Vestis Spin-off Deep Dive

October 11, 2023

Summary

Vestis (VSTS) spun off from Aramark (ARMK) last week.

Vestis is the #2 competitor in the workplace supplies and uniform business industry. It provides an essential service to industrial companies. This is evidenced by: 1) 92% recurring revenue and 2) competitors saw sales decline by only mid-single-digits during the GFC.

A new CEO was hired by Vestis two years ago, and she appears to be guiding the company in the right direction (case studies covered during the investor day were compelling).

Revenue is growing at a mid-single-digit clip and margins are expanding.

If the company executes on its long-term guidance (5-7% top line growth and 500bps of EBITDA margin expansion), the stock will be a home run.

The stock is trading at 9.2x my 2024 EBITDA estimate below peers (UNF-9.6x, CTAS-20.9).

My fair value estimate is $21 based on an EV/EBITDA multiple of 11x. My only concern is that half of Vestis’ workforce is unionized which is a concern in the current labor environment with labor strikes.

I’m not in a rush to buy the stock given that only 22% of shares have traded since the spin-off ( I typically like to see 40% to 50% trade before buying).

Nonetheless, the stock looks quite interesting.

Resources

Low Tide Investments Vestis Investment Case

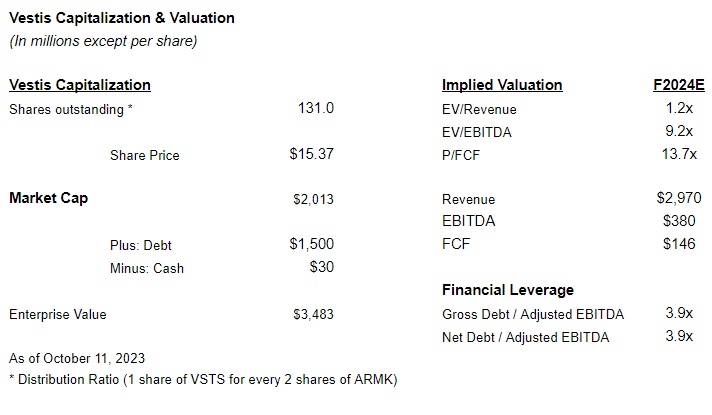

Capitalization and Valuation

Background

On October 2, 2023, Aramark (ARMK) spun off its Uniform Services Business, Vestis (VSTS) in a tax free transaction. Aramark shareholders received 1 share of VSTS for every 2 shares of ARMK.

Rationale for the Spin-off

Aramark included all the boilerplate reasons for pursuing a spin-off:

But I think the main reason for the separation has to do with valuation. Aramark is hopeful that the spin-off will trade at a premium to ARMK.

In terms of a potential range of valuation outcomes, the uniform services business has two comps, Cintas (CTAS) and UniFirst (UFS)

CTAS trades at 20.9x NTM EBITDA while UNF trades at 9.6x NTM EBITDA. Whether this transaction unlocks value will depend on whether VSTS trades closer to CTAS or UNF.

Vestis Overview

Vestis serves an estimated $48BN market. It competes primarily with UniFirst and Cintas.

Vestis offers full-service uniform solutions including the ability to design, source, manufacture, customize, personalize, deliver, launder, sanitize, mend and replace uniforms on a regular and recurring basis.

Its uniform offerings include shirts, pants, outerwear, gowns, scrubs, high visibility garments and flame-resistant garments, along with shoes and accessories.

In addition to uniforms, Ventis also provides workplace supplies including managed restroom supply services, first-aid supplies and safety products, floor mats, towels, linens and other workplace supplies.

Vestis’ value proposition is that it’s more efficient for companies to outsource the services that Vestis provides rather than doing it inhouse.

This intuitively makes sense to me.

Vestis serves many different industries:

And has low customer concentration:

Vestis estimates recurring revenue of 92% FY 22.

Industry

Vestis operates in a large, fragmented market. It is the number 2 player in the industry, behind Cintas (CTAS) and ahead of Unfirst (UNF).

Vestis Strategy

Vestis’ strategy is to focus on retaining customers, with an increased emphasis on increasing revenue per stop through cross-selling, investing in attractive sectors, margin accretive products and service offerings and adding new customers on existing routes to increase our route density.

Vestis hopes that focusing on the above will drive higher growth rates with more attractive margin profiles.

Vestis serves an attractive, large and long-tenured customer base with services and products that generate recurring revenue streams that typically allow more predictability of revenue than non-recurring revenue business models. In FY ‘22, 92% of revenue was recurring.

Vestis will focus on continuing to retain its customers by delivering consistent value through new or updated services and products. The company will work to modernize the customer experience to make it easier for our customers to continue to do business with Vestis.

Examples:

- new technology, such as sophisticated, digital customer portals,

- investments in our customer service process to enhance the route check-in process

- predictive analytics that help to better anticipate customer service opportunities.

Vestis will try to increase revenue per stop through cross selling, thus, leveraging its fixed cost base.

On average, Vestis’ current customers take advantage of approximately 30% to 40% of the company’s full line of services and products.

Vestis believes there is an opportunity to increase its wallet share with existing customers through cross-selling additional services and products, including compelling adjacent services such as first aid and managed restroom services.

Successful cross selling will result in high-margin growth with existing customers by increasing revenue per stop and leveraging our existing delivery costs.

Vestis also plans on being more deliberate about which new customers to target. In short, Vestis plans to target customers that:

- Are growing

- Are unlikely to churn

- Will increase route density.

Vestis’ business strategy makes a lot of sense, and the examples that the company discussed during its analyst day bring its strategy to life.

Capital Structure

Vestis has net debt of $1,470MM at an interest rate of SOFR + 2.25%. SOFR is currently at 5.31% Thus, Vestis’ annual interest charge will be ~7.56%.

Vestis has an $800MM term loan that matures in 2 years. I expect the company to refinance that loan as soon as possible.

Management

After listening to the investor day, I’m impressed with the management team and in particular, CEO, Kim Scott.

Ms. Scott joined Vestis in October 2021. Prior to that, she worked at Terminix and Rubicon Global where she learned route optimization best practices.

The Bull Case

Management’s guidance is to grow revenue 5% to 7% for the next 5 years while increasing its EBITDA margin to 19% (at the midpoint).

Is this reasonable?

Since Kim Scott joined the company two years ago, the topline has grown at a 4.6% CAGR. Meanwhile EBITDA margins have increased from 11.0% in FY2021 to 14.0% in FY2023E.

More importantly, the initiatives laid out at the investor day seem reasonable. There appears to be some low hanging fruit.

If we assume revenue can grow at 6% for the next 5 years and EBITDA margin expands to 19%, Vestis will generate $716MM of EBITDA and $384MM of FCF in FY 2028.

If VSTS were to trade at 13x EBITDA multiple (UNF trades at 10x and CTAS trades 21x), the stock would be worth ~$53 (over a triple and a 28% IRR).

Valuation & Capitalization

By my estimates, VSTS is trading at 9.2x 2024 EBITDA and 13.7x 2024 FCF.

As covered above, UNF and CTAS are the best comps.

However, CTAS is the market leader with higher returns on capital and trades at a significant premium (20.8x NTM EBITDA). UNF currently trades at 9.8x forward EBITDA.

Assuming VSTS deserves to trade at a ~10% premium to UNF given its higher ROIC and scale, VSTS should trade at ~11x EBITDA.

At that multiple, the stock would be worth $21.

Since the spin-off, ~23% of Vestis shares outstanding have traded. I typically like to see 40% to 50% of shares trade before establishing a position.

Risks

Debt: Vestis has ~4 turns of debt which could be problematic if we are about to enter a recession.

- Mitigant: ~92% of revenue is recurring which gives me comfort with the debt load.

Recession: A recession in the U.S. and Canada would negatively impact Vestis.

- Mitigant: UNF experienced only a 2% organic revenue drop during the GFC while Cintas experienced an organic revenue drop of 5% to 7% depending on the division.

Unionized Labor Force: 10,500 of 20,000 employees are unionized which could be problematic given the current labor environment.

Disclosure/Disclaimer:

All expressions of opinion are subject to change without notice. All published emails/articles/correspondence is provided for informational purposes. We do not warrant the completeness or accuracy of this content. Please do your own due diligence and consult with an investment adviser before buying or selling any stock mentioned on www.stockspinoffinvesting.com.

Leave A Comment