Thoughts on Ligand Spin-off, OmniAB, and RemainCo

November 1, 2022

Summary

Ligand (LGND) is on track to close the merger of its OmniAb business with Avista Public Acquisition Corp II (AHPA) on November 1, 2022. Subsequent to the merger, Ligand (LGND) will spin off its ~85% stake in the business. The new company will trade under the ticker OABI.

LGND shareholders will receive 4.9 shares of OABI for every share of LGND (shareholders will also receive “earnout shares” which I’m ignoring because they will begin trading way out of the money.

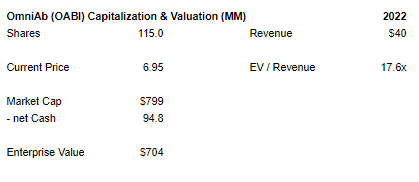

The spin-off is trading in the when-issued market currently at a price of $6.95. This implies a market cap of $800 and an enterprise value of $704MM.

The spin-off is trading at 18x 2022 revenue guidance and appears quite expensive. Comparable companies (more details below) trade closer to 5.1x revenue. Assuming a 5.1x revenue multiple, OABI is worth $2.55 per share (market cap of $293MM and EV of $198MM).

Indiscriminate selling pressure could exacerbate downward pressure on OABI’s share price once regular way trading begins.

RemainCo looks pretty attractive although I don’t have enough conviction in it to recommend the stock on a standalone basis.

Resources

Ligand Announces Record Date For Spin-off – October 2022

Ligand Corporate Slide Deck – September 2022

Registration Statement For SPAC Combination – September 2022

OmniAb Slide Deck – June 21, 2022

Good Article on Competition Landscape for Abcellera – November 2021

Background

On November 19, 2022, Ligand Pharma (LGND) announced that it would spin-off its OmniAb business.

The OmniAb business is an antibody discovery platform. Ligand management decided it would be best to separate this business from the remaining business, Ligand’s existing collection of core royalties and its pipeline.

At the time, management thought that 20% of OmniAb would be IPO’d and the remaining stake would eventually be spun off.

In early 2022, with the IPO window closed, management amended its plans and decided to spin off its 100% stake in OmniAb.

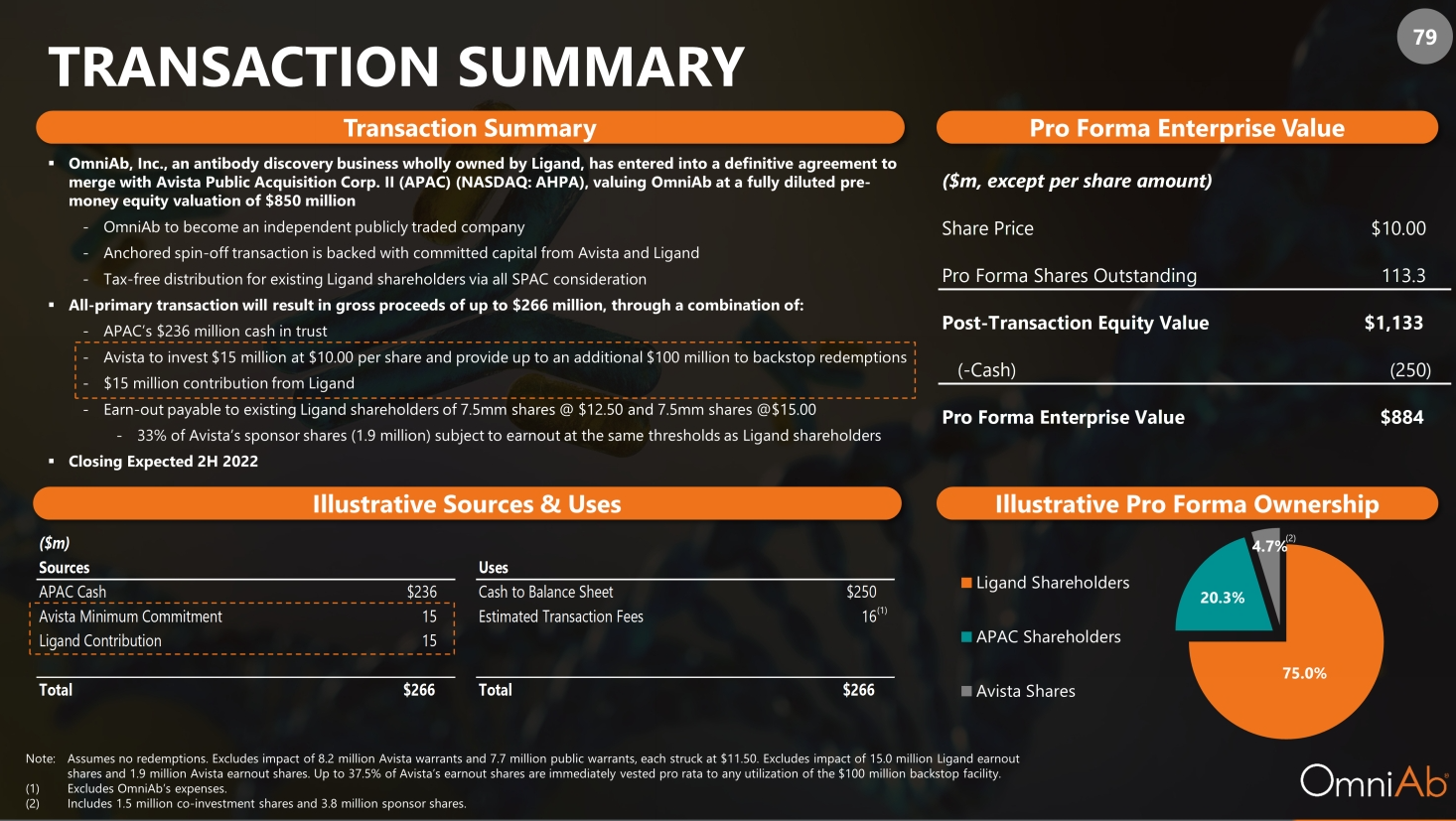

Shortly thereafter, Avista reached out and proposed that its SPAC, Avista Public Acquisition Corp. II (“APAC”), combine with OmniAb at a pre-money valuation of $850MM.

What is OmniAb?

OmniAb has a technology platform that helps other biotech and pharma companies screen and discover therapeutic human antibodies.

OmniAb primarily derives revenue from license fees for technology access, milestones from partnered programs and service revenue from research programs.

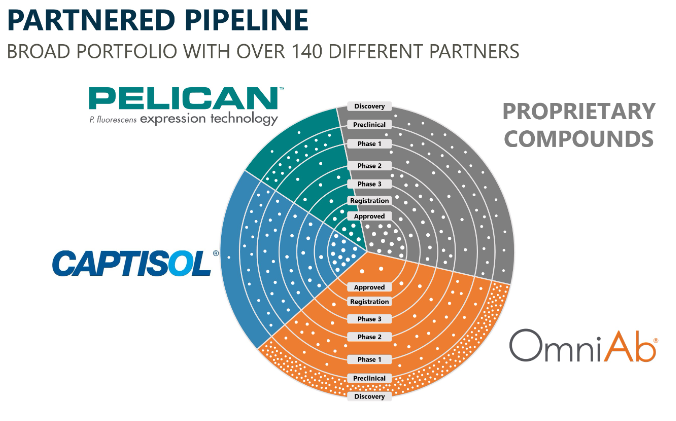

OmniAb boasts a large number of partnerships:

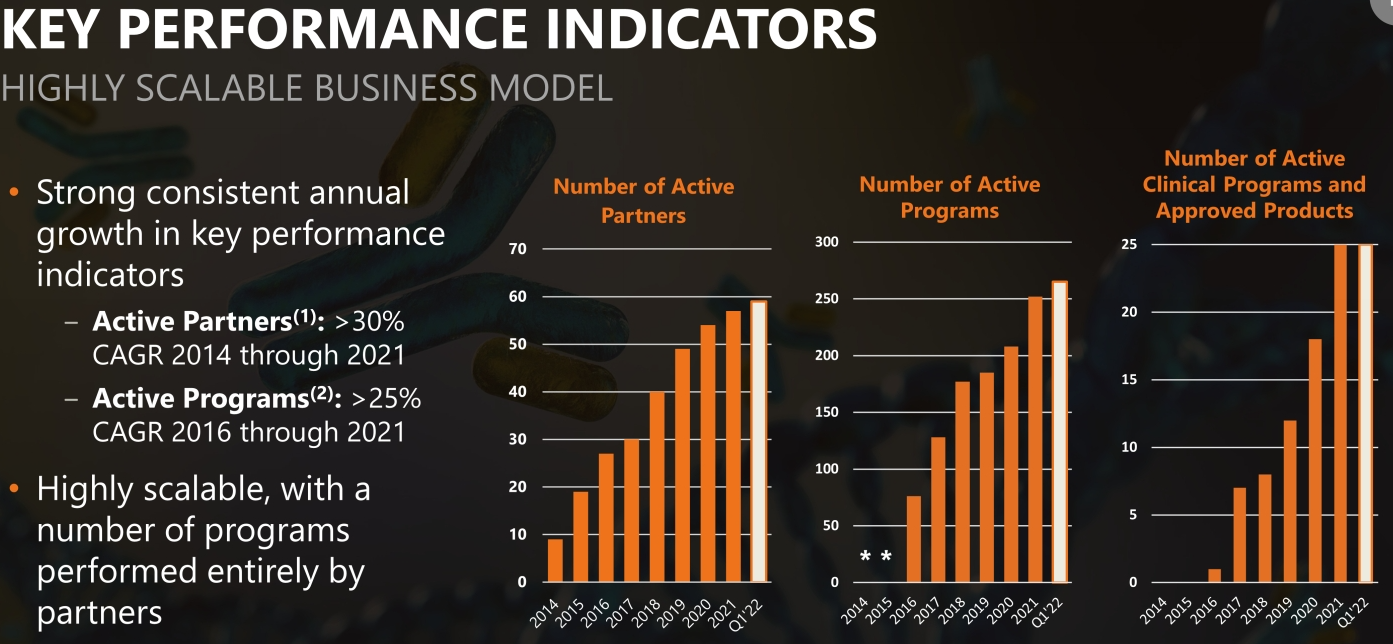

And growing key performance indicators:

But revenue to date is relatively modest.

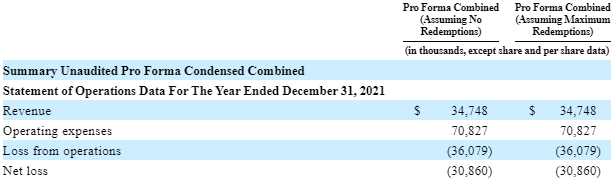

In 2021, OmniAb had $34.7MM of revenue…

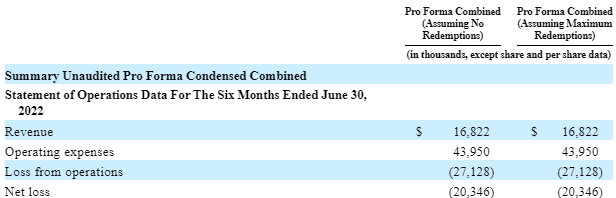

Through the first half of 2022, OmniAb has generated $16.8MM of revenue….

And losses have been significant (as shown above)…

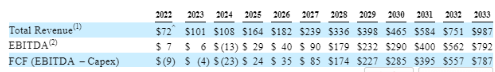

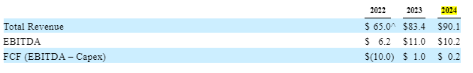

For what it’s worth, management’s projects (taken from the original SPAC filling) show steady growth:

Although those projections were lowered…

I spoke to investor relations and learned that guidance for OmniAb for 2022 stands at $40MM of revenue.

Nonetheless, the company has grown well historically…

“For the years ended December 31, 2021, 2020 and 2019, our revenue was $34.7 million, $23.3 million and $18.3 million, respectively.”

And should continue to do so.

But the SPAC projections are probably too optimistic.

Valuation and Comparable Companies

The SPAC transaction initially valued OmniAb at an equity value (market cap) of $1,133MM and an enterprise value of $884MM ($250MM of net cash on balance sheet).

This initial valuation seemed high. Using 2022 revenue guidance of $40MM, OmniAb initially valued at 22x revenue!

Where do comparable companies trade?

Management points to two in its slide deck: Adimab and Abcellera.

Adimab is private, but Abcellera is publicly traded under the ticker ABCL.

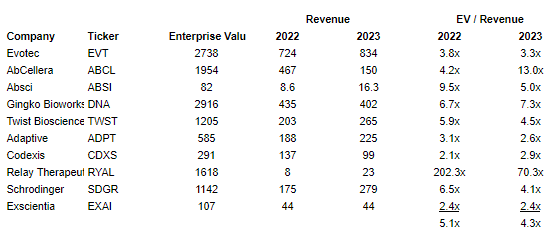

Abcellera trades at a NTM EV / revenue multiple of 11.0x and a TTM EV/revenue multiple of 3.9x.

Consensus expects revenue to continue to fall for Abcellera

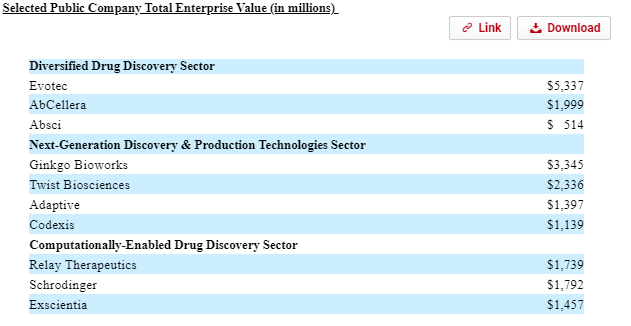

The SPAC registration statement identifies some other comparable companies.

These companies trade at a median EV / 2022 revenue multiple of 5.1x.

The one outlier is Relay Therapeutics which trades at 202x revenue. However, Relay looks like a more traditional biotech company. While OmniAb partners with other biotech companies in exchange for royalties, Relay develops its own biotech drugs and keeps 100% of the economics. It recently released promising data for a drug focused on bile duct cancer.

If we assume a 5.1x revenue multiple is appropriate, the stock is worth $2.55 per share (market cap of $293MM and EV of $198MM).

In the when issued market, OABI is trading at $6.95 which implies a 17.6x revenue multiple.

I do think that the spin-off could be interesting at the right price.

If we see massive selling pressure, it could be an interesting long term investment given that:

- Cash burn is relatively small / manageable.

- Revenue will continue to grow and eventually the company will be profitable.

- Pipeline looks large.

What about RemainCo?

I spent a little time on the RemainCo but am not going to dive too deeply as I don’t think it’s that interesting.

It does look a lot more reasonably valued than the spin-off, though.

RemainCo has a broad portfolio of drugs in development utilizing various technologies.

It will spin off its OmniAb technology but will retain its proprietary compounds, Captisol based compounds, and compounds developed with Pelican technology.

Ligand RemainCo’s business model is similar to OmniAb in that it generally partners with other pharma companies to develop drugs and is rewarded with a royalty and/or milestone payments.

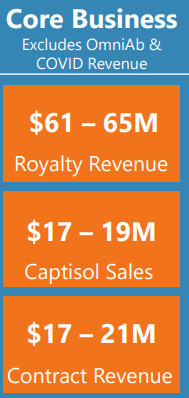

Ligand RemainCo is guiding to 2022 Core revenue of $97MM to $104MM and EPS of $1.80 to $2.05.

That revenue guidance is made up of the following three buckets:

In 2021, Kyprolis generated $27.5MM of royalty revenue for Ligand. Kyprolis is used to treat multiple myeloma and is marketed by Amgen. In Q2 2022, Kyprolis revenue grew 12% y/y. Ligand gets a 1.5% to 3.0% tiered royalty on global sales.

Captisol is a chemical that is mixed with other drugs to increase their solubility and stability. Captisol is used with many FDA approved drugs including Gilead’s Veklury®, Amgen’s Kyprolis®, Baxter International’s Nexterone®, Acrotech Biopharma L.L.C.’s and CASI Pharmaceuticals’ Evomela®, Melinta Therapeutics’ Baxdela® and Sage Therapeutics’ Zulresso.

In 2020, Captisol sales boomed due to COVID induced increased sales for Gilead’s Veklury.

On a “normalized” basis, Ligand expected ~$18MM of sales per year.

Contract revenue consists of contingent milestone-based payments as well as R&D services.

Consensus expects revenue to decline in 2022 and 2023 due to tough comps from the Captisol boom.

Over the long term, sales should grow as more drugs are eventually approved.

Guidance and Valuation

Ligand RemainCo is guiding to core EPS of $1.98 at the midpoint and expects 50% growth next year (translates to EPS of $2.97).

As such, Ligand RemainCo is trading in the when issued market at $50 per share or 16.8x 2023 earnings. Seems modestly cheap, but not compelling.

Disclosure/Disclaimer:

All expressions of opinion are subject to change without notice. This article is provided for informational purposes. We do not warrant the completeness or accuracy of this content. Please do your own due diligence and consult with an investment adviser before buying or selling any stock mentioned on www.stockspinoffinvesting.com.

Leave A Comment