The Market is Wrong on Vista Outdoors

Vista Outdoors (VSTO) surprised the market when it announced on October 16 that it would sell its Sporting Products business.

The market didn’t like the deal as the stock fell by ~24%.

And reaction from X (twitter) was the same:

But if you take a step back, the situation looks kind of interesting now.

Taking a Step Back

On May 5, 2022, Vista announced that it would break up into two companies.

A Sporting Products (guns & ammunition) and an Outdoor Products business.

The plan was to spin-off the Outdoor Products business and the Sporting Products business (guns) would become RemainCo.

The thesis for the spin-off was that Outdoor Products companies trade at premium valuations to guns & ammo companies due to ESG concerns.

Here are the Outdoor Products comps that management has cited in its presentation.

Here are the Sporting Products comps that management has cited in its presentation.

The disappointing market reaction was related to the sales price of the Sporting Products (guns & Ammo) business.

Management noted the business will be sold for ~5x EBITDA.

As you can see from the comps above, peers trade at 6.5x EBITDA.

I think the sale price is a little light but not horrible. The revenue multiple is 1.3x which is inline with peers. If the Sporting Products business were to trade as a separate entity, I’m not sure it would trade much above 5x EBITDA.

What is interesting is what is going to be done with the cash.

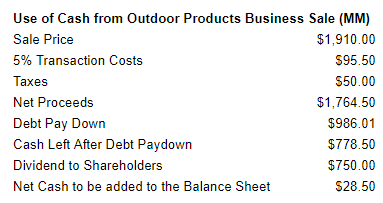

The sale price is $1.91BN.

I assume 5% transaction costs and management has guided that it has structured the sale in a tax efficient manner such that it will only have to pay $50MM of taxes.

With the proceeds, Vista will repay its $986MM of gross debt and return $750MM of cash to shareholders (I’m assuming a special dividend).

That will leave ~$28.5MM of cash to be added to Vista’s balance sheet.

Vista already has $63MM of cash on its balance sheet.

Plus, I expect the company to generate another $176MM in cash before the transaction closes (average FCF generation over the past 3 years was $346MM).

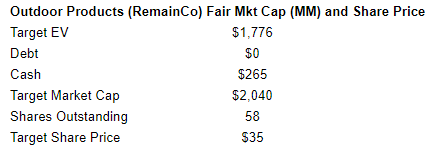

So once the transaction closes and the special dividend has been paid out, Vista should have $265MM of net cash on its balance sheet.

RemainCo Valuation

What’s the right valuation for RemainCo?

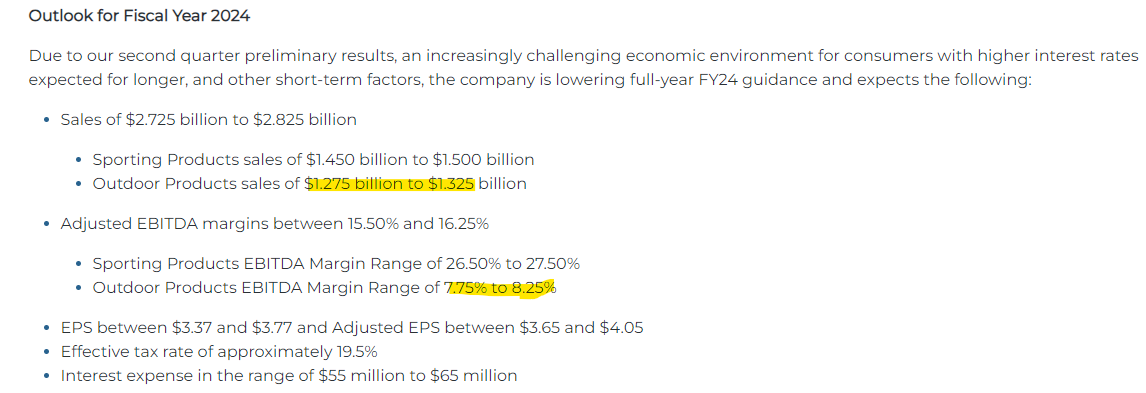

Updated guidance is for Outdoor Products revenue of $1.3BN and adjusted EBITDA guidance of $104MM.

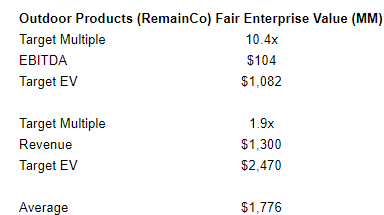

The comps that management cited in its spin-off presentation trade at 1.9x revenue and 10.4x EBITDA.

Assuming that’s the right valuation, the Outdoor Products business is worth between $1.1BN and $2.5BN ($1.8BN at the midpoint). See the math below.

Adding in the $265MM of net cash that RemainCo should have on its balance sheet and a fair market cap / share price is $2BN / $35.

Better yet, shareholders will receive a $13 special dividend.

VSTO stock is currently at $25. What’s the catch?

There are two:

(1) The comps could be wrong.

A better comp may be American Outdoor Brands (AOUT) which trades at 0.6x NTM revenue and 9.1x NTM EBITDA.

At that valuation, Outdoor Products (RemainCo) is worth $1.1BN and $19 per share.

Shareholders will get a $13 special dividend so the total return ($32) looks quite attractive vs. the current share price of $25.

(2) The second catch is the industry outlook.

The best special situation investing set-ups are when a corporate change creates a unique situation in an industry that is rapidly improving (think Thungela in 2021).

In the case of VSTO we have what looks like an attractive relative valuation offset by challenged fundamentals.

Management just reduced guidance for the Outdoor Products business citing:

“decreased buying across all business units as channel partners continue to be cautious with purchasing due to inventory levels and as consumers are pressured by high interest rates and other short-term factors.”

Thus, I’m happy to add this one to my watch list and follow the story, but I don’t think investors NEED to purchase it today.

Want to know my three highest conviction ideas today?

Sign up for my premium newsletter here.

Hi Rich! Thanks for the update, in line with what I was thinking… Just one thing, I think you called the Outdoor Products as the ammo part here: “The disappointing market reaction was related to the sales price of the Outdoor Products (guns & Ammo) business” and I think it is the Sporting Products. You also say “The plan was to spin-off the Outdoor Products business and the Sporting Products business (guns) would become RemainCo”, but when you do the valuation of the RemainCo you are valuing the Outdoor Products. I get it because I’m looking at the situation, but maybe its confusing for someone else reading. Thanks again for the update!!!

Thanks for the comment, Alvaro. I corrected it!

Only thing you left out was the EBITDA forecast is segment, they said there are opex associated with that, so real EBITDA is more like 70mm—I have asked them for specifics and also cap ex forecast to see if they can generate much cash—besides that another good writeup!

Thanks for the comment Adam!