonable assumption, but I would be impressed if the Sphere could generate $300MM of EBITDA.

- That would get investors excited about other potential Sphere locations.

Disclosure/Disclaimer:

All expressions of opinion are subject to change without notice. This article is provided for informational purposes. We do not warrant the completeness or accuracy of this content. Please do your own due diligence and consult with an investment adviser before buying or selling any stock mentioned on www.stockspinoffinvesting.com.

Leave A Comment