Will the Nextracker IPO/Spin-off unlock Value?

February 16, 2023

Introduction

Last week (Feb 9, 2023), Nextracker (NXT) went public through an IPO.

Shares priced at the high end of the range ($24) and quickly surged to $30 and continue to perform well.

While this is an IPO – not my focus (IPO’s usually aren’t mispriced!) – the interesting angle here is that Flex Ltd (FLEX) owns a majority stake in NXT.

The situation is more interesting because FLEX trades at 6.6x forward EBITDA while NXT trades at 14.7x EBITDA.

So the transaction has the potential to unlock value, especially if FLEX’s stake is spun off.

Nextracker

Let’s start with Nextracker.

What is it? And what does it do?

Nextracker was founded in 2013 by CEO, Dan Shugar.

It is a leader in the solar tracking industry. NXT’s products enable solar panels to follow the sun’s movement across the sky.

Solar trackers generate up to 25% more energy than projects that do not track the sun.

Nextracker was acquired by Flex Ltd in 2015 for $245MM.

Nextracker’s current enterprise value is $4.8BN.

Growth

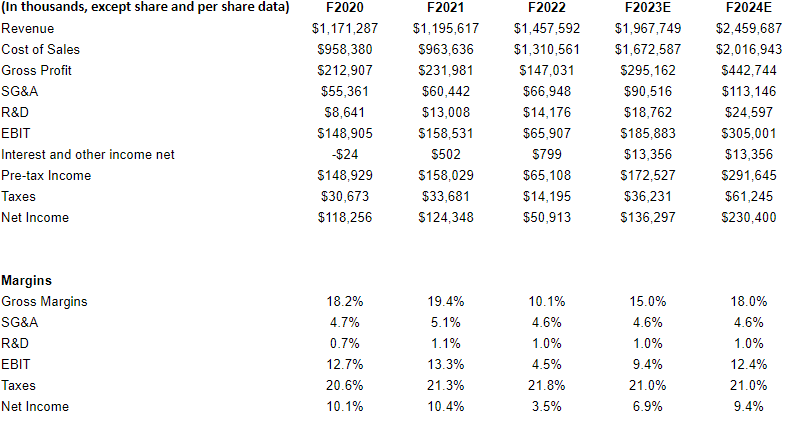

Nextracker has been growing strongly.

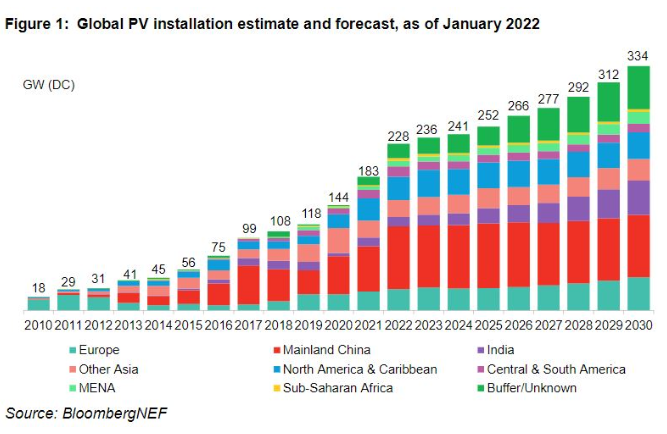

The company grows with the solar industry and should benefit from secular tailwinds for decades to come.

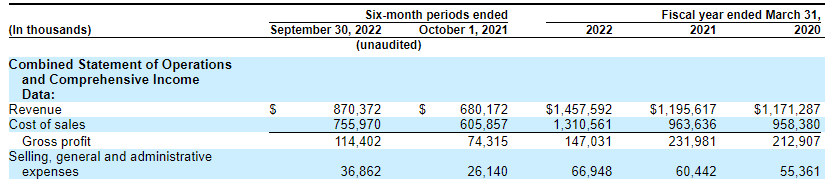

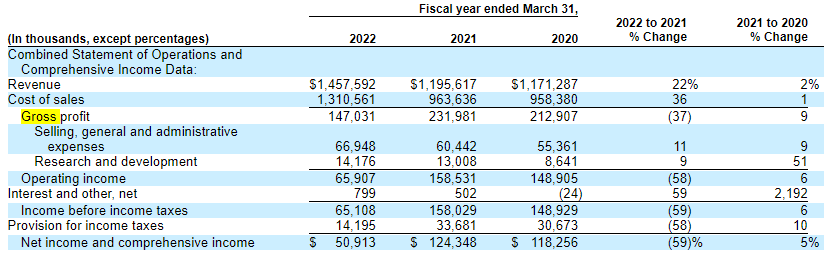

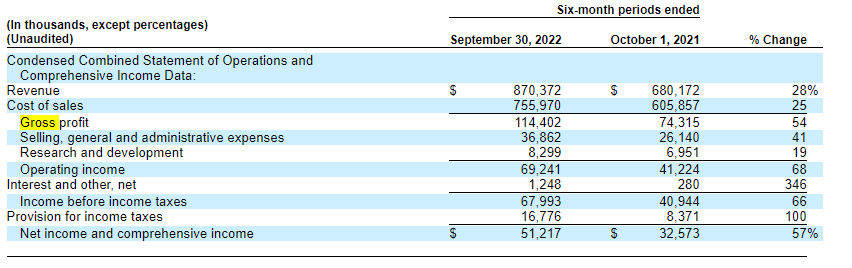

Revenue grew 22% in fiscal 2022 (2021 growth was muted due to supply chain issues). Growth through the first 6 months of fiscal 2023 has accelerated to 28%.

Given secular tailwinds for clean energy, demand for solar should continue to grow. And Nextracker revenue should grow with demand for solar.

Profitability

Gross margins took a big hit in fiscal 2022 as freight costs increased 106% y/y (!!) to $152MM and other logistical challenges.

Extrapolating from past trends (assuming 25% revenue growth) and assuming gross margin recovers almost to 2020 levels, Nextracker should generate $2.5BN of revenue in 2024 and $302MM of EBIT.

Nextracker Valuation

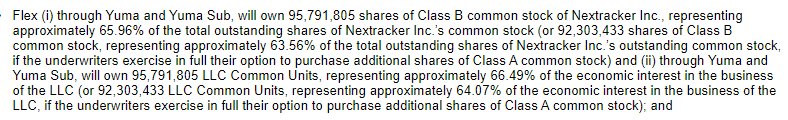

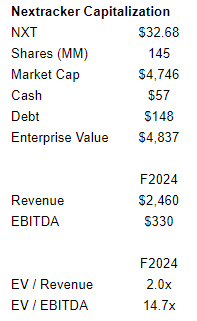

Calculating Nextracker’s market cap and enterprise value is a little tricky as there are various classes of shares.

My best guess is there are 145MM shares outstanding based on the following disclosure (underwriters exercised their right to purchase additional shares).

As such, Nextracker is trading an EV/F2024 revenue multiple of 2.0x and an EV/2023 EBIT multiple of 14.7x.

This doesn’t seem expensive for a company with secular growth potential.

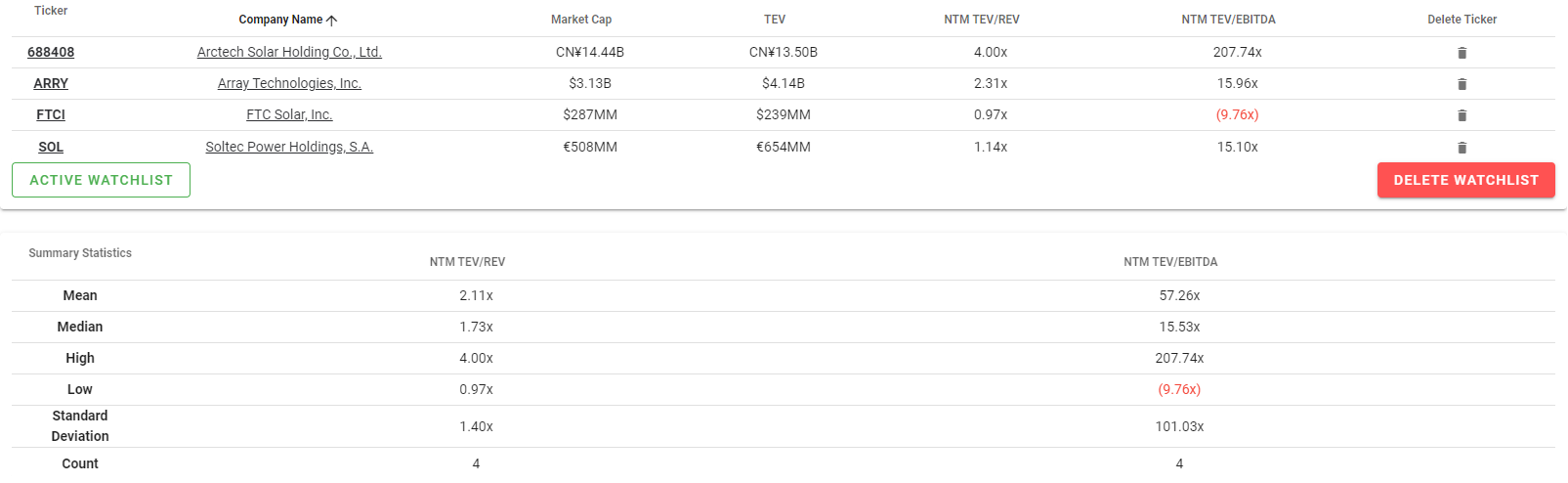

Nextracker lists Arctech Solar, Array Technologies, FTC Solar, PV Hardware and Soltec as its main competitors.

On a median basis, they trade at 1.7x forward revenue and 15.5x forward EBITDA.

Of the comps, Array Technologies seems to be the best comp as it has a similar revenue level and is based in the US.

ARRY trades at 2.3x revenue and 16.0x EBITDA.

All in all, Nextracker looks reasonably priced. It doesn’t look wildly overpriced but it also doesn’t look like a screaming bargain.

If you want to dig deeper into Nextracker, here’s the recent S-1 filing..

Next let’s explore the spin-off dynamic…

RemainCo

As mentioned above, the most interesting angle to me is that Flex LTD trades at 6.7x forward EBITDA while NXT trades at 14.7x EBITDA.

And Flex owns the majority of NXT so there is an obvious value unlocking opportunity.

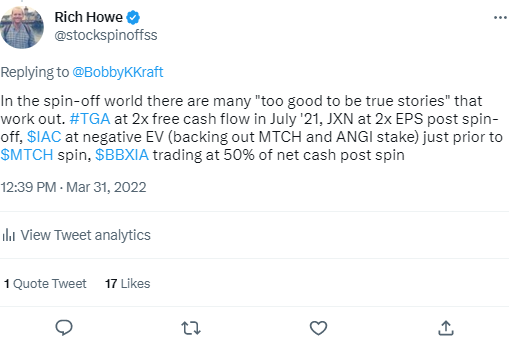

However I need to remember to heed my our advice:

Tread cautiously with SOTP stories…

With that out of the way, let’s review the basic math.

FLEX owns 92.3MM shares of NXT which is worth $3.0BN.

FLEX’s market capitalization is $11.0BN and its enterprise value is $13.1BN.

So if FLEX did decide to spin-off its stake in NXT, it would work out to a “dividend” of 27% ($3BN/$11BN).

But will a spin-off happen?

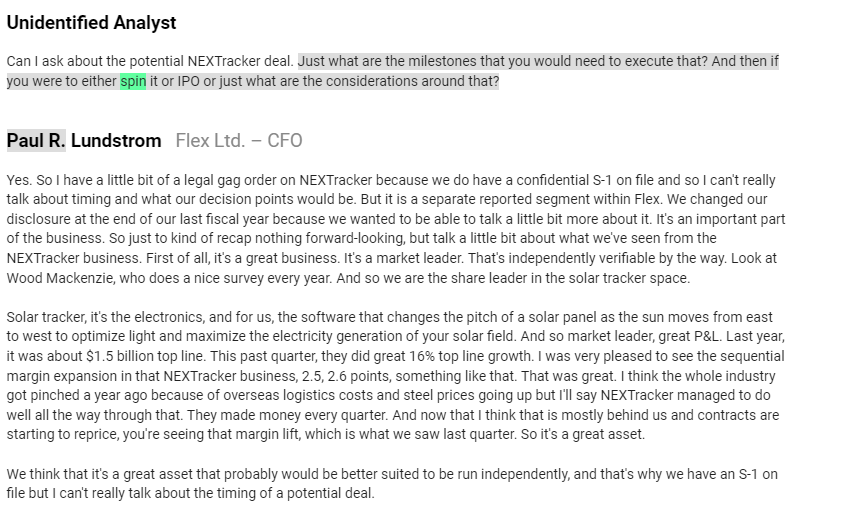

Management has been coy when asked directly, but reading between the lines, it’s probably likely (judging from the September 2022 conference transcript below) some portion of NXT will be spun off.

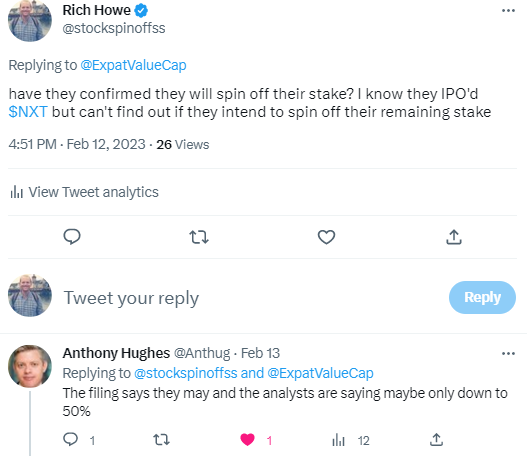

Judging from some twitter intel, management has implied that they will only spin off 50% of their stake.

So a partial spin-off is interesting and attractive, but I don’t think it’s a game changer.

Flex Ltd Overview

What about Flex Ltd on a standalone basis?

It’s trading at 6.6x forward EBITDA, a relatively attractive valuation.

Perhaps it makes sense to own FLEX as a core holding, and the potential spin-off of NXT will be a bonus.

Business overview

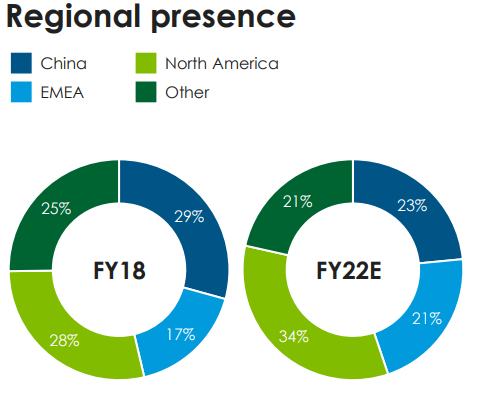

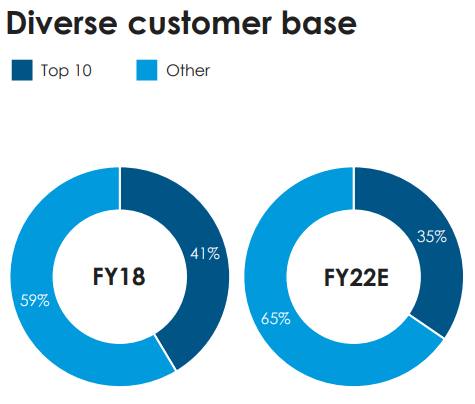

Flex’s “Core” business (excluding Flextracker) is an outsourced manufacturer.

It is diversified from geographical and customer perspective.

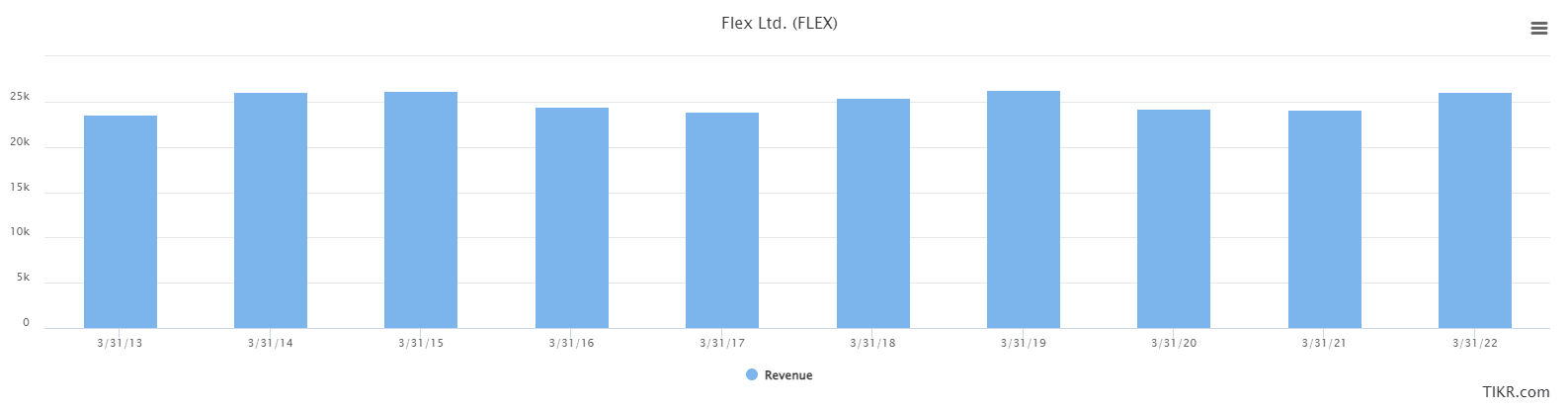

Historically, it hasn’t grown very much as shown by revenue trends over the past 10 years.

But that has started to change .

Flex’s core businesses (again, excluding Nextracker) are:

- Agility Solutions

- Reliability Solutions

Both segments are benefitting from secular growth drivers including….

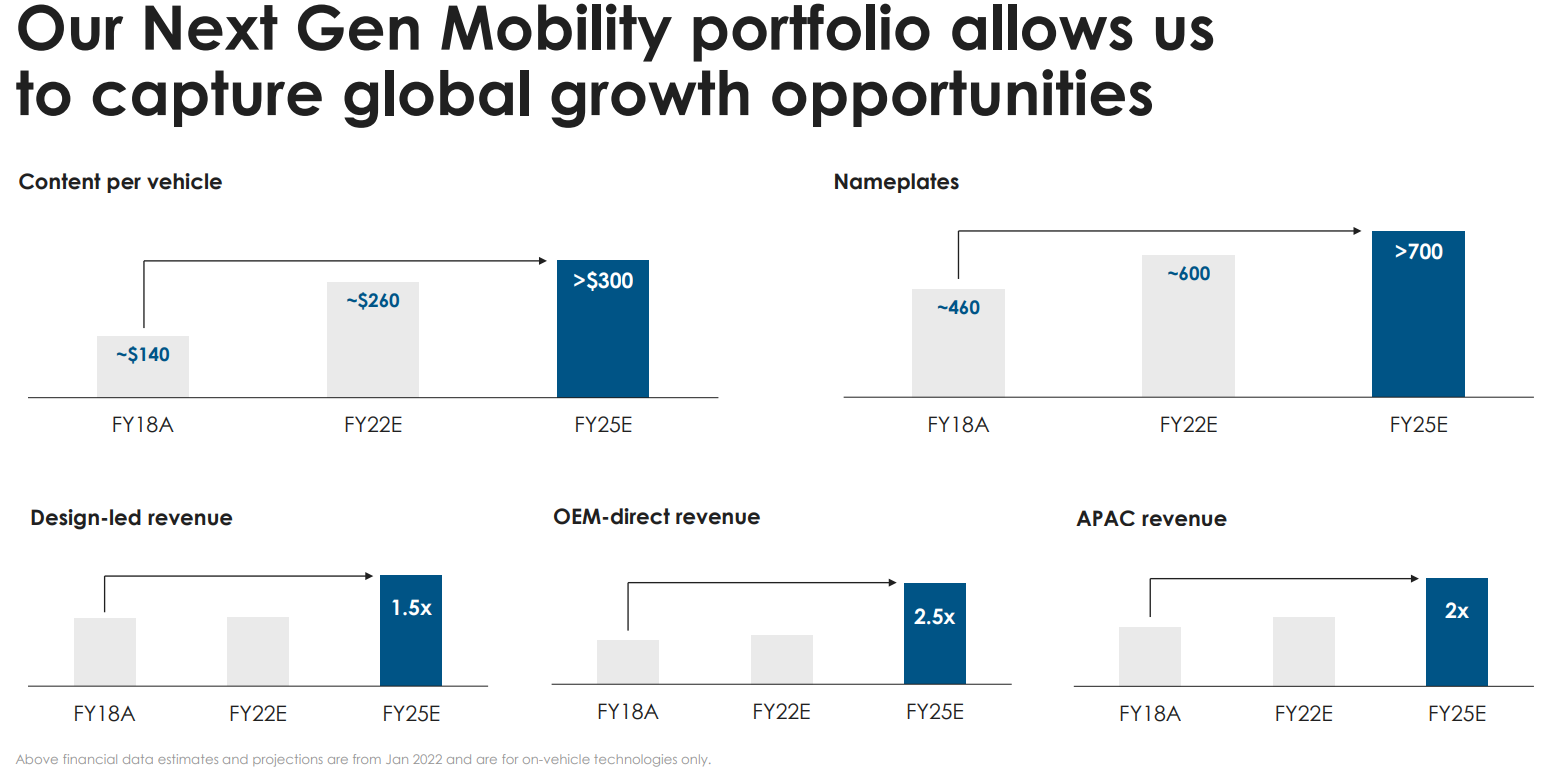

Next Generation Mobility…

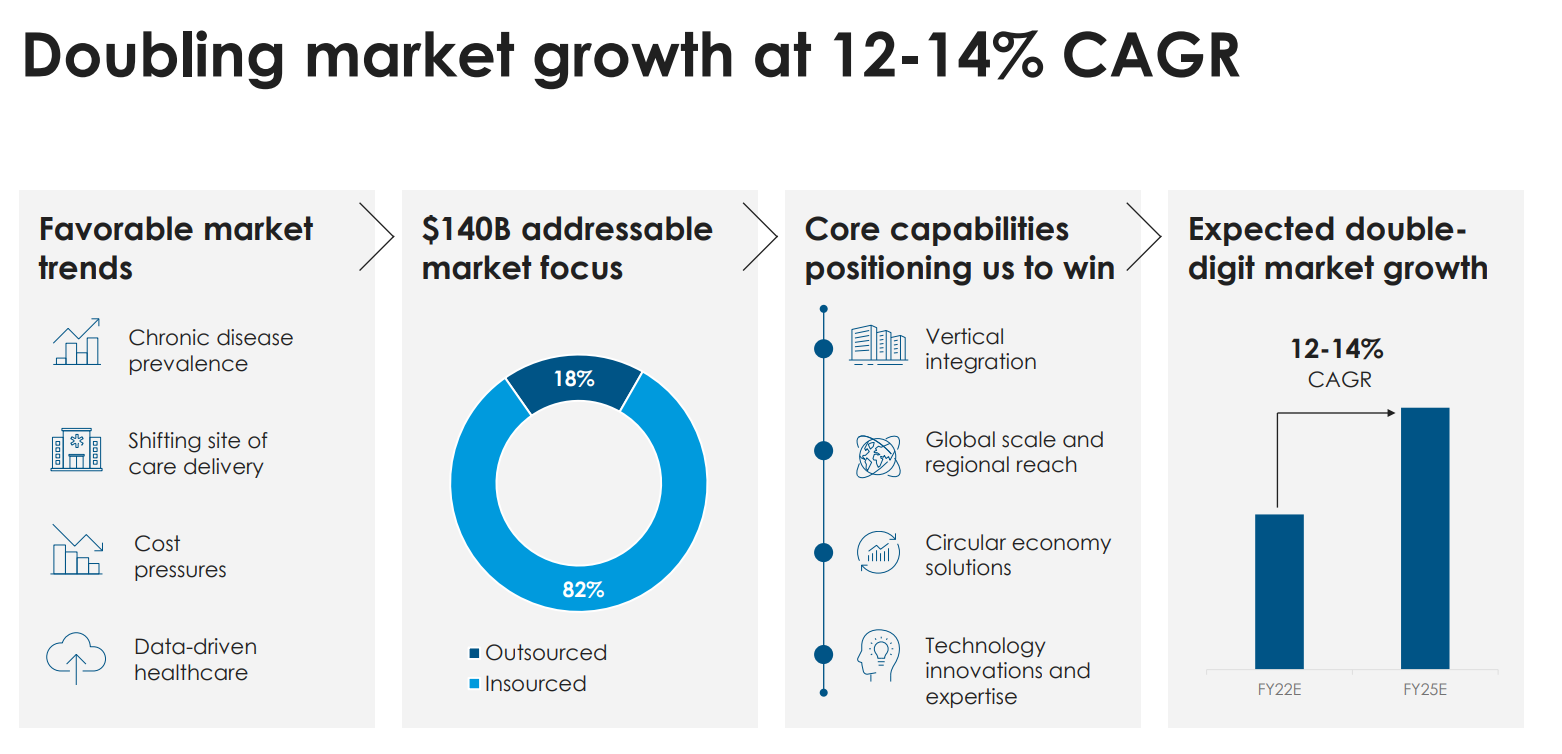

Digital Healthcare…

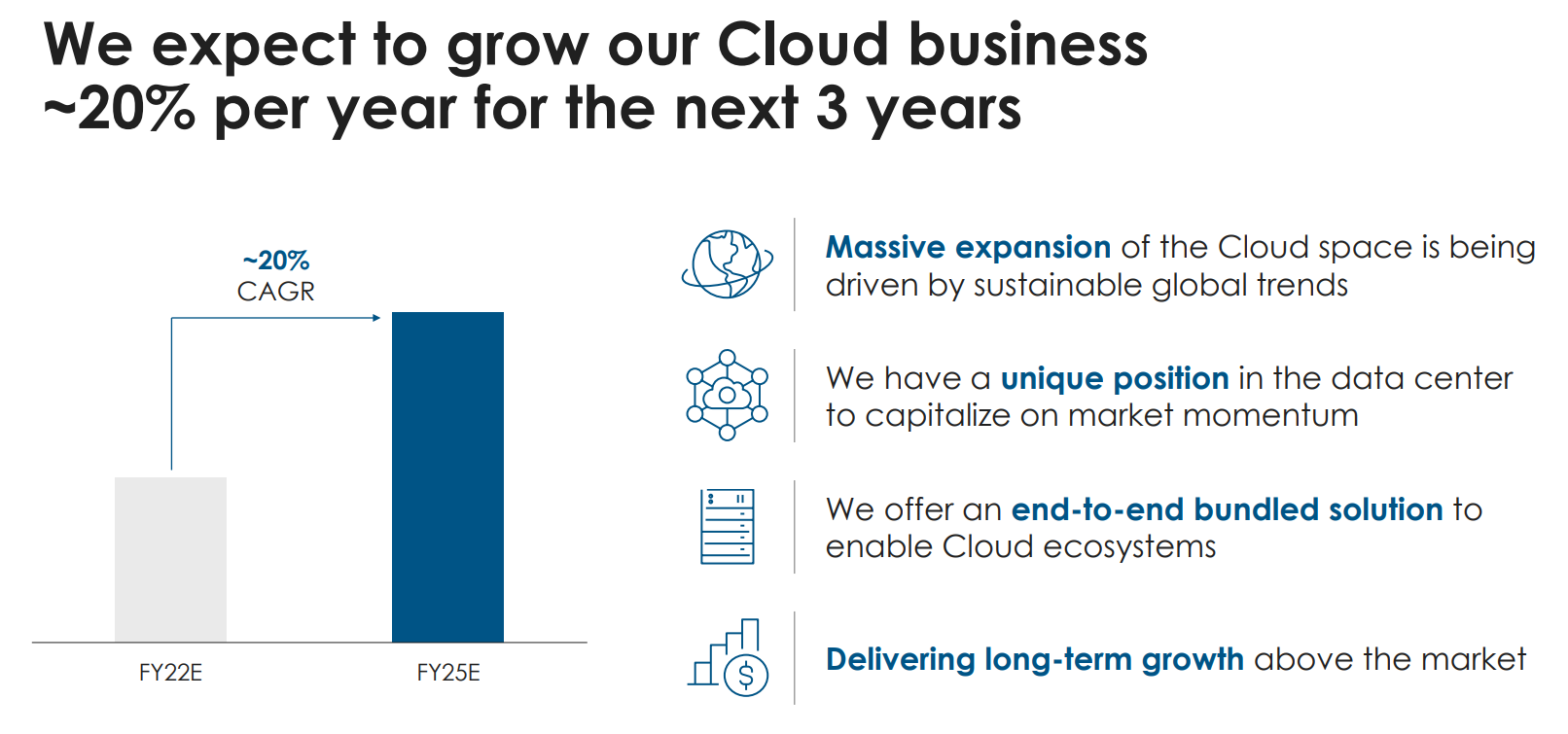

…and Cloud Expansion

As a result, Core Flex expects to grow at a high single digit clip for the foreseeable future.

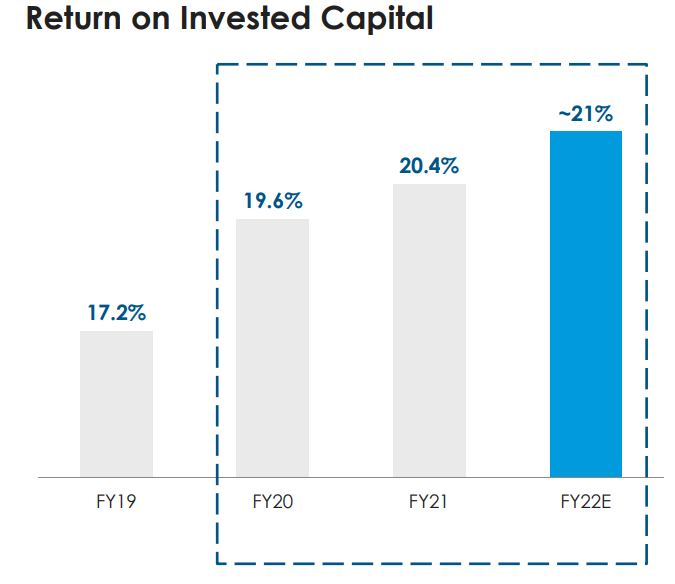

Also Flex has been focused on improving ROIC.

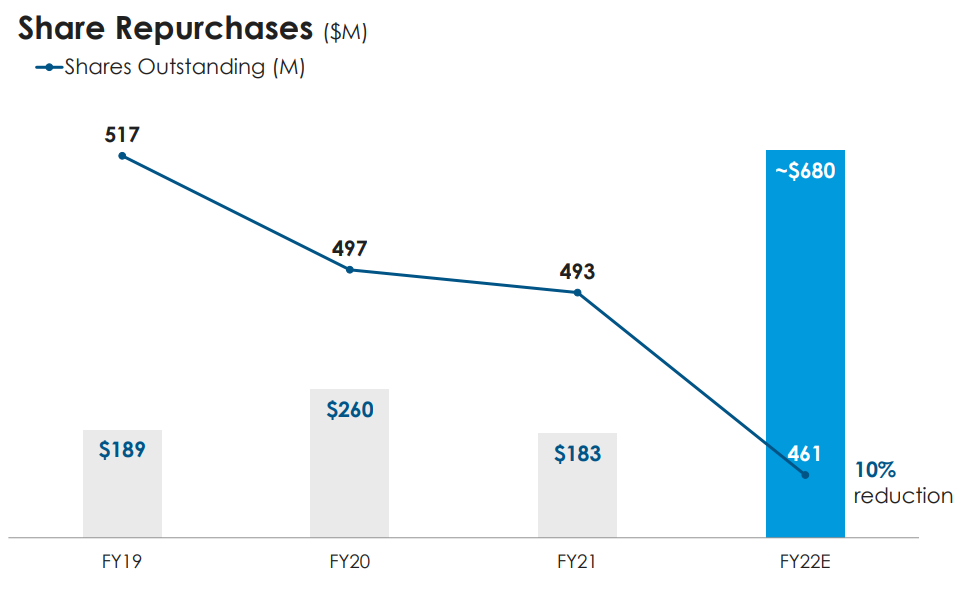

And aggressively returning cash to shareholders.

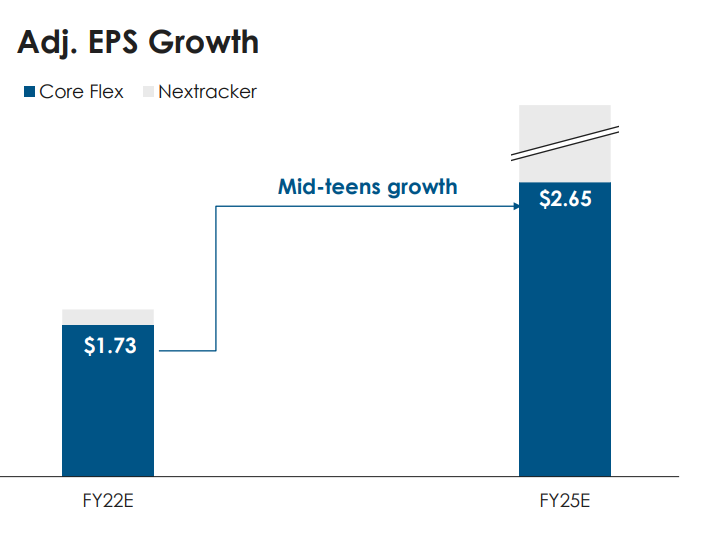

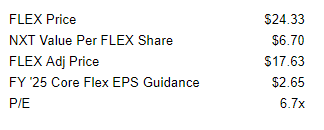

F2025 Guidance calls for core EPS of $2.65.

Backing out Flex’s ownership stake in NXT, FLEX is trading at a P/E of 6.7x F ‘25 EPS guidance.

Conclusion

I think FLEX looks attractive but not compelling enough to buy today.

I’m looking for “no brainers” and FLEX does not fit that description, at least to me (if I’m wrong, let me know!).

For example:

- Unit Corp (UNTC) is trading under 4x FCF and paying a 20% dividend.

- A stock in my research pipeline is about to spin off securities worth more than its current market cap.

So I’m going to pass on FLEX and NXT today but keep it on my watch list.

Leave A Comment